DXY is firming again as EUR wilts:

AUD was firm across the board:

Oil was also firm:

Base metals are threatening to blow off:

Big miners (LON:GLEN) stalled:

EM stocks (NYSE:EEM) did better:

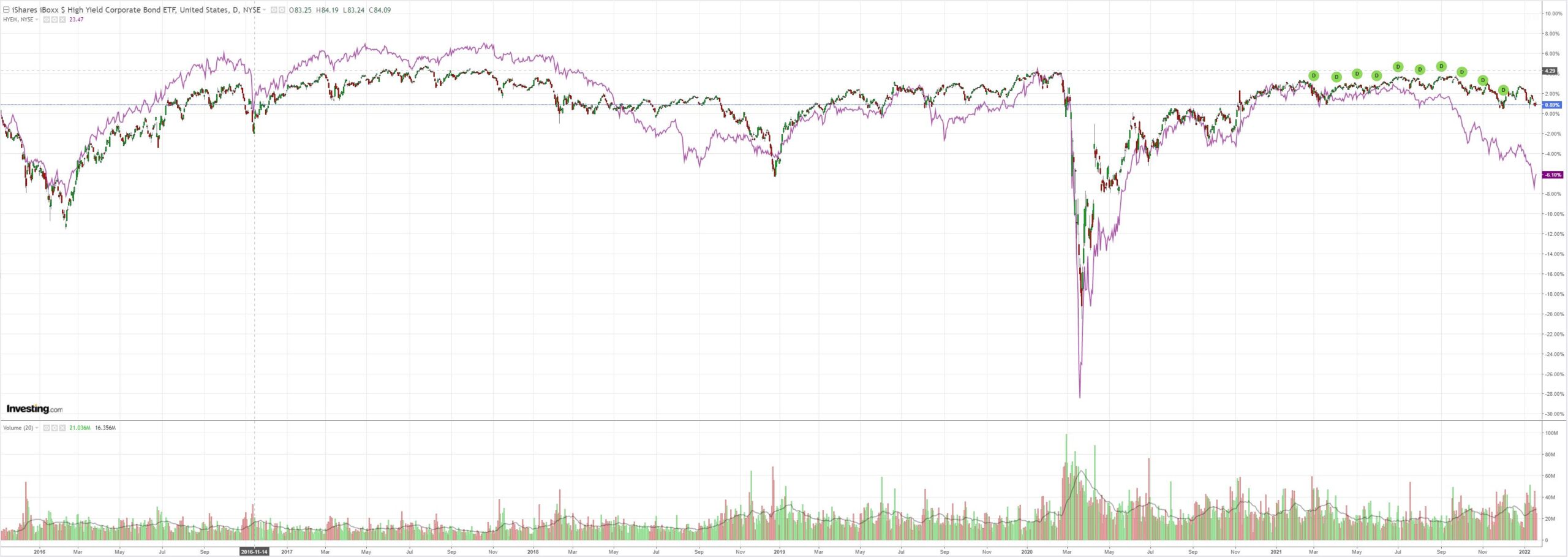

And junk (NYSE:HYG):

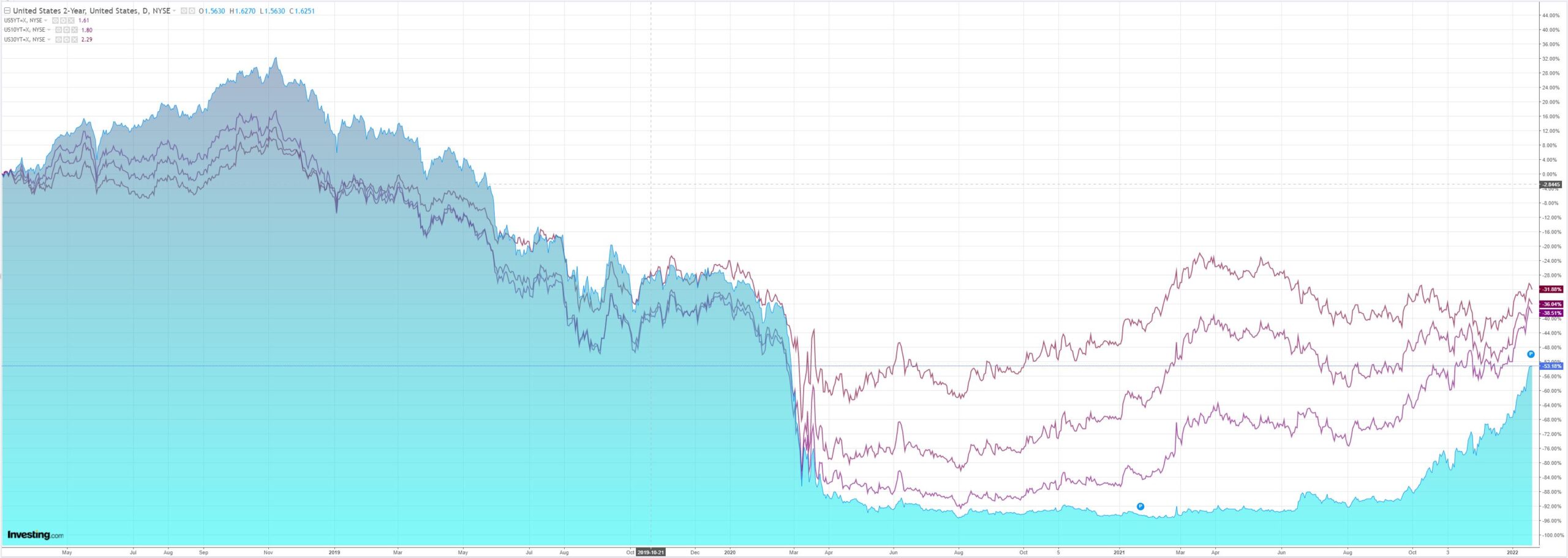

Thanks to an evening of bear flattening:

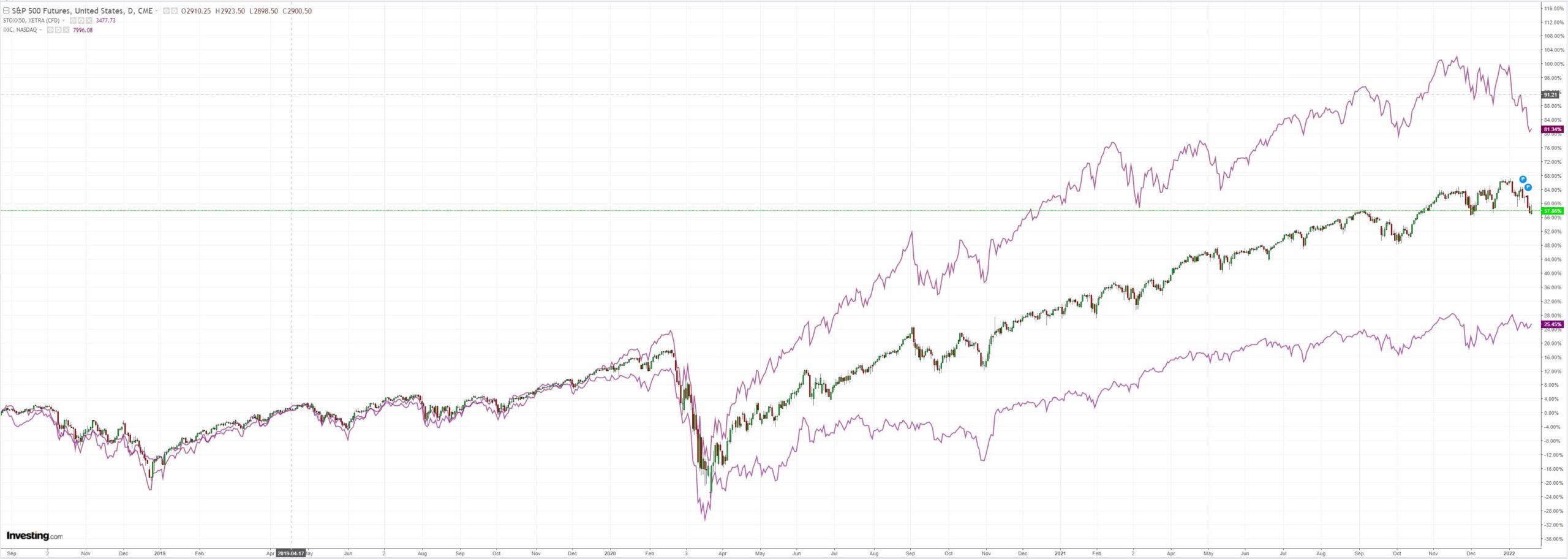

Which cut stocks some slack:

Westpac has the data wrap:

Event Wrap

US existing home sales fell more than expected, -4.6% to 6.180mn in December (est. -0.6%). A lack of inventory was one explanation for the December decline, with only 910k homes on the market – a record low. The Philadelphia Fed manufacturing index bounced 7.8 ticks to 23.2 in January, stronger than the 19.0 forecast. Initial jobless claims rose to 286k in the week ended January 15 (est. 225k) – the highest since mid-October, with covid, the holidays, and seasonals continuing to distort the data.

Norges Bank unanimously decided to keep the policy rate unchanged at 0.5%, saying: “Based on the Committee’s current assessment of the outlook and balance of risks, the policy rate will most likely be raised in March”.

Event Outlook

NZ: December’s manufacturing PMI is expected to remain fairly weak with growth in manufacturing slowing to a near-stall. Meanwhile, November’s net migration should also remain low given the ongoing border closure.

Japan: December’s CPI is expected to remain relatively weak despite global inflationary pressures (market f/c: 0.9%y/y).

Eur/UK: Concerns over omicron are expected weigh on both Euro Area consumer confidence (market f/c: -9.0) and the UK’s GfK consumer sentiment (market f/c: -15).

US: The December leading index should continue to highlight the US’ robust economic momentum heading into 2022 (market f/c: 0.8%).

BMO captures the AUD spirit de jour:

AUD: Although the RBA has been incrementally turning the ship through its removal of various extraordinary policy measures over the past 8 months, it has remained at the dovish end of the G10 central bank spectrum when it comes to rate hikes. Governor Lowe has repeatedly emphasized the point that Australia’s situation is unique because of the low likelihood of a wage-price spiral due to labour market slack. Today’s report by the Labour Force Report written by the Australian Bureau of Statistics (see bullet above) seemed almost drafted to refute that point. So did yesterday’s move by PM Morrison to encourage backpackers and students to come to Australia and help with this year’s harvest and in other service jobs. The interest rate market seems to have priced in at least partial capitulation by the RBA, with roughly 99bps of rate hikes priced in for 2022. However, we would argue that AUD is still priced for an extraordinarily dovish RBA. In our view, AUDUSD on a 72-handle is remarkably low given the trend in commodity prices and Australian interest rates. Even more stunning is AUDJPY in our view. AUDJPY on an 82-handle seems completely off given the RBA rate hikes that are priced in 2022. If it weren’t for the upcoming election, we think the case would be compelling that AUDJPY should rally to at least 86 over the next few months. The May election admittedly complicates the picture, but we still think AUDJPY is a buy on a 1M horizon with a target of around 84.50.”

Maybe. But not if Morrison succeeds in flooding the nation with 200k coolies in five months. That’ll snuff out wage gains overnight.

I still think we’ve got another AUD down leg ahead as the Fed upsets the applecart.