Forex tells a very interesting tale today. Following on from Evergrande’s extraordinarily dubious news and a PBoC liquidity injection yesterday, which dumped DXY, the Fed was hawkish which launched DXY:

The Australian dollar popped on the crosses but was whacked back down vs DXY:

Gold faded. Energy is driving the Fed into policy error crescendo:

Base metals were not convincing:

The mining dead cat purred a little:

EM stocks bounced:

Junk not so much:

And Treasuries issued a policy error warning, flattening the curve:

Which stocks ignored on general BTFD activity:

Westpac has the data:

Event Wrap

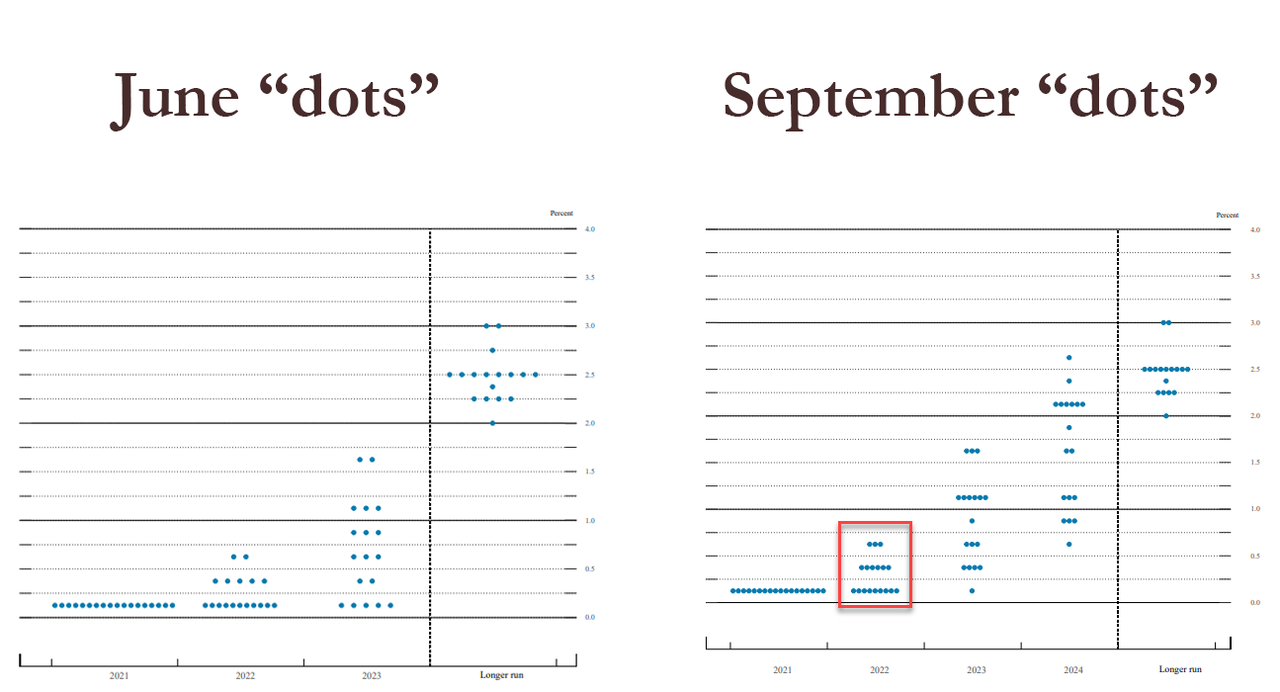

The FOMC said “moderation in the pace of asset purchases may soon be warranted” if the economy continues to make the progress toward the dual goals, signalling an announcement at the November meeting – largely as markets had expected. Chair Powell, in his press conference, said any such tapering would likely conclude around mid-2022. The statement noted the economy and employment have “continued to strengthen,” though the pandemic has slowed the recovery. The statement also noted “Inflation is elevated, largely reflecting transitory factors.” The dot plot projection for the Fed funds rate rose slightly for 2022, from a 0.125% median to 0.25%, while 2023 was increased from 0.625% to 1.0% – the latter a moderate surprise for markets.

US existing home sales in August were close to consensus, falling 2%m/m to an annualised 5.88m (est. 5.89m, prior 6.00m). NAR described the outcome as a reflection of pent up demand.

Eurozone consumer confidence rebounded to a historically high level at -4.0 (prior -5.2, est. -5.9).

Event Outlook

Australia: Weekly payrolls for the week ended 28 August will provide an interim update on the ongoing effects of the pandemic on labour.

Euro Area: The September manufacturing PMI should remain firm on robust demand and supply chain frictions (market f/c: 60.3). The September services PMI is expected to be supported by the re-opening of the Euro region (market f/c: 58.5).

UK: The September manufacturing PMI continues to point to robust growth, whilst the September services PMI should reflect delta risks for services. Further, the BoE policy decision and discussions are likely to highlight a promising outlook whilst acknowledging downside risks near term (market f/c: 0.1%).

US: The August Chicago Fed activity Index will provide a timely update on activity for the region. Initial jobless claims for the week ended Sept 18 should show the downtrend slowing (market f/c: 320k). The September manufacturing and services PMIs are also likely to remain in good health. The August leading index is also due (market f/c: 0.7%).

The Fed was hawkish:

The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals. If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

The Fed shrugged off Delta and lifted 2022 growth plus turned marginally more hawkish on the dots:

My views are unchanged. Nothing that has happened in the last 24 hours makes me any less bearish AUD or anything else. PBoC liquidity injections are incremental easing. We already know some kind of Evergrande restructuring is imminent. The Fed was, if anything, more hawkish than it has been.

This is still a 2015 or 2018 rerun with the Fed staring policy error in the face as Chinese growth fades fast, with commodities and EMs in trouble.

Sell AUD rallies.