Street Calls of the Week

DXY is breaking out:

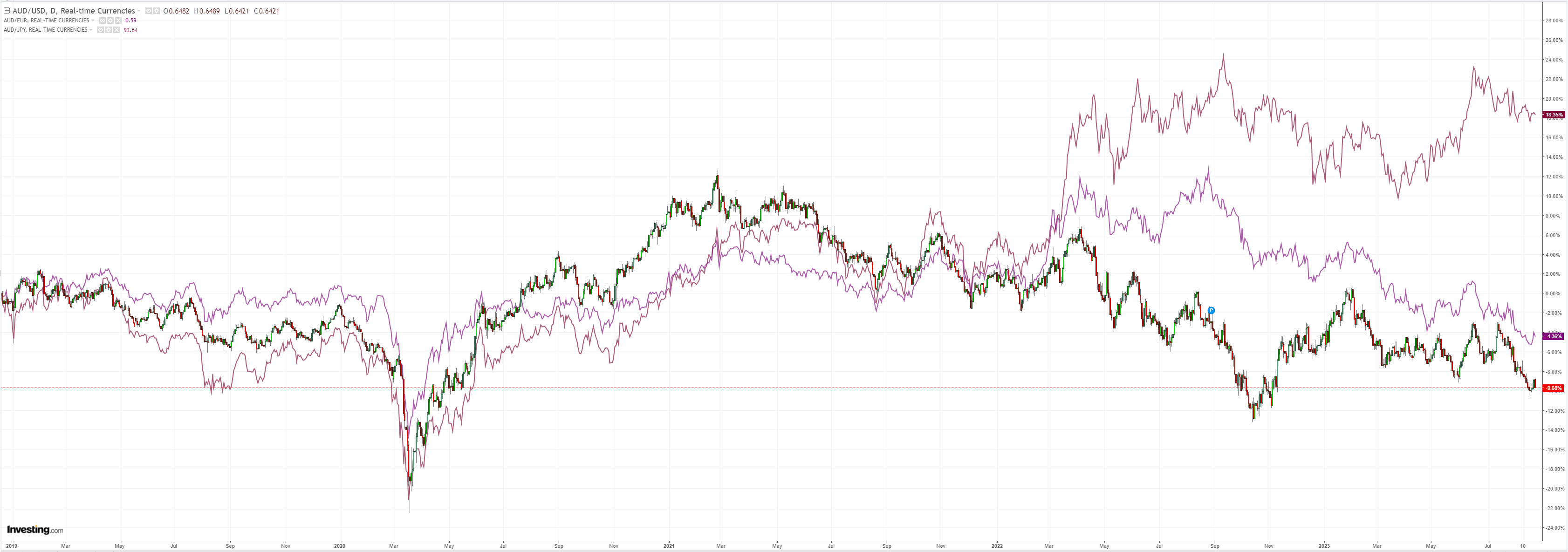

AUD plummeted:

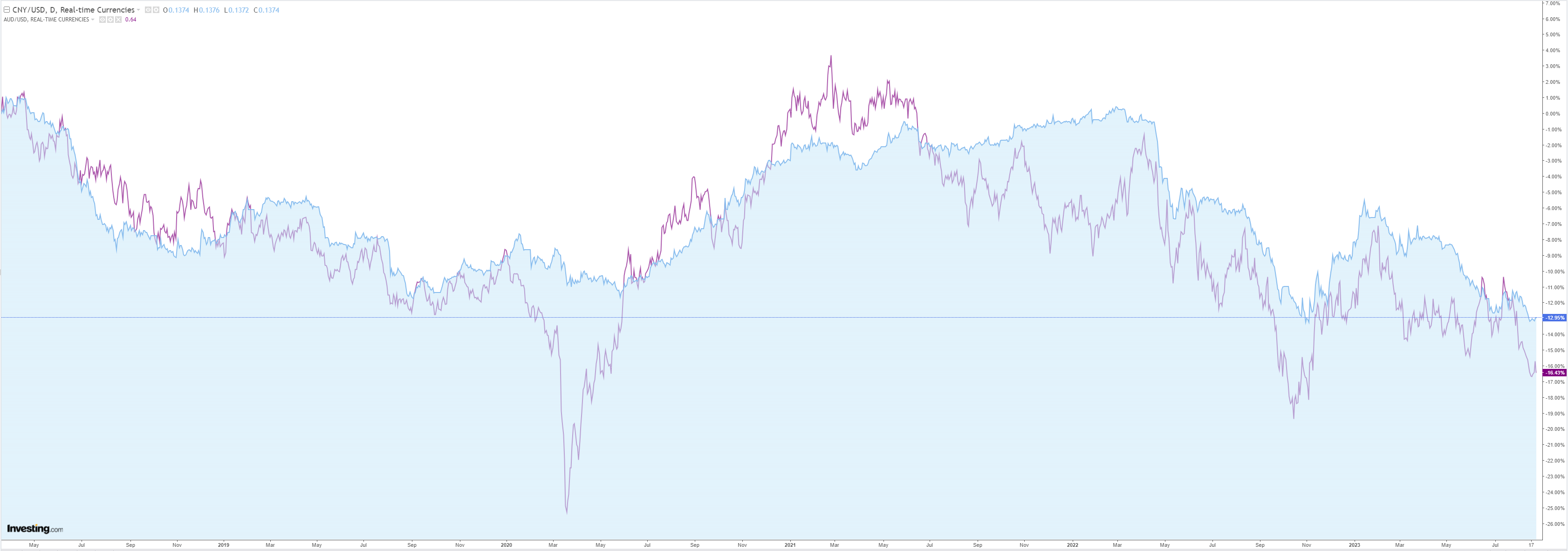

CNY has not been saved:

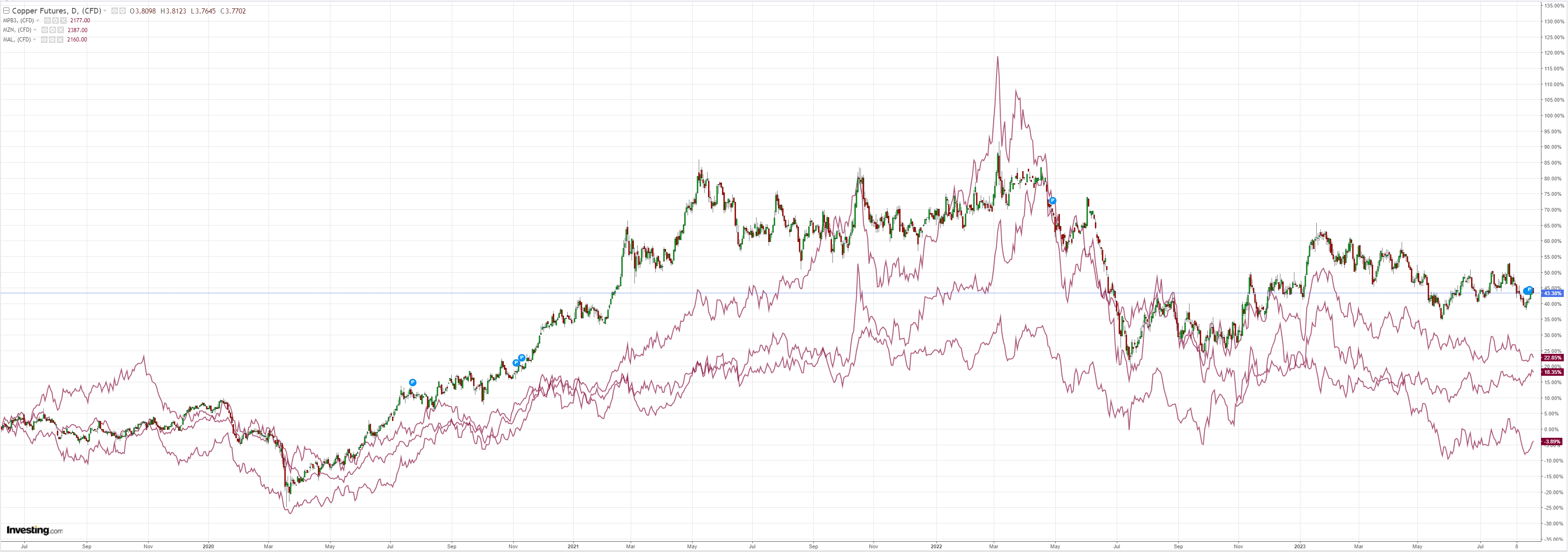

Commodities were hosed:

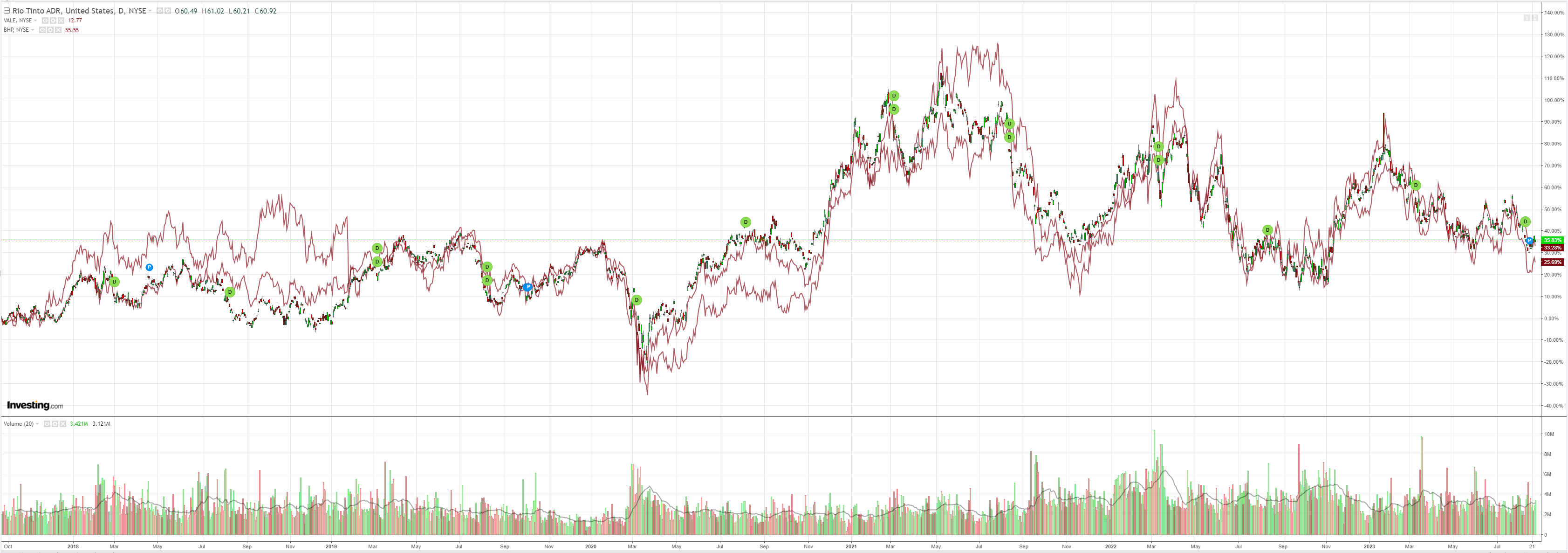

Miners too:

EM stocks fell:

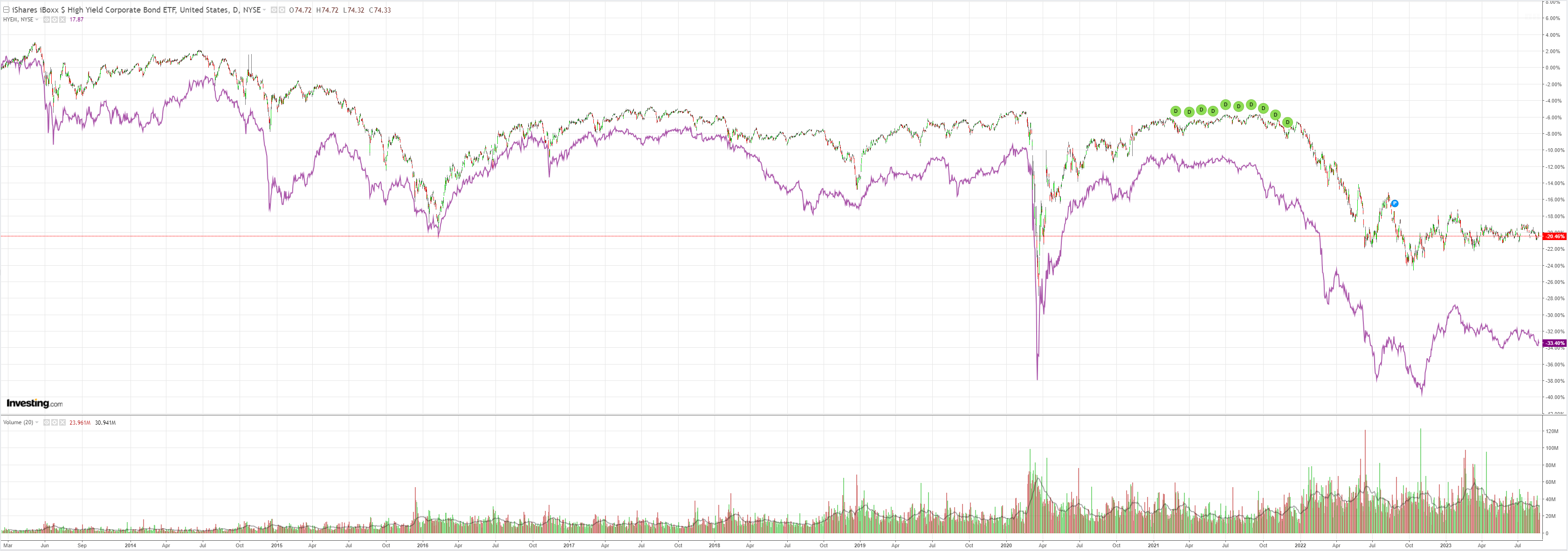

Junk too:

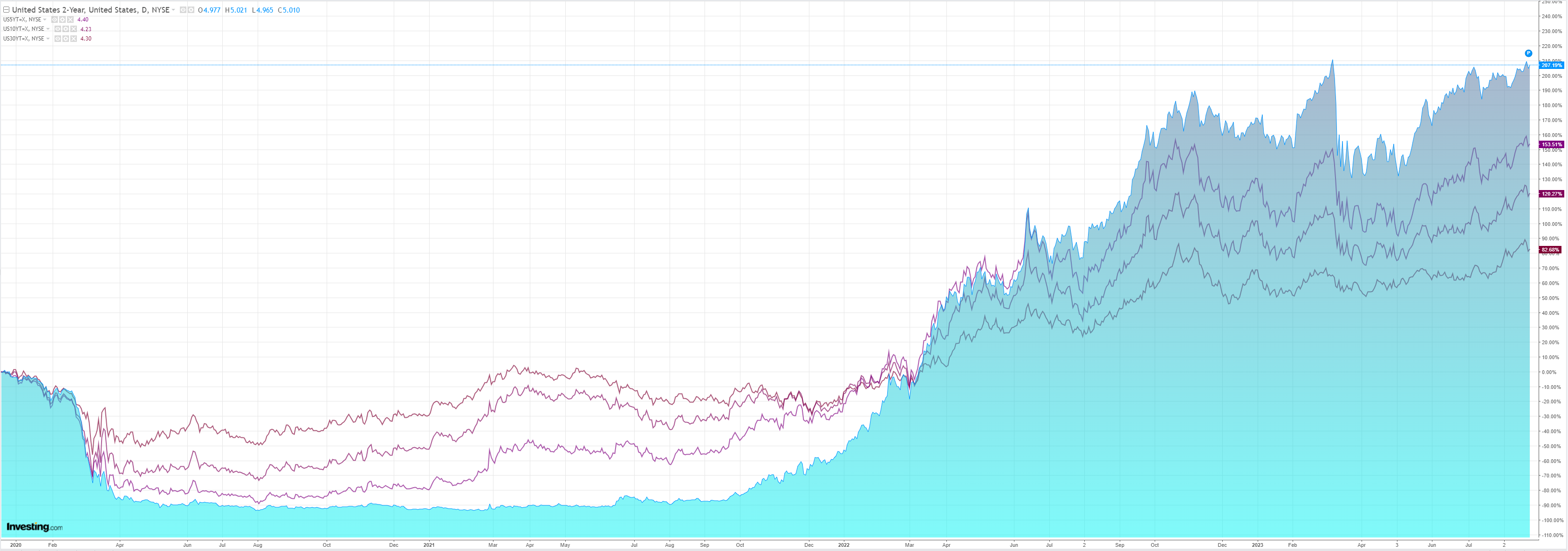

Yields rose but the curve was stable:

Stocks were smashed:

This was quite a night’s action. Not even NVDA earnings could brace the market. A very bad sign for the bubble.

Notwithstanding that tonight is Jay Powell at Jackson Hole, and if he has any brain at all, he will remain hawkish. Goldman agrees.

Markets have been trading two major themes lately: US resilience and China challenges. While these have mixed implications for other asset classes, in FX they both tend to mean one thing—a stronger Dollar. Given our fairly upbeat view on US activity (note our economists revised up their Q3 GDP tracking by 1.1pp over the last week), we don’t think relief will come from the US side. That could happen eventually, if the market gets more comfortable that disinflation can continue despite strong growth, but investors seem skeptical that can be durable. And it is worth noting that Fed policymakers felt the same way, according to the July meeting minutes. So Chair Powell’sspeech at Jackson Holethis year probably will not carry the same ‘pain’ warning as last year, but it seems the overall message will still be one of “seeing the job through,” and the Fed still thinks that likely entails a period of below-trend growth, which has clearly not been achieved yet. Therefore, a break in the Dollar likely has to come from a turn in China and Europe. A more forceful policy pushback could provide a temporary interruption, like it did a little less than a year ago. But, the most plausible path to more substantial Dollar downside involves better growth in Europe and Asia alongside continued disinflation pressures in the US, and the path to that combination has been narrowing again. Almost three-quarters of the way through 2023, we are still ‘waiting for the challengers’ to step up convincingly.

Put a nice little bow on top of that wrap. Strong DXY is the Fed’s best friend. It will tighten liquidity, pop tech, pound Chinese and EM funding, smash commodities, and deflate the world.

AUD is not done falling.