DXY is off to the races:

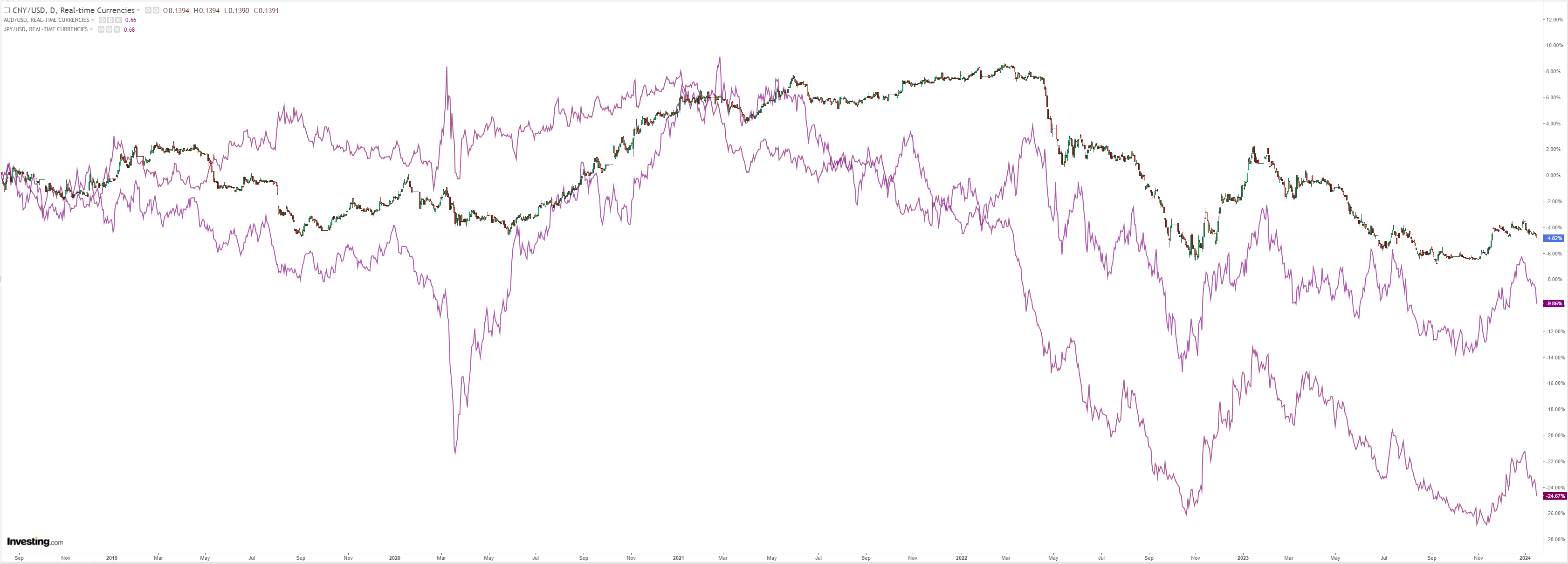

AUD massacre:

That giant sucking sound you can hear is north Asian capital flows:

Oil and gold will get hit if it runs:

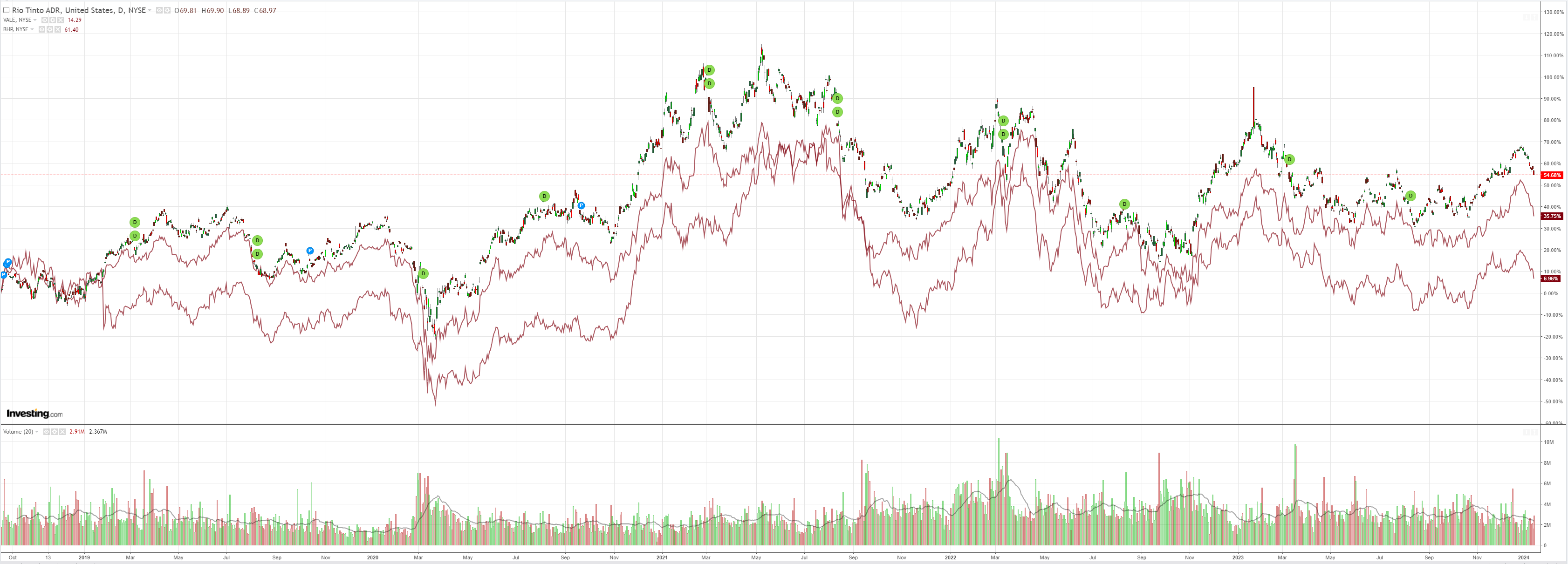

Dirt yawn:

Big miners bloodletting:

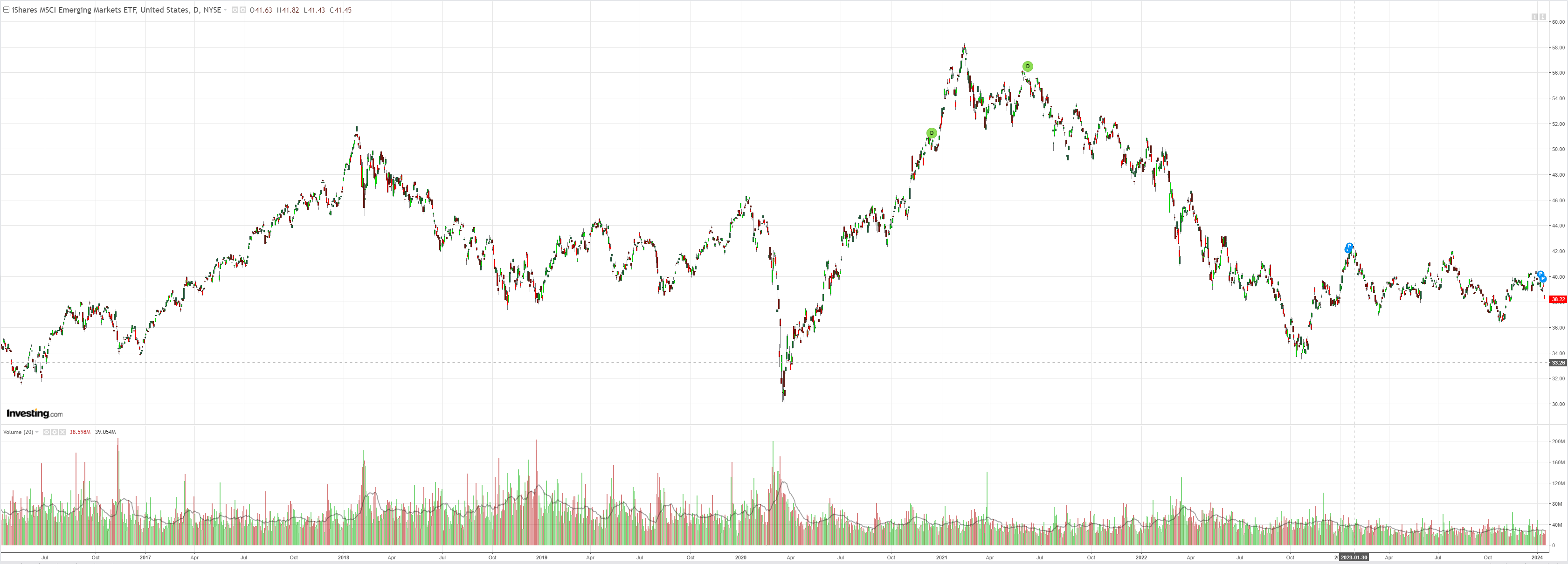

EM too:

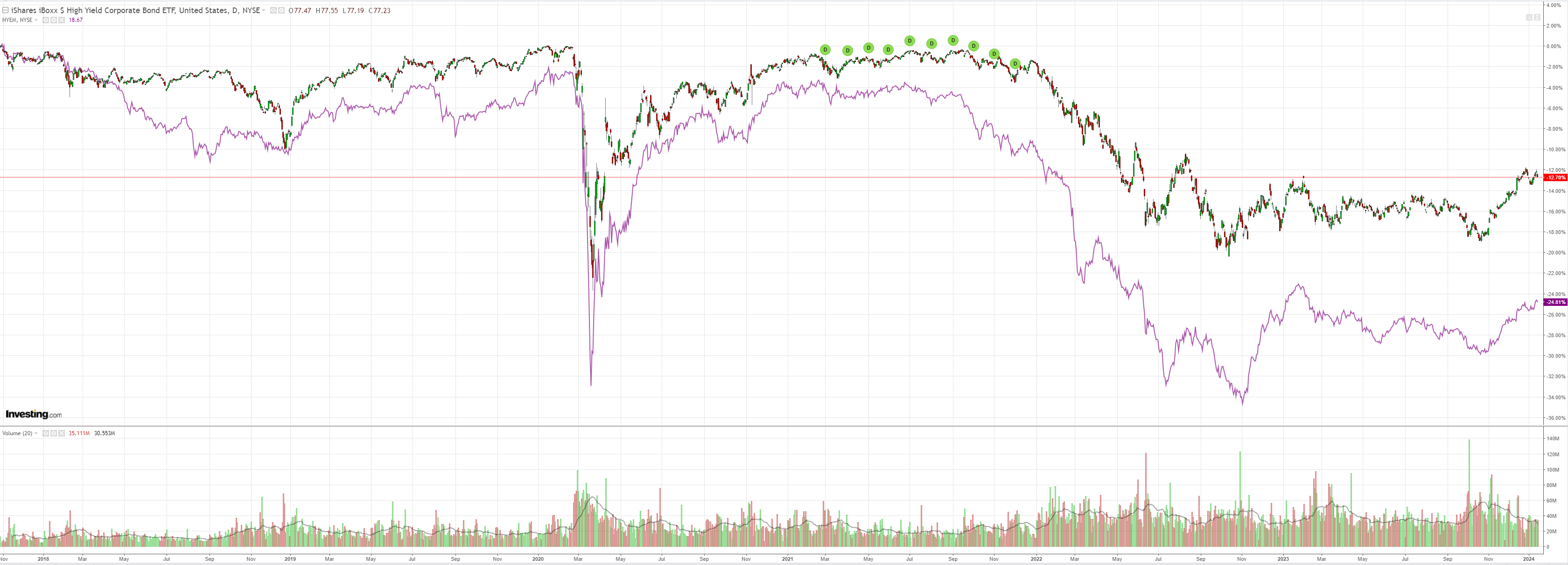

Junk unconcerned:

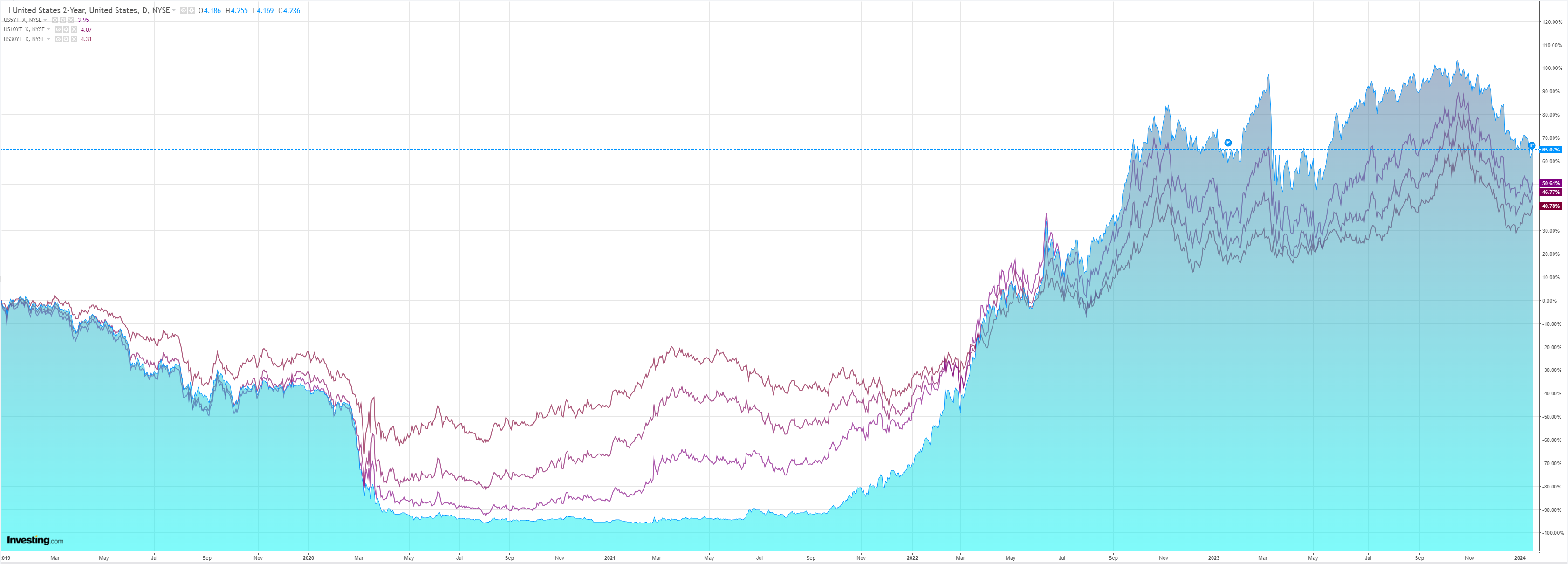

Yields up:

Stocks down:

The Fed has pushed back against early rate cuts:

Wall Street traders pared their bets on Federal Reserve rate cuts on speculation the dovish bid emboldening both stock and bond bulls has gone too far.

“We view his comments emphasizing no need to rush as indicating that he does not expect to push for a March cut — and read his arguments in general as more consistent with our baseline of a first cut in May or June,” said Krishna Guha at Evercore.

More importantly, Waller indicated three cuts this year is enough, versus the market’s six.

And who cares? This is more an overcooked market expressing its fragility than anything meaningful.

If the Fed wants to give us one more brief deflationary shock to make sure of it then so be it.

However, I think there is more going on in the case of forex and the AUD.

The relentless Chinese debt-deflation combined with Japanese inflation going nowhere fast means the return of the JPY yields widowmaker trade.

While this is intact, there is not much sense in markets selling DXY because of closing yield spreads or better growth outside the US.

Add a possible delay to Fed cuts, and it does not take much to derail the reflation trade underlying the AUD rally.

AUD’s underperformance versus cyclical beta in 2024 is shaping as a pretty good bet.