Forex is getting increasingly volatile. DXY is still trading near the top of its range but it couldn’t break out. EUR bounced:

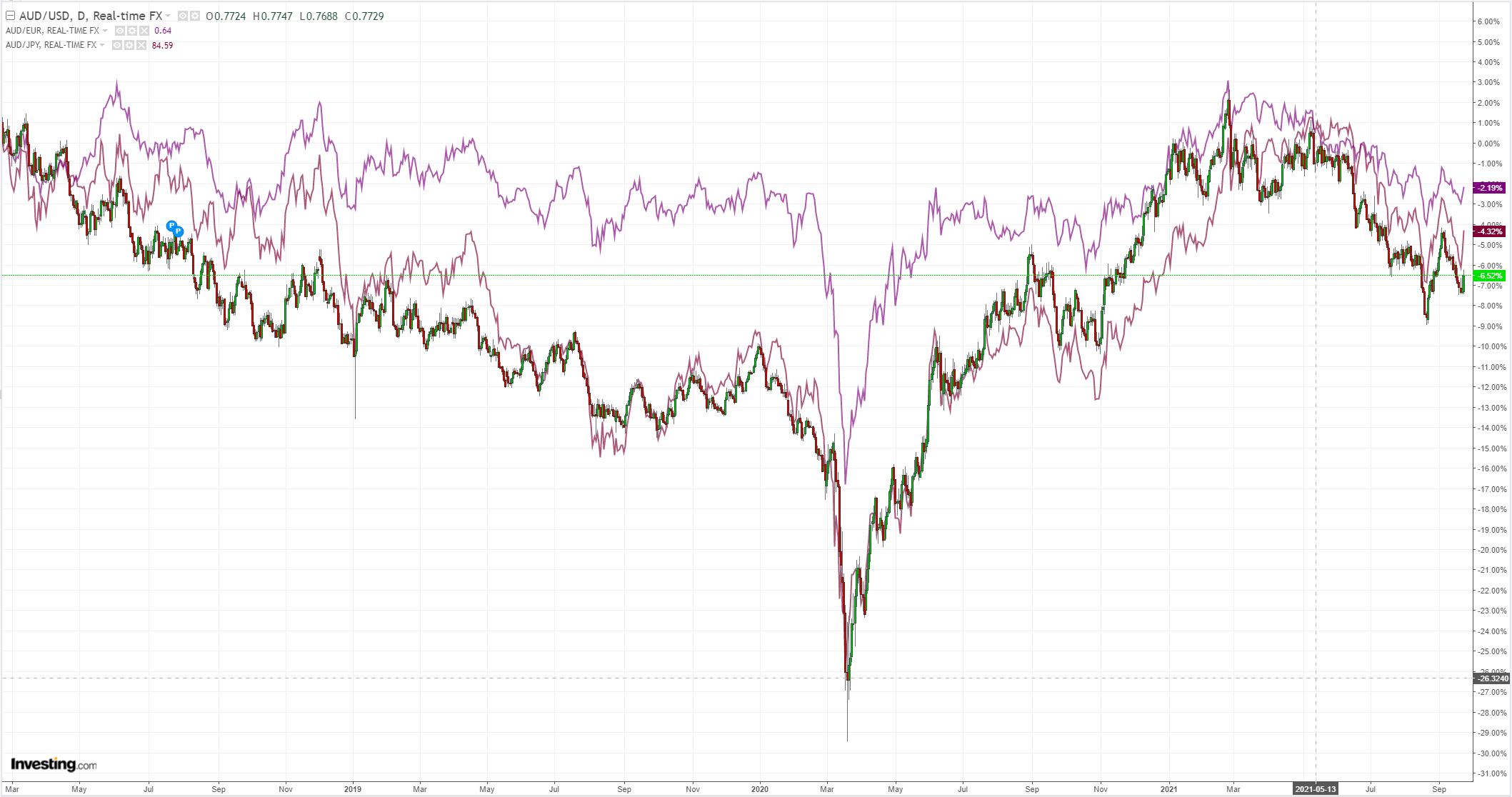

The Australian dollar took off on some easing in Evergrande fears:

The energy shock is getting worse but real yields killed gold:

Base metals did a bit better but copper was held back by fears about Evergrande:

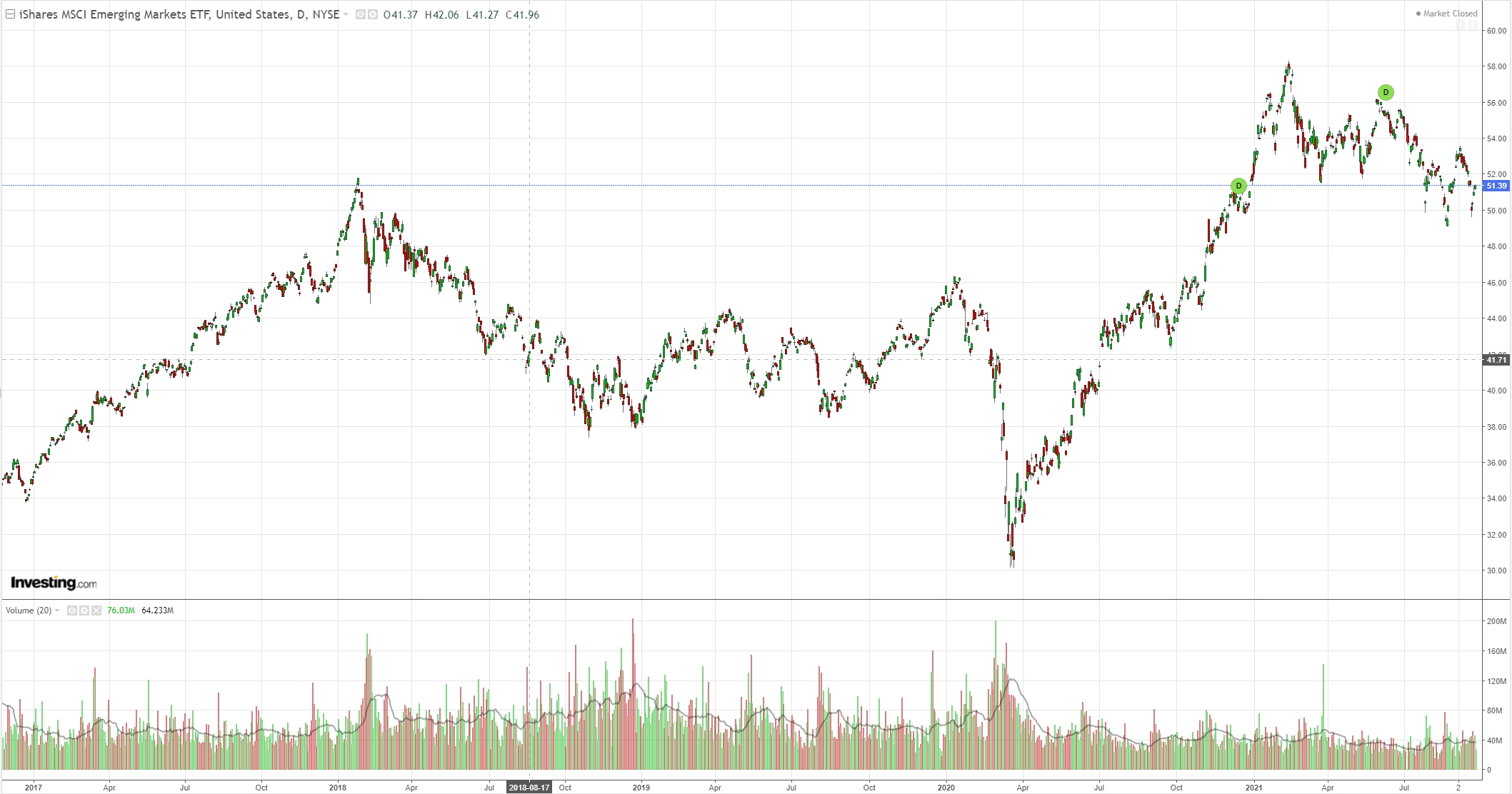

EM stocks lifted but don’t look well:

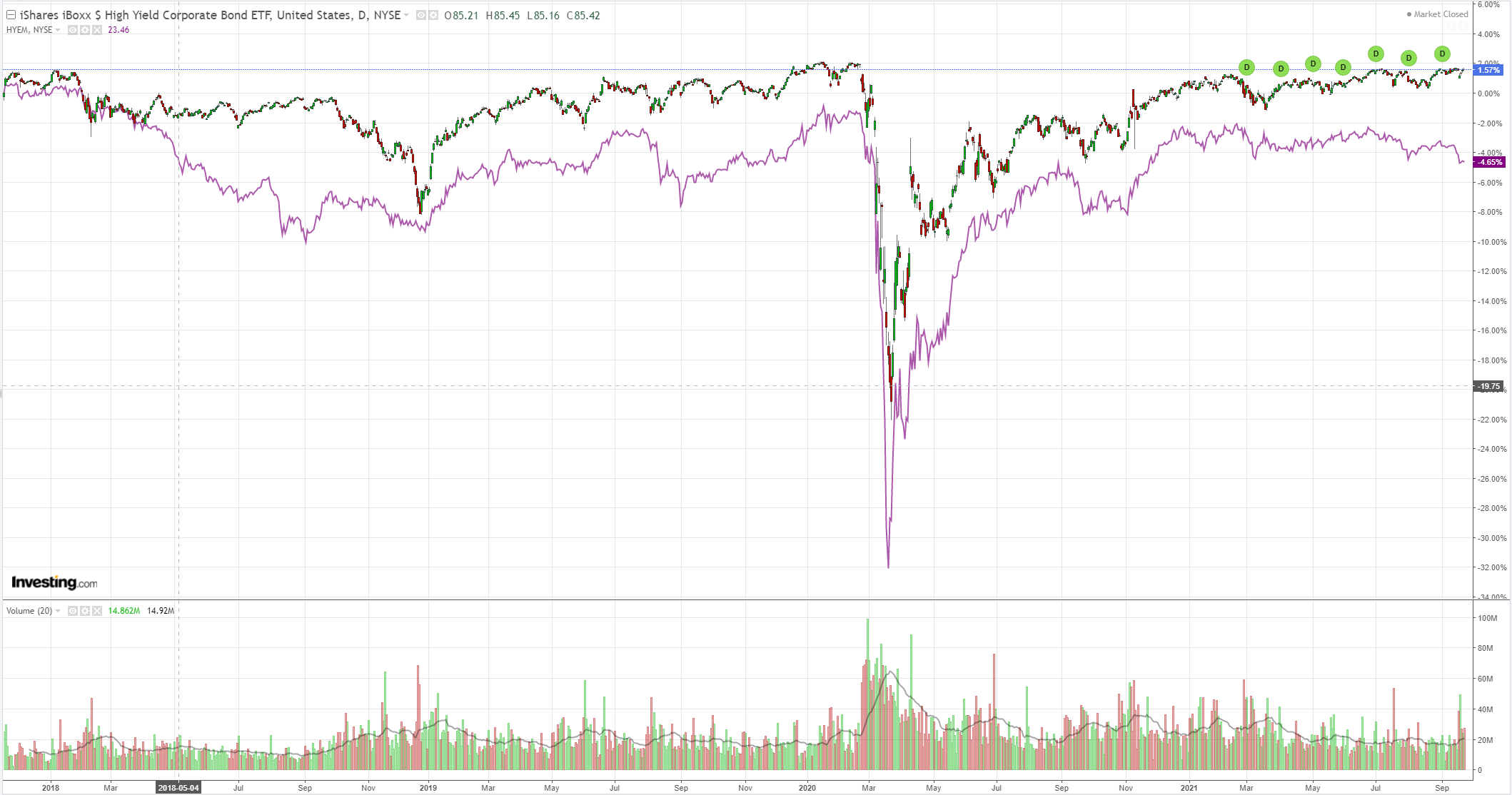

And EM junk is still warning:

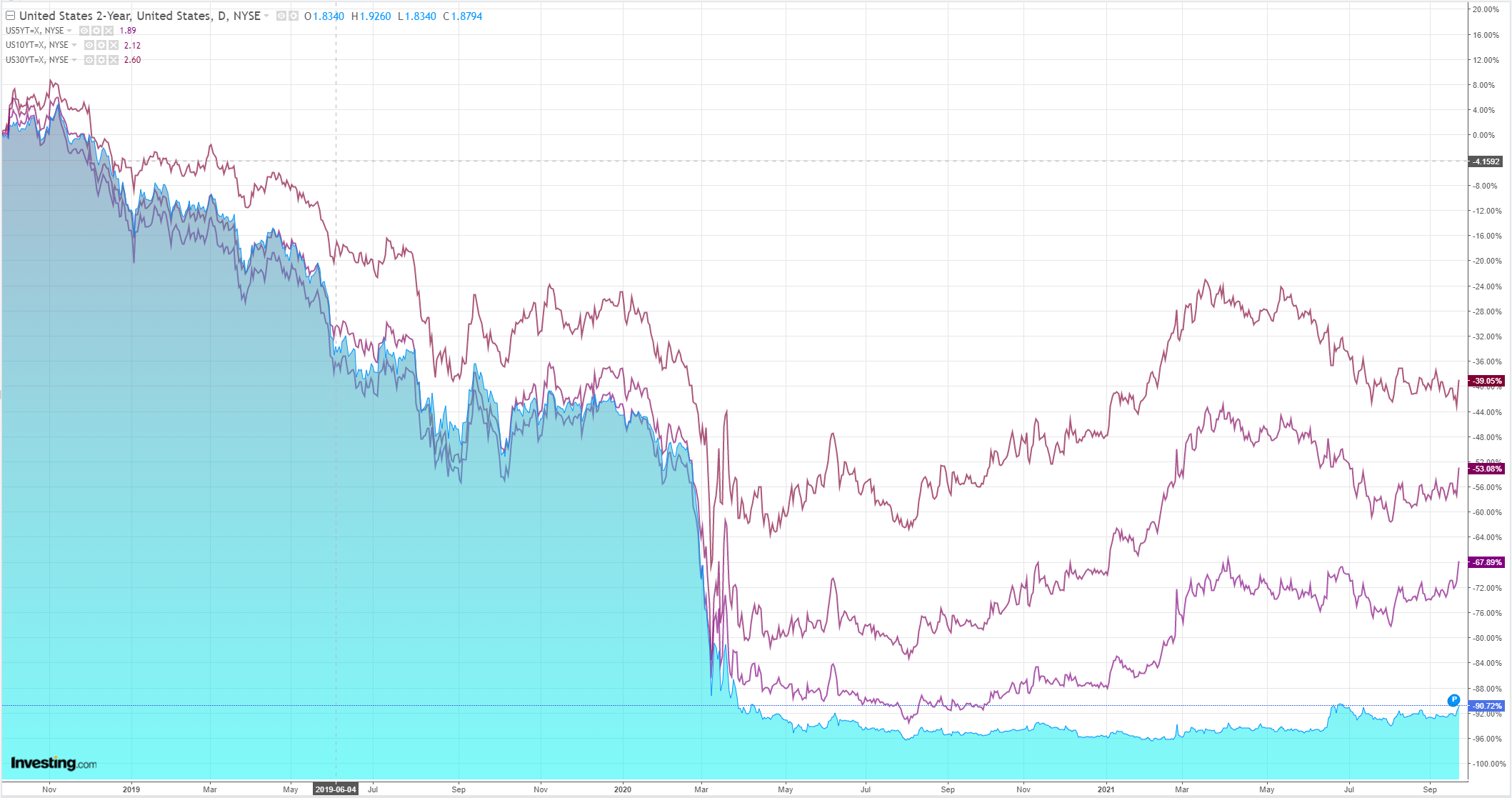

The big move of the night was yields which blasted off, lifting the curve, tracking oil:

Stocks didn’t care:

Westpac has the wrap:

Event Wrap

US weekly initial jobless claims of 351k were slightly above consensus at 320k. Prior was little changed at 335k (from 332k), whilst continuing claims rose to 2.845m (est. 2.600m, prior revised up to 2.714m from 2.665m). Markit PMIs disappointed, reflecting supply and capacity issues hampered production. Manufacturing was still strong at 60.5 (est. 61.0, prior 61.1), while services fell to 54.4 (est. 54.9. prior 55.1). The leading index for August was firm at +0.9% (est. +0.7%, prior +0.8% from initial reading of +0.9%). The Chicago national activity survey for August fell to 0.29 (est. 0.50, prior revised to 0.75 from an initial 0.53). The Kansas Fed manufacturing activity survey disappointed at 22 (est. 25, prior 29), with new orders (7 from 34) and employment (21 from 28) weaker, but prices paid remaining high at 80 (unchanged).

Eurozone manufacturing PMI fell to 58.7 (est. 60.3, prior 61.4), services to 56.3 (est. 58.5, prior 59.0).

UK manufacturing PMI fell to 56.3 (est. 59.0, prior 60.3), services holding at 54.6 (est. 55.0, prior 55.0).

The Bank of England MPC left policy rates and QE (APP) unchanged as was widely expected. The vote to hold policy rates was unanimous, but the APP vote was 7-2 with dissenters looking for an immediate end to the purchasing, rather than the end of 2021.

The minutes highlighted a higher profile for inflation into Q2 2022, with concerns over transitory inflation pressures potentially becoming more persistent. There were discussions of inflationary pressures, labour and supply shortages, higher wage settlements, and cost pass through.Norway’s central bank, Norges Bank, raised its policy rate from 0.0% to 0.25%, as was expected, and maintained its bias to gradually normalise policy, with the next rate rise expected in December.

Switzerland’s central bank, SNB, kept policy settings unchanged (benchmark rate -0.75%) and continued to stress their willingness to intervene to address CHF strength, with CHF still seen as above fair value.

Event Outlook

New Zealand: Westpac is forecasting the trade deficit to widen to $2150m in August as imports post another bumper month.

Japan: Deflationary pressures are expected to persist for the CPI despite upstream price gains (market f/c: -0.3%yr). Further, the manufacturing and services PMIs for September will be released.

Germany: The September IFO business climate survey will provide a timely guide on business sentiment (market f/c: 99.0).

UK: Re-opening momentum should support sentiment in September’s GfK consumer sentiment release.

US: New home sales for August are expected to stabilise after a large fall through 1H 2021 (market f/c 0.6%). The FOMC’s Mester, George and Williams will discuss the economic outlook. Further, Chair Powell and the FOMC’s Clarida and Bowman will host Fed listen events.

The data is weakening but nobody cared last night. It was a whack combination of Evergrande relief and oil blast off that sent risk bonkers with yields.

Chinese property is still deep in the fog so that’s pure speculation. I still say that the energy shortage is short-term but there is no doubt that a cold northern winter will deliver a serious blowoff.

Why the market is so excited by this prospect is not apparent. It will drive yields higher with Fed expectations, push DXY up, and hit growth as Chinese property development tumbles. Hardly bullish.

We’re shifting into some rarified irrationality now and the AUD is just a cork on the ocean of it.