DXY is up and away. EUR toast:

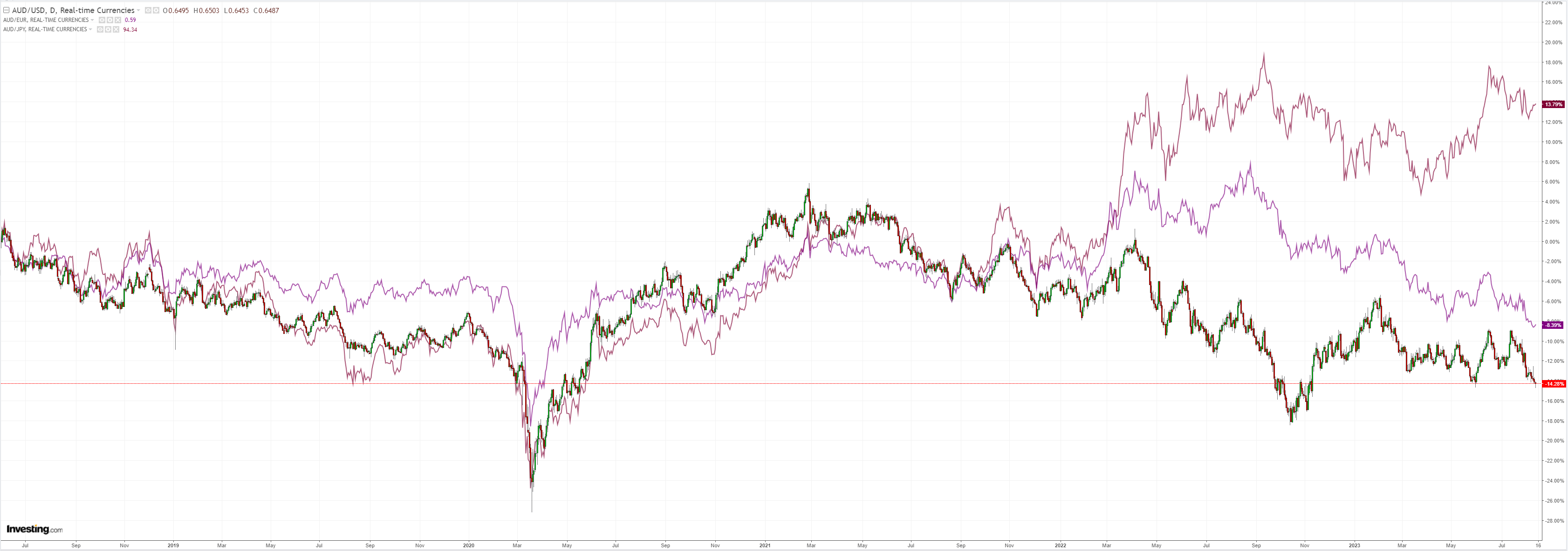

AUD is in free fall:

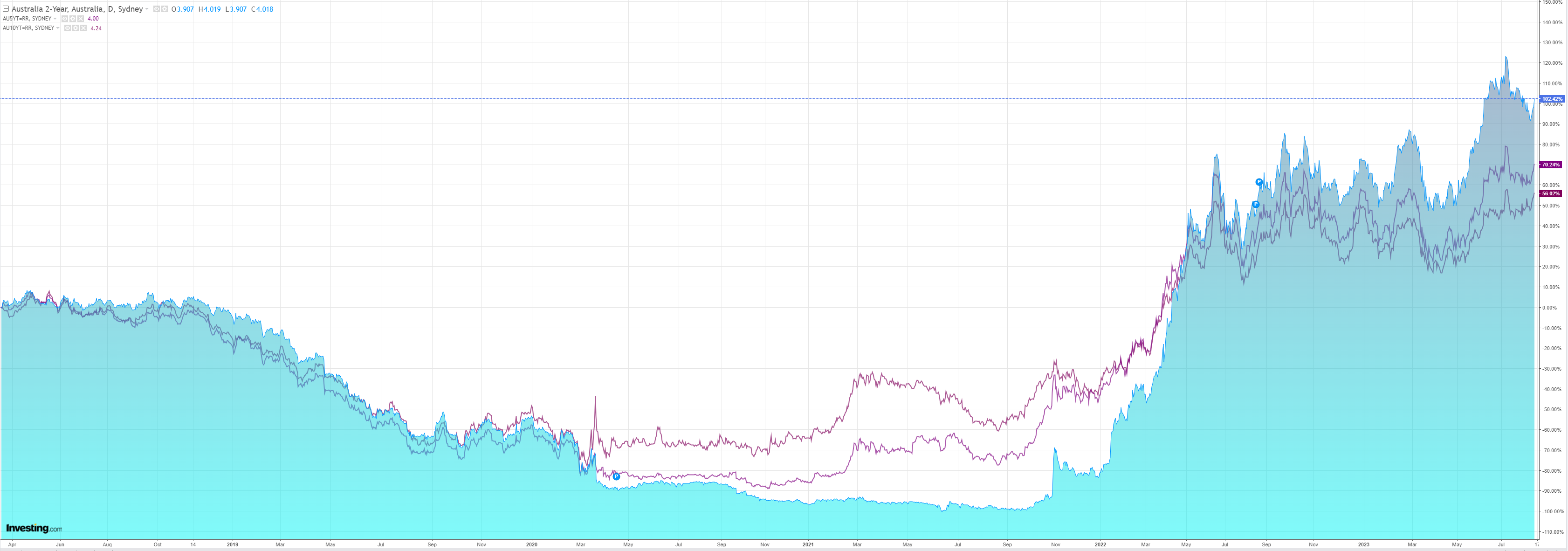

Aussie bond yields are in melt-up:

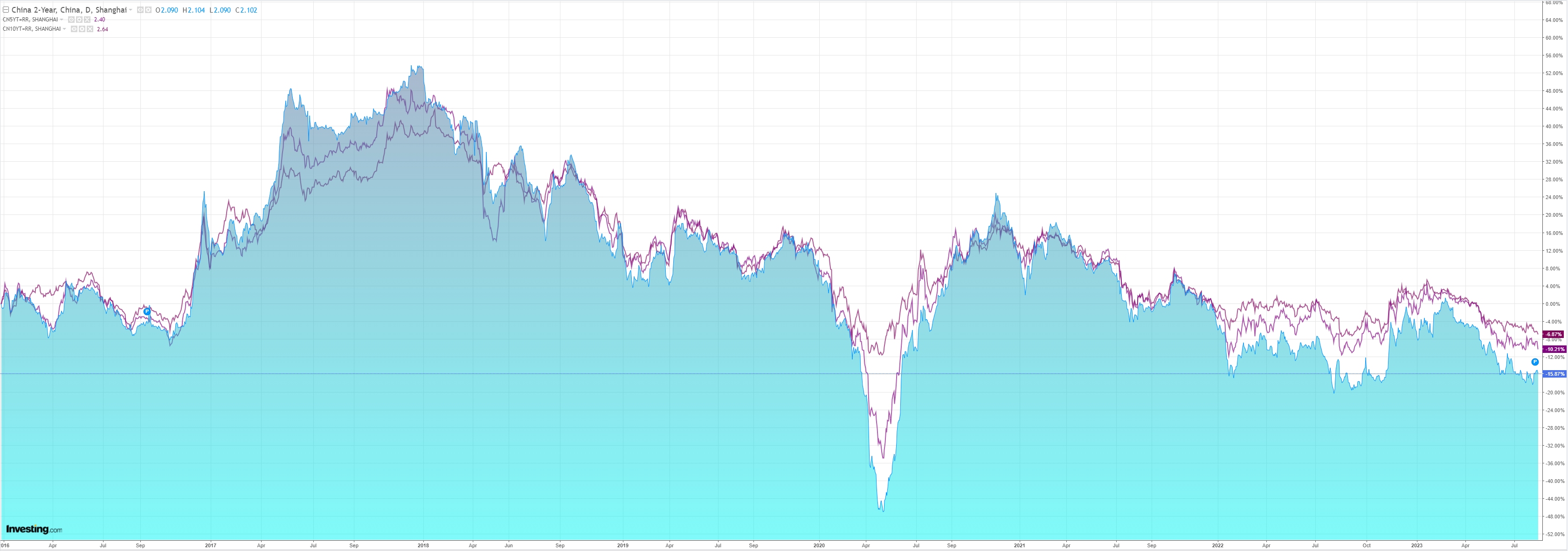

Even stranger, Chinese yields are in a melt-down:

Oil and gold fell:

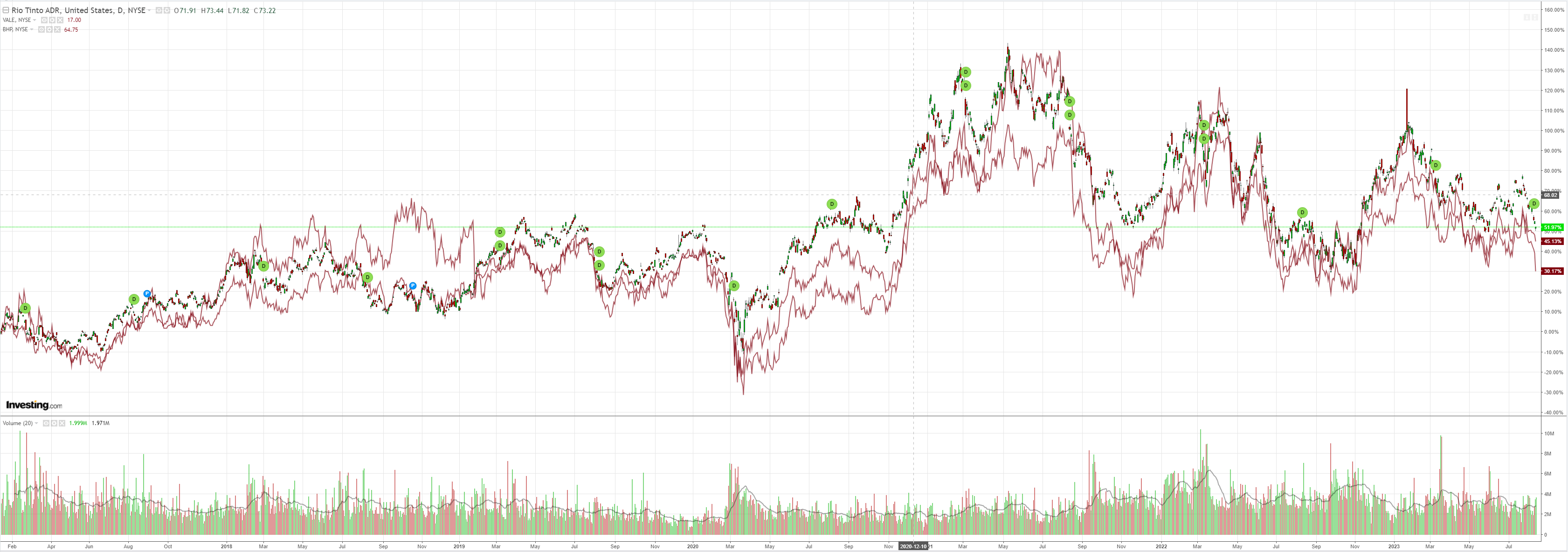

Dirt is going to retest the lows:

As are miners:

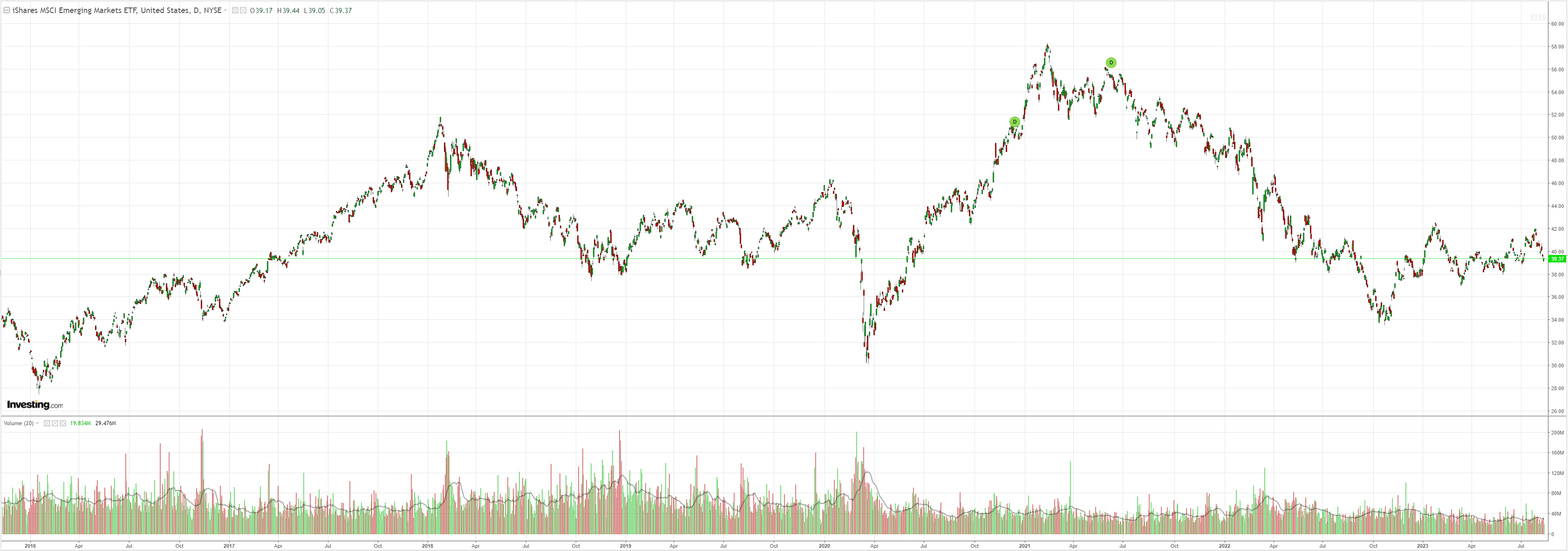

And EM stocks:

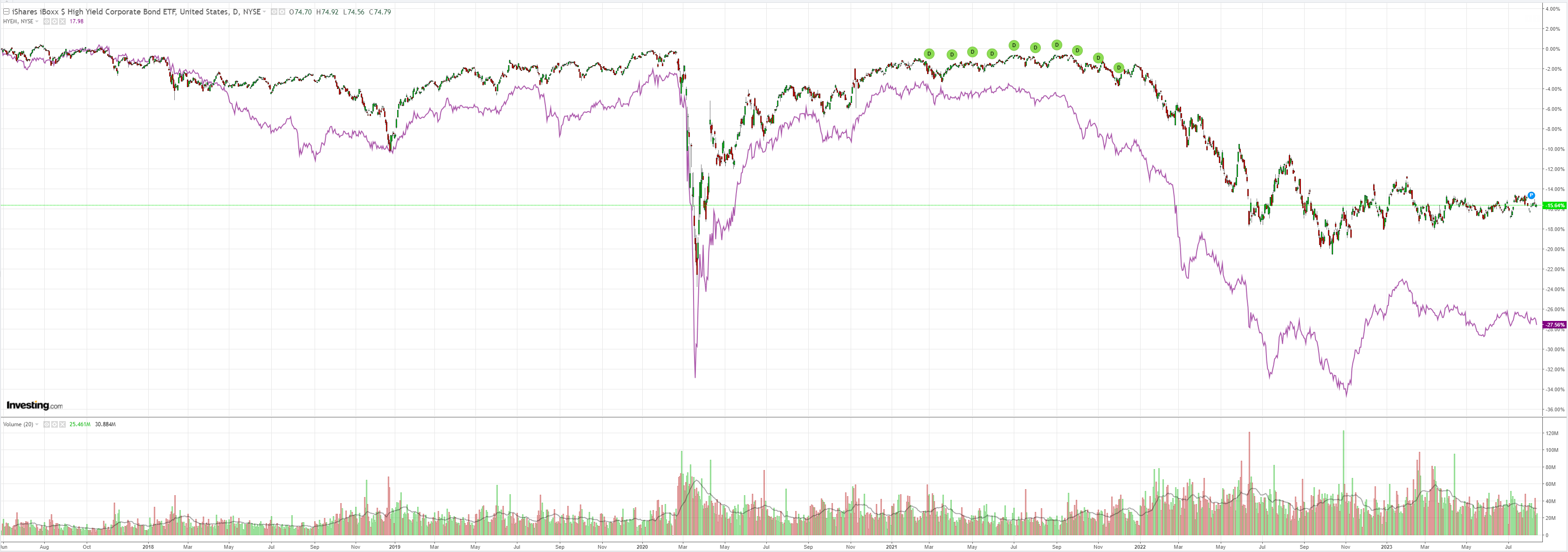

Junk is withering:

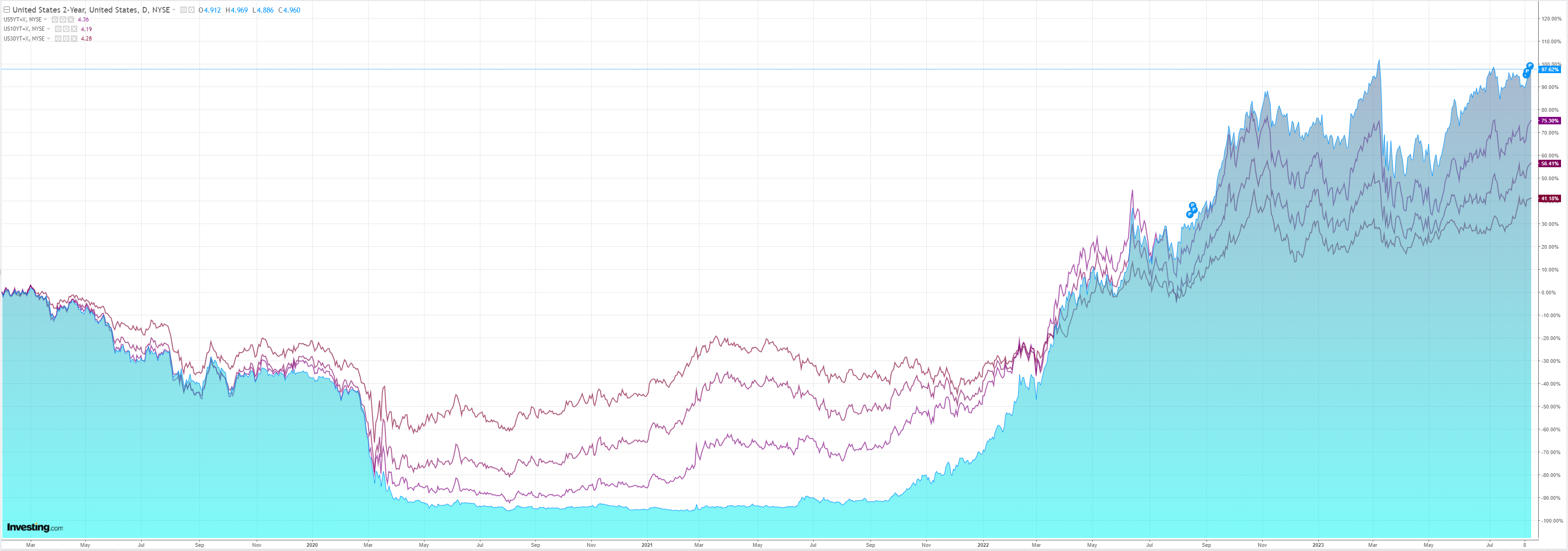

As US yields climb:

Stocks got a break:

These are very unusual circumstances.

The Australian economy is basically in recession, certainly per capita. Inflation is falling, and the RBA would normally cut in due course, sinking yields.

But Alboflation in energy and rents has delayed this normal course of events, meaning the RBA is still hawkishly on hold.

The AUD would normally hold up in such circumstances, but the developing China crisis is sinking the currency so fast that markets are in a feedback loop of a falling currency and rising yields reminiscent of an external emerging markets debt crisis.

This is even more true as EM trash currencies like CNY, RUB, and ARS also crash.

Having a strong US as the last growth man standing is adding pressure. Its bond curve is bear steepening. But Australia’s is moving even faster as long-end yields jackknife.

How much inflation will the falling AUD add? And could this dynamic get out of control? Forcing the RBA to hike into recession?

Goods deflation out of China is strong and global demand is still weakening, so tradeables’ firms should absorb much of the shock in margins.

However, Alboflation is also strong. His insane energy shock will keep adding inflation to everything. And mass immigration is delivering an unprecedented rental shock.

Tradeable firms may seek to pass on rising costs in an inflationary environment, meeting and firming still strong services inflation.

Assuming the China shock proceeds, we will see a titanic wave of deflation wash over the economy via terms of trade shock in due course.

But timing and sequencing issues here could lead to further feedback loops before we get there.

Albo’s dual obsessions of not upsetting corporations and quantitative peopling are now jeopardising Australian macro stability.