DXY again pushed for new highs on Friday night but failed. It remains a very bullish chart:

{{|5AUD}} was pulverised and broke key support. Look out below as the crosses cracked too:

Oil was bid, sadly:

Goldman’s commodity bubble is bursting spectacularly. The idea that you buy commodities as a hedge against commodities remains preposterous:

Big miners (LON:GLEN) are following:

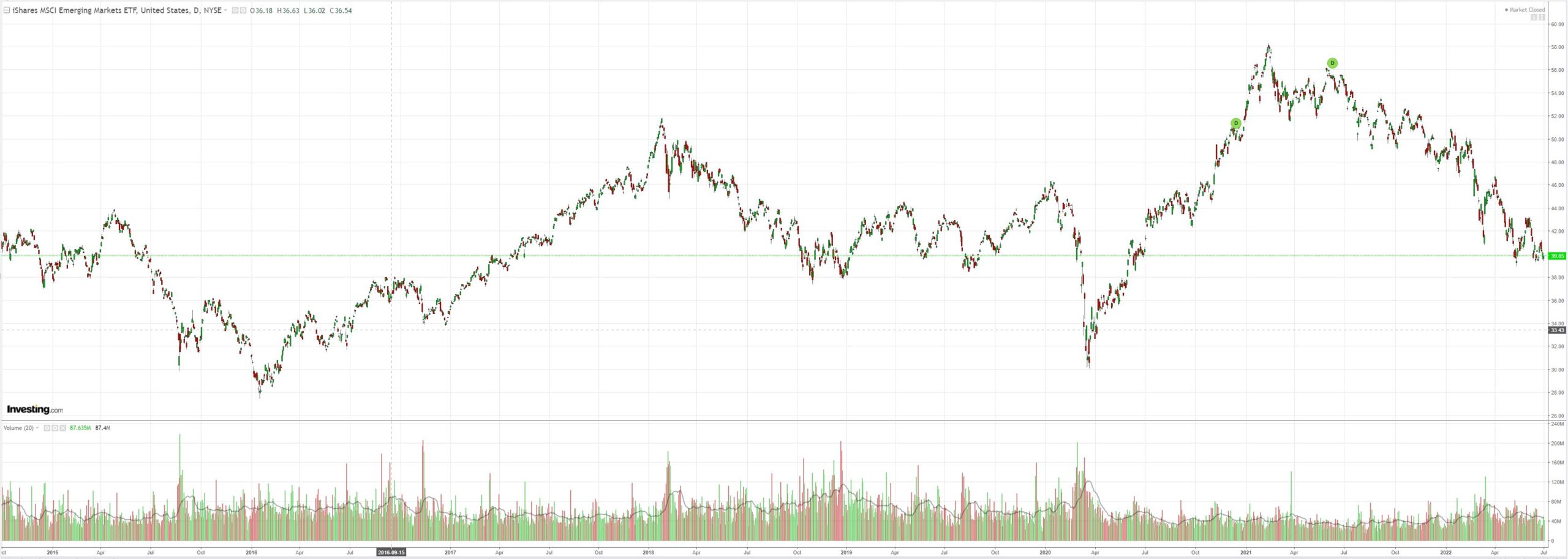

EM stocks (NYSE:EEM) hung on again but that chart is not promising:

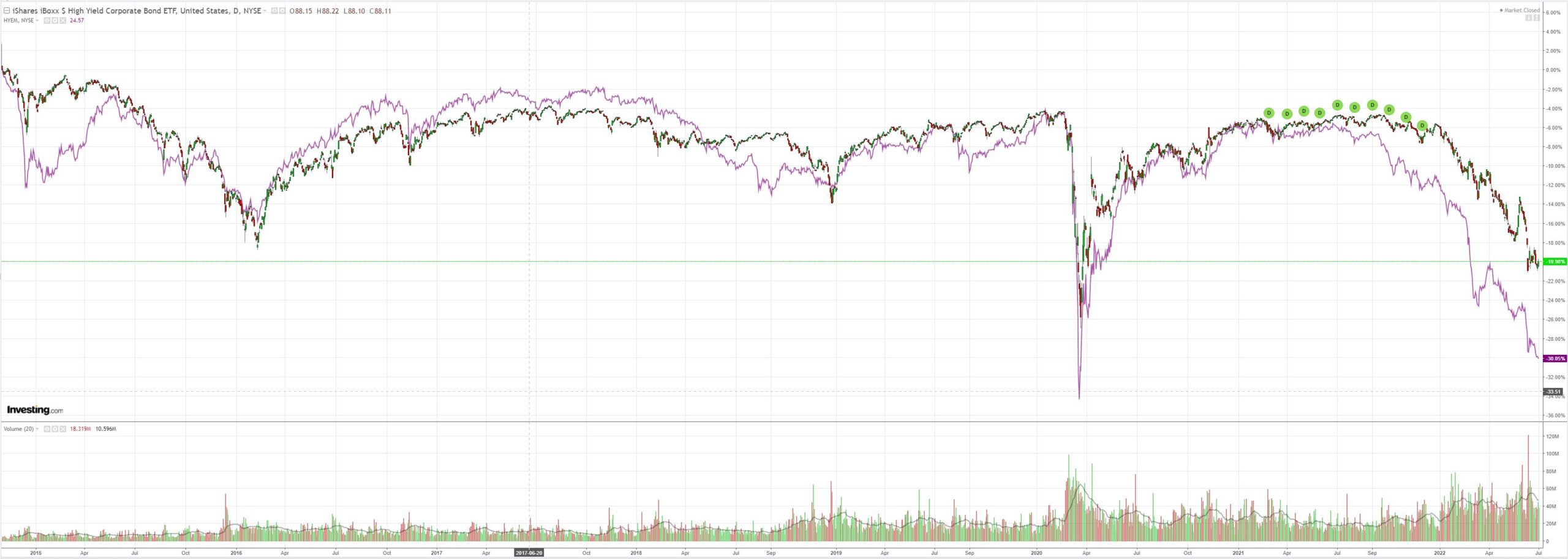

As junk (NYSE:HYG) sinks into the Mariana Trench:

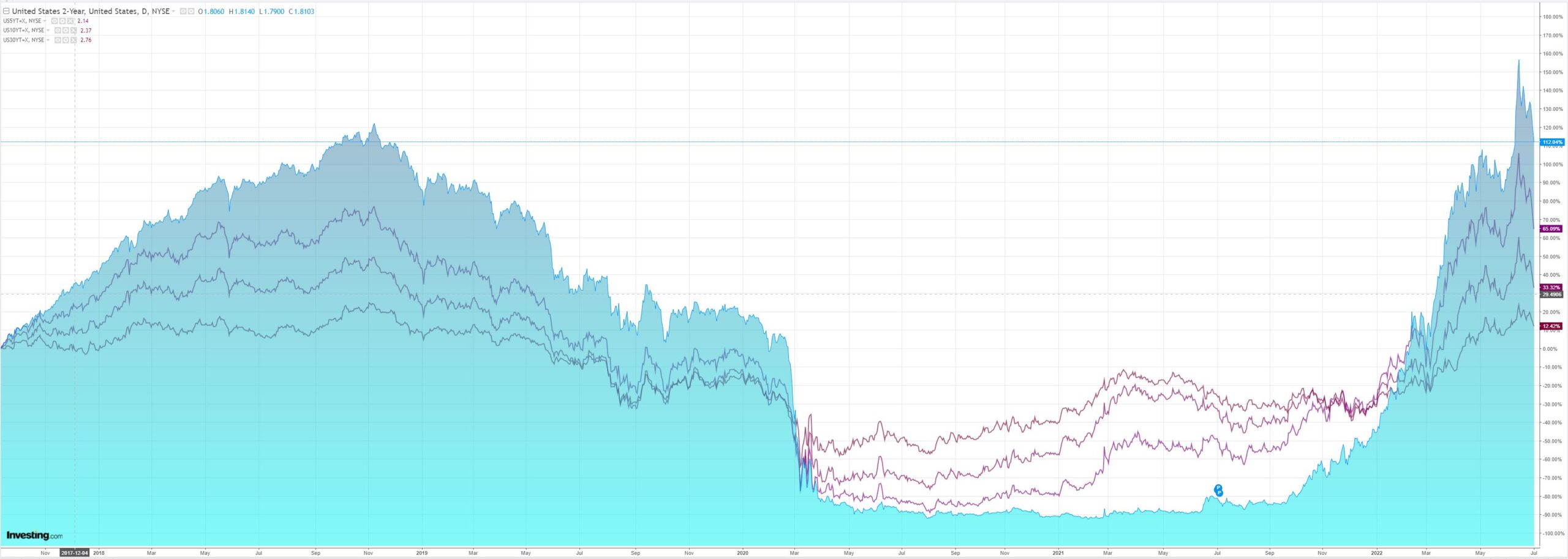

Dragging Treasury yields with it:

Which aided stocks for a night:

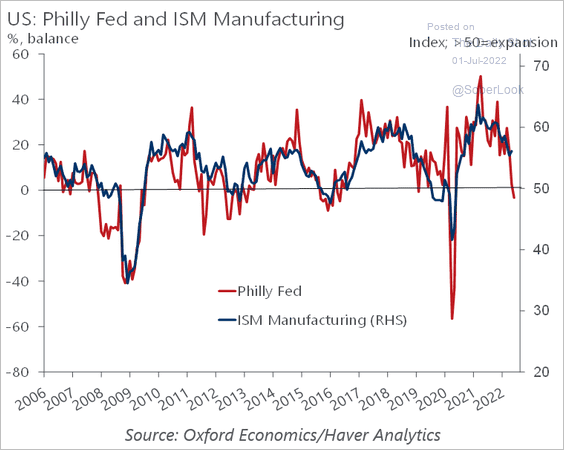

The US ISM was weak and the internals even weaker:

“The June Manufacturing PMI® registered 53 percent, down 3.1 percentage points from the reading of 56.1 percent in May. This figure indicates expansion in the overall economy for the 25th month in a row after a contraction in April and May 2020. This is the lowest Manufacturing PMI® reading since June 2020, when it registered 52.4 percent. The New Orders Index reading of 49.2 percent is 5.9 percentage points lower than the 55.1 percent recorded in May. The Production Index reading of 54.9 percent is a 0.7-percentage point increase compared to May’s figure of 54.2 percent. The Prices Index registered 78.5 percent, down 3.7 percentage points compared to the May figure of 82.2 percent. The Backlog of Orders Index registered 53.2 percent, 5.5 percentage points below the May reading of 58.7 percent. The Employment Index contracted for a second straight month at 47.3 percent, 2.3 percentage points lower than the 49.6 percent recorded in May. The Supplier Deliveries Index reading of 57.3 percent is 8.4 percentage points lower than the May figure of 65.7 percent. The Inventories Index registered 56 percent, 0.1 percentage point higher than the May reading of 55.9 percent. The New Export Orders Index reading of 50.7 percent is down 2.2 percentage points compared to May’s figure of 52.9 percent. The Imports Index climbed into expansion territory, up 2 percentage points to 50.7 percent from 48.7 percent in May.”

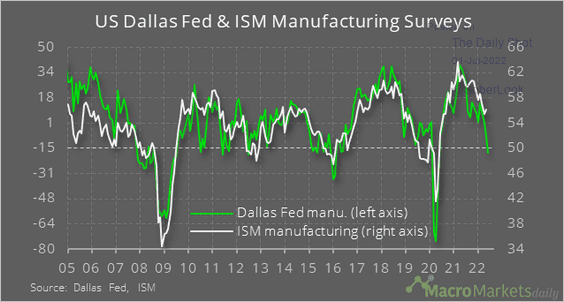

That means the new orders to inventory measure, which is a terrific leading indicator for profits in the US economy, sank to a new low. Moreover, the regional surveys are pointing the same way:

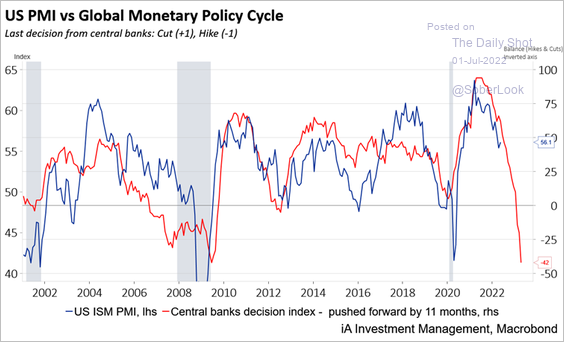

The US economy is already in recession and it is going to get worse:

Is it any wonder industrial metals are crashing?

I did warn you. The mania for commodities through Q1 was a typical blowoff top led by the Great American Bubble Machine and Zoltan the Magnificent. Now the madness of crowds is stampeding through the narrow exit.

It’s all “oversold” so some kind of bounce will happen eventually but, equally, it is still overpriced, so expect lower prices yet. This is classic commodities “up the escalator and down the lift” stuff as the cycle overwhelms any and all structural drivers (of which I remain quite skeptical as well). That it was a bubble is pretty clear:

- Prices inflated as fundamental demand drivers in China collapsed. Now those demand drivers are rebounding yet prices are crashing.

- I haven’t run the vol numbers but it was clearly a 6-sigma event for material like nickel.

- It ended with grand declarations of a “new paradigm” and “permanently high plateau” for prices. For instance, Zoltan the Magnificent actually argued that there was an air shortage.

I don’t think that the commodity bust ends until the Fed pivots which can’t happen until oil is also flushed. Below $80 is my target. This will set us up for the perfect post-Spanish Flu 1920/21 deflationary bust repeat in 2022/23.

While this goes on, pressure on the AUD will obviously persist.