The Australian dollar is melting up regardless:

Chasing the energy melt-up:

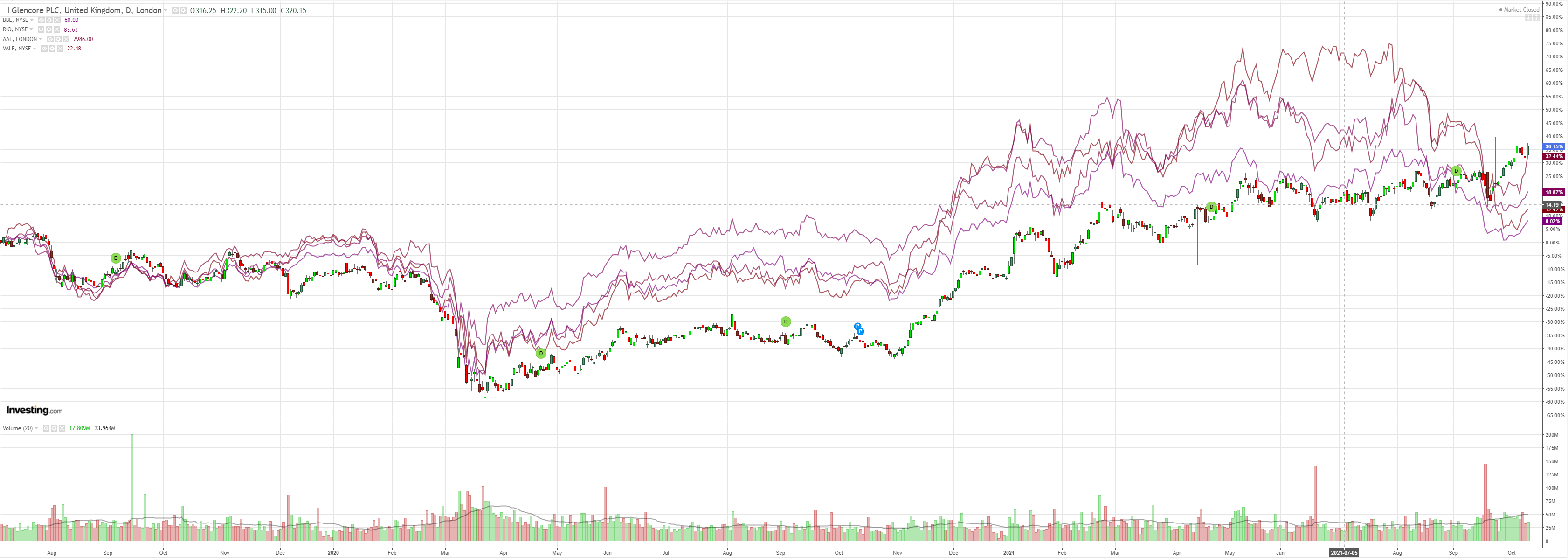

As metals go with it:

Miners are back!

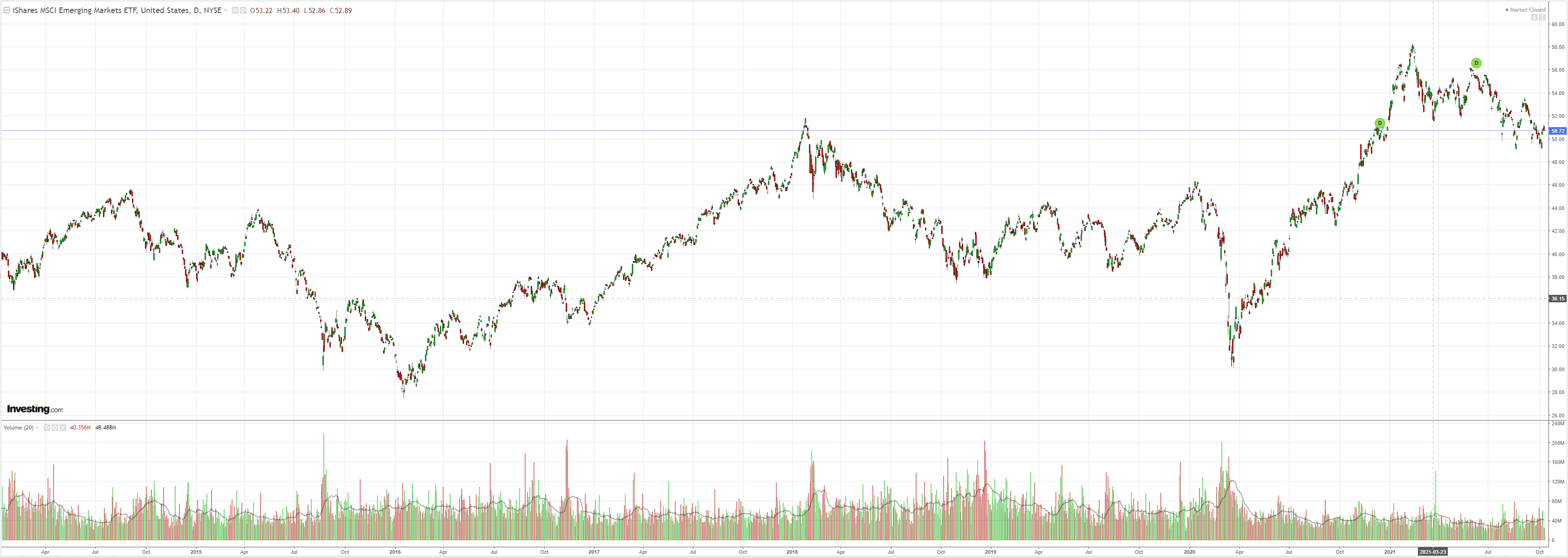

EM stocks are not:

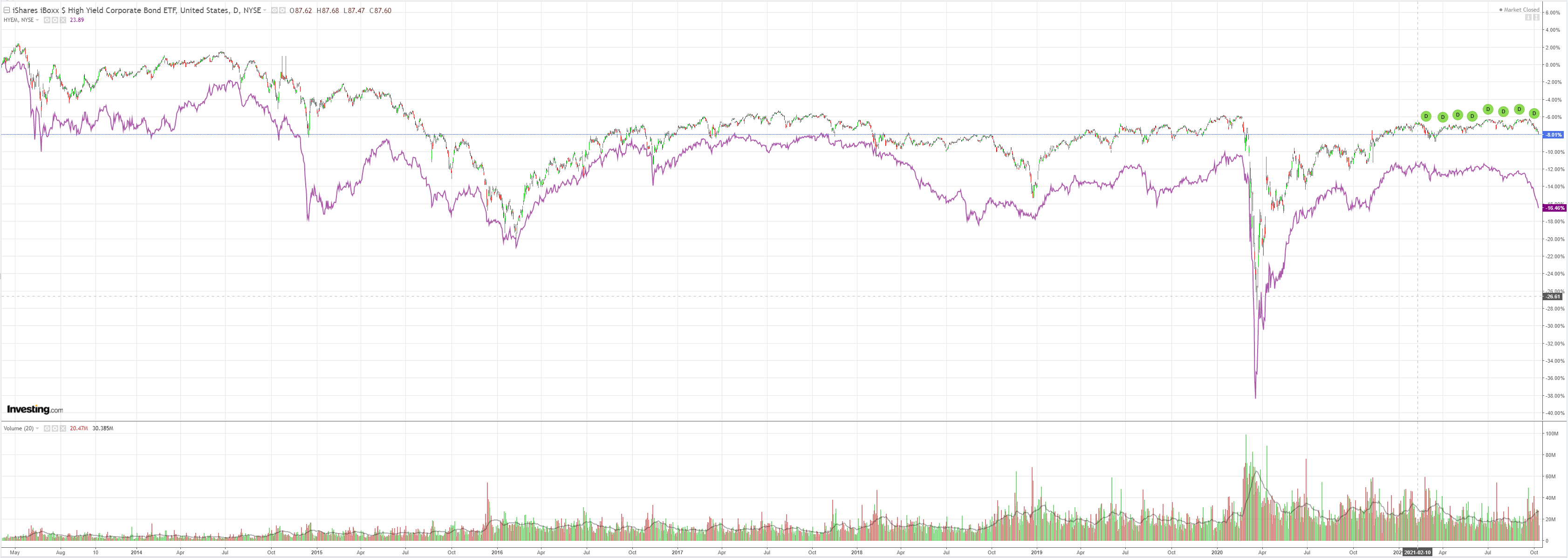

EM junk has fallen through the trapdoor. Look out equities:

US bond markets were closed. Australian yields are moonshooting:

Westpac has the data:

Event Wrap

Danish CPI in September was slightly above consensus at 2.2%y/y (est. 2.1%), as was the case in Norway at 4.1%y/y (est. 3.9%).

ECB Chief Economist Lane repeated the mantra from Lagarde over patience regarding policy shifts. He also stressed the importance of wage outcomes, but that they would not react to “one-off” moves in wages. Against that, hawk Knot warned that investors need to consider inflation risks, even if the current moves are seen as “largely temporary”.

Event Outlook

Australia: September’s NAB business survey will provide an update on how businesses are faring through Australia’s lockdowns.

New Zealand: A 10% rebound is expected in September card spending, with subdued spending in Auckland offset by gains elsewhere. Ongoing border closures meanwhile continue to keep net migration at low levels.

UK: The ILO unemployment rate is expected to edge lower to 4.5% in August, headwinds from delta notwithstanding. In Europe, the September ZEW survey is also due.

US: The NFIB small business survey is likely to remain in robust health in September, with the experience of recovery offsetting lingering uncertainties over the outlook. The August JOLTS survey should continue to show strength in labour demand, highlighting that participation is the concern. The FOMC’s Bostic will then speak on inflation.

We’ve got a good old-fashioned melt-up underway. It’s driven entirely by energy. In particular, gas and coal which were insane again yesterday. Thermal coal:

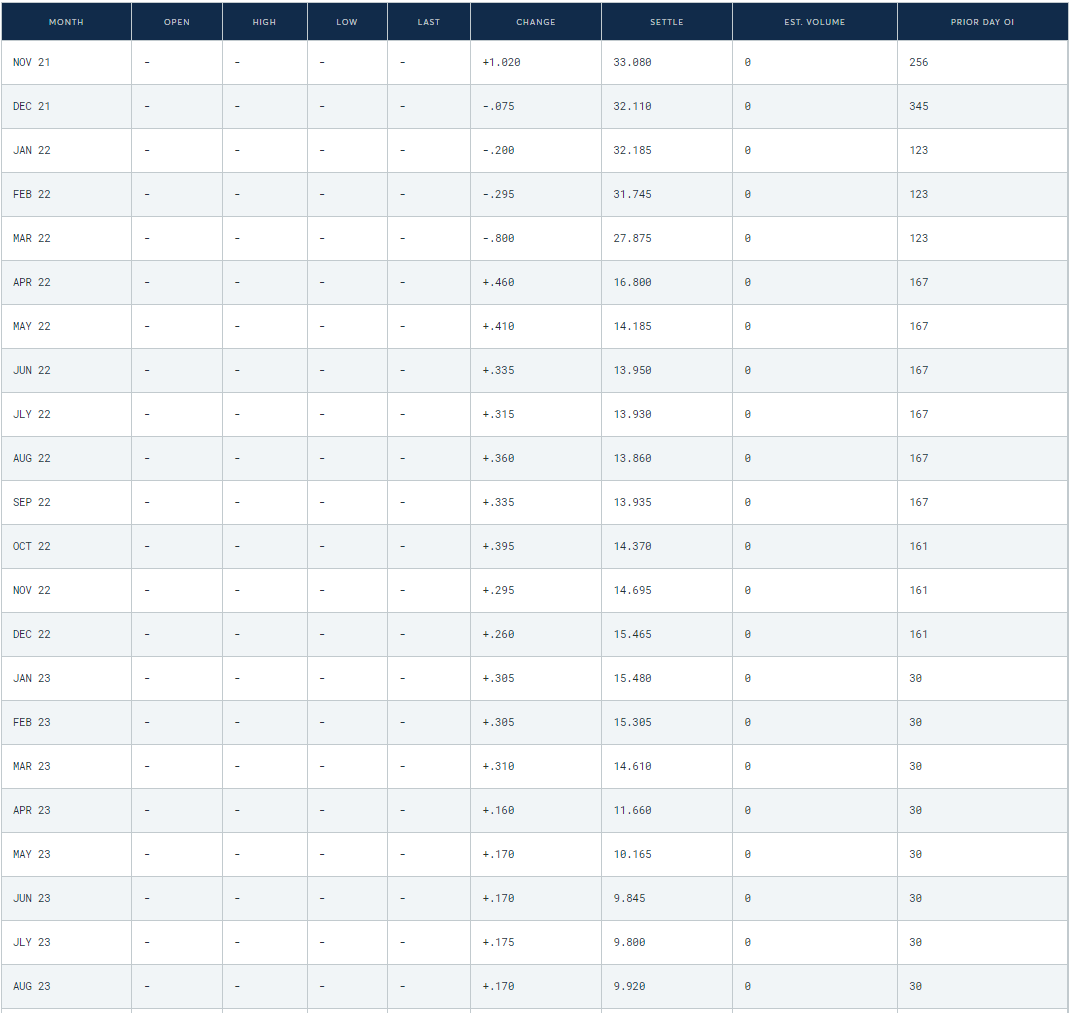

Coking coal:

And LNG:

Other commodities are being sucked back into the mania on the basis that buying commodities is the only way to protect yourself from commodity inflation (yes, and the moon is made of cheese). This is leading China to cut metals processing output to ease its energy demand thus triggering commodity shortages and still more buying to protect yourself from commodity inflation.

This crazed melt-up can keep rising until either more energy becomes available or the energy prices themselves kill real economic demand (or something else does). My best guess is that both will happen roughly at the same time in a matter of a few months. The commodity melt-up will then crash back to earth in a parabolic fireball.

The Australian dollar is a helpless soul duck-taped to the outer shell of this lunatic rocket.