DXY popped and dropped last night on strong JOLTS but mixed Fed comments. EUR was hit by weaker-than-expected inflation:

AUD careened through the trap door to new lows:

With CNY:

Oil is ready to break again, but beware the OPEC meeting:

Commodities are doomed:

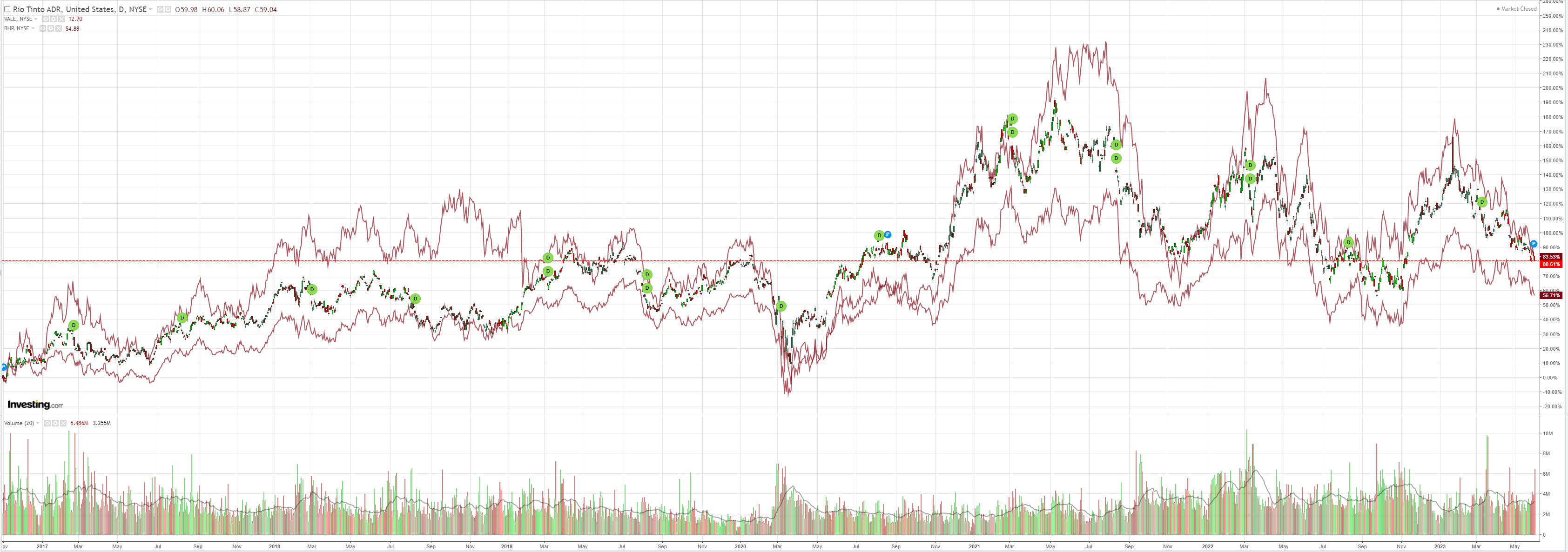

Miners (NYSE:RIO) too:

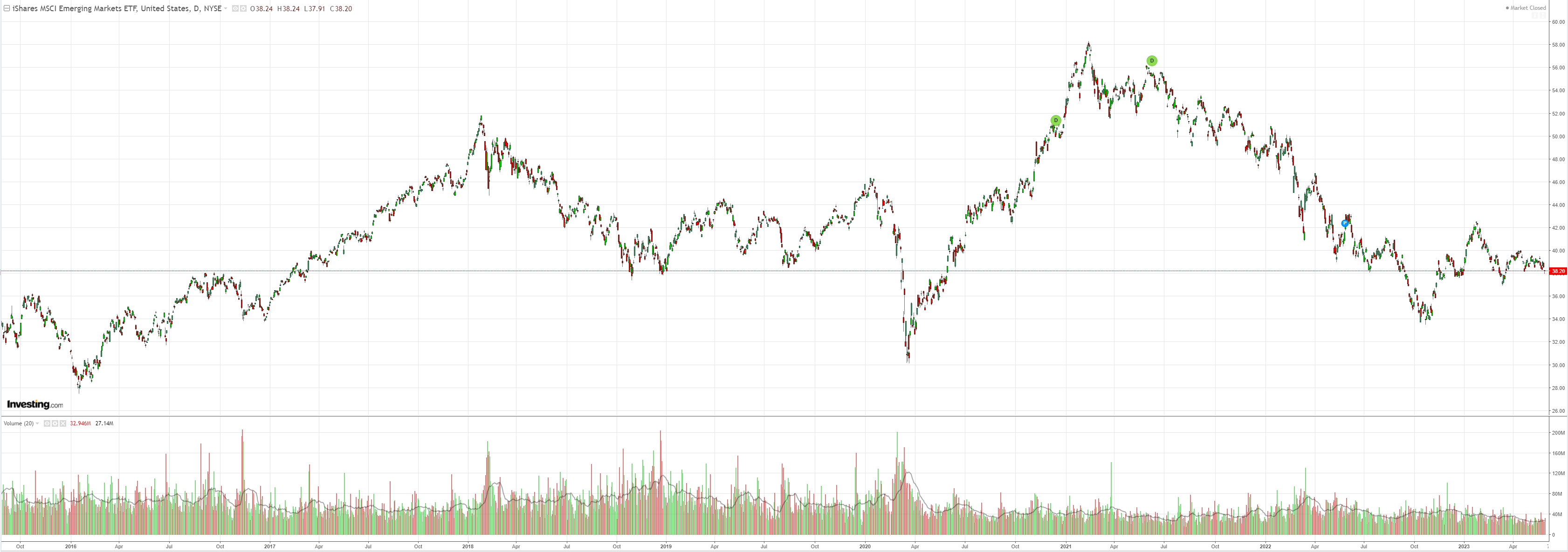

EM stocks (NYSE:EEM) are breaking down:

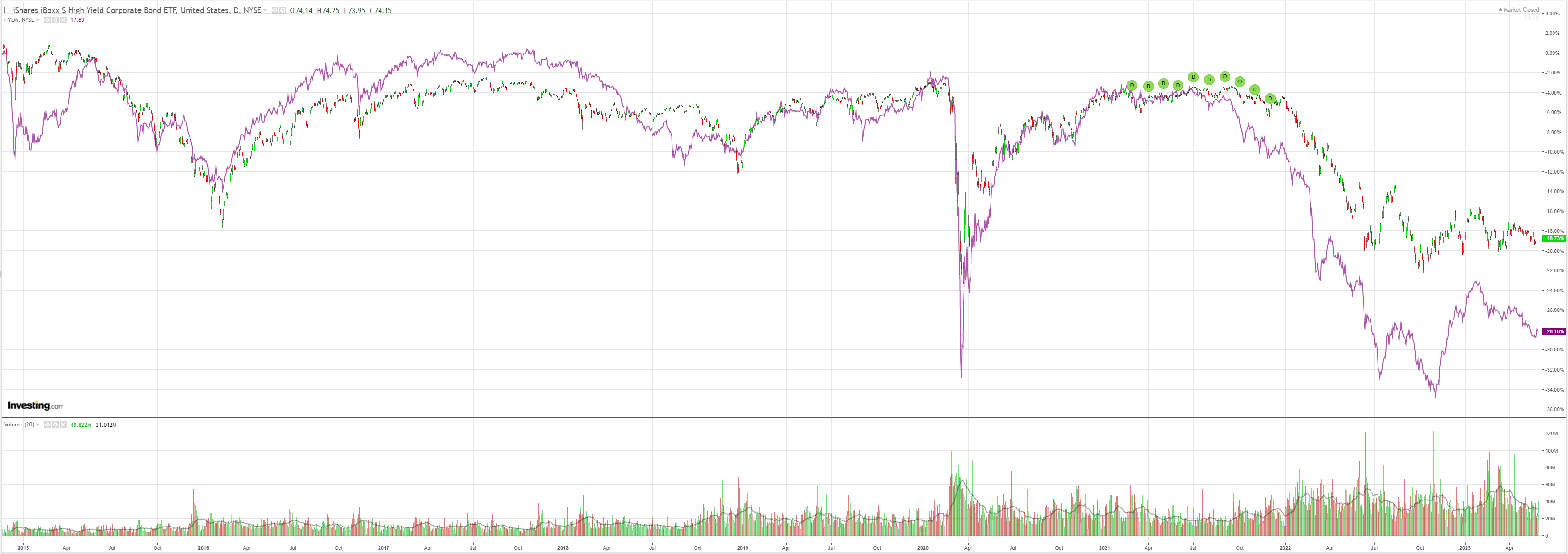

Junk iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) too:

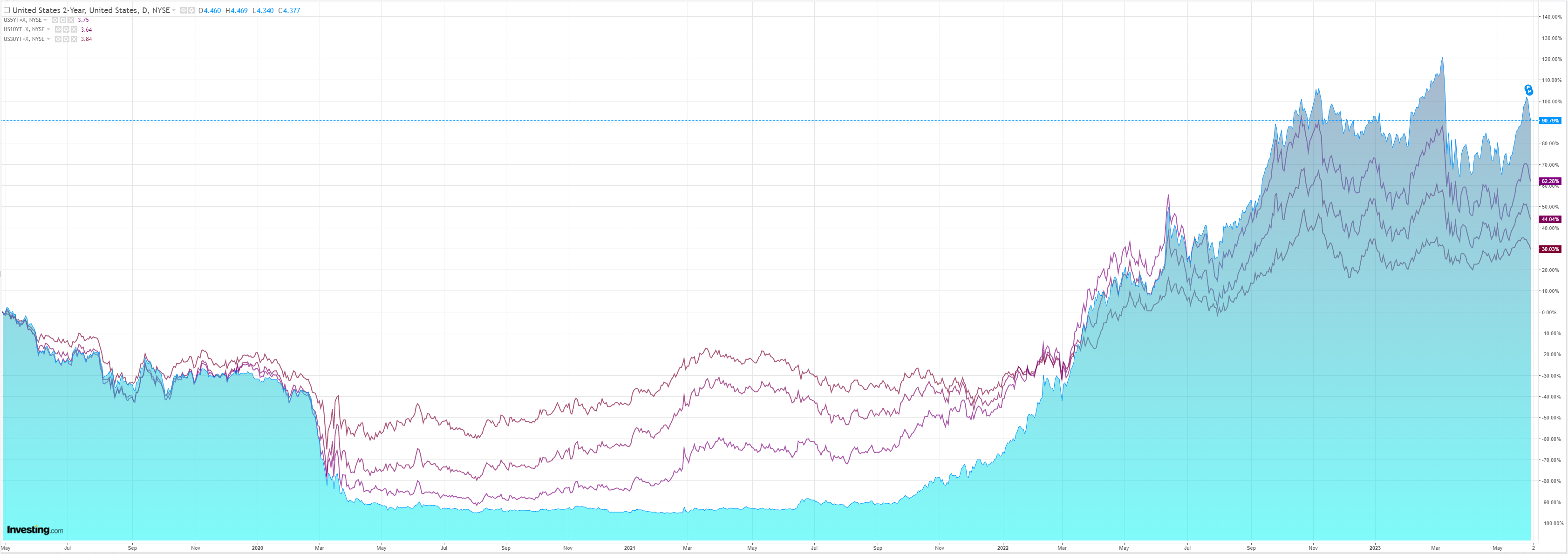

Treasuries were bid:

Stocks fell. The European trade is threatening to unwind:

China needs stimulus and targeted fiscal measures can be expected. RRR cuts and policy rate cuts too. This is going to pressure CNY and it needs to because an ex-growth China that refuses to liberalise can’t grow any other way.

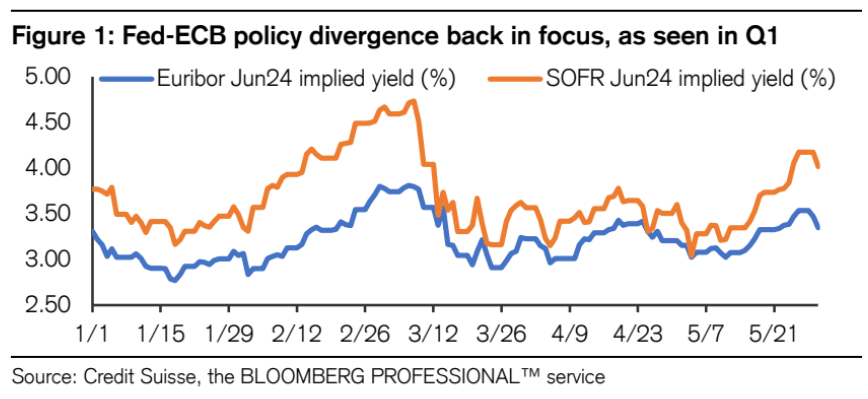

With US leadership in AI now the defining characteristic of the new cycle, even before we dispense with the old one, re-dollarisation is the theme. Credit Suisse (SIX:CSGN) has more.

Re-dollarisation

he key storyin FX markets has been the steady stream of constructive US growth data and still-too-high inflation data, prompting the market to fully price in another 25bp Fed hike by the 26 Jul meeting. With the Sep ’23 vs Sep ’24 SOFR implied rate spread still wide at-160bp, there is room for even more USD strength if the market unwinds expectations for rapid rate cuts from Q4 ’23 onwards. This week therefore is a critical milestone, as it is full of the type of data (JOLTS, ADP (NASDAQ:ADP), ISM,NFP) that could provide exactly that outcome. And if the message is clear enough to price in a definite hike in June, then the odds are the market will have to either add in the possibility of a July follow up or start to scale back hopes for rate cuts in Q4. Indeed,if US data are strong enough this week to shake convictions on priced-in rate cuts down the line, there is nothing to stop EURUSD pushing still lower to test the 200-day MA around 1.0491.

As such, tactically we would prefer to be short EURUSD from 1.0732 with a stop at 1.0835, with a target of 1.0500. Also, with spot now through our original, long-held EURGBP target at 0.8700, we now look for the pair to trade towards 0.8550. As for USDJPY, spot’s move above 140 finally elicited a response from the authorities yesterday. While this led to a reversal in USDJPY back below 140.00, it is doubtful that verbal intervention of this kind alone is likely to turn the pair’s upward trajectory. If US data further validate Fed hawkishness this week, we can see USDJPY quickly target 145.00, at which point the risks of actual intervention ahead of the next BOJ meeting would multiply.

AUD: Looking to fade AUDUSD rallies to 0.6600

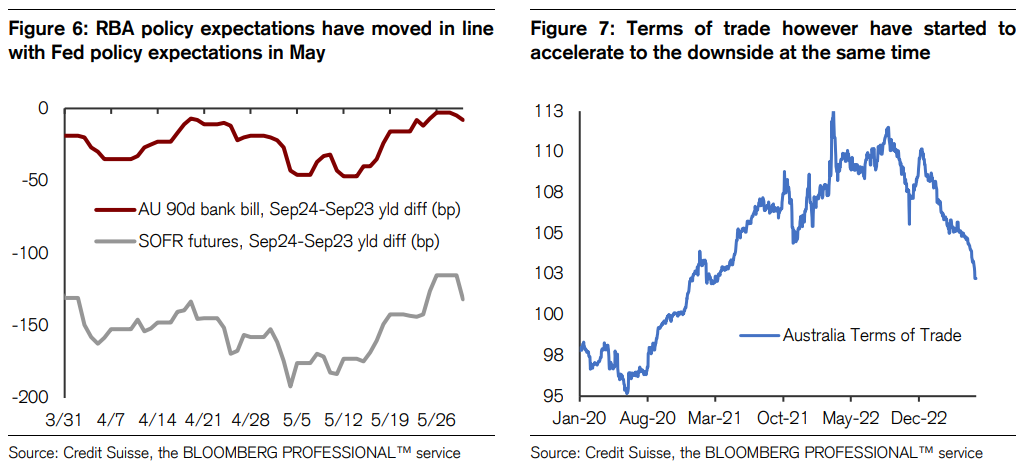

AUD’s unremarkable price action in Q2 thus far has been mostly consistent with the neutral AUDUSD 0.6600 target from our Outlook. With the RBA decision on 6 Jun playing the opening salvo of the month’s G10 central bank meeting schedule, we see scope for more interesting price developments. The RBA is a key reason for AUD’s relative resilience, as it surprised markets with a 25bp rate hike at its 2 May decision, forcing markets to re-assess the scope for further rate hikes. Over the following month, Australian rate markets priced out the ~50bp worth of RBA cuts that were pencilled in beyond the terminal rate: this likely shielded the currency from the concurrent unwind in Fed easing expectations (Figure 6).

Since then, however, Australian activity data has however almost uniformly surprised weak, with notable misses in the unemployment rate (on 18 May), Q1 wage growth (on 16 May), and more recently in Apr retail sales and building approvals (on May 25 and 29). As a result, markets are now looking for no change from the RBA next week. At the time of writing, markets are also waiting for the release of Apr CPI inflation data and for RBA Governor Lowe’s testimony before the Senate Economics Legislation Committee (both events will have taken place by the time of publication): we suspect the bar for outcomes that materially challenge current pricing for next week’s rate decision is fairly high.

Looking beyond the 6 Jun RBA decision, the recent acceleration in the commodities price decline warrant asking the question of just how resilient RBA hiking expectations can remain in the current data context, especially compared to the US where activity data continue instead to surprise strong. The recent decline in Australia’s terms of trade in particular is notable in speed and scope (see Figure 7), and we can anticipate it becoming much more visible in the data in the coming weeks. In that context, it is not a stretch to envision GDP growth estimate downgrades leading to more caution from RBA.

While we’ve held a neutral target in Q2 on AUD, our strategic preference has been to fade rallies rather than to buy dips: the potential we see for AUD to lose some of the RBA policy support it enjoyed in May keeps this bias intact. As such, while our 0.6600 neutral target has served us well so far in Q2, we are now inclined to view it as a level where we would look to fade AUDUSD strength into quarter end, targeting 0.6385 and allowing us to set the appropriate risk-reward with a stop loss at the 200-dma, around 0.6700.

Too bullish for me. I do not expect China to save commodities. Europe is going into recession. The Fed will have to chase the AI bubble and then bust the cycle.

And the foolish RBA will probably hike again bringing on a local recession.

All downside for AUD.