DXY flamed out:

AUD dead cat bounced:

CNY is still nailed to the floor:

Oil broke bigly:

Copper is right at the cliff’s edge:

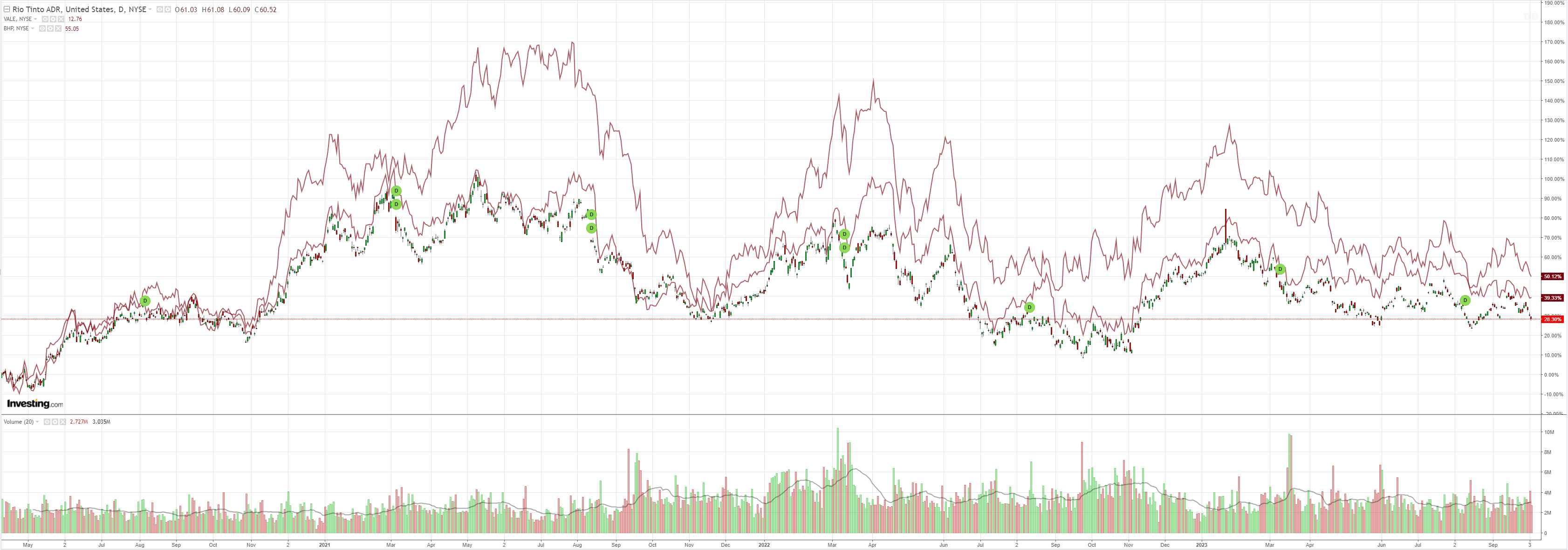

Big miners fell:

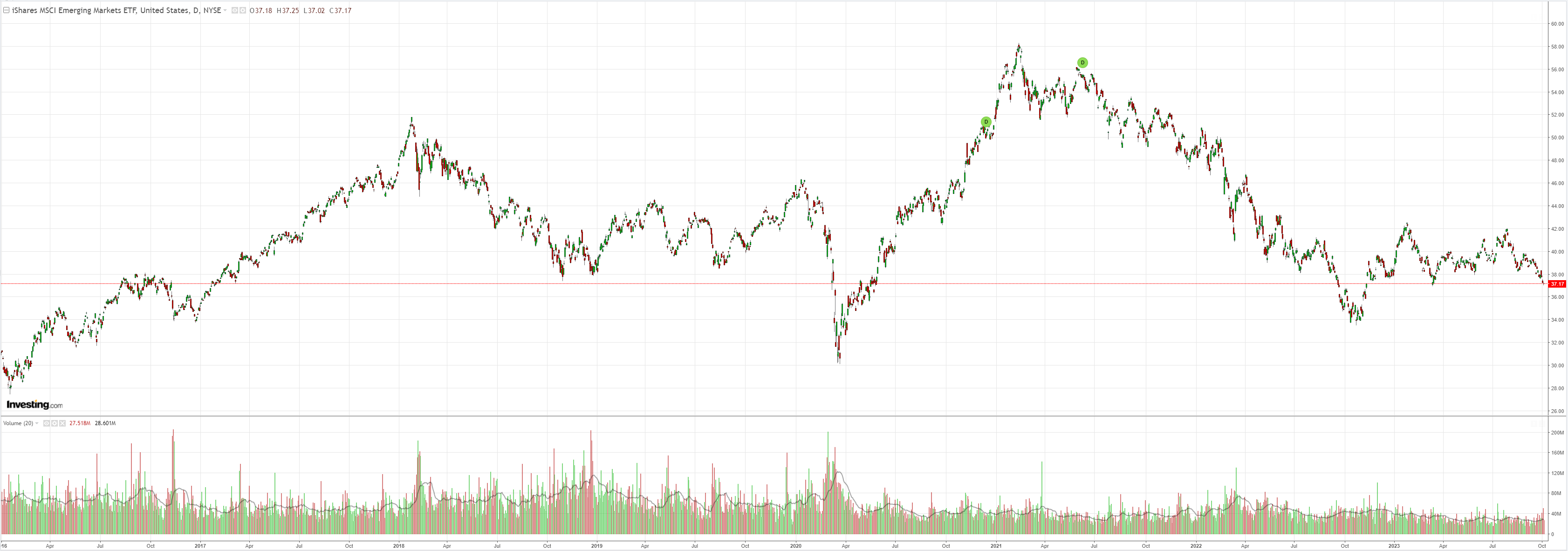

EM too:

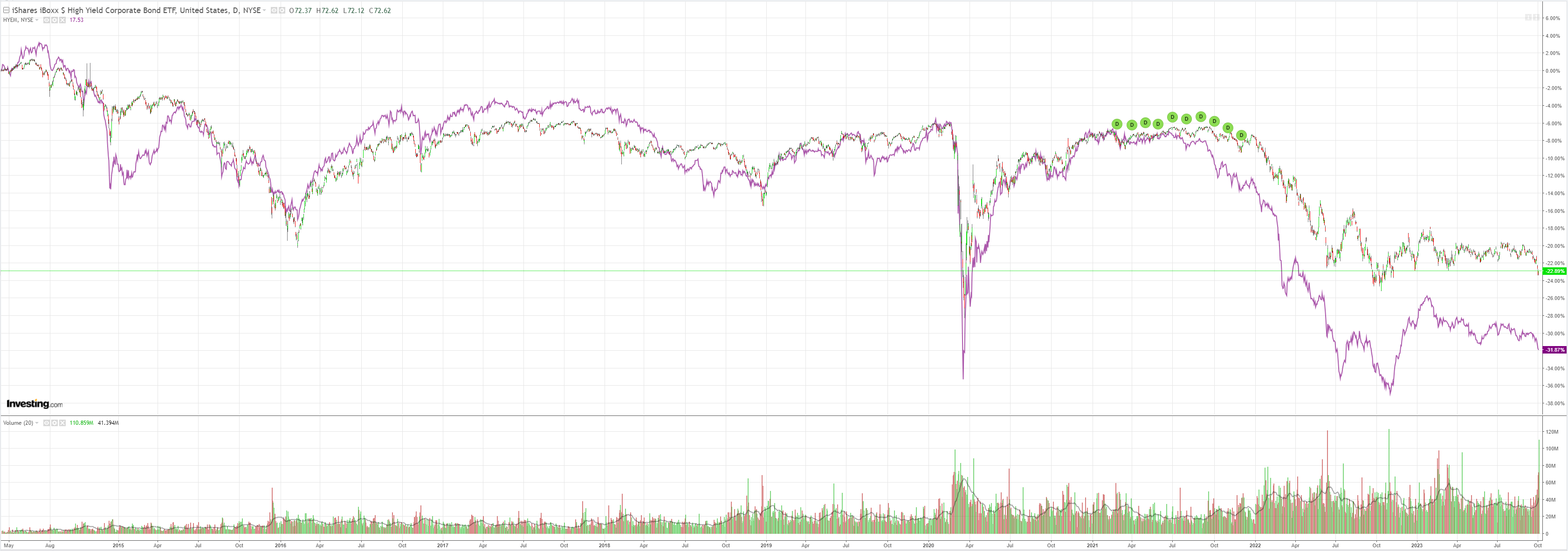

Junk is suspended mid-air:

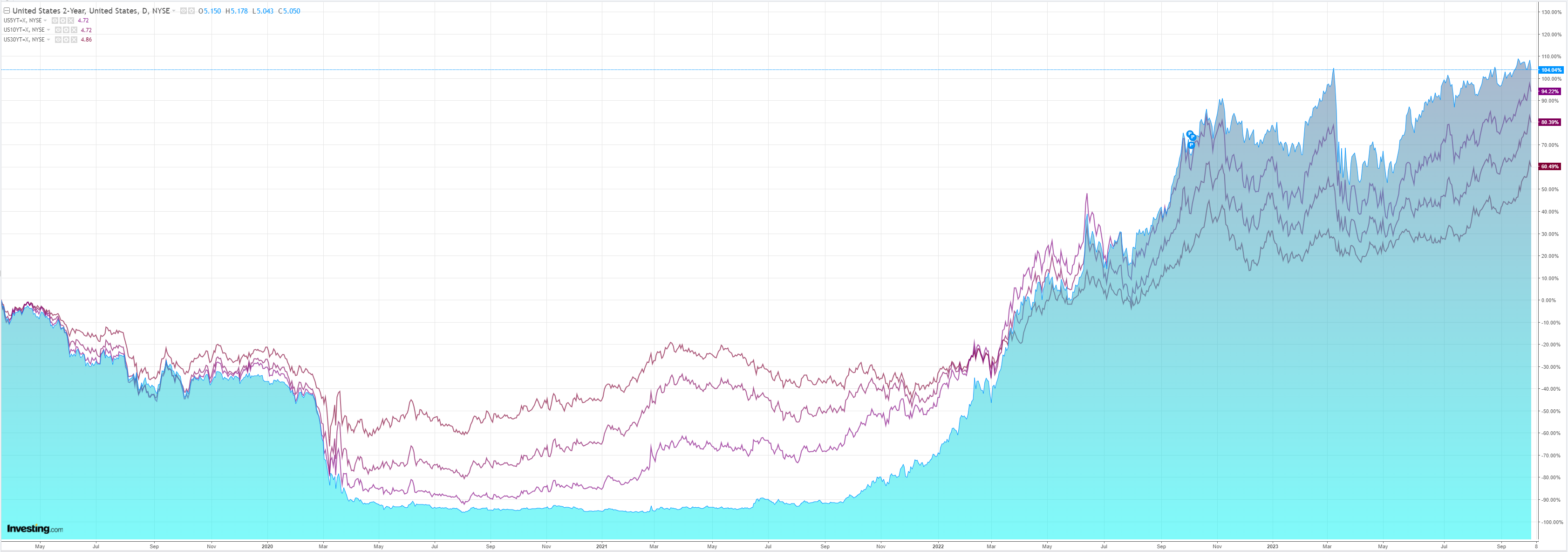

The yield rocket flamed out:

Stocks relief rallied, only guaranteeing more pain ahead:

So, yields moved high enough to break something: oil. I doubt this is enough to bring down inflation.

US data was a mixed bag. Capital goods were strong. ADP (NASDAQ:ADP) was weak. Now, we are moving to the NFP jobs release on Friday. Any relief rally needs a soft print. Anything else, and the yield rocket resumes.

Barclays (LON:BARC) has more:

Bond markets are finally listening to the Fed’s message of higher for longer, which is underpinned by a resilient economy and the return to the old regime of reasonable term premium. We still do not think the sell-off has been excessive and absent negative data surprises, risk sentiment needs to take a turn for much worse.

US Treasury yields rose over the week, led by the long end as the market absorbs the higher for longer message. Figure 1 shows that 10y yields have risen about 10bp since last Thursday’s close (and 50bp since the beginning of the month), and the 2s30s curve steepened by 15bp. However, the bear steepening was not limited to the US, and USTs actually outperformed on a global basis. Figure 1 shows that long end yields have risen more in the UK and Germany. The outperformance is more evident in real yield space, where Bunds sold off the most (Figure 2). We believe markets are coming to the realization that while central banks are near the end of their hiking cycles (perhaps a bit sooner than they should), cuts are far into the future. Rising oil prices are pointing in the same direction.

Risk assets are being adversely impacted; US and European equities have fallen by 1-2pp, CDX IG spreads have widened and VIX has risen to 17 from the recent lows of 13. Not surprisingly, USD has appreciated in this context.

We believe bond markets are returning to the “old regime”, where investors need compensation to take duration risks and the resilience of the economy is questioning long-held assumptions about a low neutral rate. We still do not think the sell-off has been excessive and do not yet see a catalyst for a reversal in the near term. Consensus already expects activity and labor market data to slow sharply and the upcoming payroll report may very well surprise to the upside. A short government shutdown is unlikely to be a material drag on the economy.

Inflows into bond funds are not picking up despite higher yields. Separately, comparisons are being drawn to the late 2018 episode when yields rose sharply after Chair Powell said there was a long way to go to neutral. They peaked not much after and rallied significantly before the end of the year. However, that was likely a result of escalating rhetoric on US-China trade, which significantly dented the global growth outlook. Hence, absent negative data surprises, an exogenous shock is likely needed for a meaningful reversal.

My view is not so sanguine. It is all well and good to wax about the term premium, but DM economies are still heavily indebted, and current interest rates are unsustainable for large portions of it over the long term.

Lots of debt has been termed out but will come due. US credit card rates, mortgage rates, SME business lending rates and sovereign debt rates are paralysing at these levels.

The risk-free rate is a price maker, not a taker, and must come down from current levels. Even it takes yield curve control to do it.

But we are not there yet. Private markets can still get us there, as this week attests.

The yield back-up has now crushed oil and begun to deflate the equity bubble. Is that enough to snuff out inflation? I still think the US needs a hard landing to restore labour market balance and competitive price pressures.

If so, it is still a sell AUD rallies market.