DXY sagged last night:

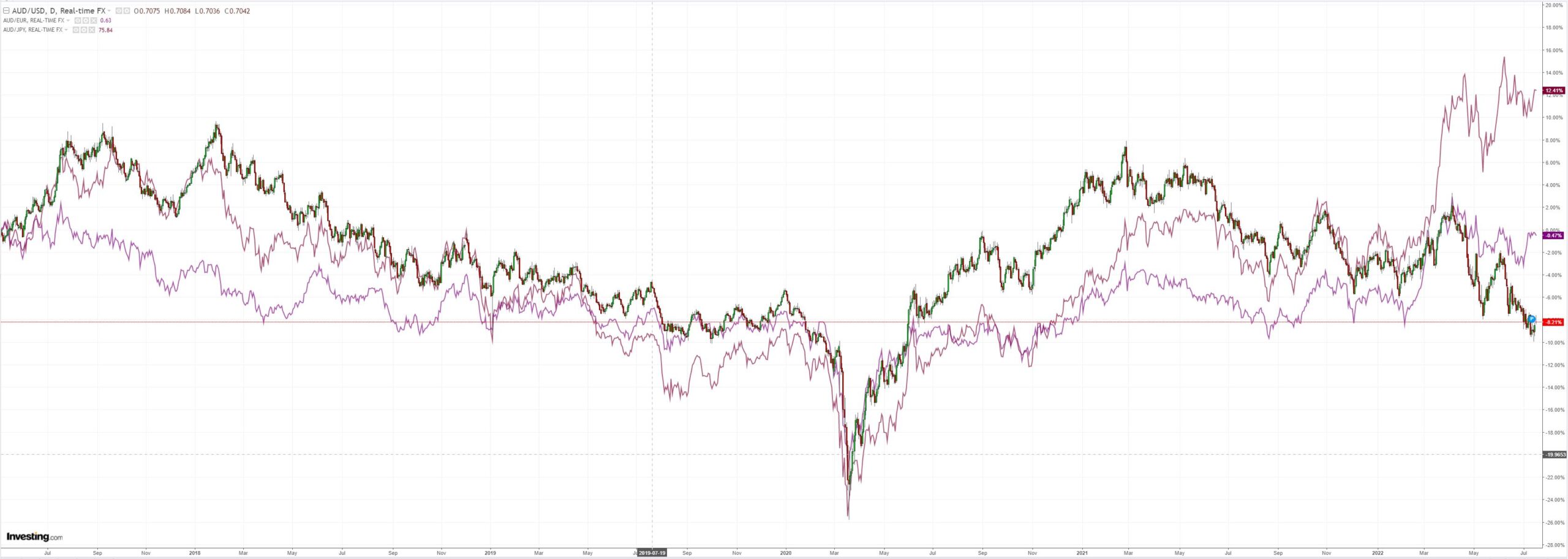

AUD only managed a few pips higher:

Oil wrecked the rally, as it has done with every one so far:

Metals dead cat bounced:

Miners (LON:GLEN) a bit:

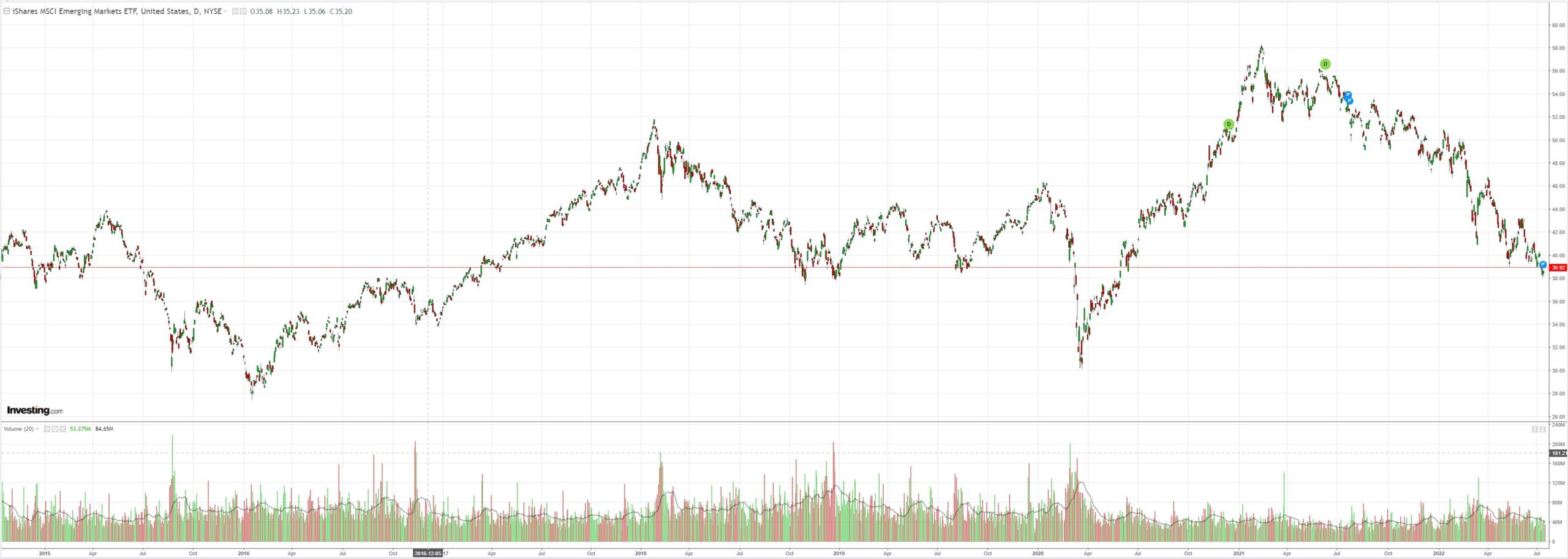

EM stocks (NYSE:EEM) not so much:

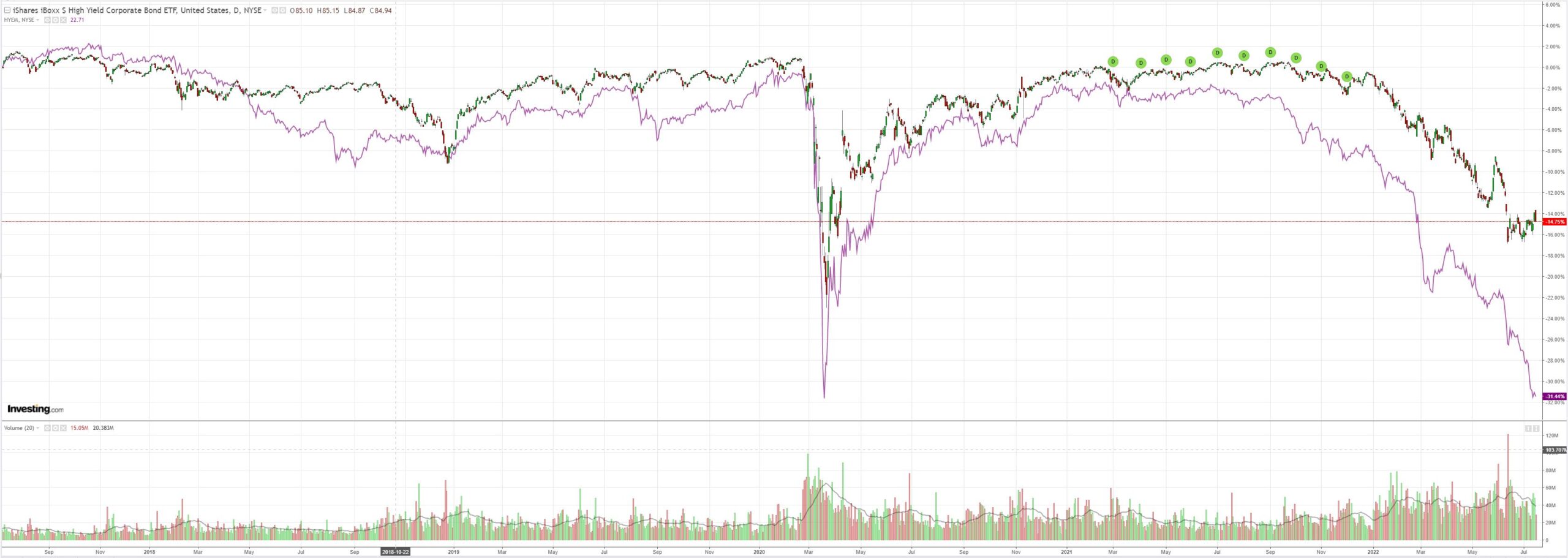

And none for junk (NYSE:HYG):

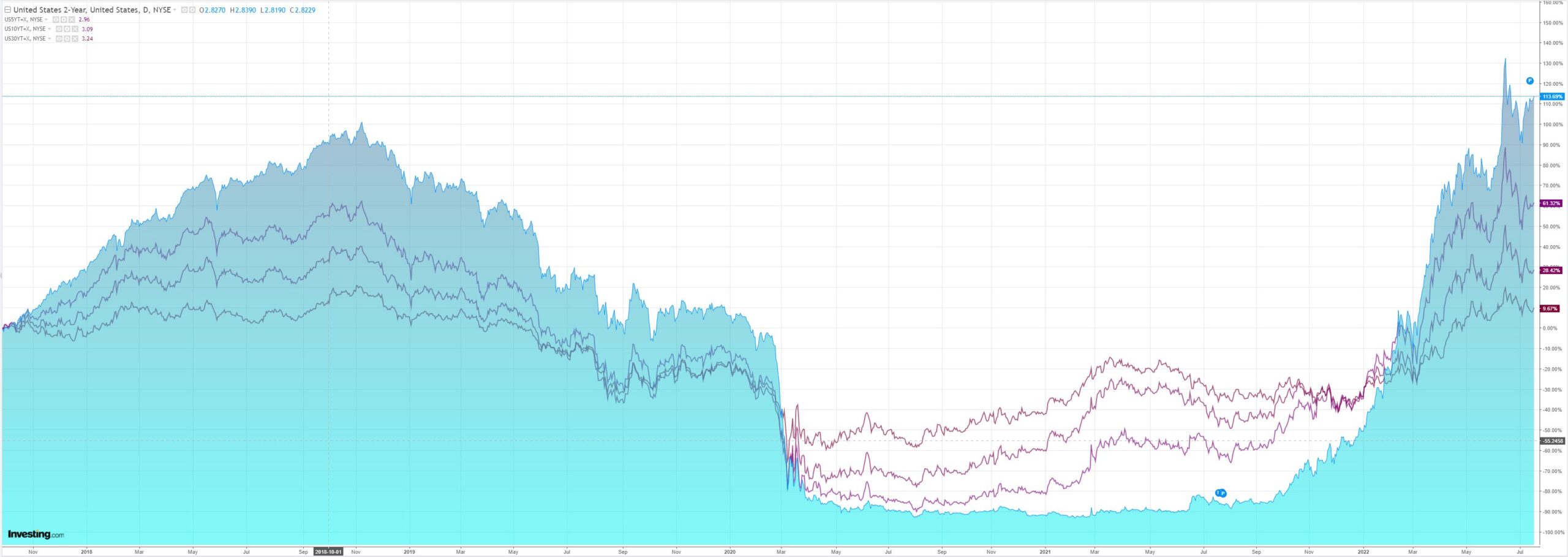

Yields firmed:

As stocks slumped:

Westpac has the wrap:

Event Wrap

US homebuilder confidence (NAHB) fell, the headline index down from 67 to 55 (est. 65), extending a decline which started in November 2020. All components fell sharply. Homebuilders are facing surging mortgage rates and declining affordability with prices at or near record peaks. And rising costs of land, labour, and materials are weighing on builders, though the report did indicate lumber costs have been easing with lower building activity.

Event Outlook

Aust: The RBA's July meeting minutes will provide colour around the second consecutive 50bp hike and risks to the outlook. Meanwhile, RBA Deputy Governor Bullock will speak on how households are placed for interest rate rises at the ESA Business Lunch in Brisbane, 12pm AEST.

Eur/UK: The final estimate for the Eurozone's June CPI will confirm the major contributions from food and energy inflation. The UK's ILO unemployment rate is expected to hold at its pre-pandemic level in May (market f/c: 3.8%).

US: Near-term input supply constraints and tightening financial conditions are weighing on the outlook for housing starts and building permits (market f/c: 2.0% and -2.7% respectively).

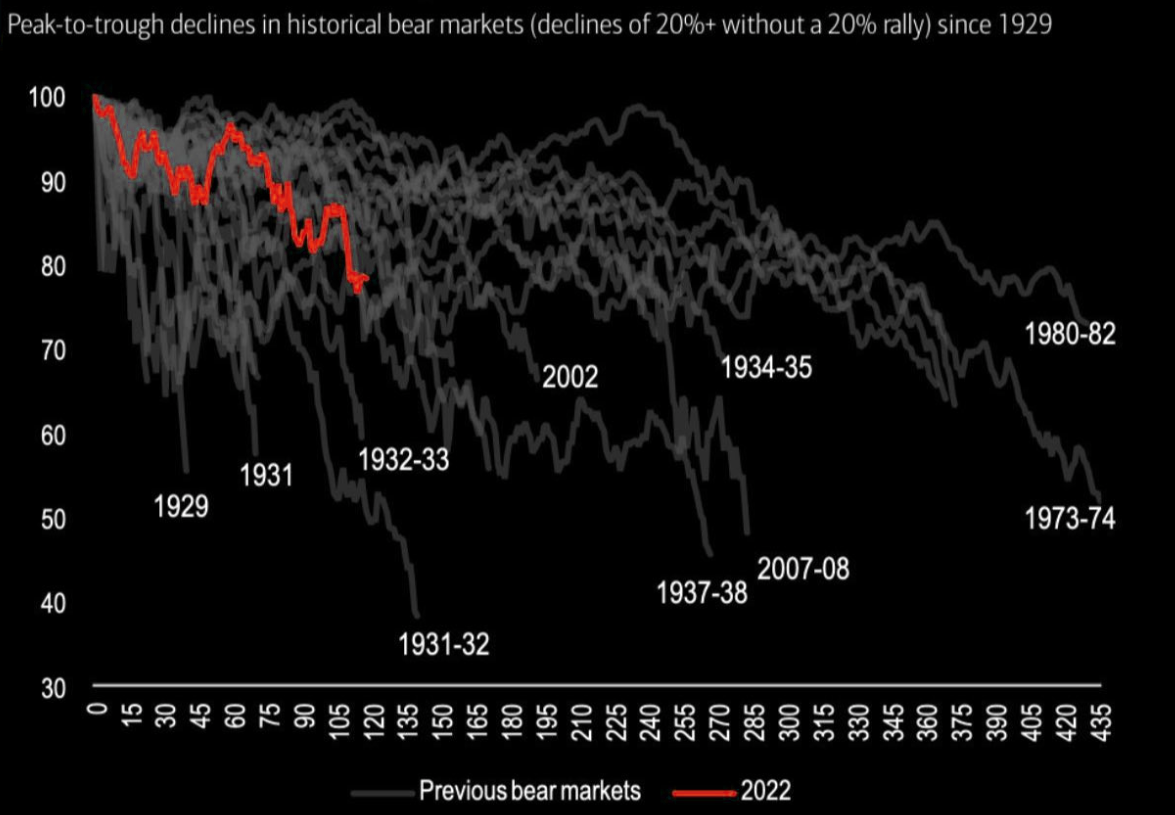

What is most noteworthy about this bear market is its failure to rally. Usually, when we get sell-offs of this nature we get huge counter-trend bounces but that is not happening this time. This is one of fastest declines in history:

The reason is straightforward. Every time we get an equity bounce it immediately awakens the commodity and especially energy mania which revitalises fears of higher interest rates.

In this sense, the Wall Street investment banks that are pushing the commodity bubble are amusingly caught in a paradox of diminishing returns because whenever they succeed in inflating oil they only manage to deflate equities.

As a commodity currency, AUD is particularly exposed to this dynamic.