DXY is back:

AUD puke:

The peg:

Oil is in trouble:

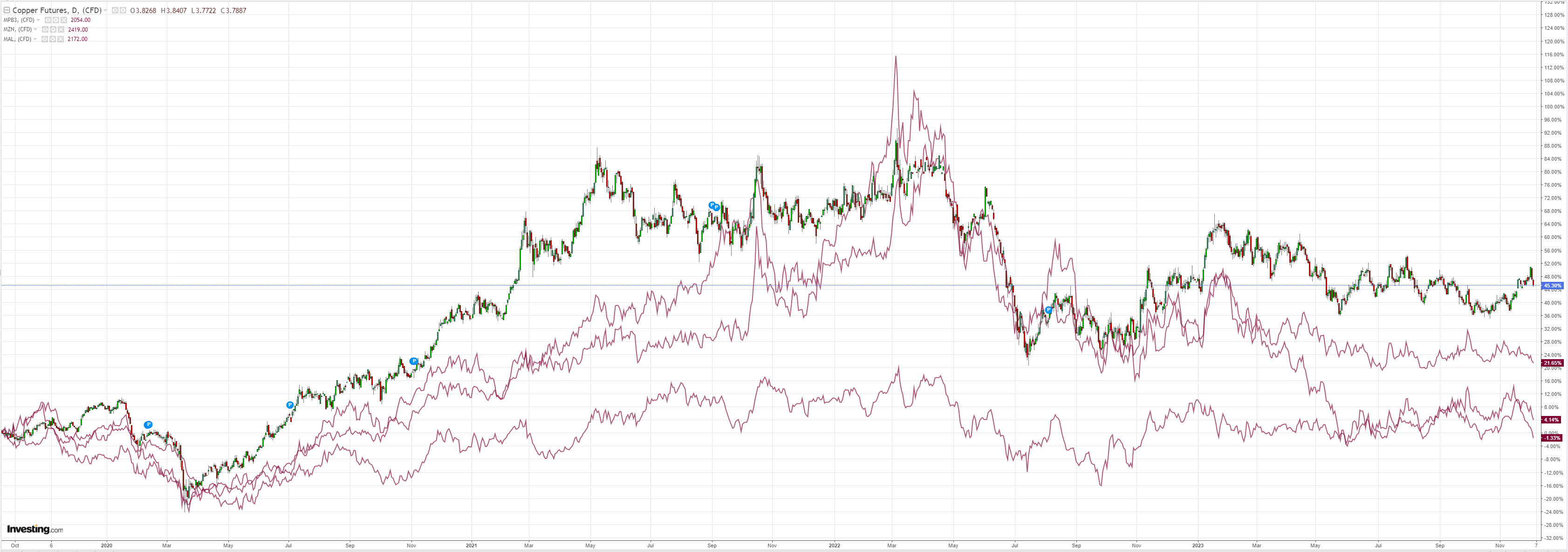

Dirt gave up:

Miners too:

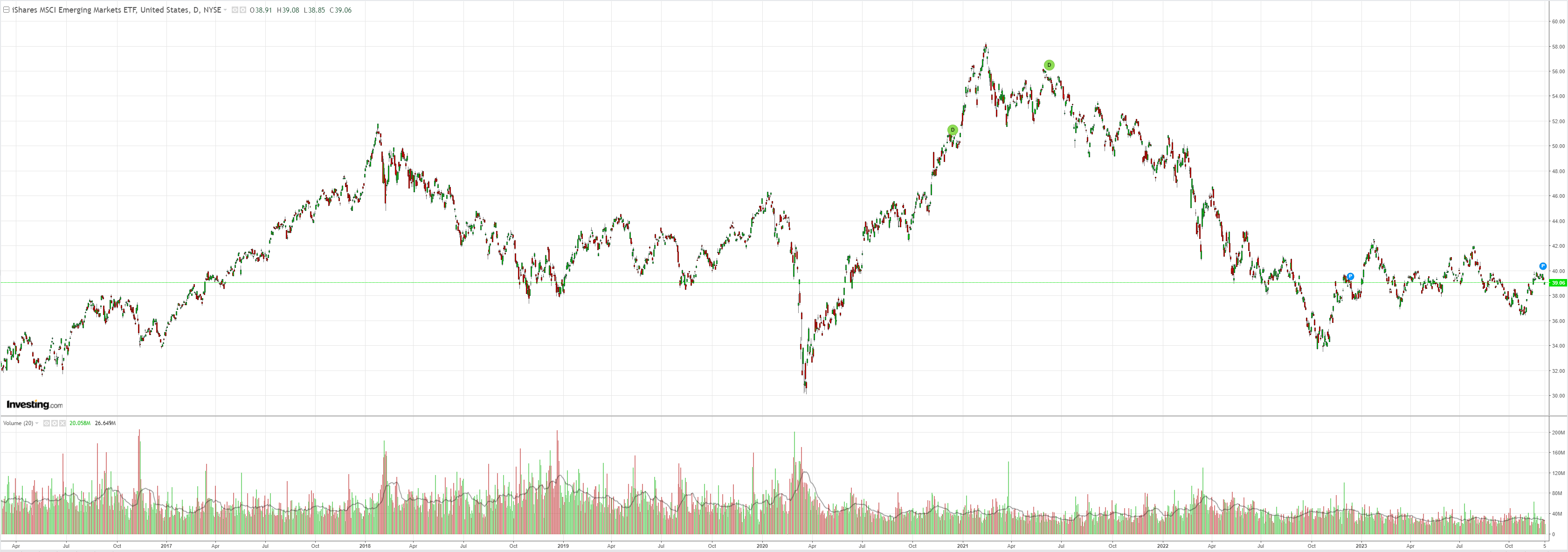

EM dead:

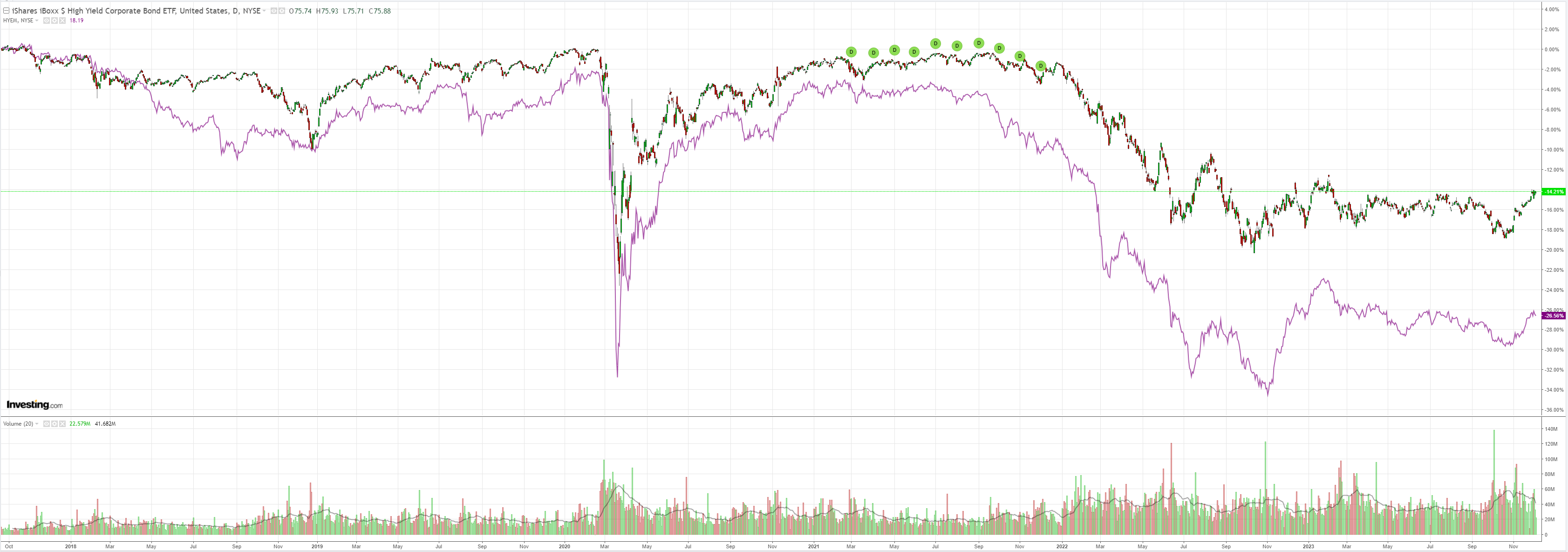

Junk pause:

Bonds are hot, hot, hot:

Stocks are not, not, not:

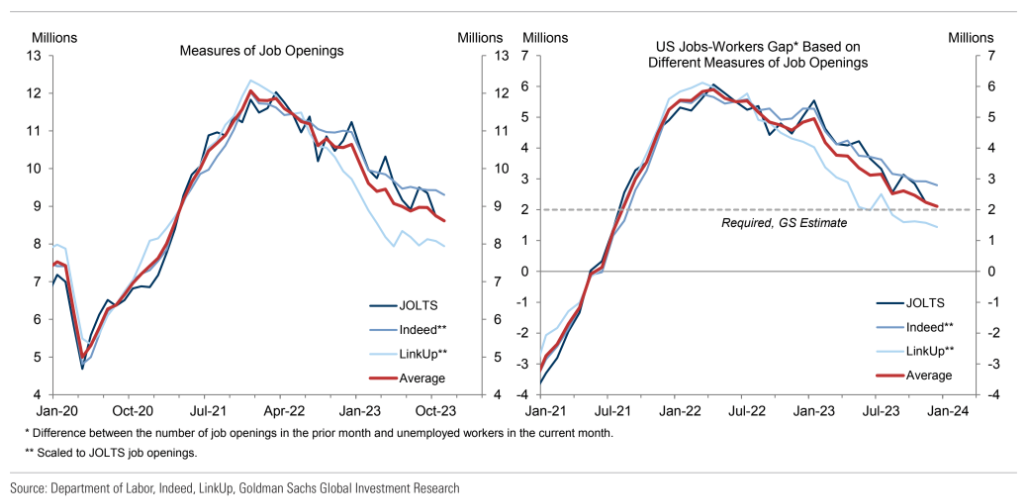

More weak US data delivered the Treasury heat. Goldman:

Job openings decreased by 617k to 8,733k in October (vs. a downwardly revised 9,350k in September), below expectations for a more modest decline. We have previously noted that JOLTS’s low response rate has likely contributed to the series’ outsized month-to-month volatility and larger-than-usual revisions, but alternative measures of job openings corroborate the October decline and have fallen further since. After incorporating today’s JOLTS data, our jobs-workers gap based on the JOLTS, Indeed, and LinkUp measures of job openings stands at roughly 2mn workers—in line with the level we estimate is necessary to rebalance the labor market and return inflation to 2% on a sustainable basis. The job openings rate decreased by three tenths to 5.3% and the hiring rate decreased by one tenth to 3.7%. The quits rate was unchanged at 2.3% and the layoff rate was unchanged at 1.0%.

I guess the falls in DXY are paused as the market digests how hard the US landing will be.

I think it will be harder than the market has priced, so I see AUD as bottomed out.

How hard the US lands will determine how fast AUD rises.