DXY sank last night which is very bad news for the world:

AUD dutifully popped:

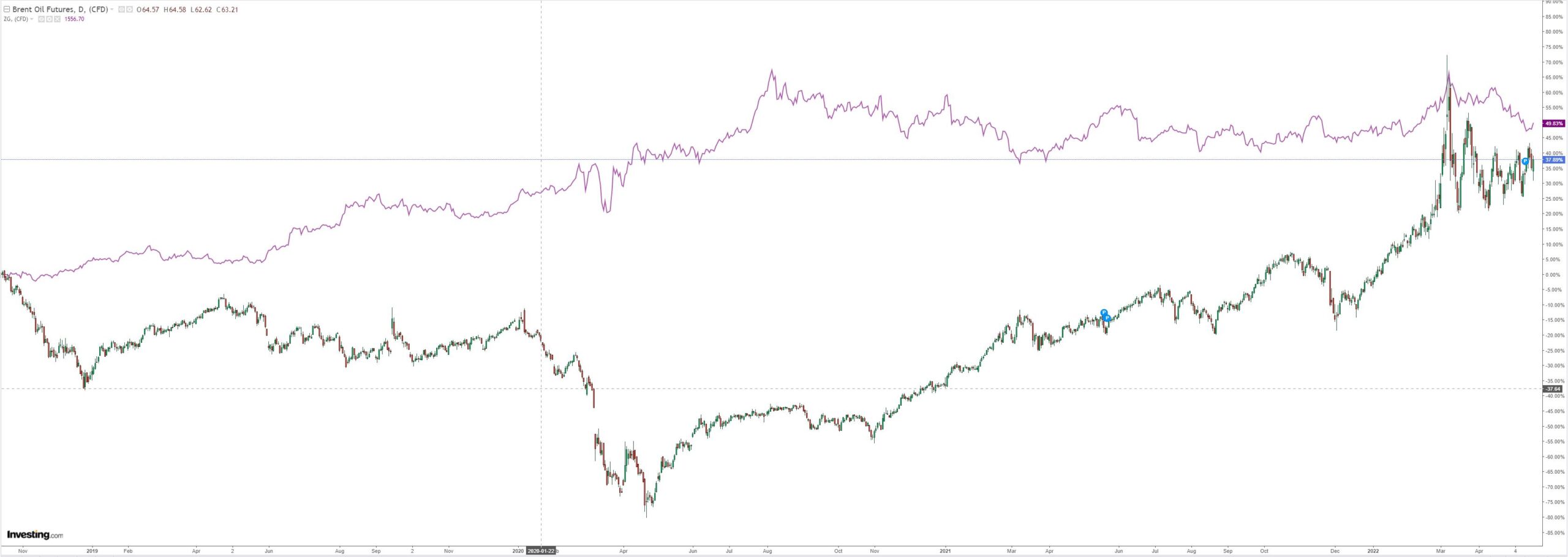

Oil just won’t fall:

Metals surged:

And miners (LON:GLEN):

EM stocks (NYSE:EEM) were not so good:

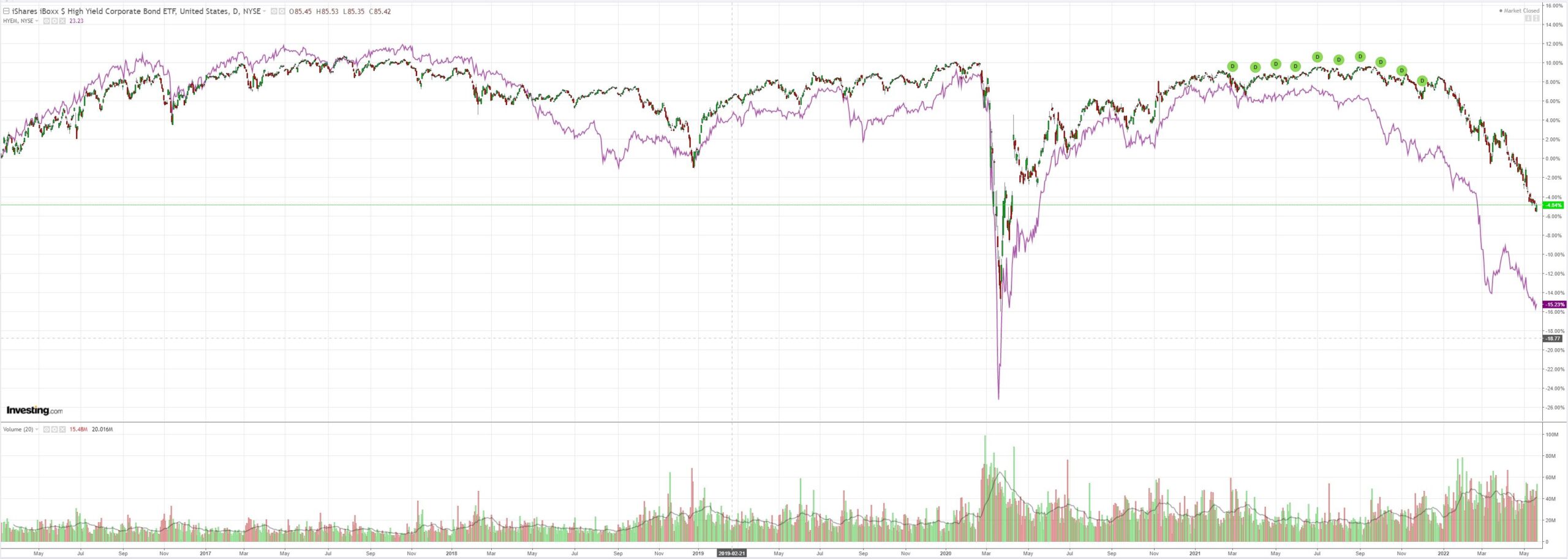

Nor junk (NYSE:HYG):

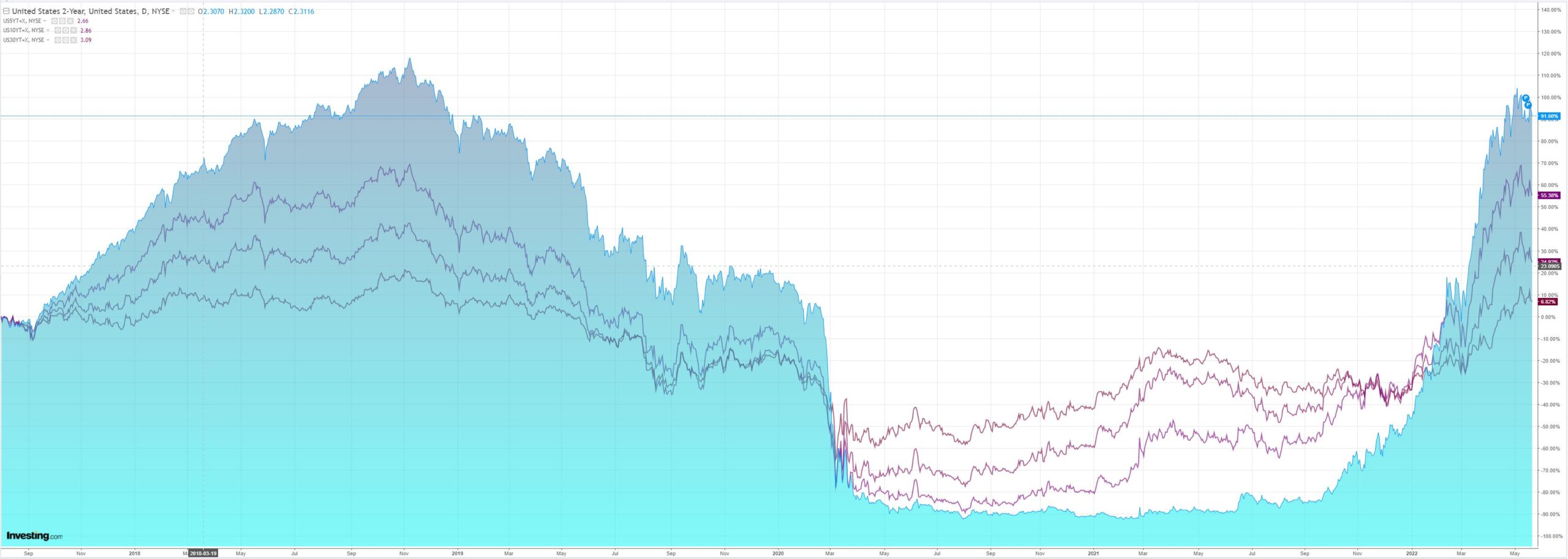

Long bond yields are threatening to stall and fall:

But stocks fell anyway:

Westpac has the wrap:

Event Wrap

US existing home sales in April fell to 5.61m annualised (est. 5.65m, prior 5.75m), the lowest reading since June 2020 but still above pre-pandemic levels. NAR’s chief economist Yan said that high house prices and higher mortgage rates suggest further declines.

The Leading Index for April fell 0.3%m/m (est. flat, prior revised to +0.1%m/m from +0.3%m/m). The weakest component was consumer expectations. Weekly initial jobless claims were 218k (est. 200k, prior revised from 203k to 197k), with continuing claims at 1.317m (est. 1.320m). The Philadelphia Fed business survey for May disappointed at 2.6 (est. 15.0, prior 17.6). The survey cited muted optimism, despite a rise in new orders, employment and shipments.FOMC member George said she is “very comfortable” with raising rates 50bp, and would need to see something “very different” in order to be more aggressive than that. On the stock market’s declines, she said the FOMC’s actions are “not aimed at equity markets in particular but I think it is one of the avenues through which tighter financial conditions will emerge,” she added.

The ECB minutes underscored the shift in tone of late, with some members calling for policy adjustment as soon as possible. ECB speakers continued to call for the end of QE and imminent rate hikes thereafter.

The UK industry trends survey was surprisingly firm at 26 (est. 12, prior 14). Against lower confidence (-30%) and weak investment plans, output grew at fastest pace in 10 months on the back of solid demand. Cost pressures remain the key concer.

Event Outlook

NZ: The recent strength in dairy prices should run up against the oil price surge, seeing the trade deficit narrow slightly in April (Westpac f/c: -$200mn).

Japan: Underlying momentum in the CPI will likely remain subdued in April given that inflation ex food and energy is still in negative territory (market f/c: 2.5%yr).

Eur/UK: Inflation is pressuring the real spending capacity of European households, likely resulting in weak consumer confidence persisting in May (market f/c: -21.5). These risks are also present in the UK and are set to weigh on retail sales activity (market f/c: -0.3%) and GfK consumer sentiment (market f/c: -39).

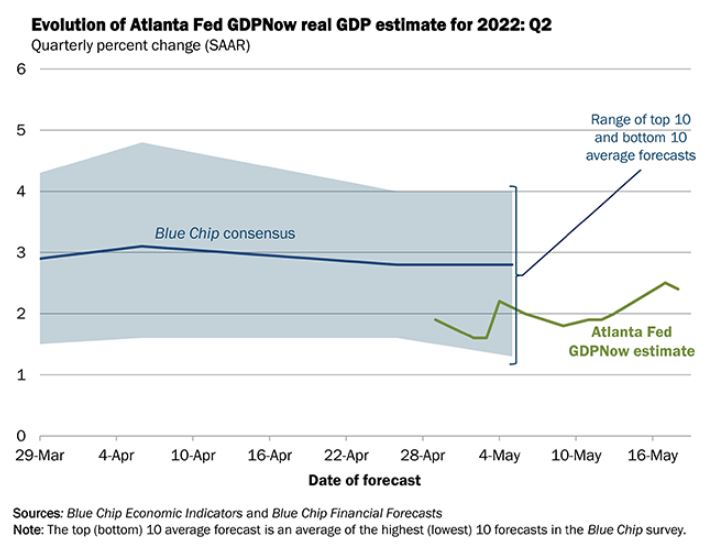

Weak US data did for DXY and yields. But the Fed’s GDPNow measure is still fine:

So, I don’t think the Fed is ready to pivot. If it does then it will be condemning the US to runaway stagflation, made worse by any Chinese rebound and its impact on oil.

However, markets are finally starting to sniff out that the FCI tightening is going to slow growth before very long.

In forex terms, a stagflationary outcome will be AUD positive. This is a risk case in my view.

My base case remains a global recession, given we’re already in it, and another flush for risk assets including AUD as DXY bounces one last time in a safe haven trade.