DXY was smashed Friday night and EUR roared as the NU COVID strain rocked markets:

Australian dollar was Nuked on all major crosses:

Oil!

Metals were not hit quite so hard:

Nor miners:

But, ominously, EMs stocks shattered support in their bearish pattern:

Worse, the rout was led by junk debt:

Bonds boomed:

And stocks busted:

The curiosity of the night was the big dump in DXY. Typically, “risk off” flows into the US dollar not out. I would argue that this means we are not yet in a violent “risk off” state. At this point, NU (now OMICRON) is a nuisance, not an outright threat to growth.

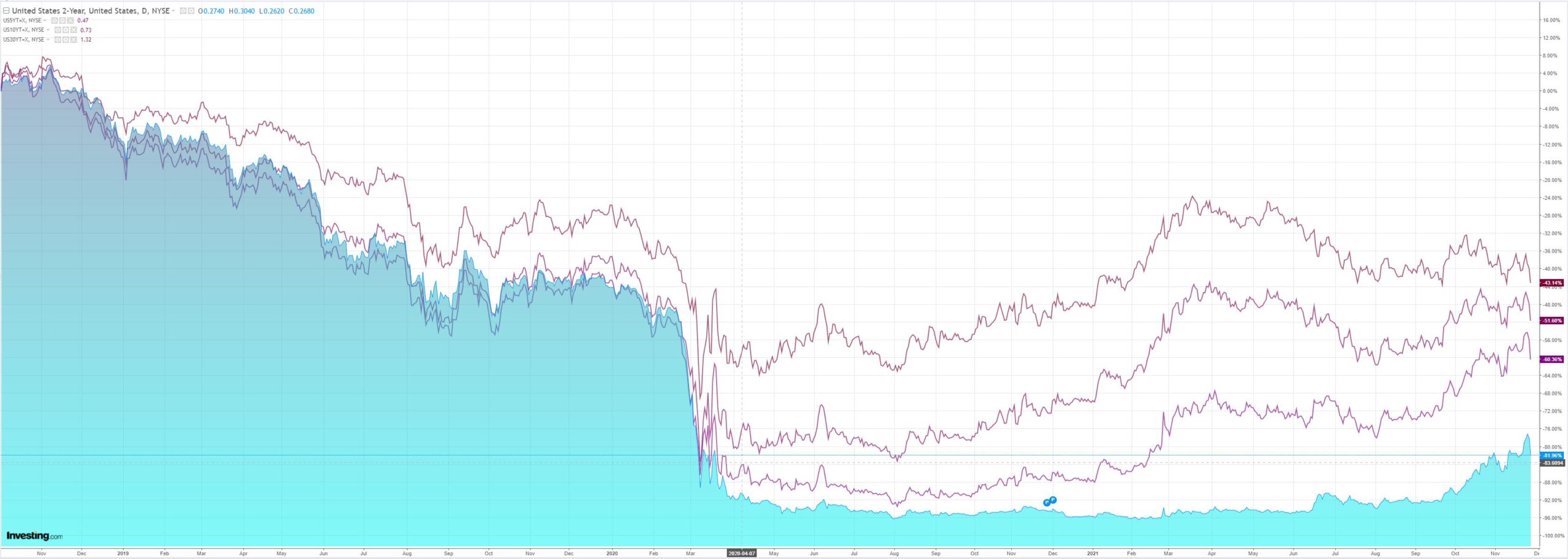

But, it may turn out to be the latter in short order. BMO explores the DXY dynamics with reference to the 2020 COVID crash:

USD & EURUSD: As popular as the term ‘safe haven flow’ has been today in the press and on trading desks, the overall result for FX markets is evidence that we should be viewing developments through a different lens. Fundamentals were already evolving negatively for the major European currencies prior to today; in terms of the impact on supply chain disruptions, goods shortages, free movement, and international trade, the Nu variant potentially worsens that backdrop. Therefore, it is not clear why FX investors would seek ‘safety’ in anything but the USD. However, the USD is trading lower on the day in BBDXY terms (-0.3% to -0.2%), so we need to look beyond ‘safe haven flow’ for an explanation of the volatility in the USD. It’s helpful to use March 2020 as a template. At the Western outset of COVID-19 (‘phase 1‘), the USD pulled back sharply (EURUSD rallied) as US yields collapsed and USD longs were squeezed. Once that adjustment had run its course, the USD rebounded (‘phase 2‘) until the enormous increase in USD liquidity from the Fed’s balance sheet expansion worked its way through the system and restarted the rally in risk assets (‘phase 3‘). The USD then steadily declined over the balance of 2020 (i.e. from about late-May onwards). At the start of this week, the USD OIS curve had a Fed Funds mid-rate of about 70bps discounted by the end of 2022. As of today, that pricing has shifted from 70bps to about 50bps (i.e. a 20bps adjustment). The 2023 portion of the Eurodollar curve has also responded to the news, and we plot the impact of this adjustment on EURUSD spot in Figure 2. We view this as an indication that the USD is currently somewhere in between a ‘phase 1‘ and a ‘phase 2‘ move. The other two factors which drove the BBDXY (and EURUSD) today are positioning (i.e. short-EUR unwinds), and the decline in the oil price, which we flagged as a potential topside risk for EURUSD spot earlier in the week. The positioning factor probably has further to run. However, the extent to which the current move in oil feeds a EUR-bullish response should be mitigated by the fact that expectations for weaker demand (i.e. reduced travel) are driving the current decline in the oil price, as opposed to an outsized increase in supply. We don’t have a firm view on how far the re-pricing of the US curve is likely to run at this stage. But a key difference between today and 2020 is that the rates and FX markets are dealing with the reduction in Fed rate hike expectations — not the potential for an entirely new phase of Fed quantitative easing. It’s arguable that the current inflation dynamic doesn’t even allow for such flexibility on the part of central banks. In an extreme case, even if the adjustment underway were to eventually remove all Fed rate hikes from the curve, and discount a new timetable for the Fed’s withdrawal of stimulus, the positive impact on EURUSD is unlikely to be of the same order of magnitude as the one which occurred in 2020 (i.e. ‘phase 3‘). The pre-existing economic and geopolitical backdrop heading into the Nu variant, the balance of risks over the next 1-2M, and the potential for a shift to ‘phase 2‘ in the USD, should eventually open the door to selling opportunities in EURUSD spot.

That is solid analysis worth heeding.