Street Calls of the Week

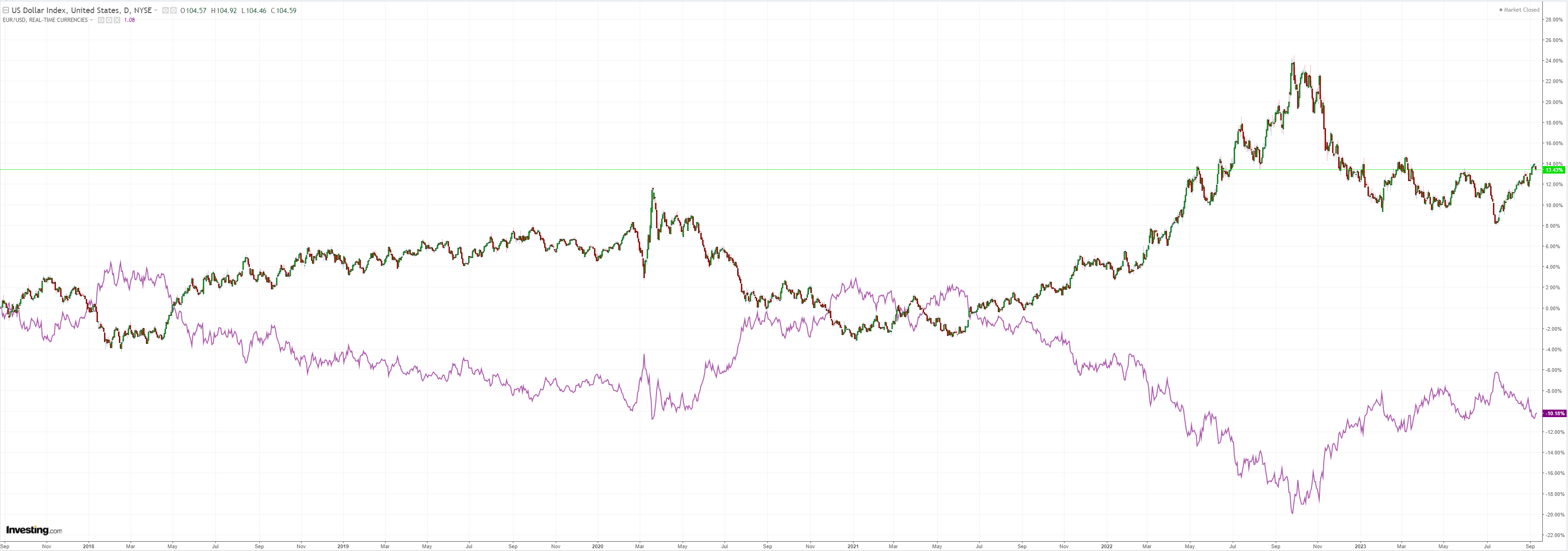

DXY fell yesterday:

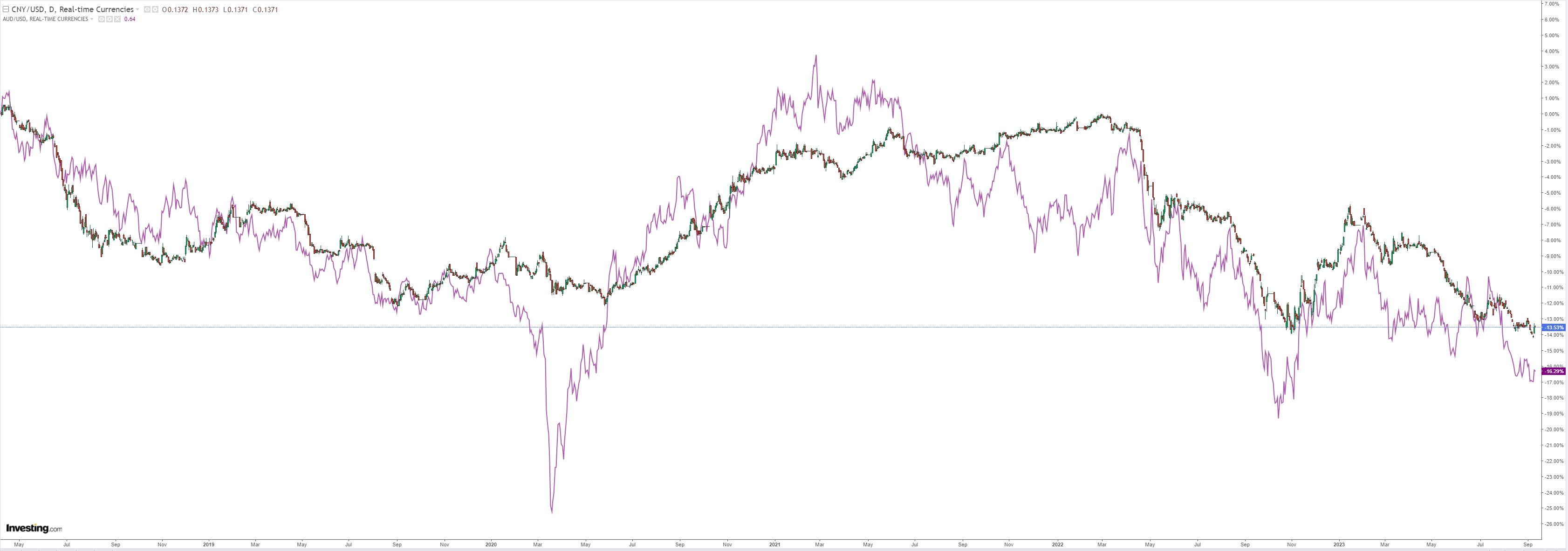

Giving AUD a reprieve:

More to the point, CNY:

But DXY And oil are joined at the hip and the latter ain’t done:

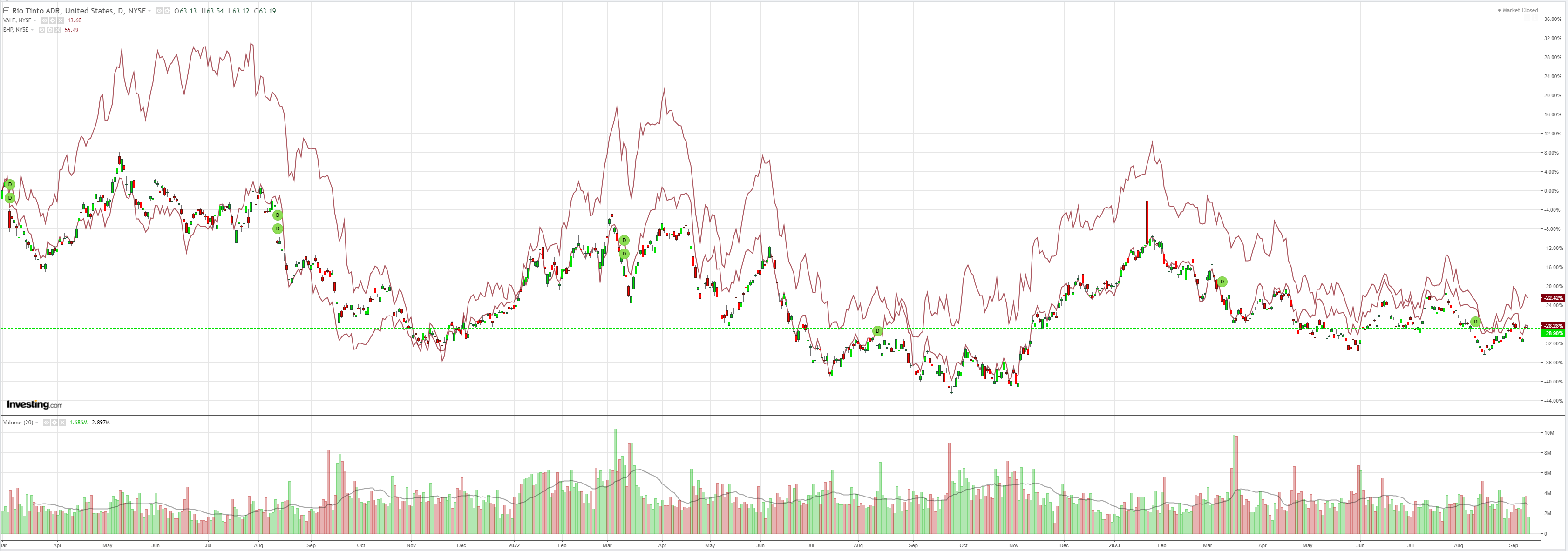

Dirt is range trading:

Miners rolled:

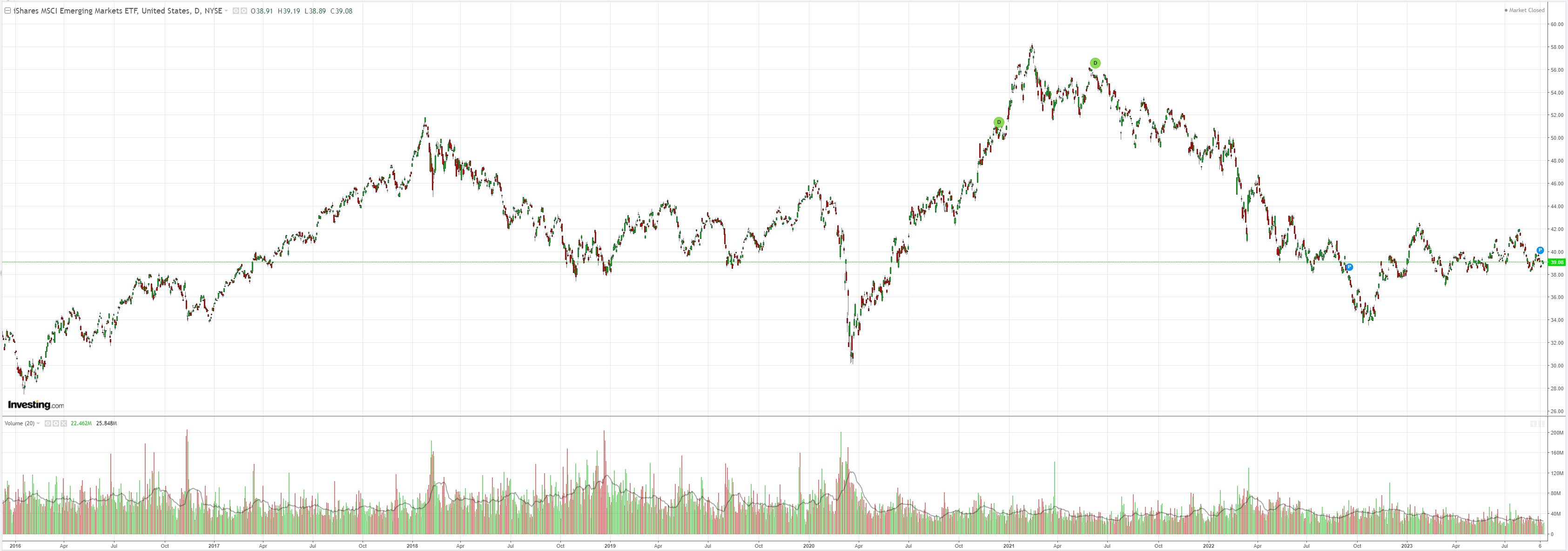

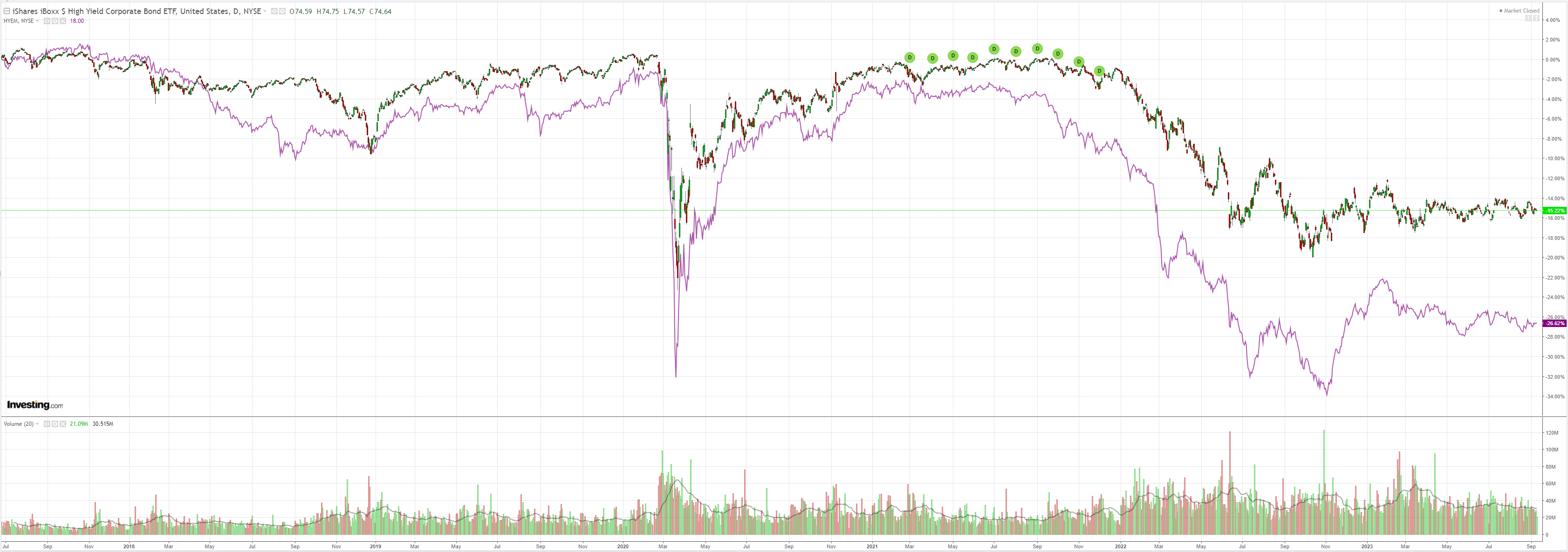

EM and junk caught in ranges:

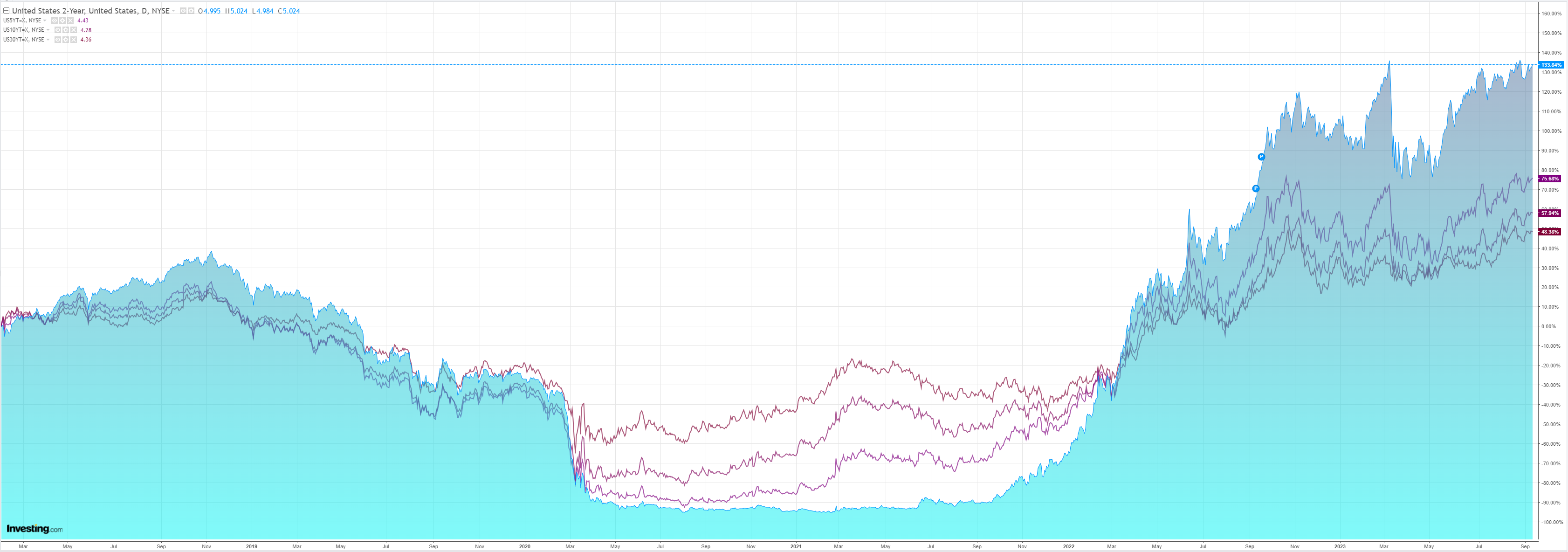

The curve steepened:

Stocks have lost their mojo:

The problem is the much-adored “soft landing” has transpired before the inflation job is done. Oil, yields and DXY are on the march, and the tech bubble hates all three as duration is sold, DXY crimp profits, and oil saps global demand.

OPEC is forecasting a 3mb/d shortfall”

And markets are moving, chasing the golden cross:

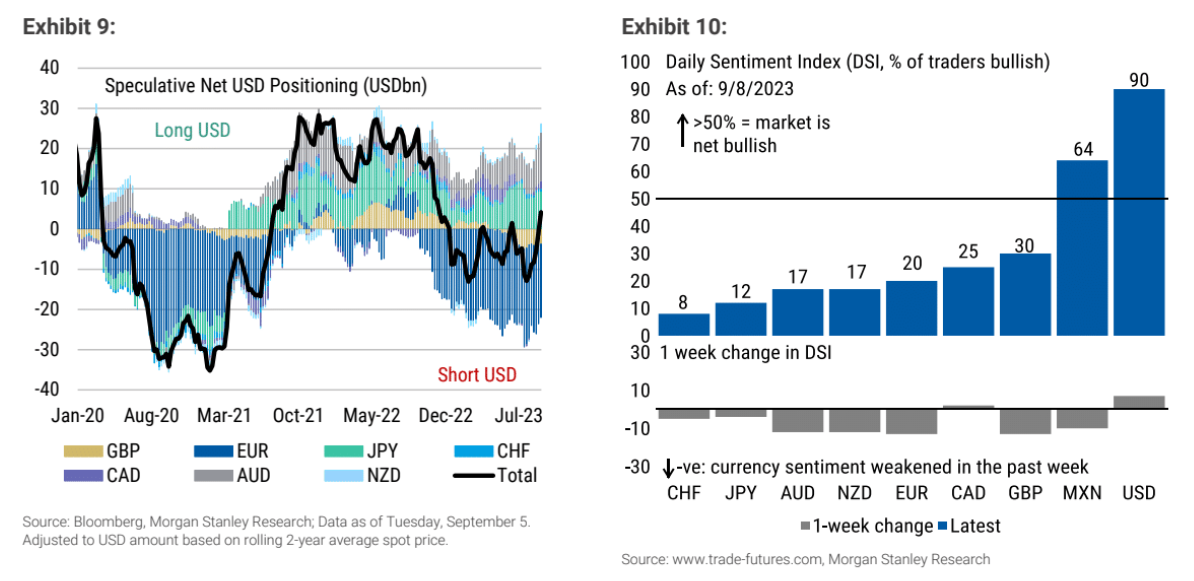

With DXY chasing and positional scope for it keep doing so:

The Fed is really caught in a bind now, and its soft landing is back in trouble. It should never have allowed the stock market wealth effect to return prematurely.

AUD will get some support from oil but while DXY is the only play in town, and China still isn’t recovering, the pressure for lower will remain.