DXY looks like it wants to break out:

AUF popped and dropped but is still grinding higher overall:

CNY is mired:

Oil finally took a breather as the machines ran out of puff:

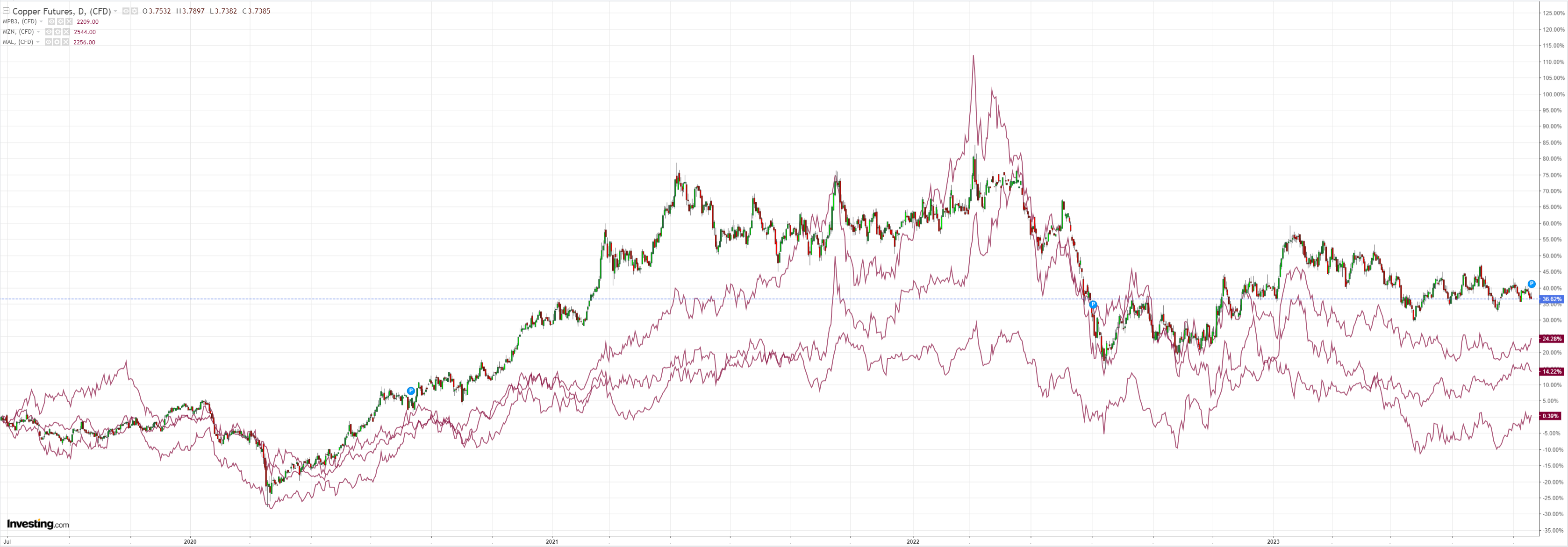

Dirt is worthless:

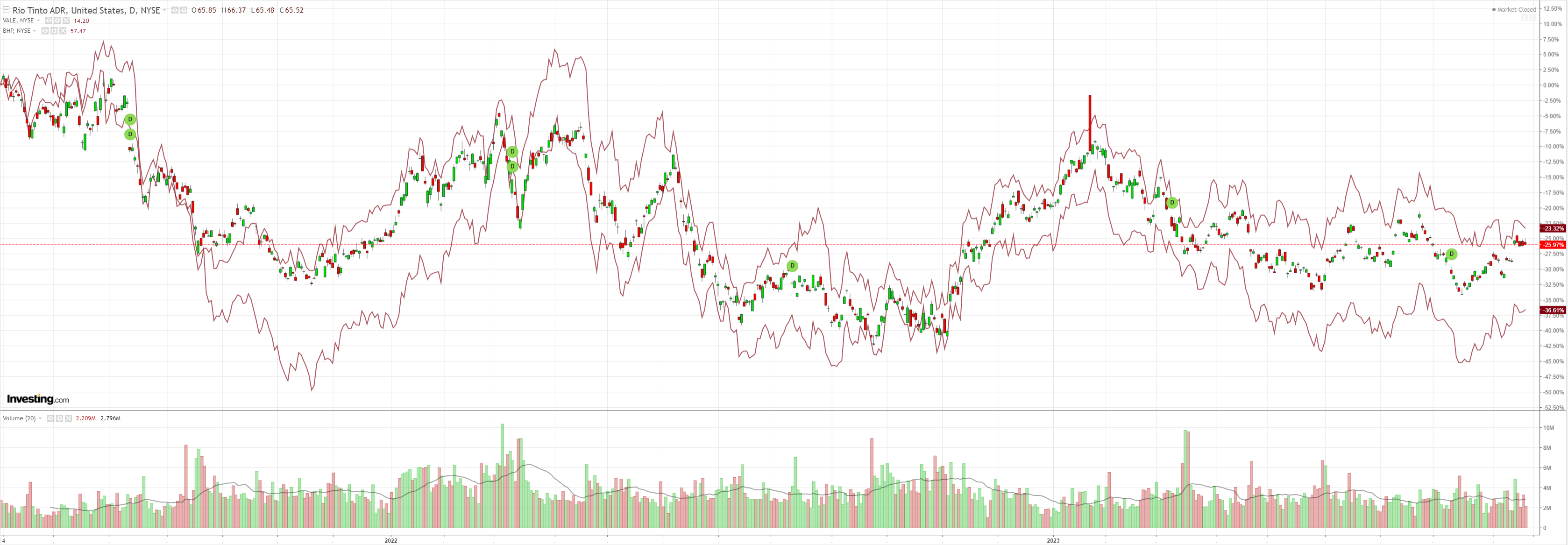

Miners have stalled:

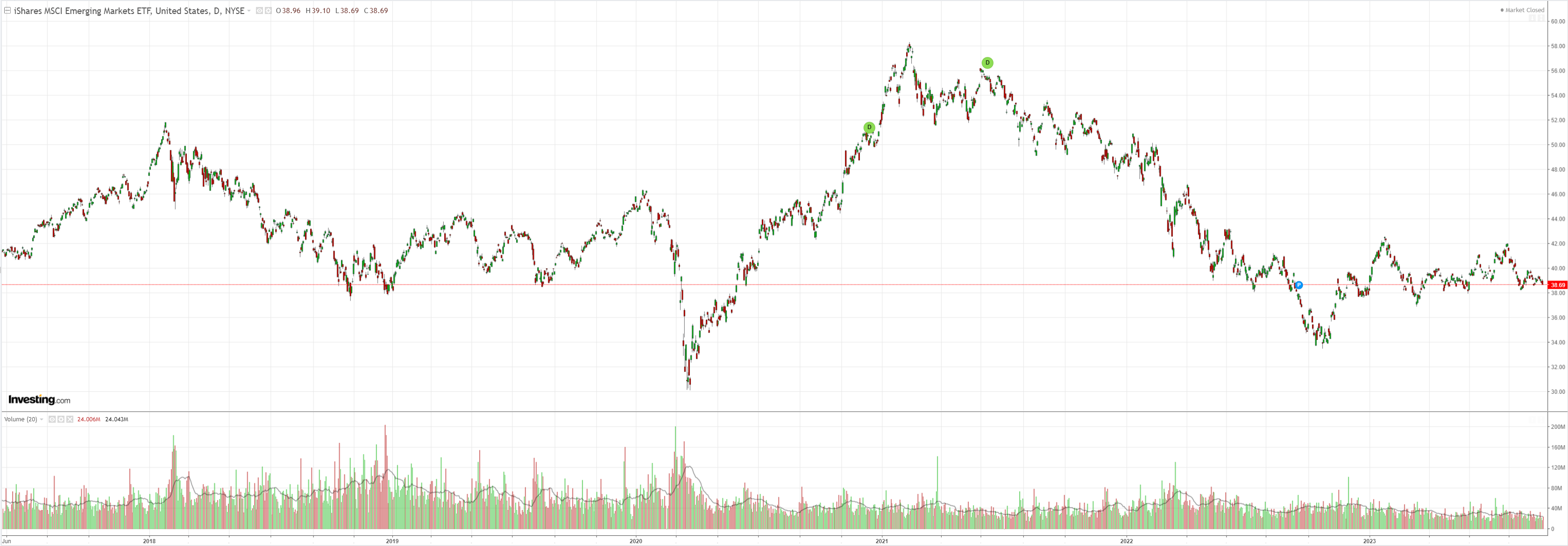

EM stocks look like they might retest lows:

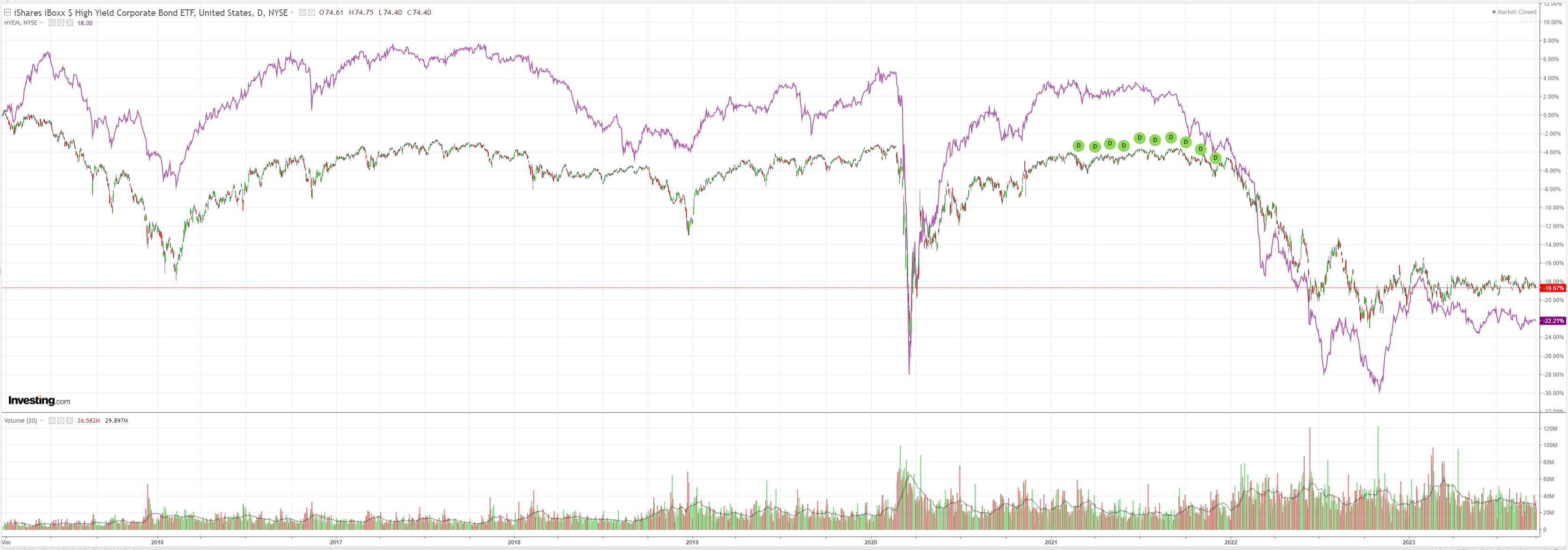

Junk is in no man’s land:

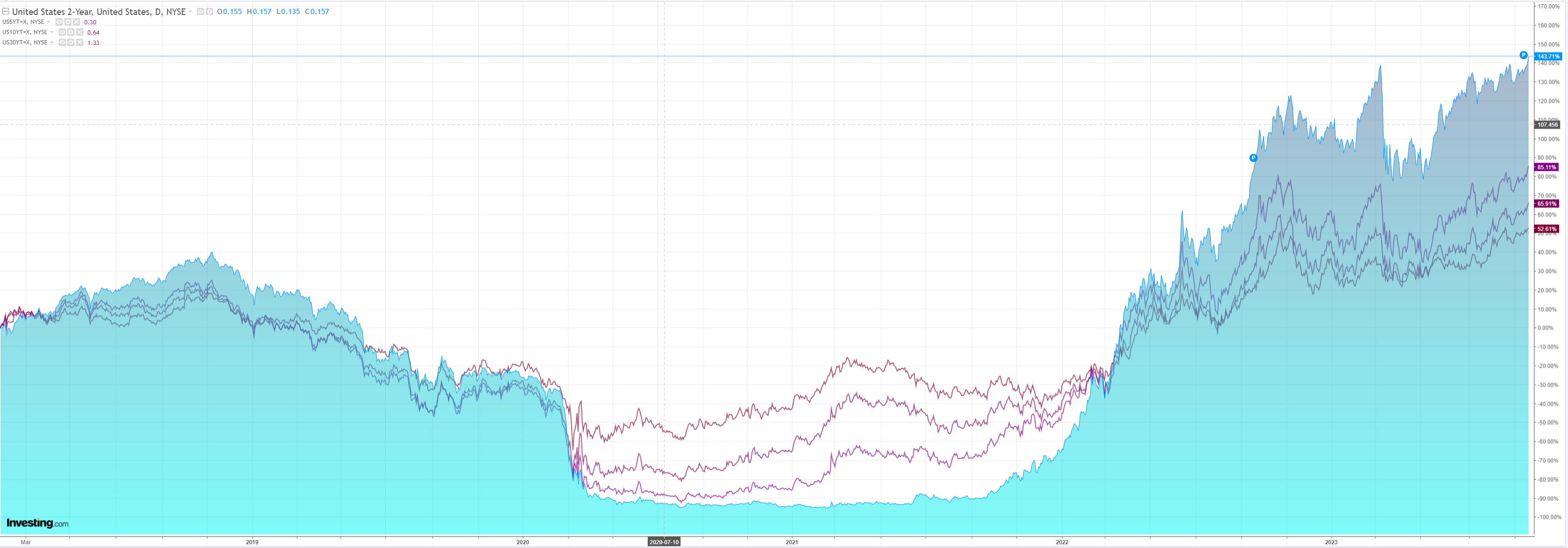

The curve steepened as yields backed-up:

Stocks were flogged:

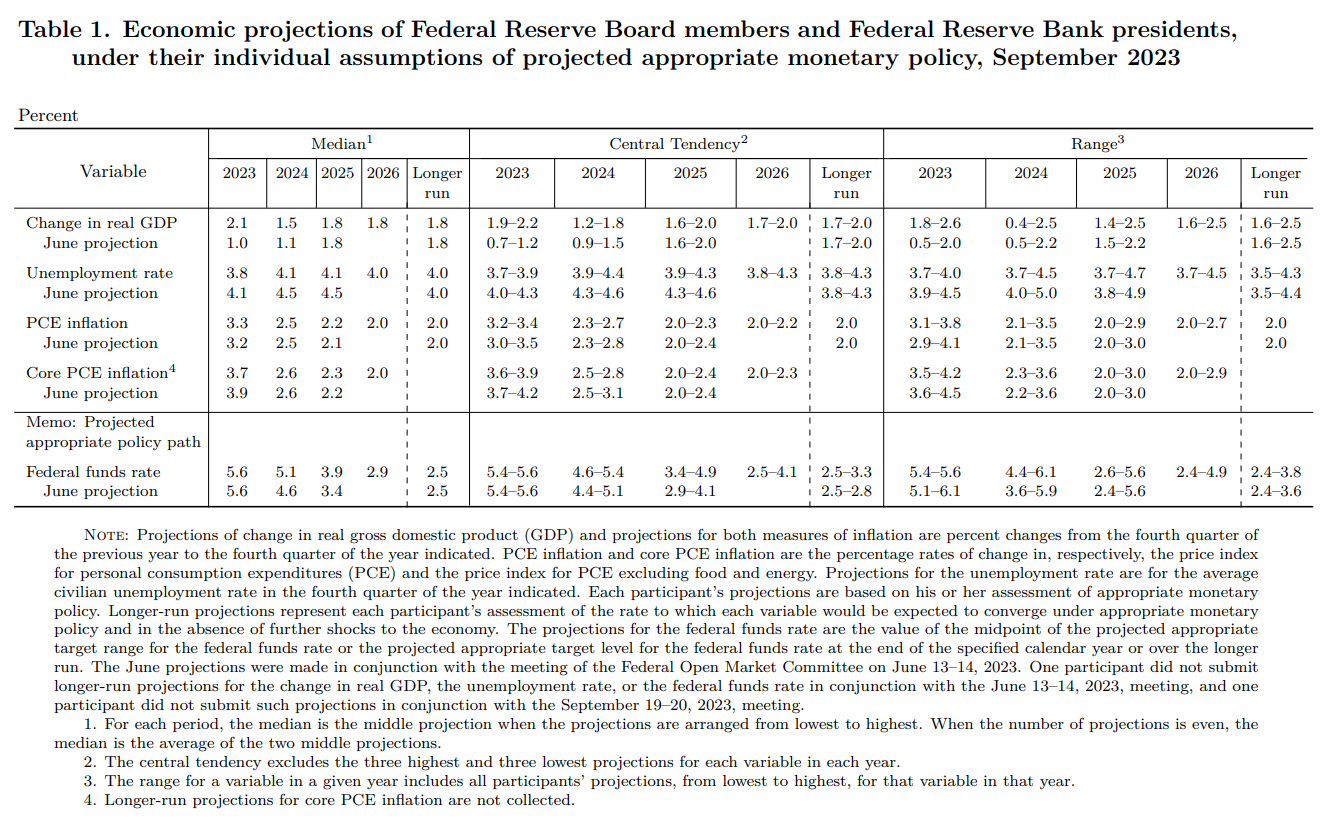

The Fed did deliver a hawkish surprise. Growth and inflation forecasts were lifted, and the projected Fed funds rate:

The 2024 expected rate path lost one and a half rate cuts, and 2025, up to four cuts.

This is such a strong re-evaluation of the rate path that it rather looks like the Fed recalibrating its assessment of r*.

No wonder stocks didn’t like it, and DXY did. This hints at a higher structural shift higher in the US neutral interest rate. Stocks are NOT priced for that.

With the rest of the world now paused or cutting, DXY has a free hand to run.

AUD is still very oversold, and the Chinese recovery fantasy is helping it for now. But this boosts the DXY bull market case so the headwinds are not going away anytime soon.