Now things are getting interesting. DXY was bid last night as EUR reversed:

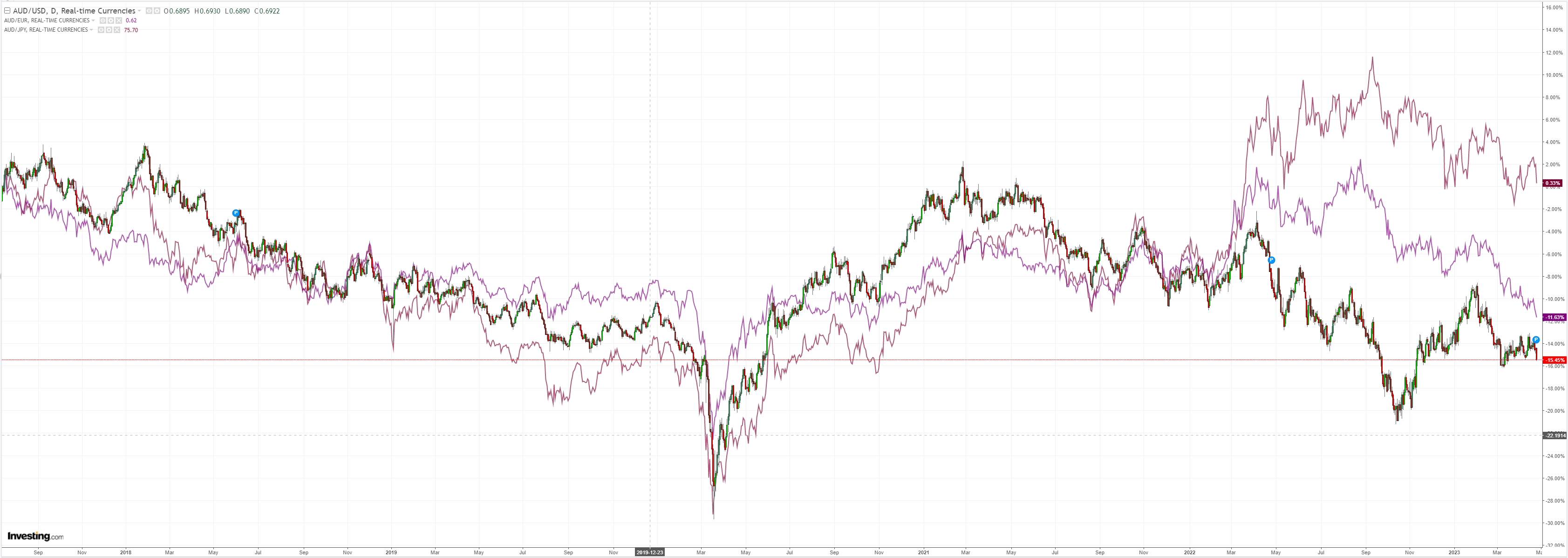

AUD puked:

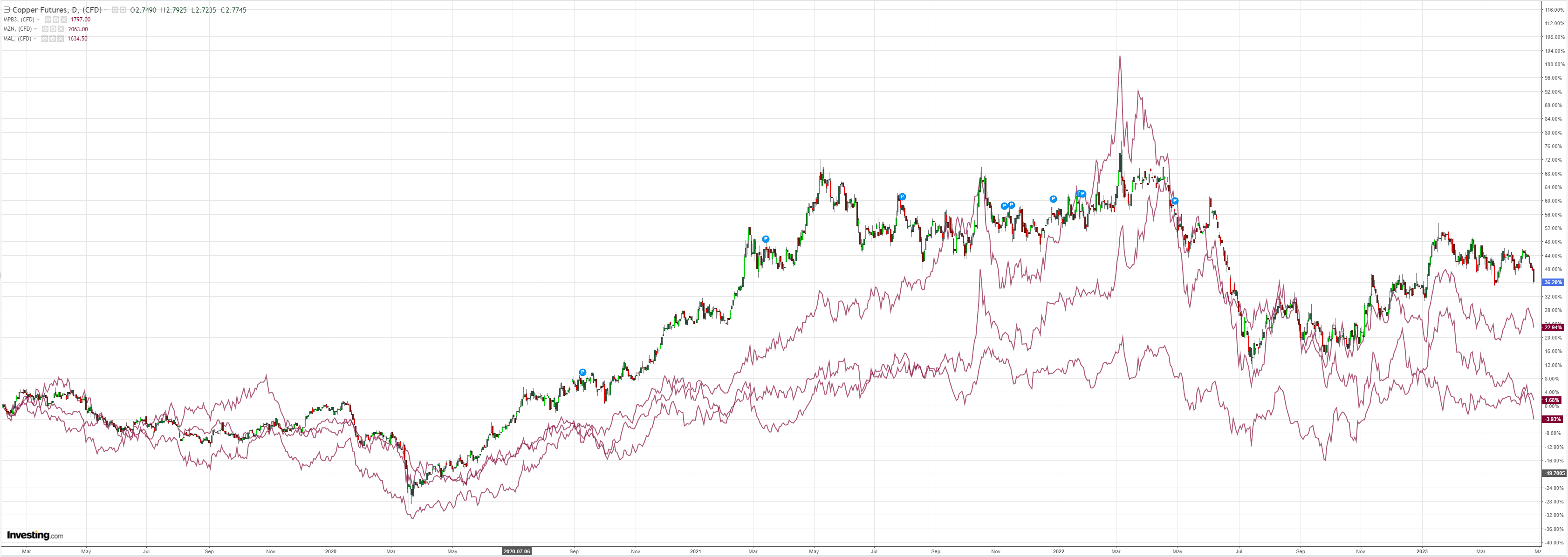

Gold held on but commods were pulverised:

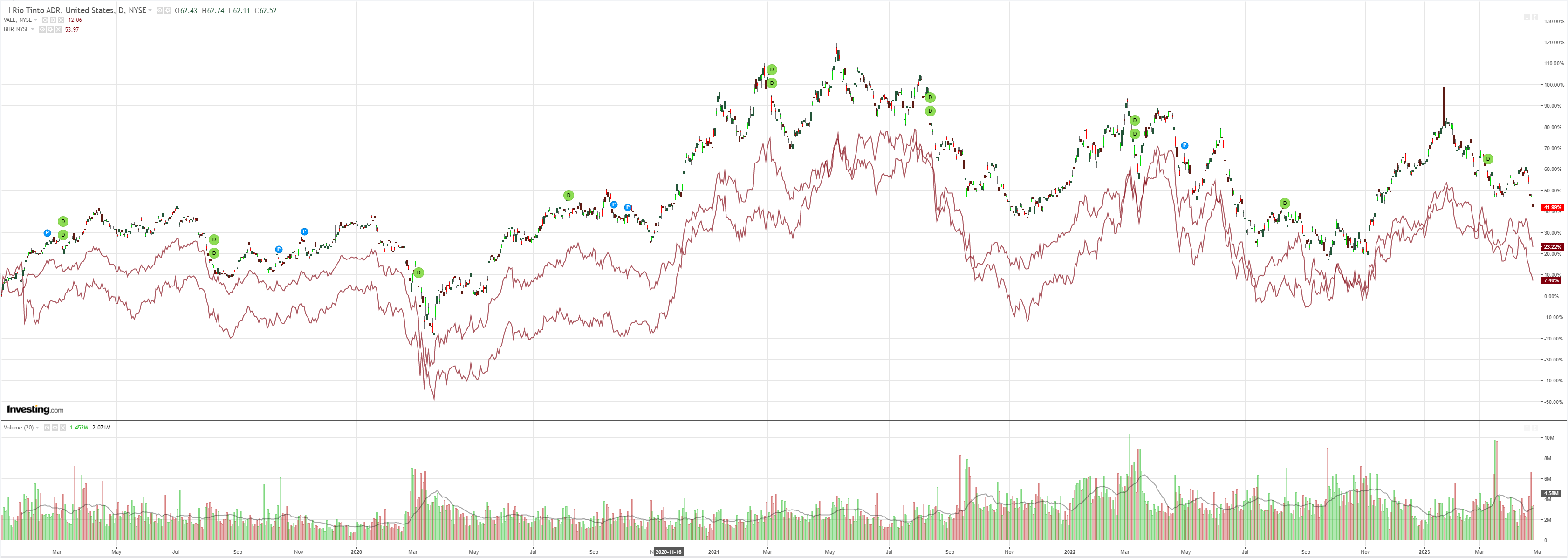

Big miners (NYSE:RIO) have fallen down a shaft:

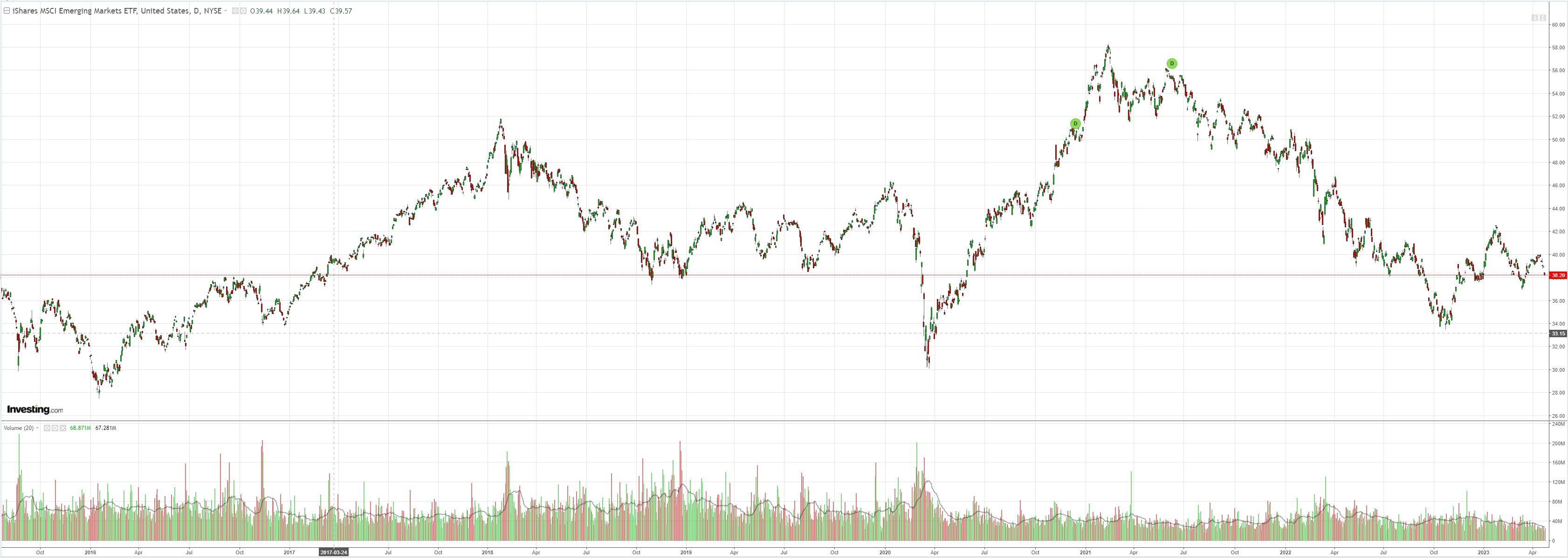

EM stocks (NYSE:EEM) are at the neckline of a bizarre head and shoulder pattern:

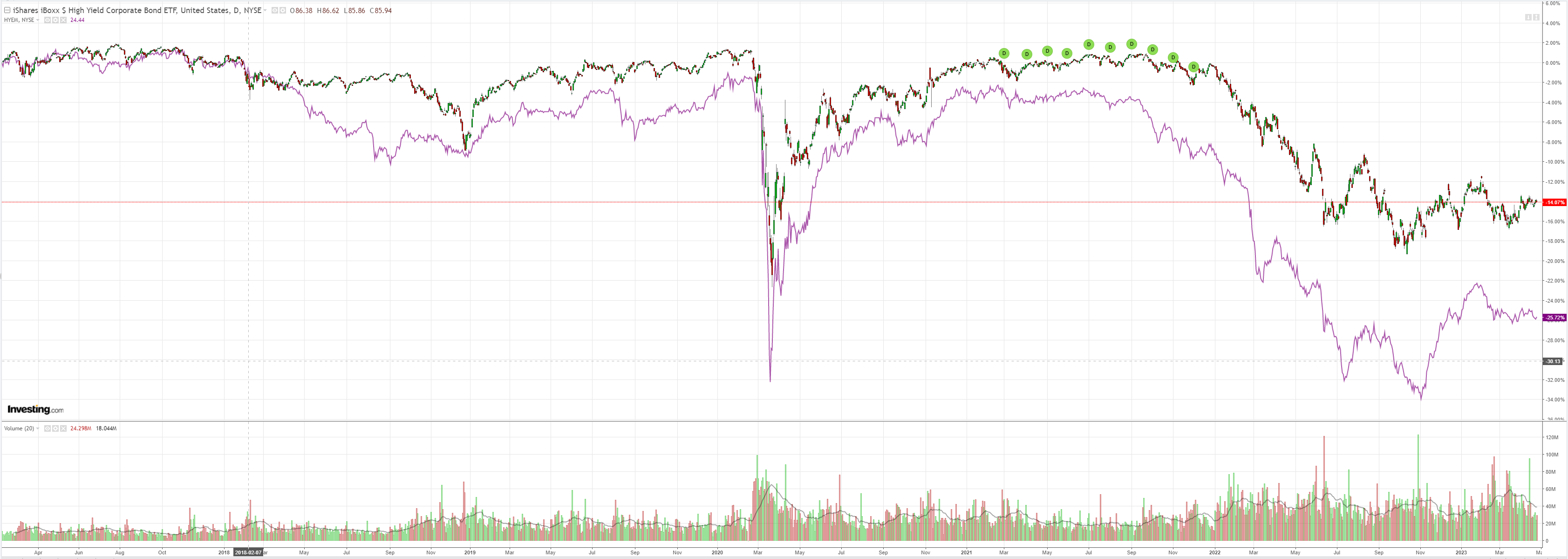

But junk (NYSE:HYG) is OK:

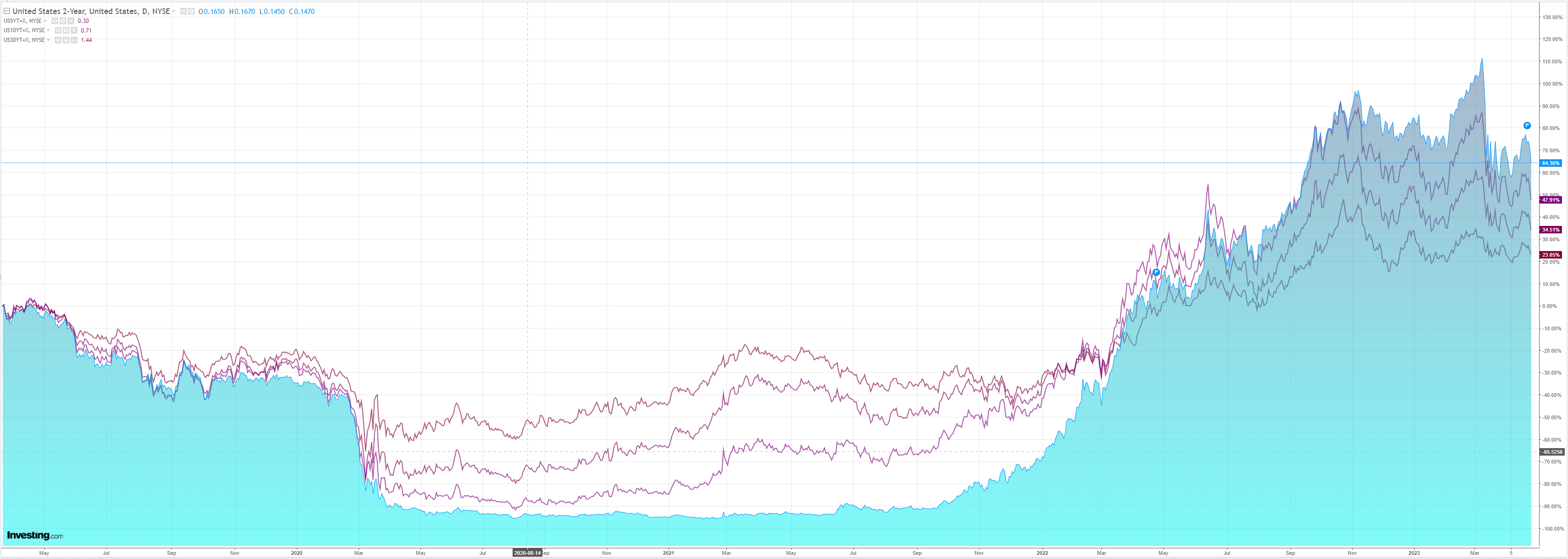

As Treasuries are bid:

And stocks swoon:

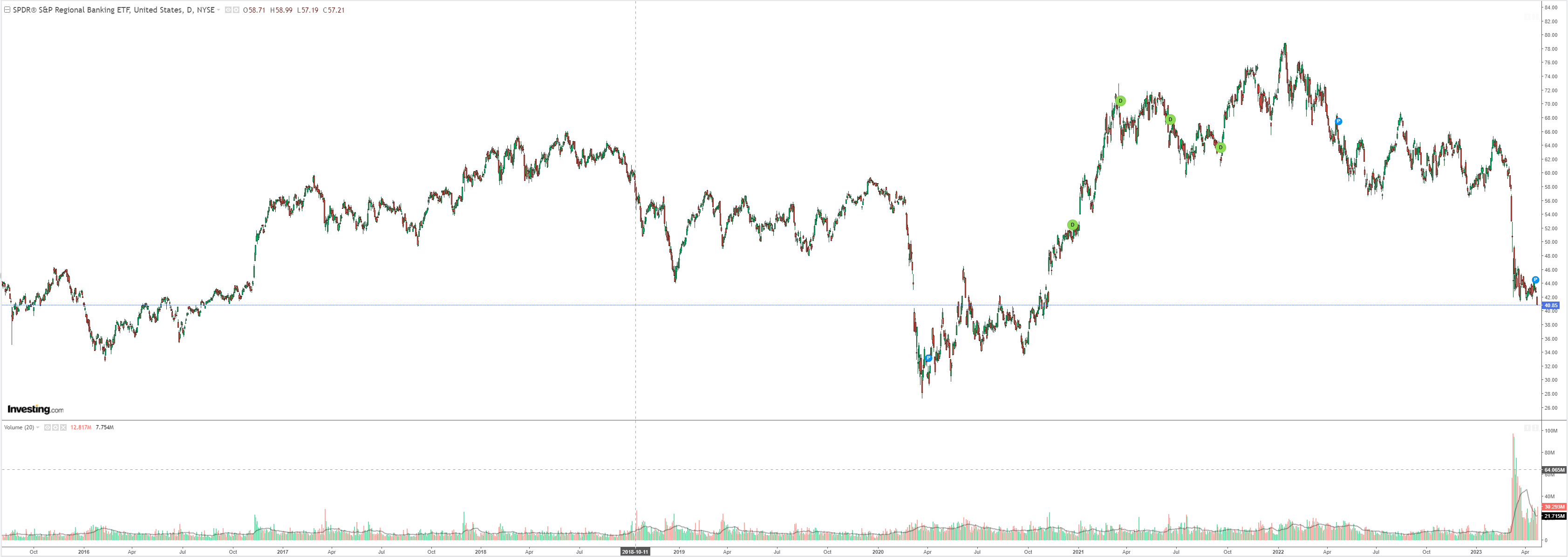

(NYSE:KRE) broke:

The market is awakening to the fact that the Chinese recovery, such as it is, is not going to add to global net demand. It is domestic and services driven. Hot money is fleeing Chinese stocks and commodities:

CNY is taking a bath and is always bad for AUD:

The post-October risk rally was based upon the China reopening and an end to Europe’s energy woes. The former is breaking down, the latter will come in due course as markets sell Europe as a China proxy.

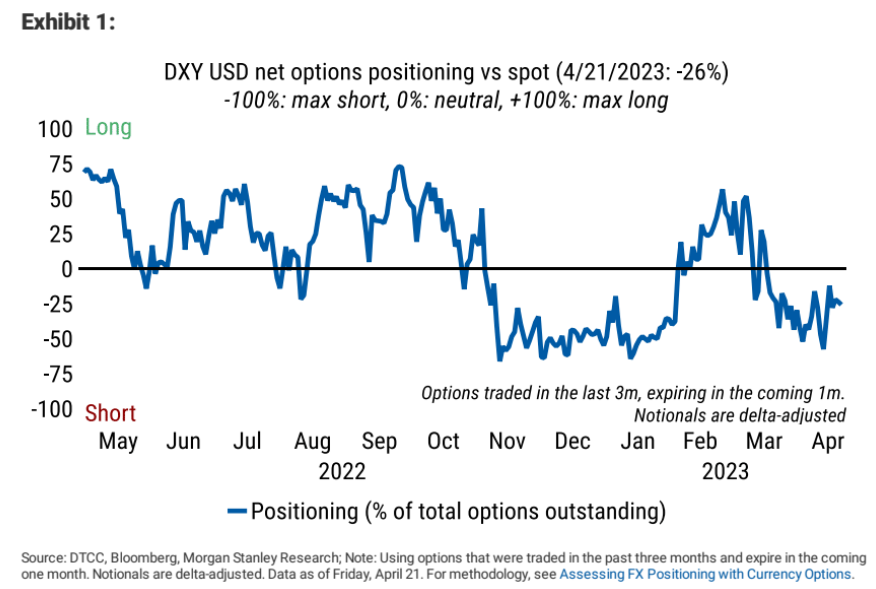

Amazingly, markets are still short DXY going into this:

With the Fed still tightening and the debt-ceiling shock fast approaching, AUD is about as appealing as a pool of vomit.