DXY held on:

AUD let go:

North Asia is offering support:

Oil puked again:

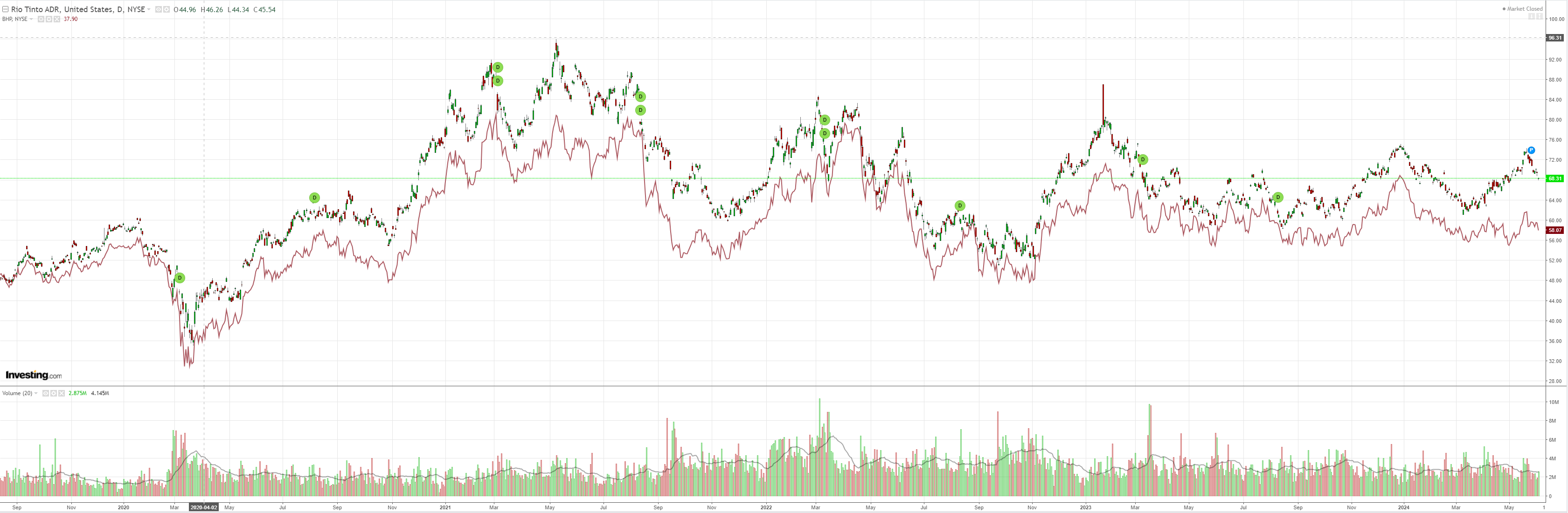

Metals mania has turned metals meltdown:

Big miners are breaking down:

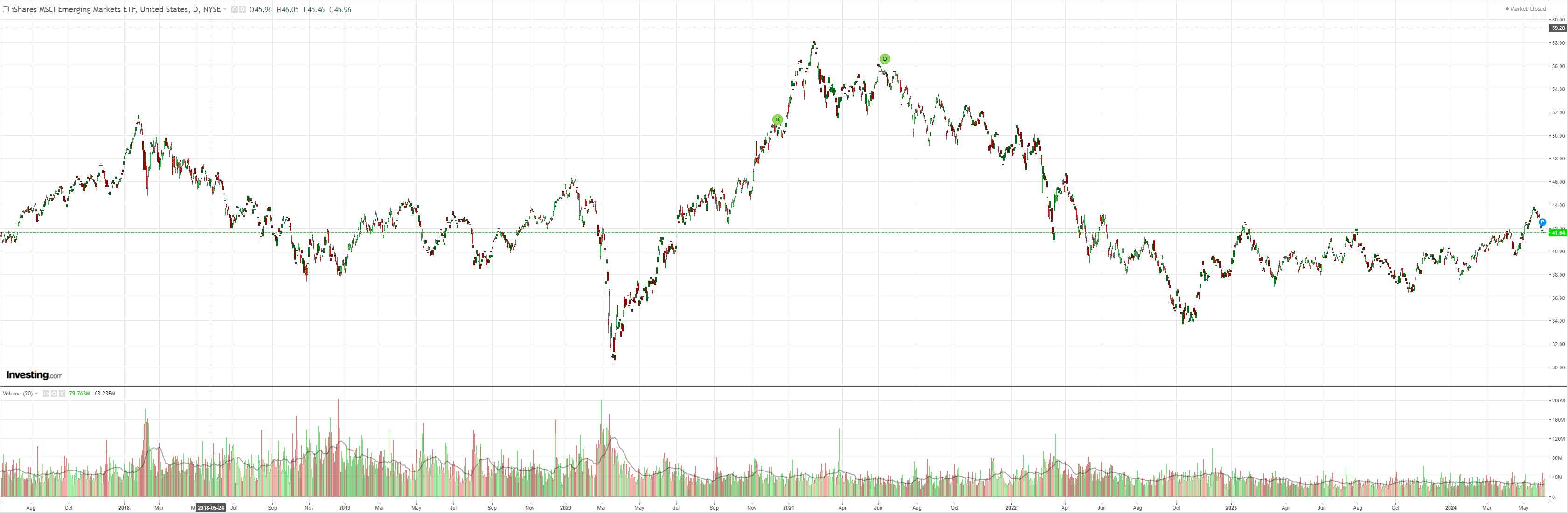

EM too:

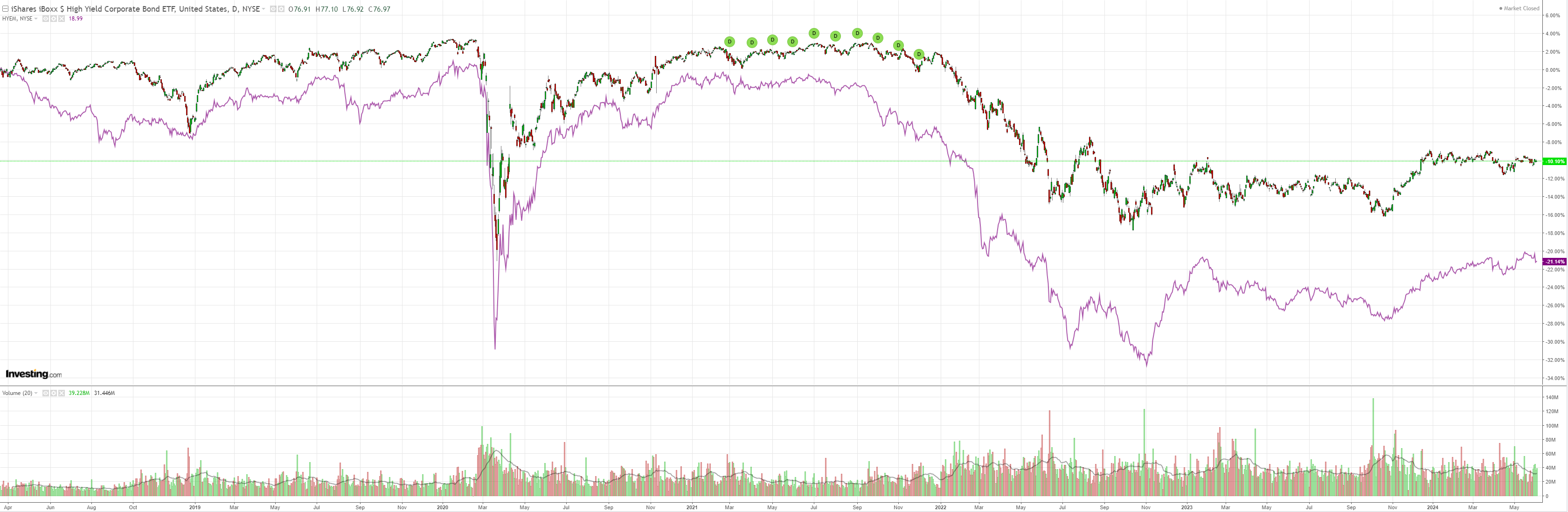

Junk is OK:

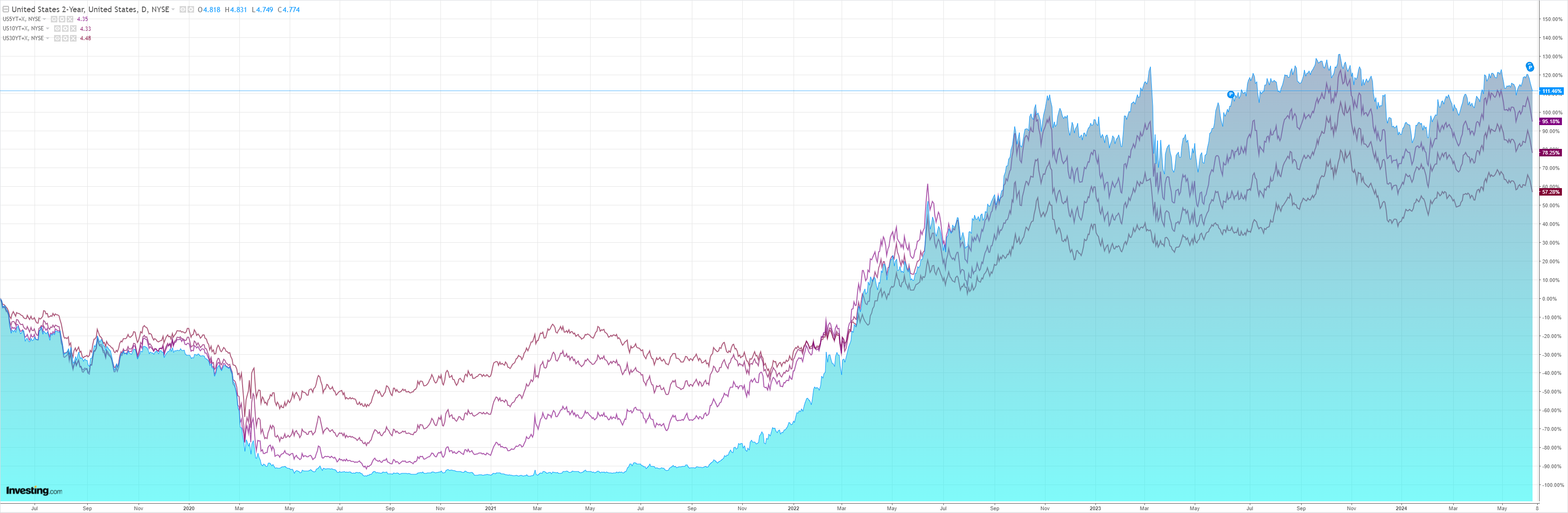

Bonds ignited:

Stocks are hanging on:

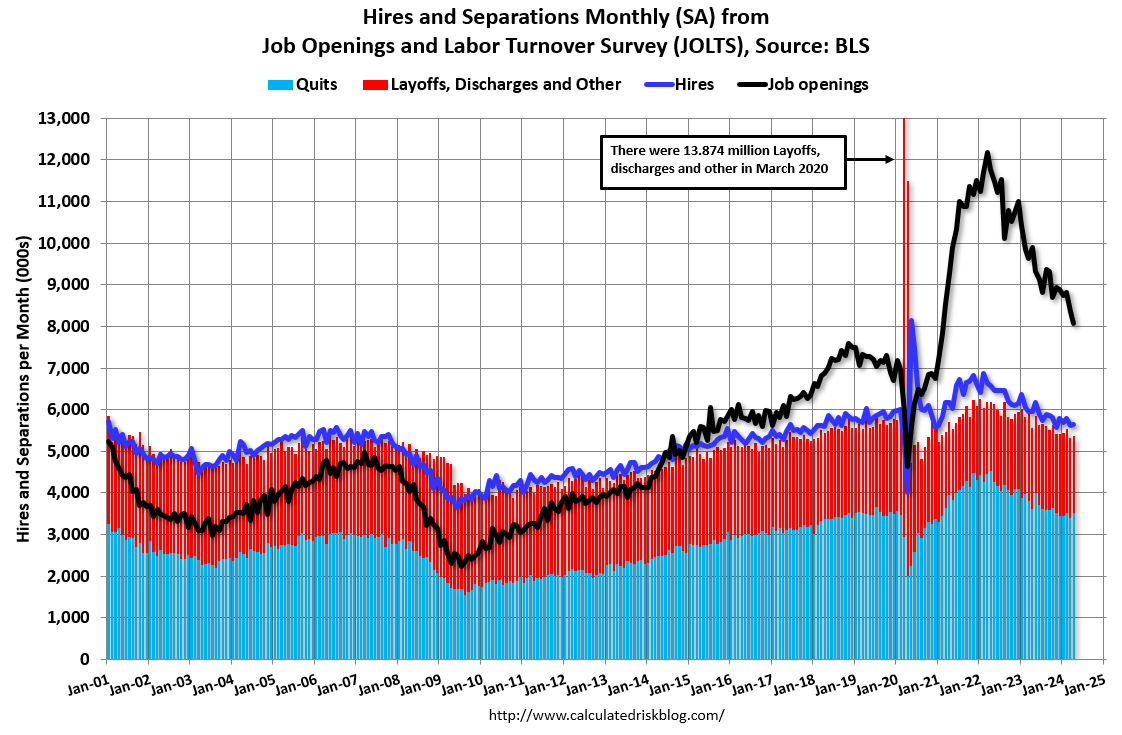

JOLTS were weak:

The number of job openings changed little at 8.1 million on the last business day of April, the U.S. Bureau of Labor Statistics reported today. Over the month, both the number of hires and total separations were little changed at 5.6 million and 5.4 million, respectively. Within separations, quits (3.5 million) and layoffs and discharges (1.5 million) changed little.

The US labour market is back to 2018 levels of tightness. This is helping put a bid under bonds as growth fears resurface.

The same fading inflation fears and the oil smash emanating from Saudi Arabia appear to have popped the metals bubble.

Suddenly, ongoing disinflation is the theme.

Much of this is just Wall Street playing short-term liquidity games.

The soft landing is intact. It is still disinflationary. The Fed will be cutting in H2.

On balance, this is still AUD bullish.