DXY took off last night and EUR crashed:

The Australian dollar was poleaxed:

Base metals were mixed:

Big miners LON:GLEN) rallied:

EM stocks (NYSE:EEM) were slaughtered:

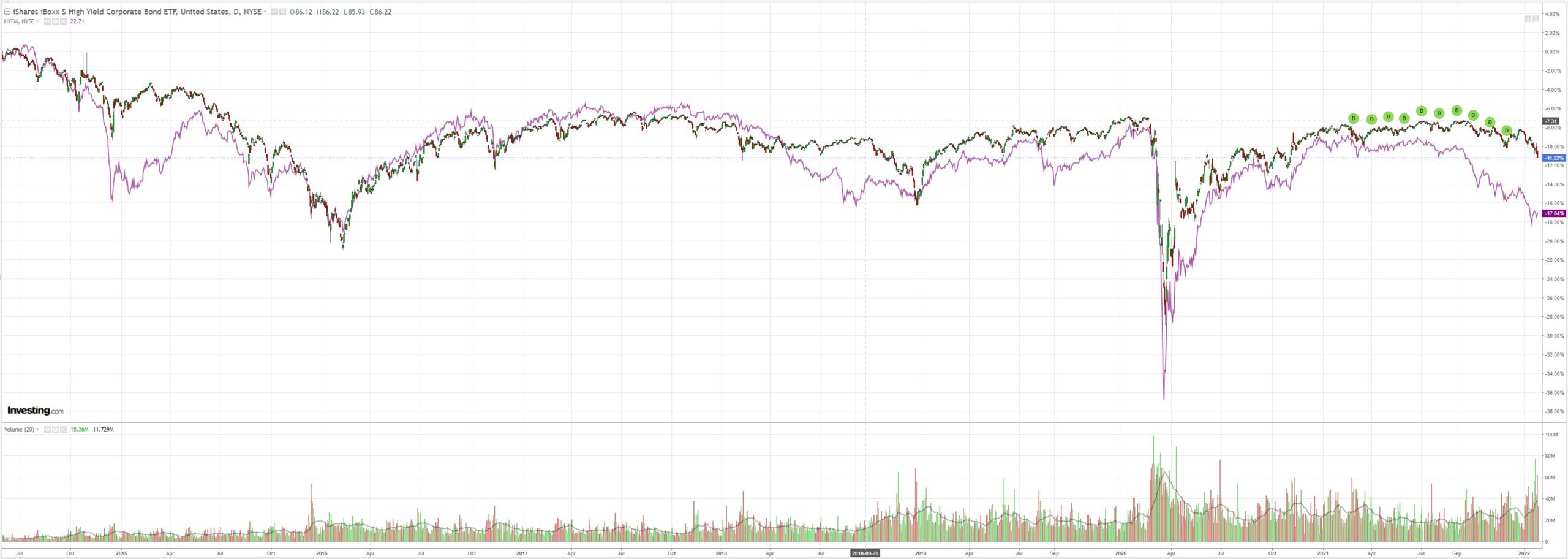

DM junk broke. EM was OK:

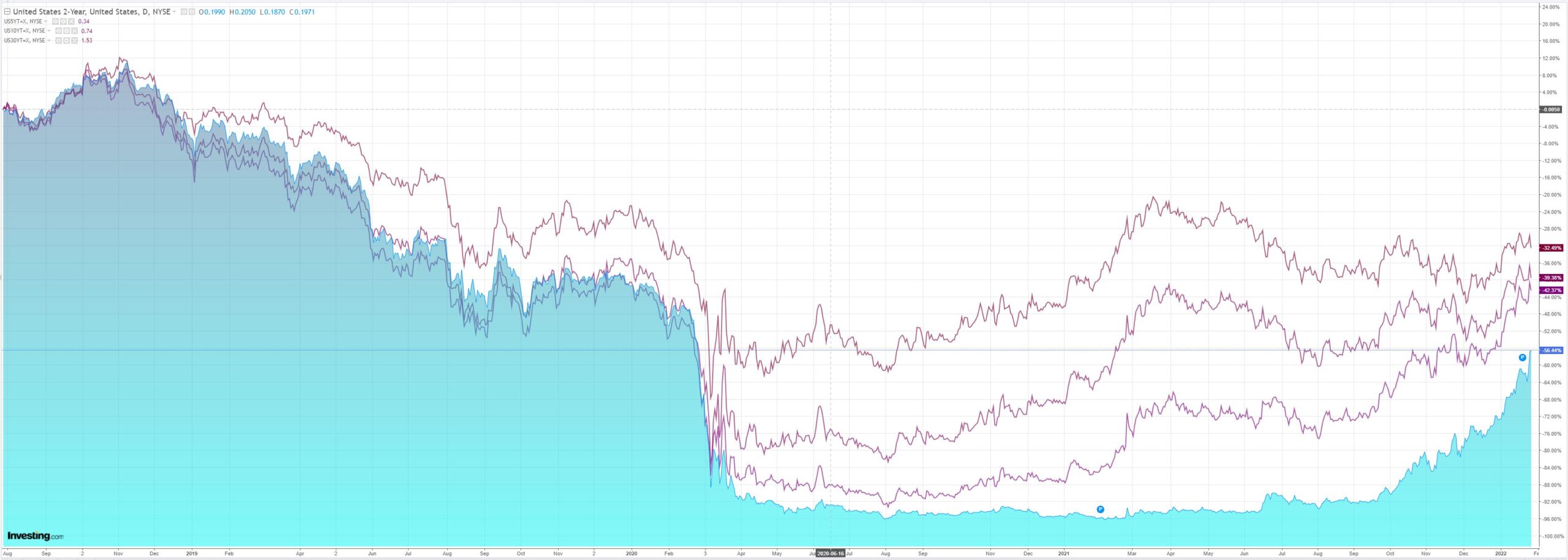

The United States 2-Year was pulverised. 5-10 is approaching inversion:

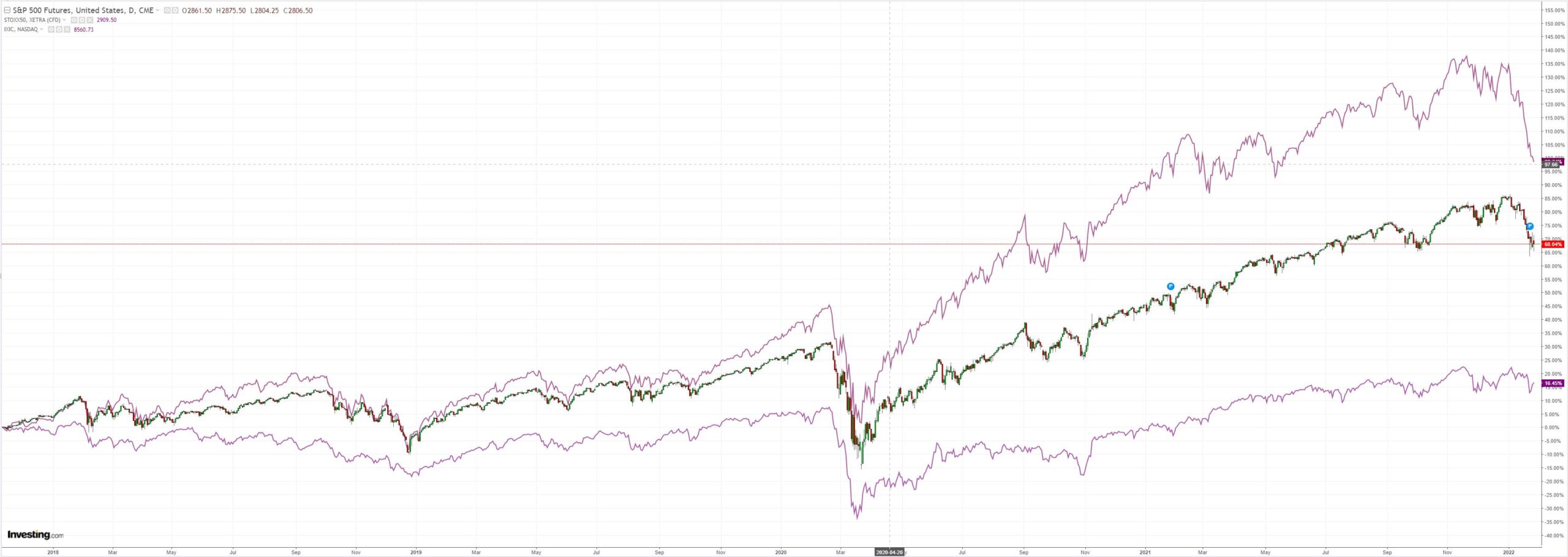

Stocks fell:

In news, US GDP was strong in Q4 thanks to inventory rebuild. Goldman:

Real GDP rose 6.9% annualized in the fourth quarter—1.4pp above consensus—as a large inventory contribution and services-driven consumption strength were partially offset by sizable declines in structures investment and government spending. After incorporating price-related news from today’s report, we boosted our December core PCE inflation forecast by 1bp +0.41% month-over-month, implying a year-over-year rate of +4.78%, ahead of tomorrow’s release. Durable goods orders decreased by more than consensus expectations in December, and core capital goods orders remained flat versus expectations for a slight increase. Initial jobless claims declined a bit more than expected, while continuing claims increased more than expected.

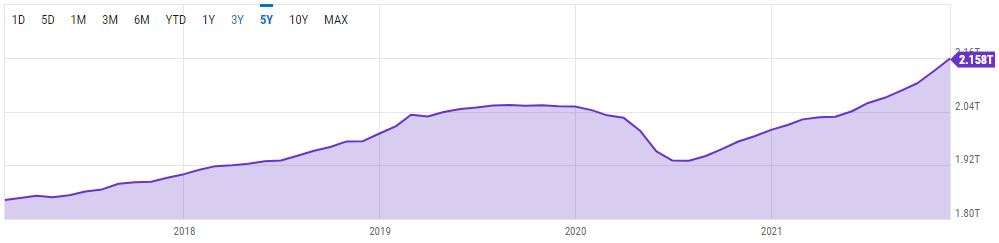

Let’s not get too far ahead of ourselves but US inventories are now stacked:

Once Fed tightening bites on demand, there’s suddenly going to be a lot of stuff lying about…just sayin’.

That means there is some precipitous point ahead where the Fed overcooks its tightening and inflation doesn’t just ease, it collapses, and the rundown of those inventories could trigger a new recession.

Where is that point? I don’t know. What I can say is that the Fed can’t stop tightening while oil is going up on yesteryear’s stagflation chimera. Likewise, when the Fed eventually breaks oil, I expect the entire commodities complex to go down with it.

In short, once the Fed is done, global inflation is going into freefall.

Be warned, everything in this cycle has moved much faster than previous iterations owing to the extreme downside and upside forces.

We are very swiftly moving towards the endgame of the COVID crazy cycle and the Australian dollar is not going to stop falling until we do.