DXY sank Friday night even with risk-off:

AUD was still firm:

Oil struggled:

Metals are trying to base:

Miners (LON:GLEN) following:

EM stocks (NYSE:EEM) chunked it:

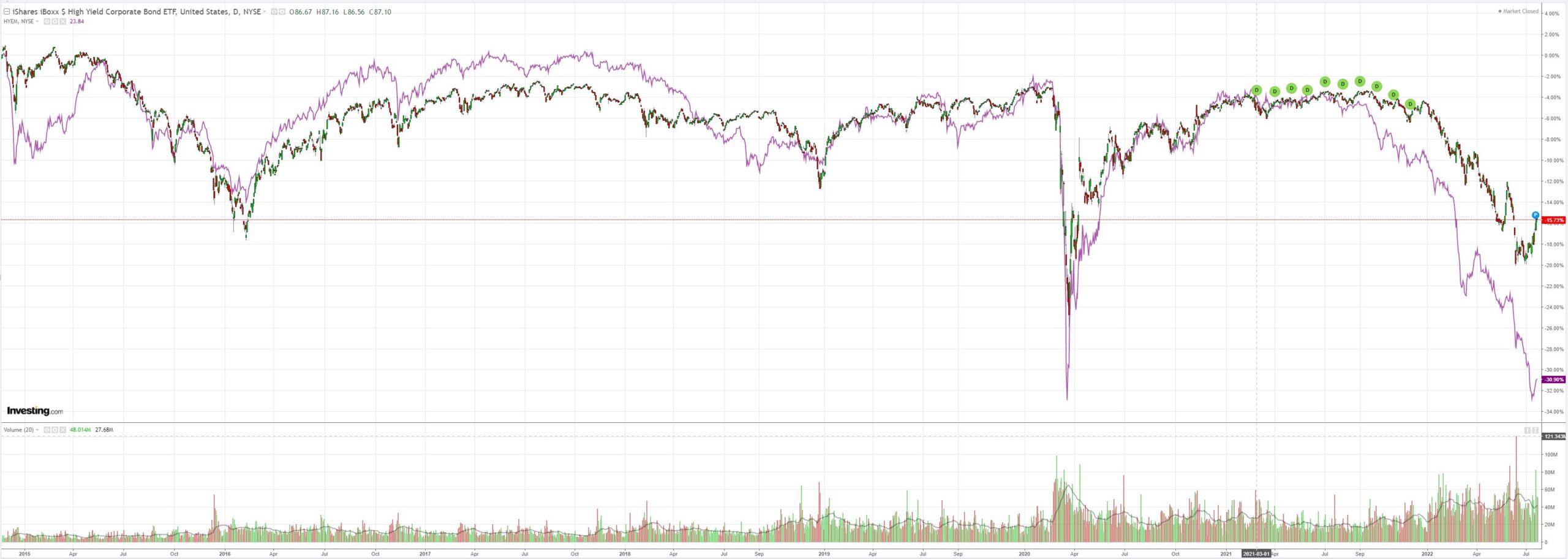

But junk (NYSE:HYG) did better:

Treasury yields were pulverised:

Stocks too:

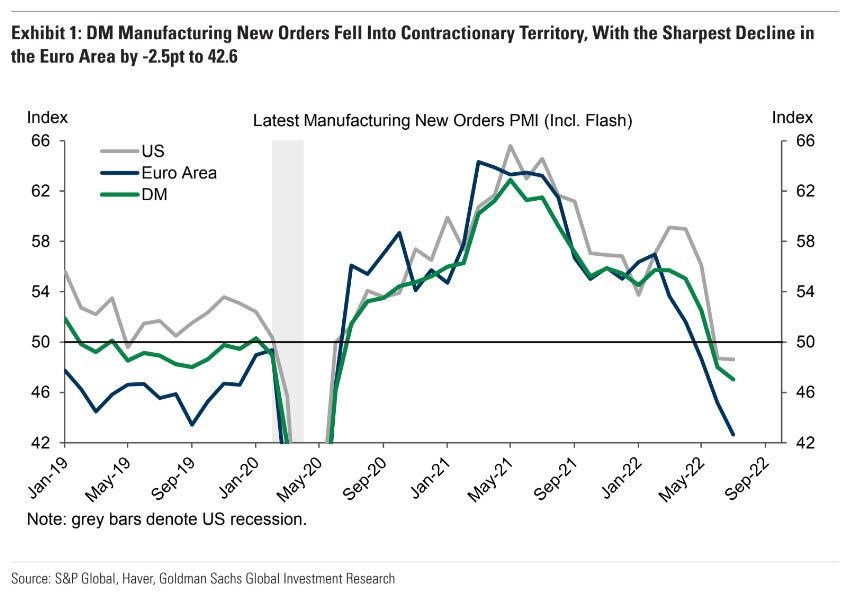

It is amusing to watch markets try to silo the unsiloable. EUR is rebounding on rate hikes and a resumption of Russian gas flows. But perhaps they should look at the economy as well.

The ECB has just launched an aggressive 50bps increment tightening campaign to extinguish supply-side energy inflation that it can’t affect as the economy literally free falls into recession on the same:

The ECB has a history of making quixotic hawkish policy errors and it’s just made another of them. TSLombard:

The ECB is being forced to match what the Fed does to support EUR and thereby avoid making its inflation problems worse. But the economy is not in the same strong position as the US, and the risk of recession is material. Earnings forecast do not yet reflect this risk.

Bonds: The ECB is determined to hike aggressively against multi decade high inflation; markets price around 185bps worth of ECB hikes by December, with a safety net for Italian BTPs in place, the ECB would be increasingly tempted to validate that pricing.

FX: Europe is facing a stagflation trifecta; a widening growth and inflation differential between the US and euro area, coupled with an eventual divergence in central bank responses and a weakening CNY, keeps downward pressure on the EUR.

EUR meet barge pole.

AUD likewise.