UBS Group AG (SIX:UBSG) agreed to buy Credit Suisse Group AG (SIX:CSGN) in a historic, government-brokered deal aimed at containing a crisis of confidence that had started to spread across global financial markets.

The Swiss bank is paying 3 billion francs ($3.25 billion) for its rival in an all-share deal that includes extensive government guarantees and liquidity provisions. The price is less than half the 7.4 billion francs Credit Suisse was worth at the close of trading on Friday.

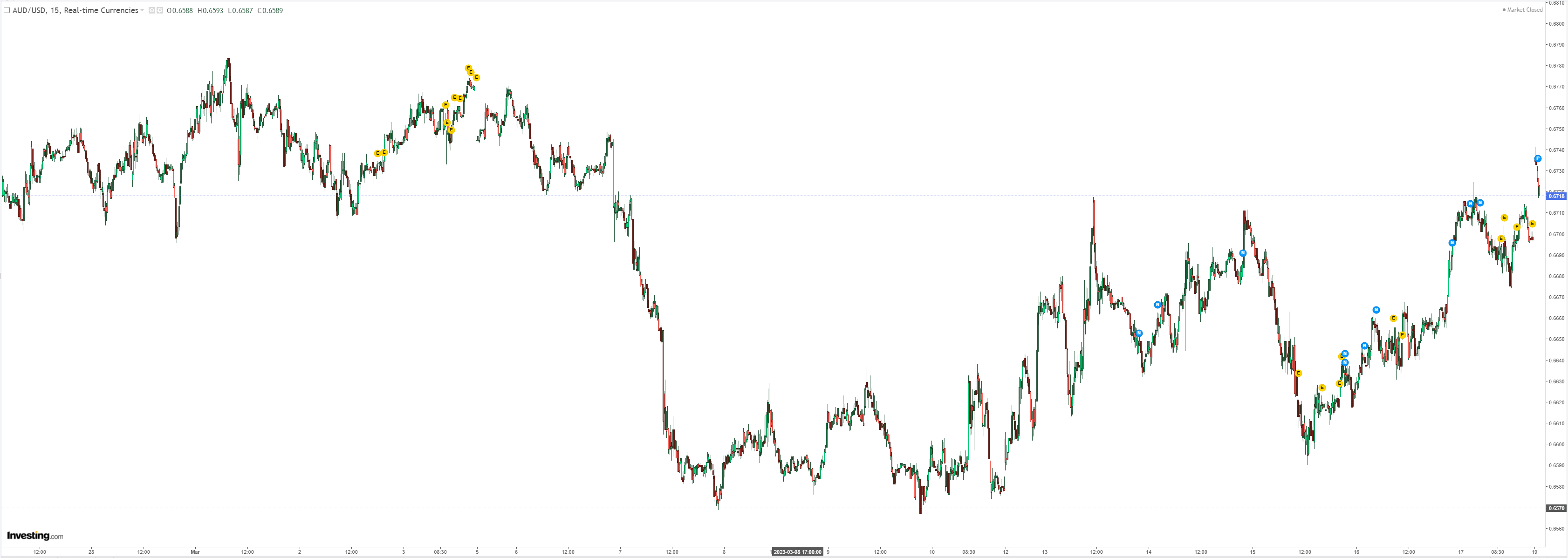

AUD leaped then tanked:

Morgan Stanley (NYSE:MS) is arguing that the persistent bank failures are shifting FX safe haven mode.

Is the USD Moving Into Regime 4?

Financial sector volatility has raised investor questions about the path of monetary policy and the outlook for growth and inflation. A consequence of this heightened focus and volatility is that,according to our banks analysts and economists, bank funding costs may rise, lending standards may tighten,and the monetary policy transmission mechanism may be amplified. See the full article here: USD | Shifting to (Regime) 4th gear?

In FX, this suggests that investors may raise the probability that we will soon be entering Regime 4 of our USD framework. This implies safe haven FX gains (mostnoticeably the USD) versus risk currencies.

Why? Because amplified monetary policy tightening and supplemental drags on economic data come at a time when rapid monetary tightening is already passing through and realized inflation data continues to support central bankers’ arguments that further tightening is needed. A rising probability of ‘over-tightening’ raises the chances of a ‘hard landing’ which likely sees real rates and break-evens both pushing lower, supporting the USD and JPY.

While the USD’s performance and the risks of a hard landing and Regime 4 are likely positively related, the silver lining is that such an outcome is also more likely to decisively tackle inflation. This would enable central banks to return policy to neutral far more quickly than is priced and would kick off a new cycle. This opens us up to a pivot to Regime 1 after the dust settles which sees broad-based USD weakness.

We recommend investors add NZD/USD short positions to hedge for this rising “Regime 4” risk and, in addition to activity and inflation, we will be closely watching bank funding costs and lending standards to gauge how much the transmission mechanism may be amplified.

The next test is this week’s Fed meeting. I expect the bank to pause. But some are going all the way to a cut, such as Nomura.

We expect a 25bp cut and halt of QT at the March FOMC meeting. Policymakers took bold actions over the weekend to safeguard the deposits of two failed banks – SVB Financial Group (NASDAQ:SIVB) and Signature Bank (NASDAQ:SBNY) – and to provide liquidity to banks through the Fed’s new lending facility (the Bank Term Funding Program). In addition, a group of large banks supported First Republic Bank. However, we think significant vulnerabilities remain in the banking sector, stoking market concerns. That was evident with the recent Fed reporting on discount window lending to the US banks, although the usage of the discount window was concentrated in the San Francisco Fed and New York Fed regions.

In the near term, markets are likely to remain volatile due to uncertainties around bank contagion concerns and near-term Fed actions. As we argued recently, deposit flight is a psychological phenomenon and it could be difficult to stem outflows of deposits from small banks led by nimble corporate depositors and rates-sensitive retail bank customers. Even if financial conditions do not change in a non-liner way, ongoing pressures on banks to raise deposit rates and cope with unrealized capital losses on their investment portfolio are likely to significantly constrain bank-lending activities. This supports our view that the US economy is likely to fall into a recession during H2 2023.

Against this backdrop, we expect a 25bp rate cut along with a halt of QT at the March FOMC meeting. The ongoing financial stress in the US banking sector was in large part caused by the rapid pace of rate hikes by the Fed. Halting rate hikes and demonstrating a willingness to use monetary policy to contain financial stability risks may be necessary to restore market confidence in the banking system. Markets appear to believe the Fed maintains a distinction between monetary policy and macroprudential policy. By contrast, we think the line between the two is blurring. While a 25bp rate cut would be unlikely to materially support the banking sector, a rate cut should send two important messages tothe markets: 1) the Fed is ready to use monetary policy to contain financial stability risksand 2) the Fed is entering a phase of fine-tuning its stance on monetary policy.

To cut would send the opposite message to markets: this is an emergency and, I suspect, safe haven buying would accelerate.

Then again, it is an emergency so don’t discount it!