Street Calls of the Week

DXY bounced hard last night. EUR may have formed a double top:

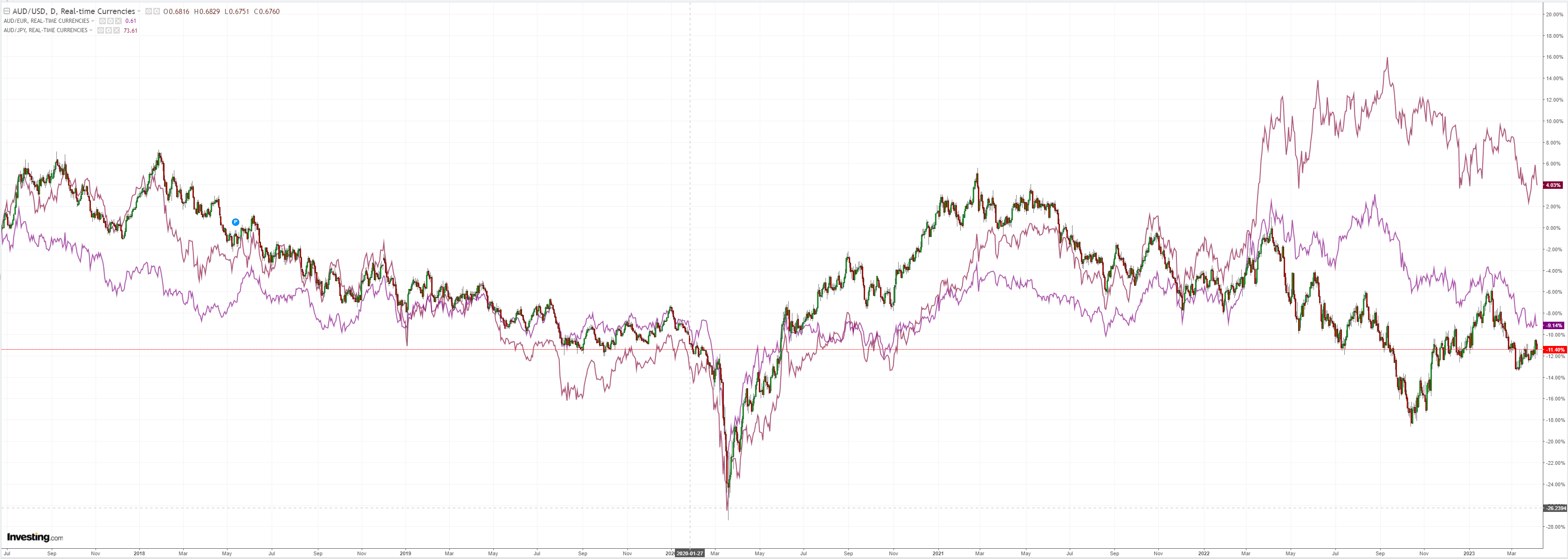

AUD was pulverised then bounced some:

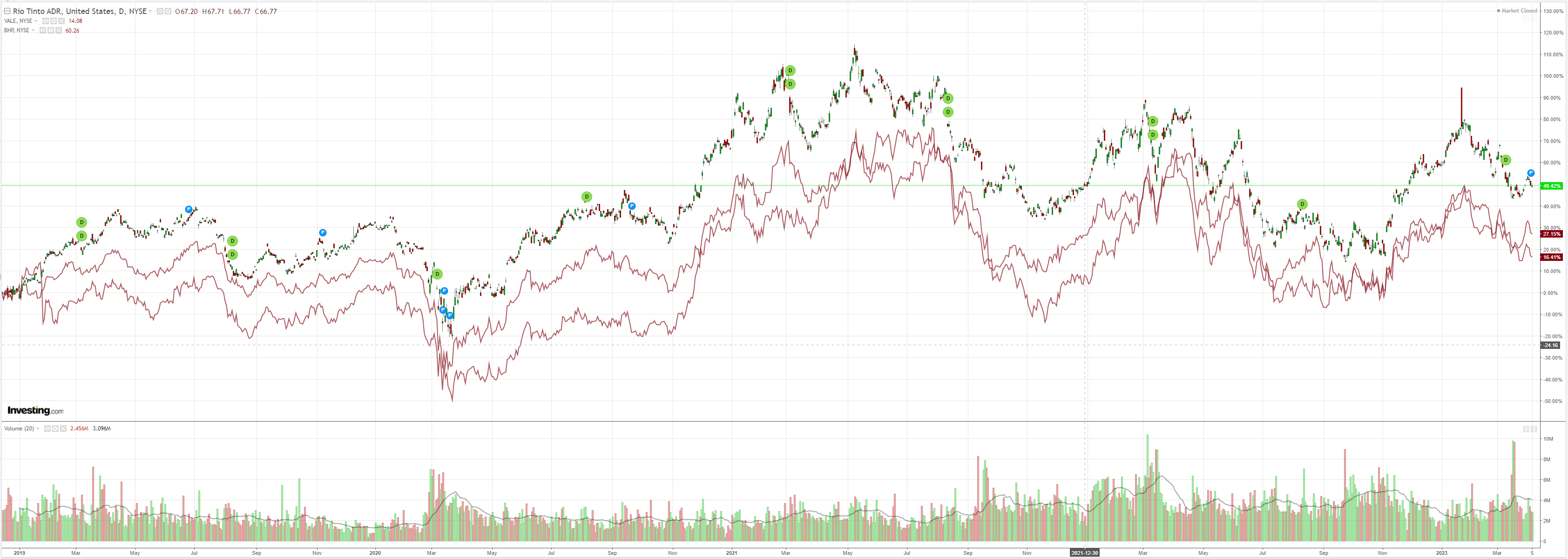

Dirt is falling:

Miners (NYSE:RIO) too:

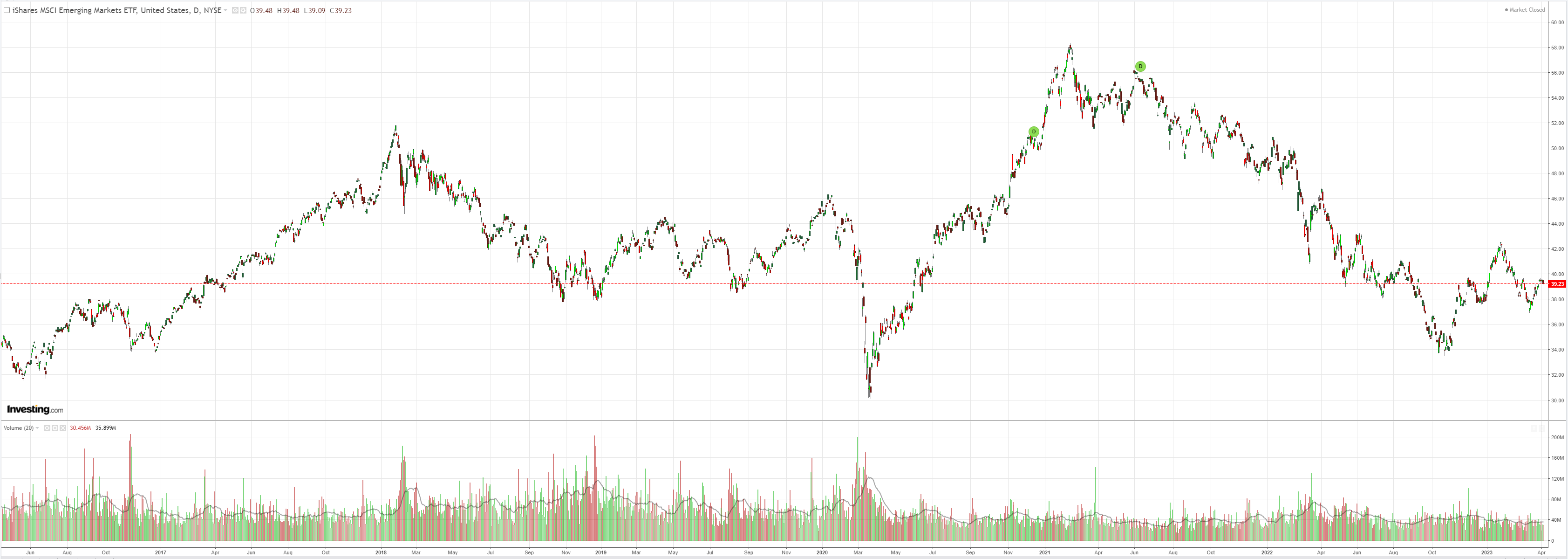

And EM stocks (NYSE:EEM):

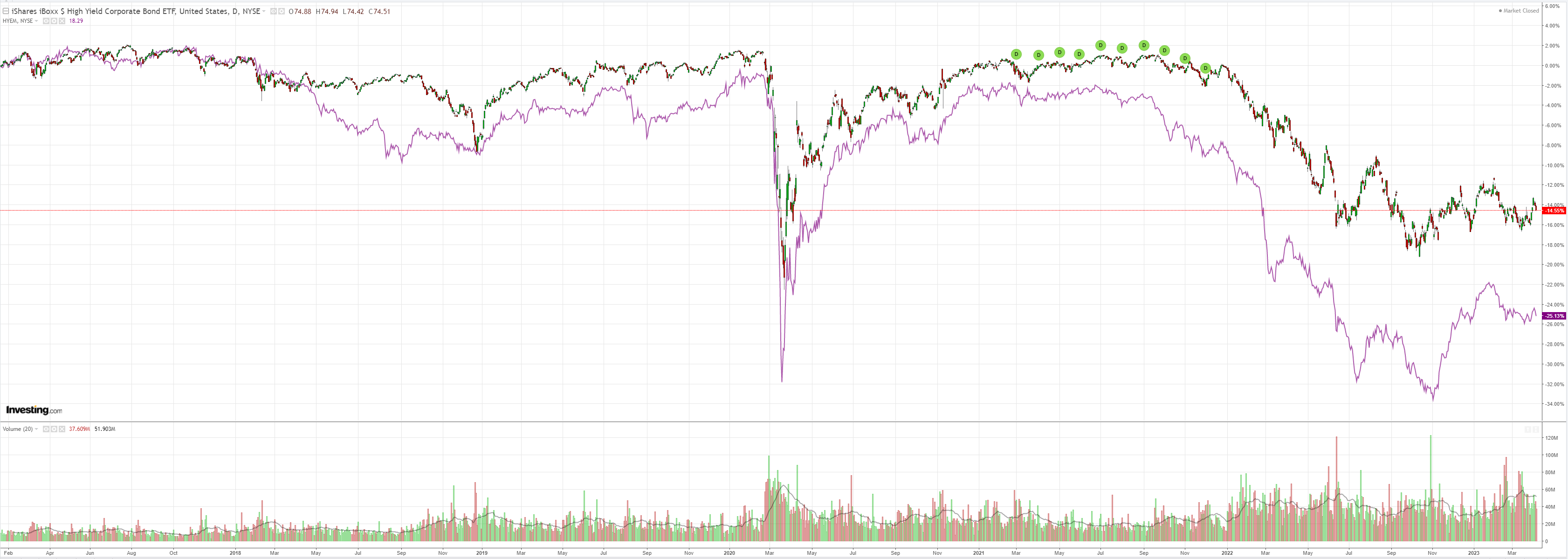

Make junk (NYSE:HYG) weak again:

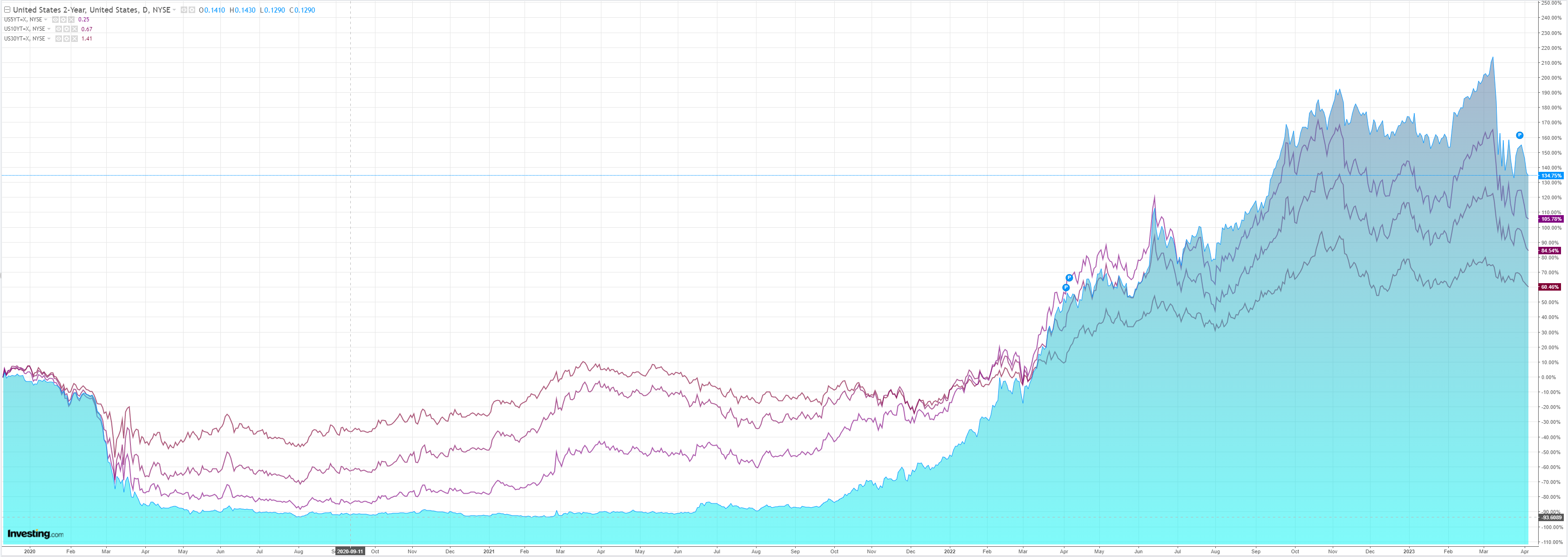

US yields broke support:

Stocks are also toying with double tops:

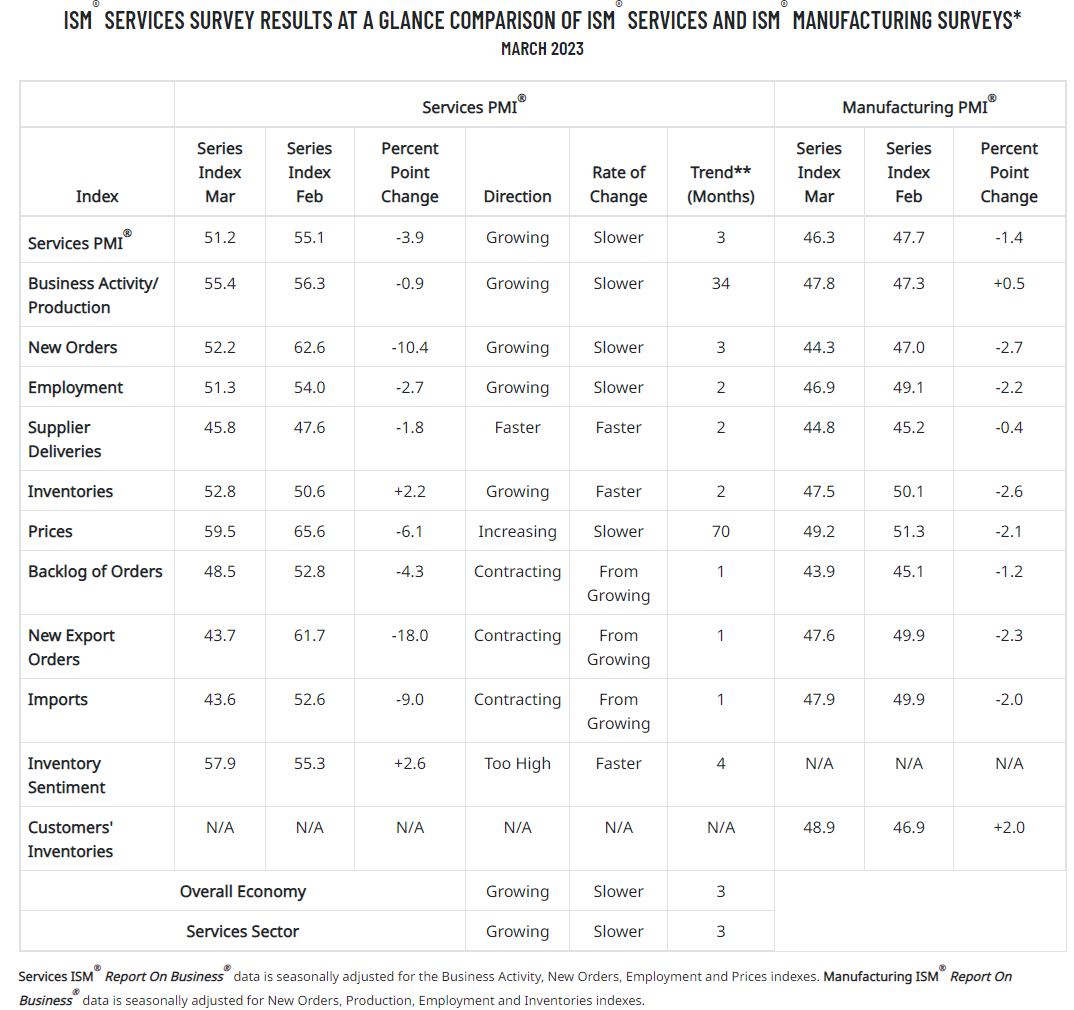

US data is weakening fast. The Services ISM was a shocker:

ADP slowed as well, up by 145,000 jobs in March and annual pay was up 6.9 percent year-over-year. That’s a nasty combination.

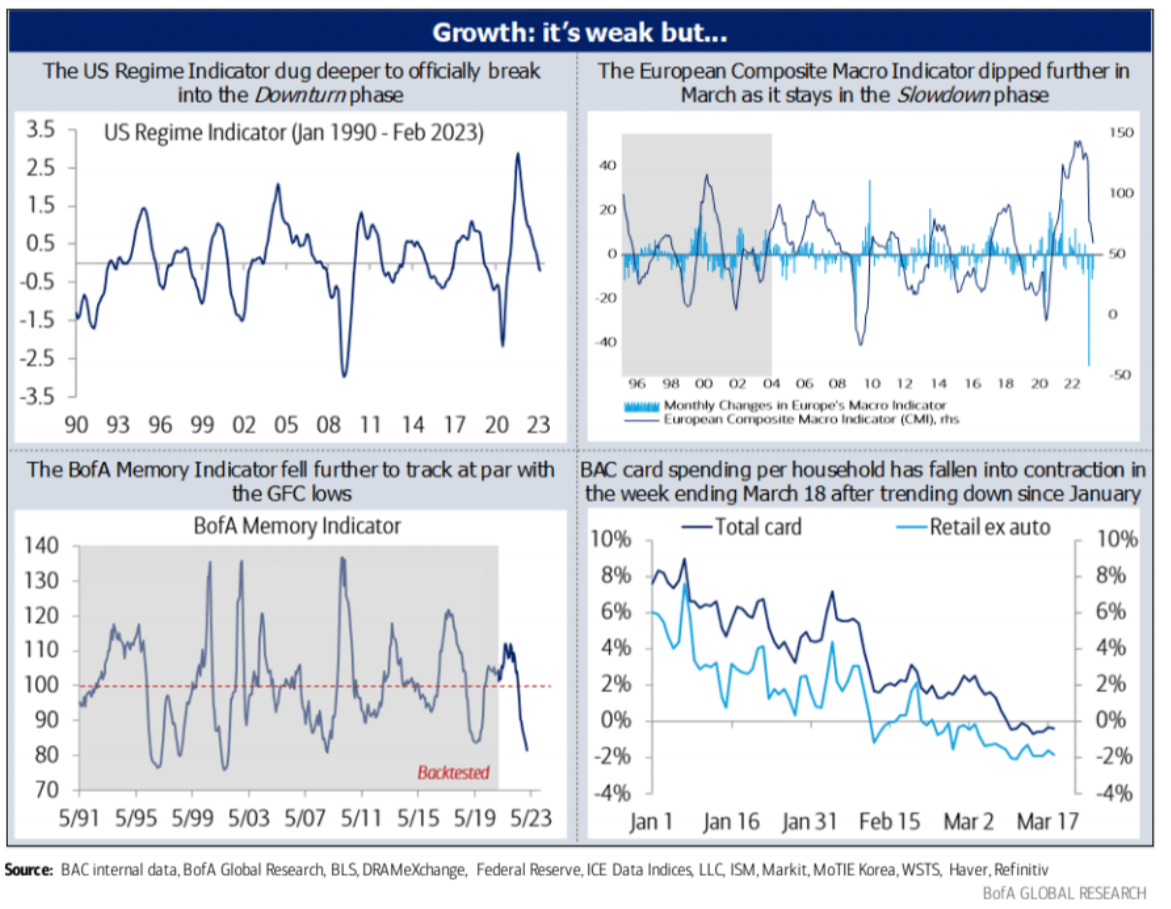

BofA’s macro metrics are slumping:

The US is heading into a recession and it is becoming obvious. Credit card spending is further confirmed to have been hit by the bank run (which I would not expect) and the (NYSE:KRE) is breaking down again:

However, this is all well-telegraphed. What is not is that the Eurozone is fast catching down which matters a lot for FX.

As the ECB is forced to pause as well then the interest rate and growth uplift for EUR will simultaneously disappear.

I still don’t trust the falling DXY but AUD is at least behaving normally by weakening anyway.