DXY is sagging again as European HICP’s came in hot:

AUD is underperforming:

Oil is at former support now resistance:

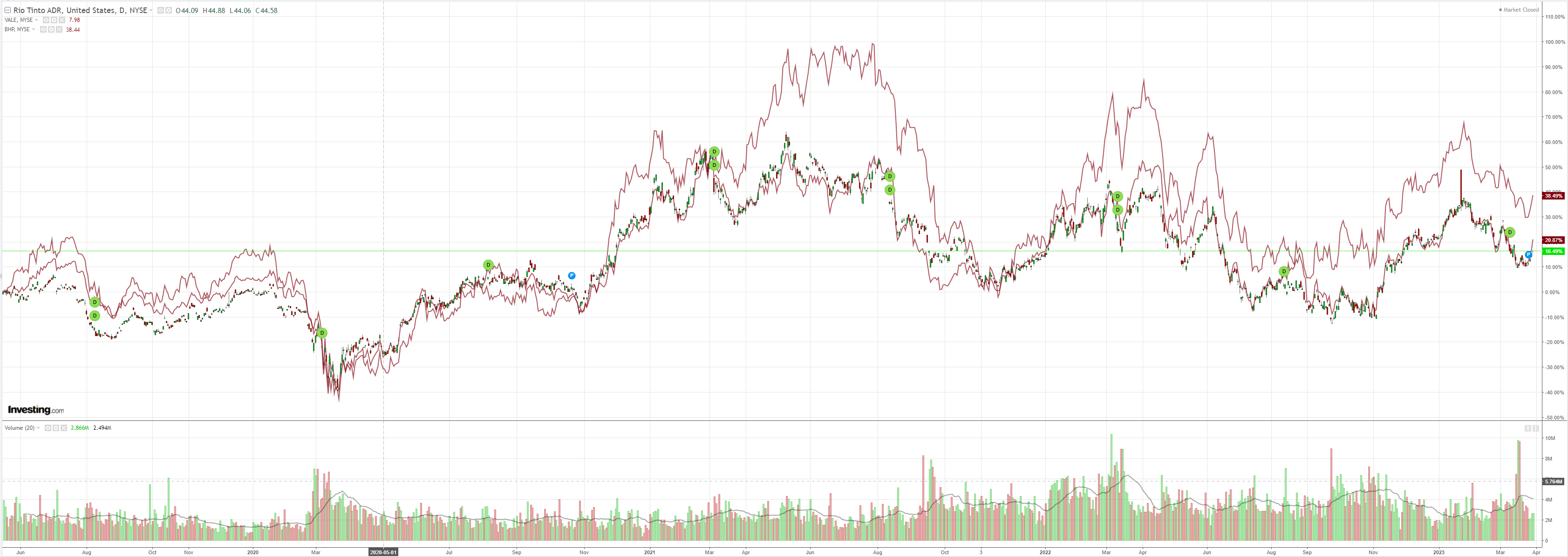

Dirt has discounted very little:

Miners (NYSE:RIO) to the moon:

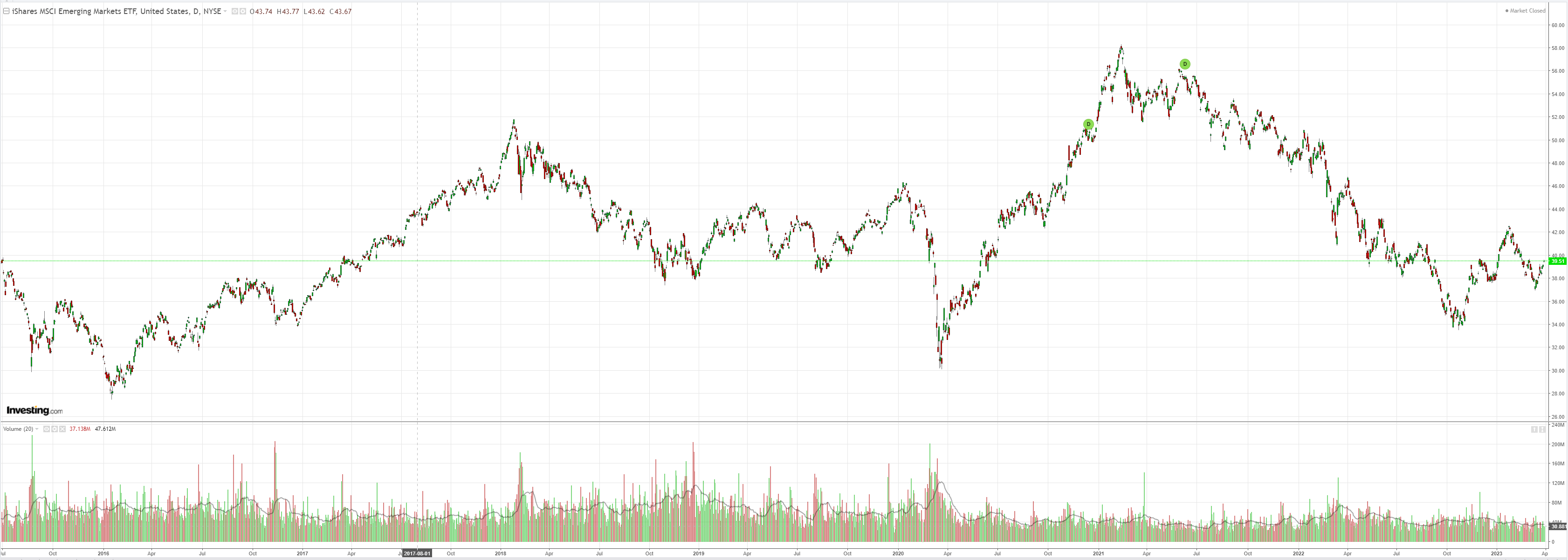

EM stocks (NYSE:EEM) firming:

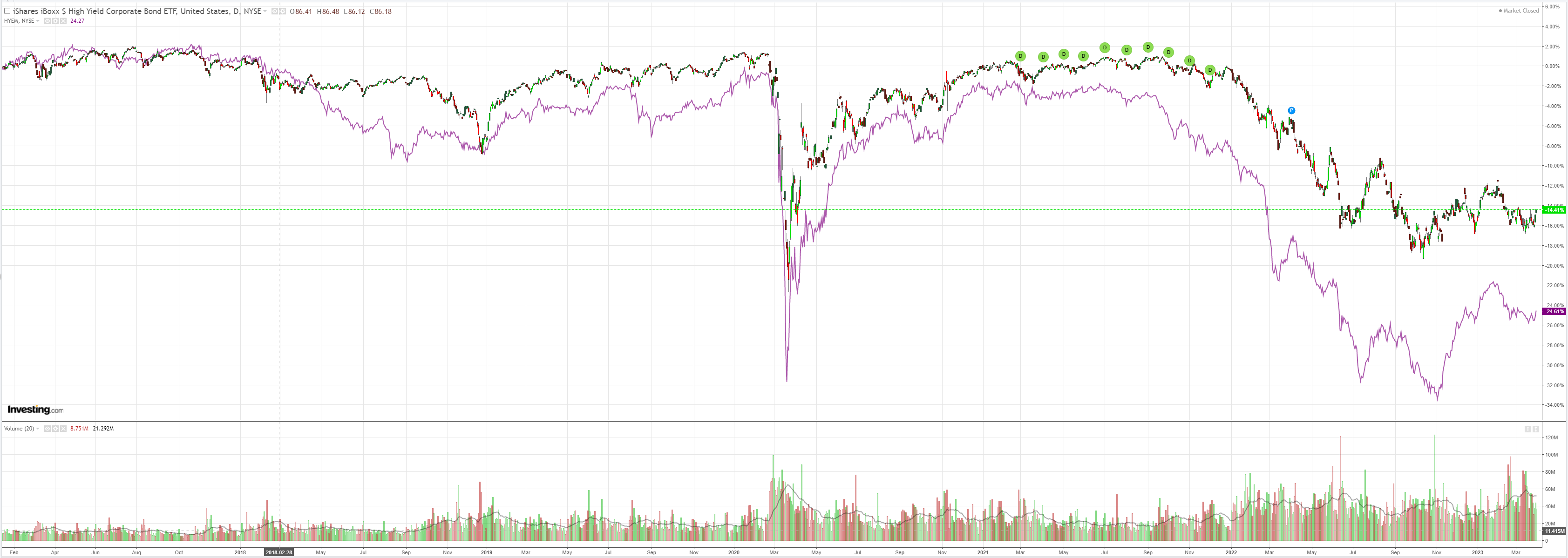

And junk (NYSE:HYG):

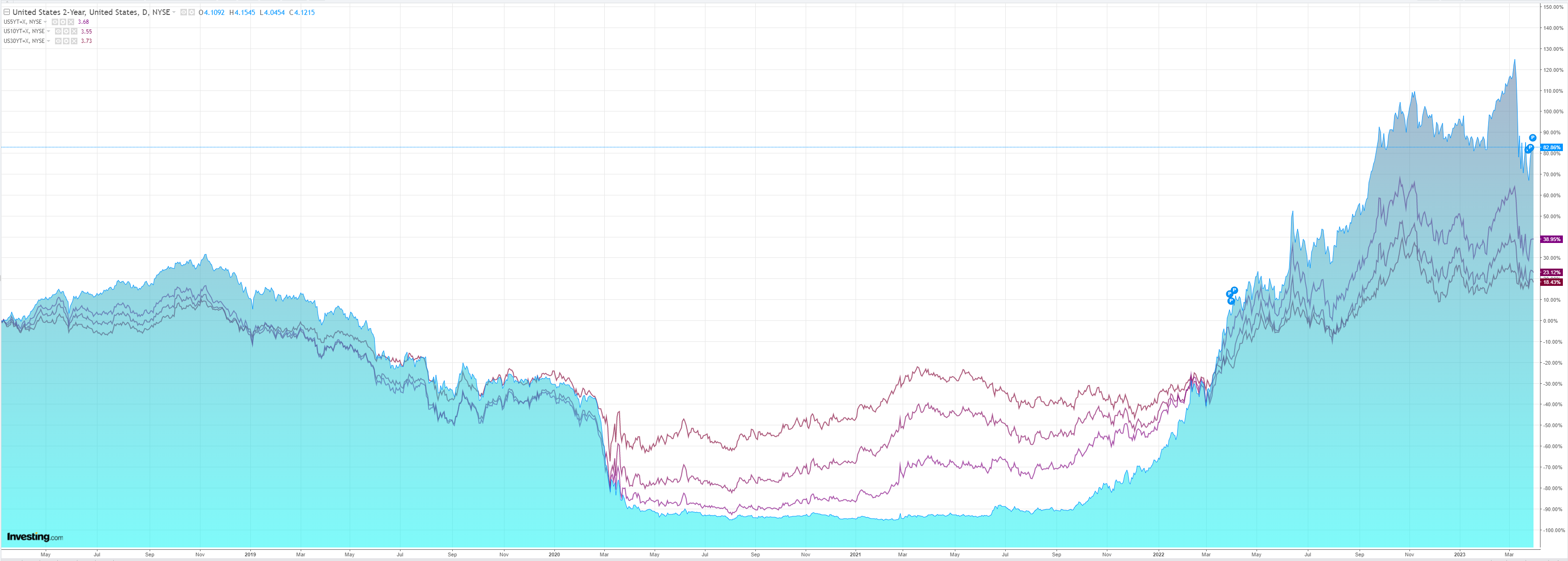

As Treasuries are bid:

Stocks discount nothing but blue skies:

All that is missing is all that matters:

If US regional banks don’t bounce then this rally is useless. My guess is that they will and that will mark the end of the rally!

The larger picture is unchanged. US inflation is not beaten. But European inflation looks even worse. Hence the ongoing bid for EUR so long as things don’t get real.

As discussed many times this month, this dynamic is upsetting the traditional DXY safe haven play. Credit Agricole (EPA:CAGR) explores alternatives.

USD: the high-yielding, safe-haven USD to lose more ground mainly vs other safe-havens for now:

o 3M-6M outlook: peaking Fed tightening cycle, a US recession and US debt ceiling could keep the USD on the defensive but any underperformance should be more pronounced vs safe-havens like the JPY, CHF and EUR as well as gold. The USD could hold its ground vs commodity and risk-correlated currencies against the backdrop of heightened market uncertainty.

o 9M-12M outlook: the USD to bottom out thanks to easing financial conditions and economic recovery in the US as well as more favourable US asset valuations. In contrast, the energy crisis could rear its ugly head again in a blow to European G10 currencies and energy importers like the JPY.

• EUR: still on an uptrend but many positives already in the price of EUR/USD

o 3M-6M outlook: A softer landing in Europe, repatriation flows into the Eurozone and China reopening to support the undervalued EUR/USD.

o 9M-12M outlook: Recurrent European energy problems and other persistent risks to the economic recovery => weigh on the EUR.

• JPY: to benefit from market expectation of further BoJ policy normalisation and repatriation flows into Japan. CHF: we are constructive, expecting further SNB tightening and given the CHF appeal as a hedge against Eurozone peripheral risks.

• GBP: Higher UK real rates and yields needed to boost the GBP in the long term. SEK: remains a higher-beta proxy for the EUR and could outperform the USD later on in 2023. XAU to continue to shine.

• AUD, CAD, NZD and NOK: to benefit from a global softer landing, followed by a cyclical upturn in late 2023 and into 2024 that could keep commodity prices fairly resilient. Risk aversion could make the commodity currencies vulnerable in 3M-6M. G10 FX outlook: In search for (safe-haven) USD proxies 30 March 2023 (14:03 CET)Key risks:

• A more persistent inflation shock and monetary tightening, stagflation and geopolitical risks => risk of harder landing.

• A boost to King USD but also liquid safe havens like the JPY, CHF and EUR on the back of investor repatriation flows.

I still like JPY as the safe haven currency of choice for now. Gold further out.