DXY is up and away:

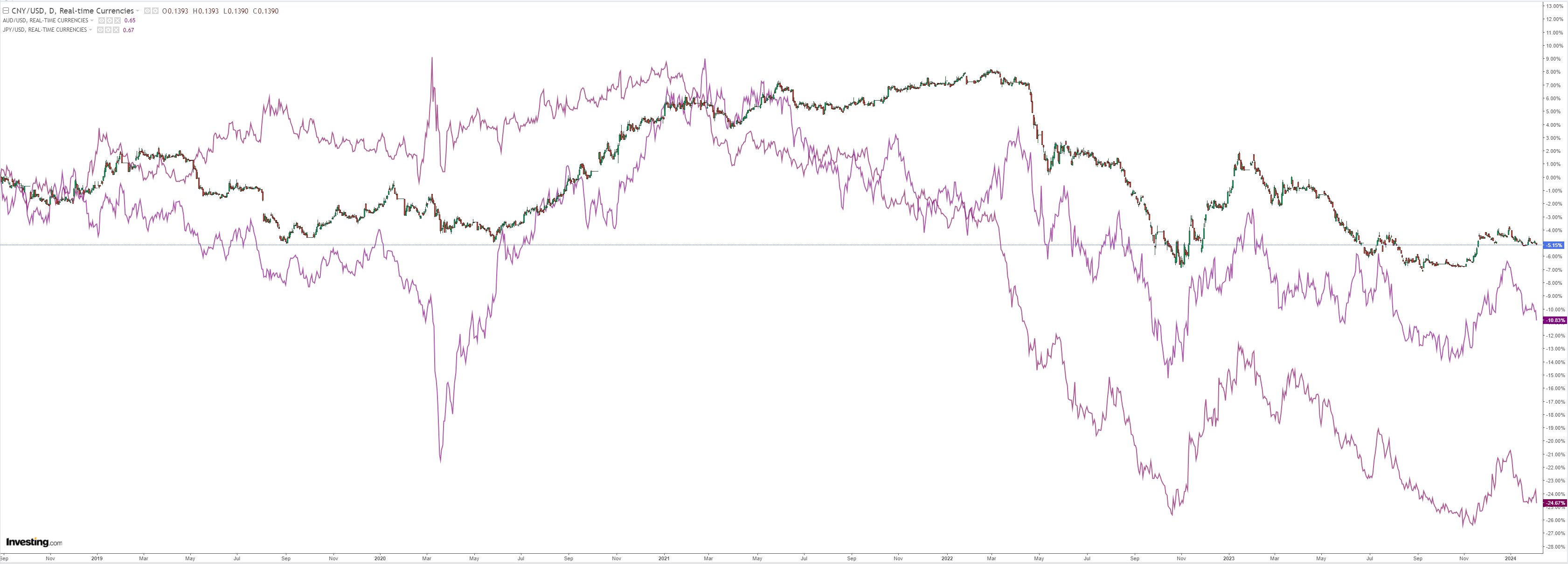

AUD broke a head and shoulders top and is in free fall:

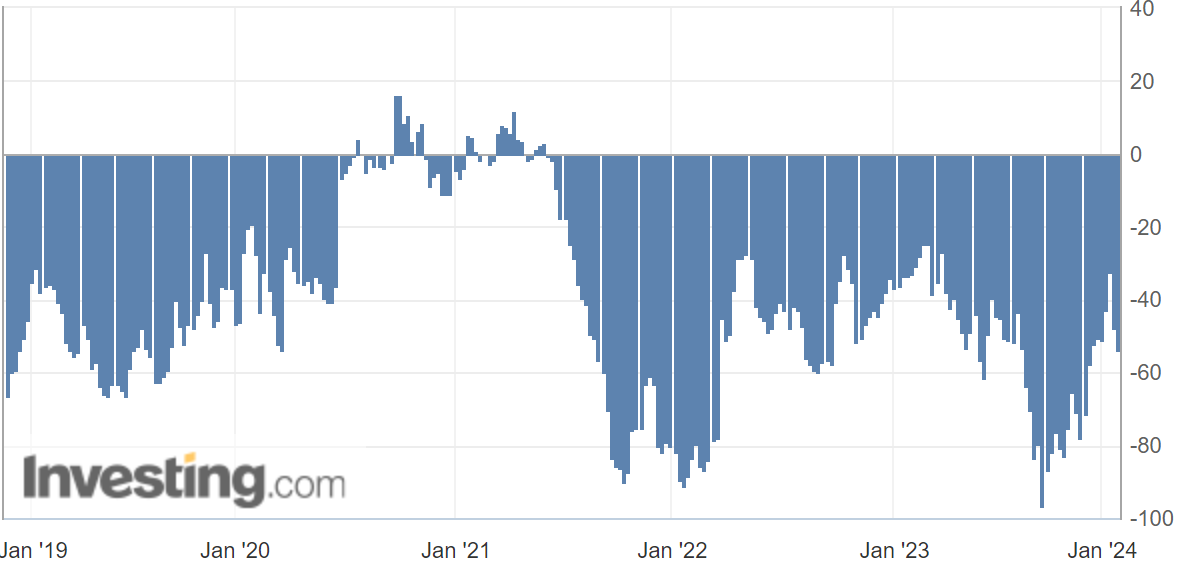

AUD positioning is not extreme and has room to fall:

North Asia too:

Oil puke:

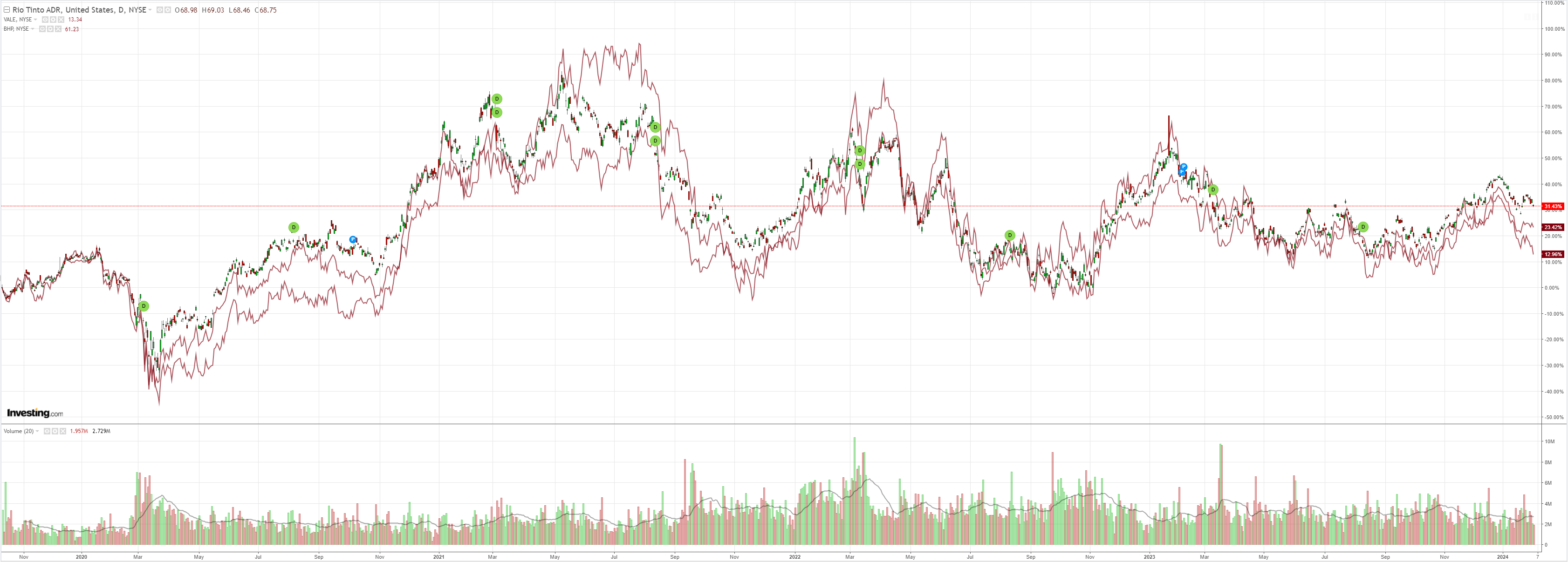

Dirt puke:

Mining puke:

EM meh:

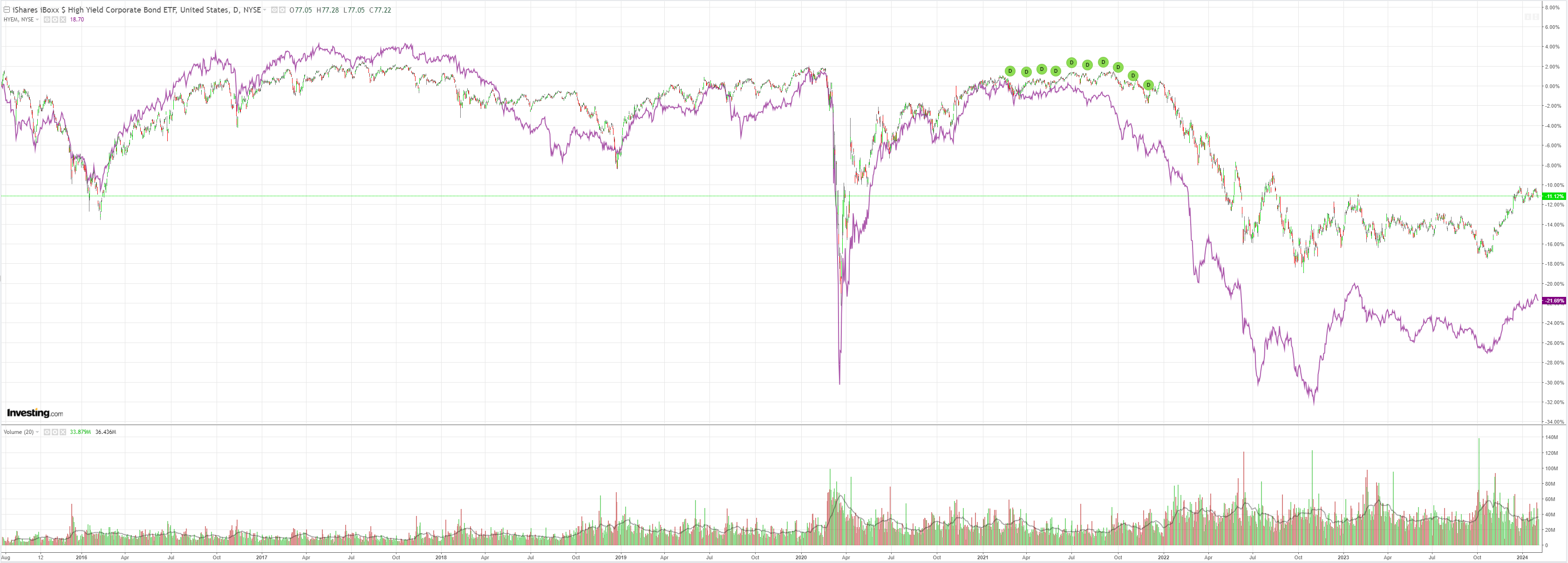

Junk puke:

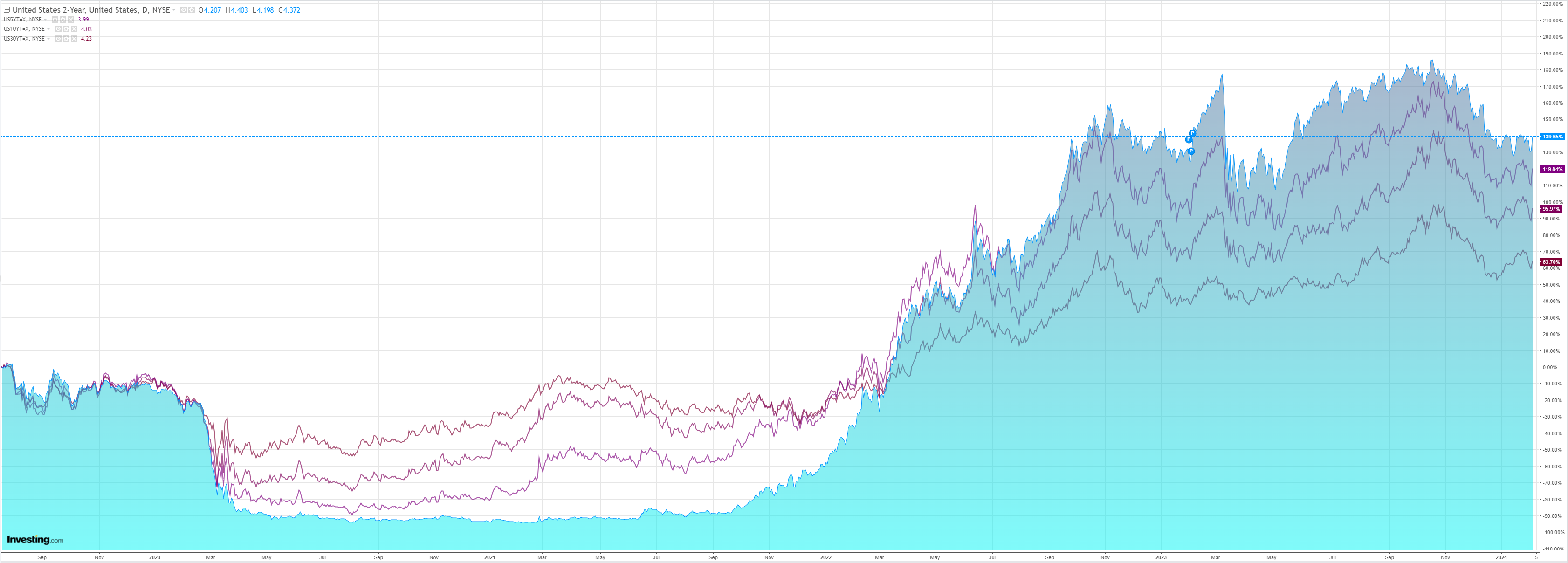

Treasury puke:

Stocks whoa!

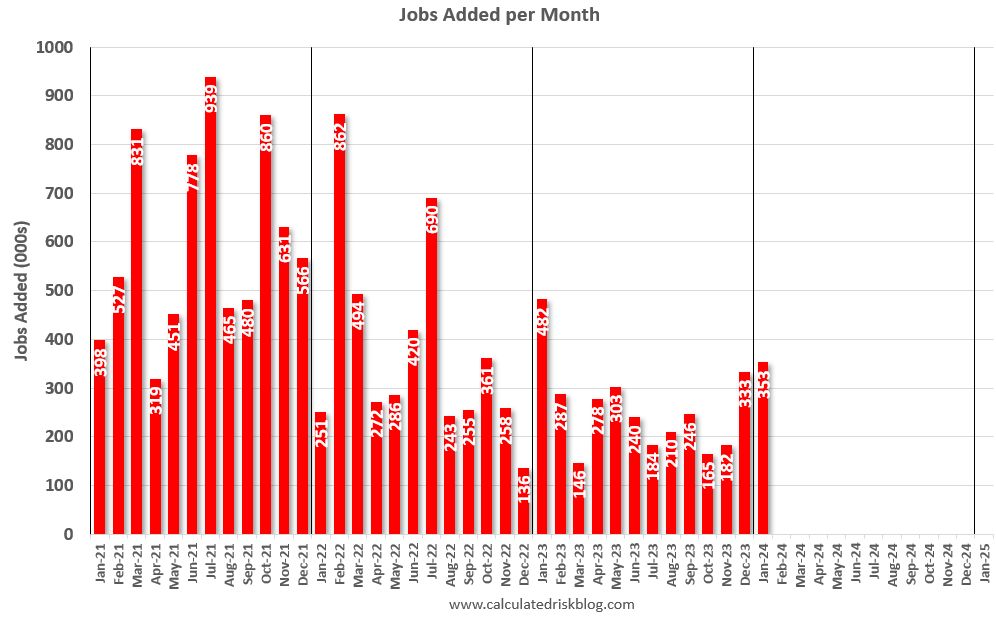

US jobs went nuts:

Total nonfarm payroll employment rose by 353,000 in January, and the unemployment rate remained at 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, health care, retail trade, and social assistance. Employment declined in the mining, quarrying, and oil and gas extraction industry.

The change in total nonfarm payroll employment for November was revised up by 9,000, from +173,000 to +182,000, and the change for December was revised up by 117,000, from +216,000 to +333,000. With these revisions, employment in November and December combined is 126,000 higher than previously reported.

Individual job reports are useless. But the trend matters, and it is firming.

The Fed has time to wait and will no longer cut in March, though its small bank funding facility will be problematic.

With DXY strong and China weak, I expect global disinflation to continue, so I still expect Fed cuts.

Roughly two-thirds of the COVID inflation burst was supply side shocks, so as they disappear and inflation falls, allowing real rates to rise is an unnecessary tightening.

The US economy has slowed a lot but appears to be putting in a feather bed soft landing. On the other hand, the mismanaged Australian economy has crashed into a consumer hard landing.

Ipso facto, it is likely that the RBA will have cut much deeper than the Fed, and maybe before it, with the outlook just as bad as China disappears into a debt-deflation trap.

And the AUD is toast.