Street Calls of the Week

DXY firmed Friday night:

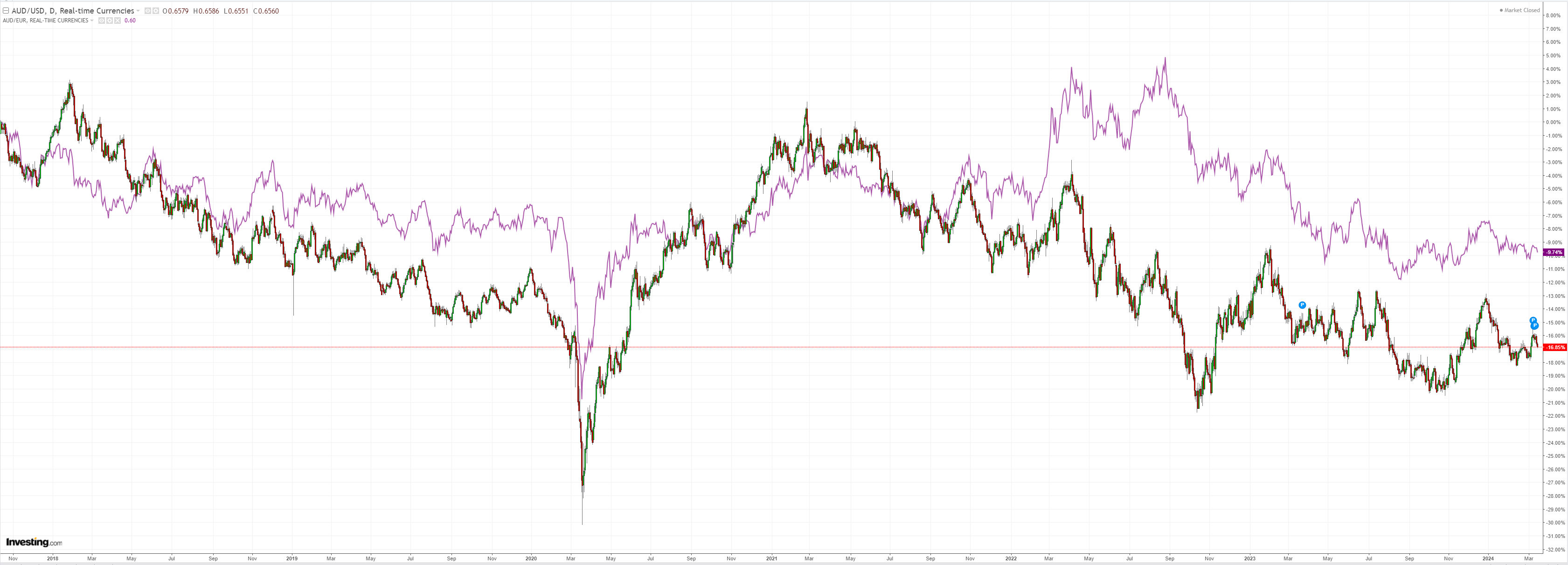

AUD fell:

With North Asia:

Oil popped, gold dropped:

Copper is one man base metals band:

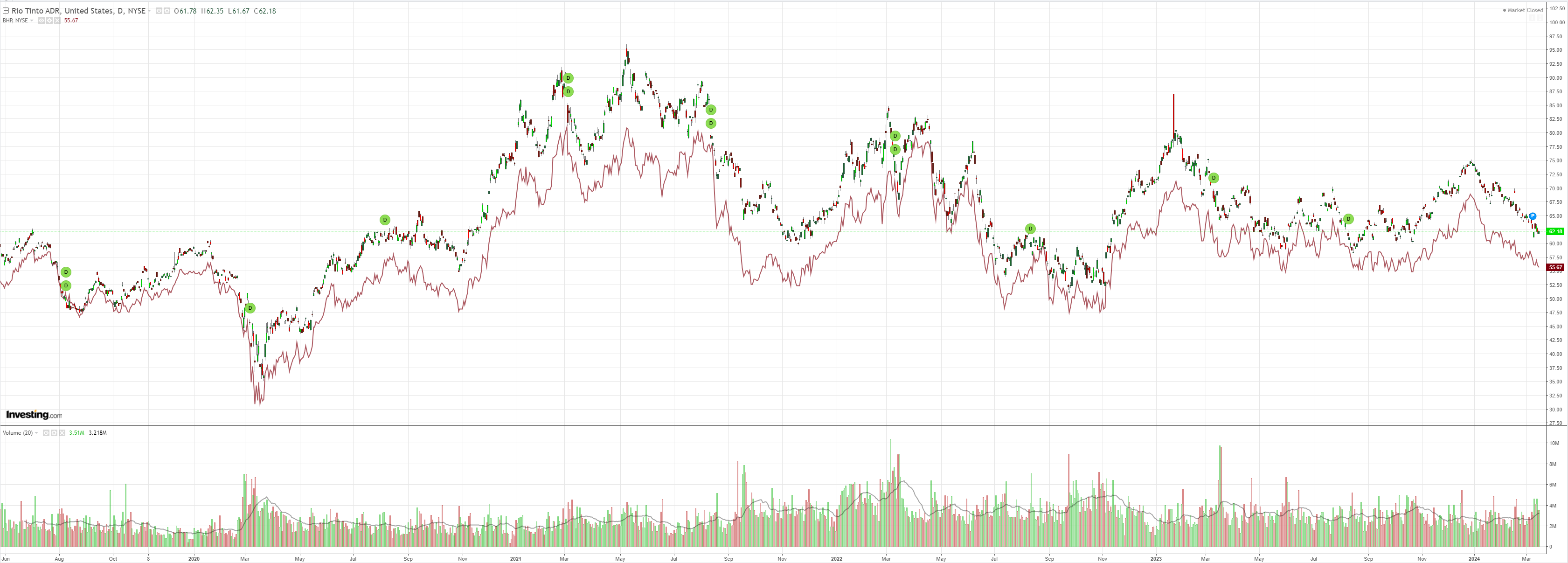

The miner retest gathers pace:

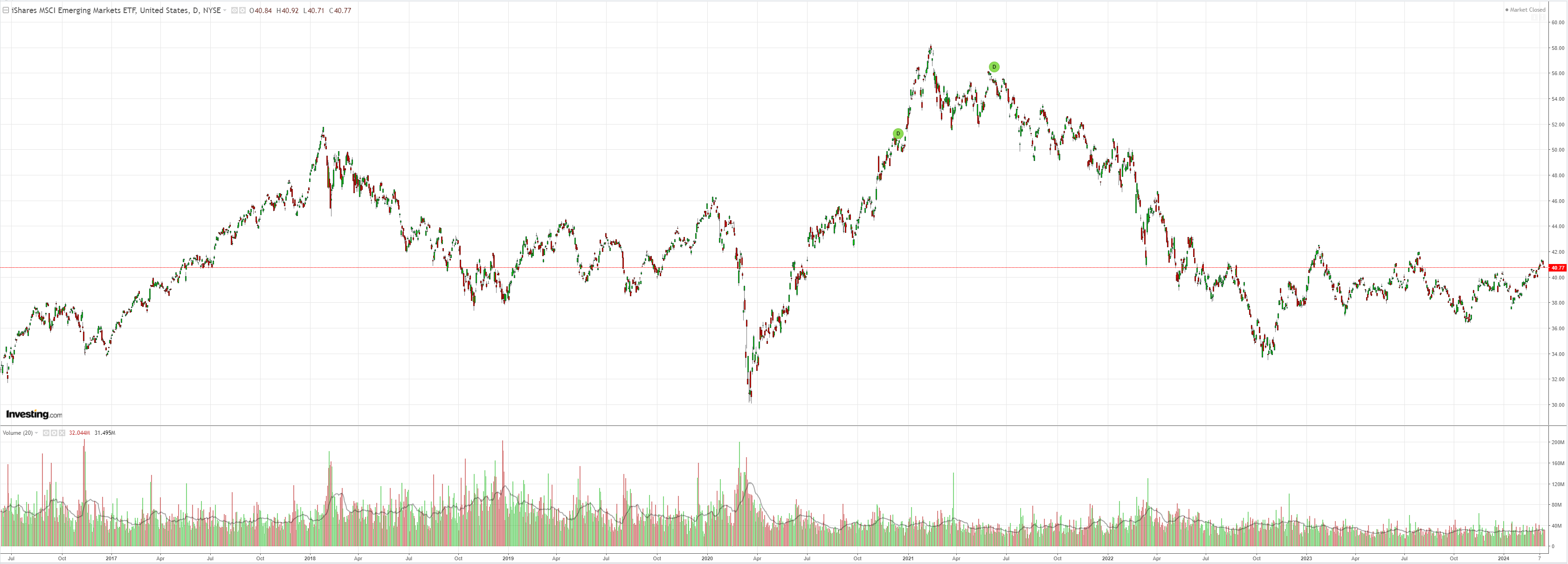

EM puked:

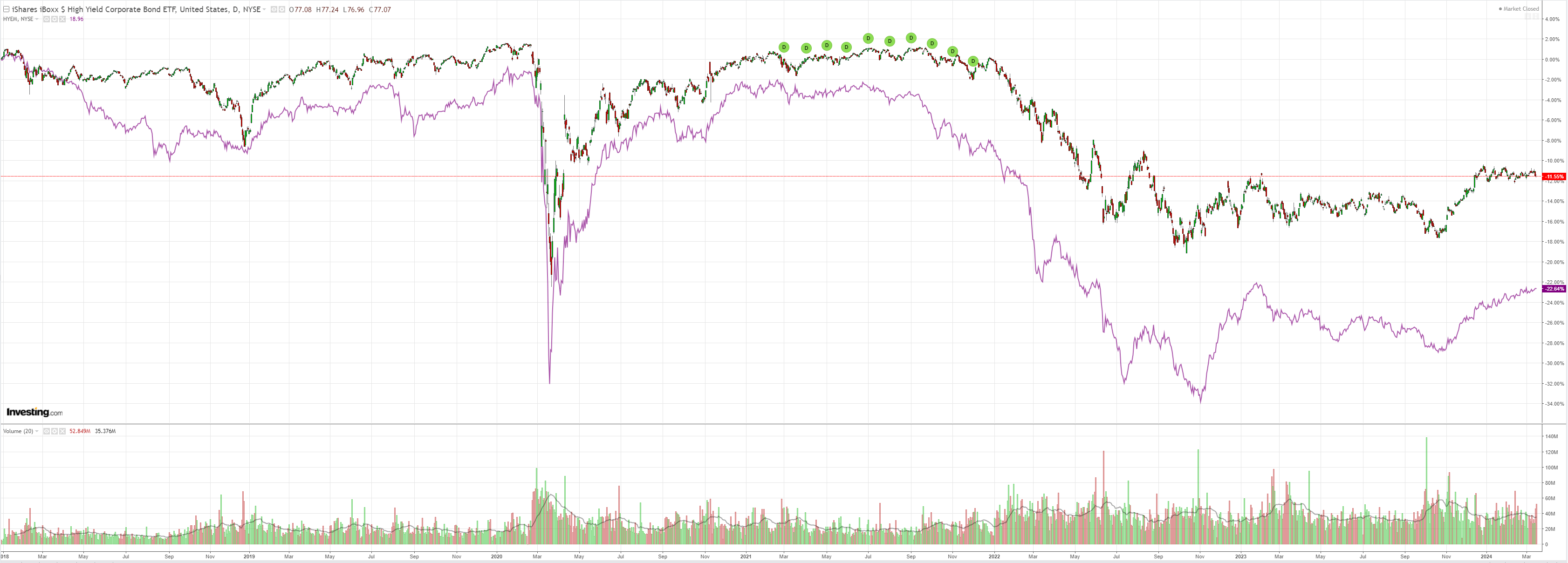

But junk was firm:

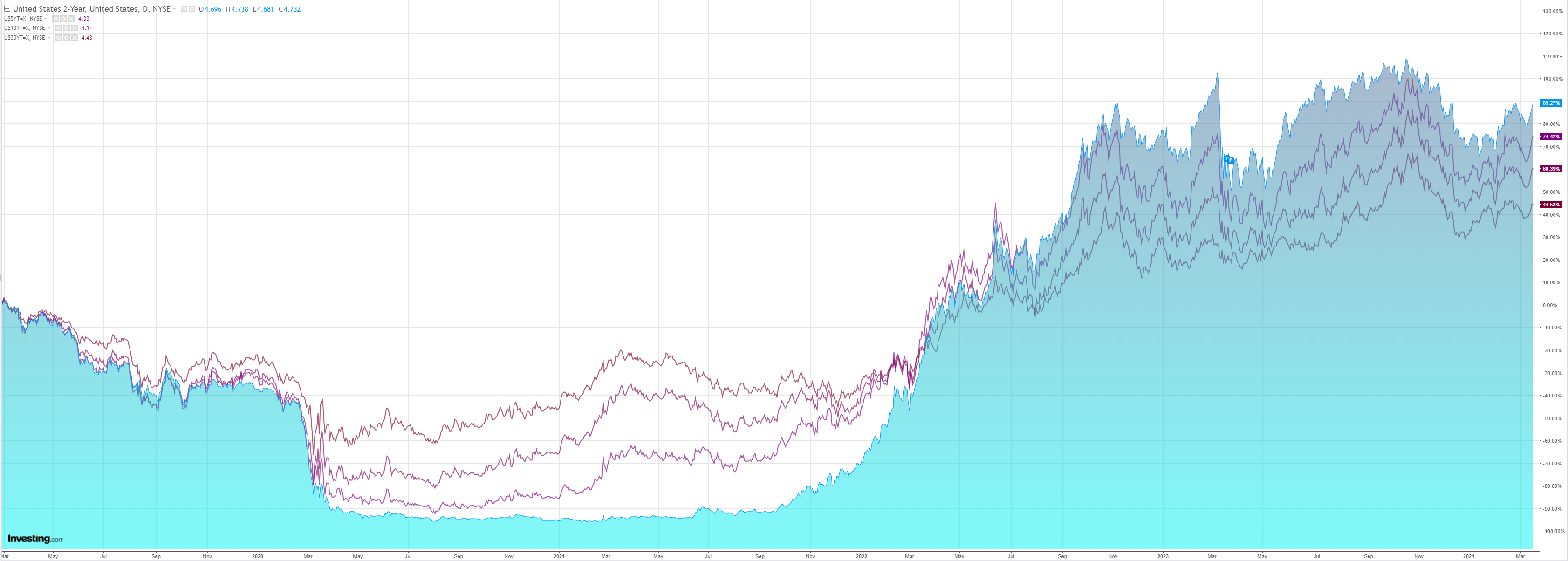

Yields whoa!

A stock correction may finally be here:

We are experiencing another cyclical pop in inflation that has punctuated disinflationary progress for a few years. I am not overly concerned by it. Core inflation in the US still has many embedded falls ahead.

If it delays the Fed and hands us a decent stock correction, I’ll gladly buy.

Conversely, my outlook for the next cycle remains deeply troubling for Australia.

Point one is the convergence of obesity drugs and AI to lift labour participation and mass eliminate jobs in an immigration-driven labour supply-led economic growth model. AI is a more significant threat to Australian growth than any other developed markets.

Point two is that China has entered a period of depression economics, with Aussie bulk commodities among the most prominent victims. This will gut national income and the budget, severely complicating fiscal responses to point one.

There are many unknowns. However, if Peak Human, Peak Fat, and Peak China converge upon the mass-immigration economy in the next few years, then monetary policy and a falling currency will be the primary mechanisms of adjustment.

The RBA once said it would not intervene even if the AUD fell into the 30s.

We may test that commitment in the years ahead.