DXY eased up overnight but EUR kept falling:

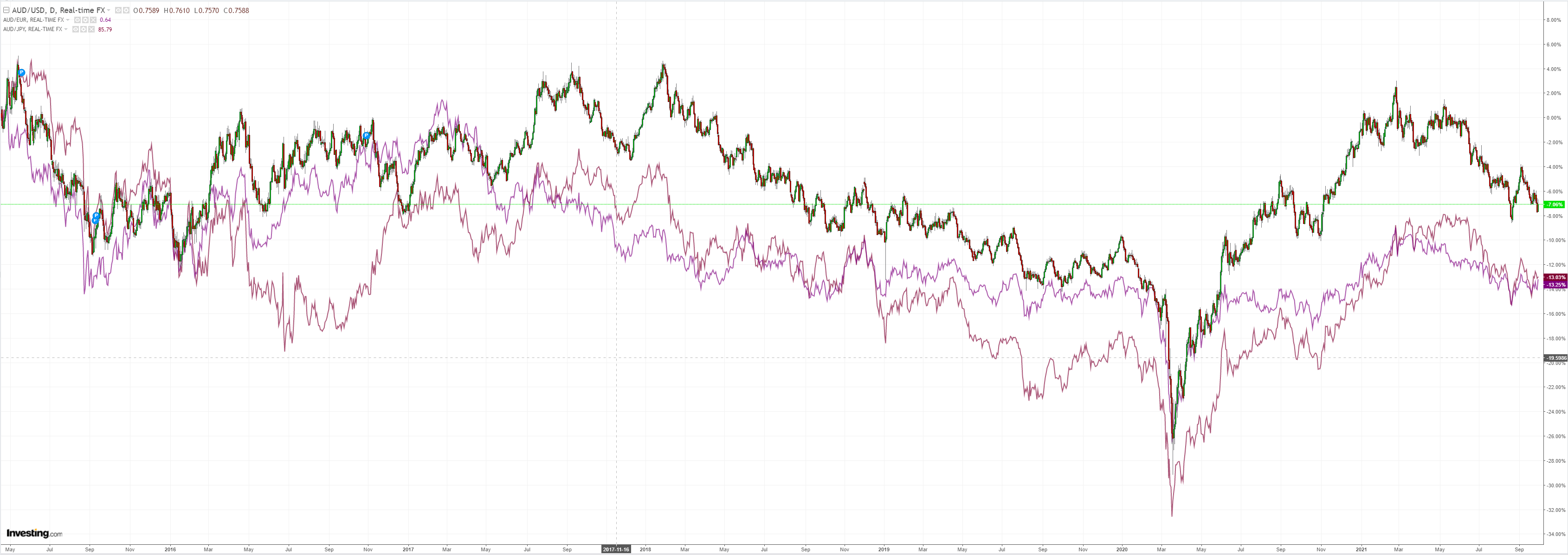

The Australian dollar rebounded:

So did oil and gold:

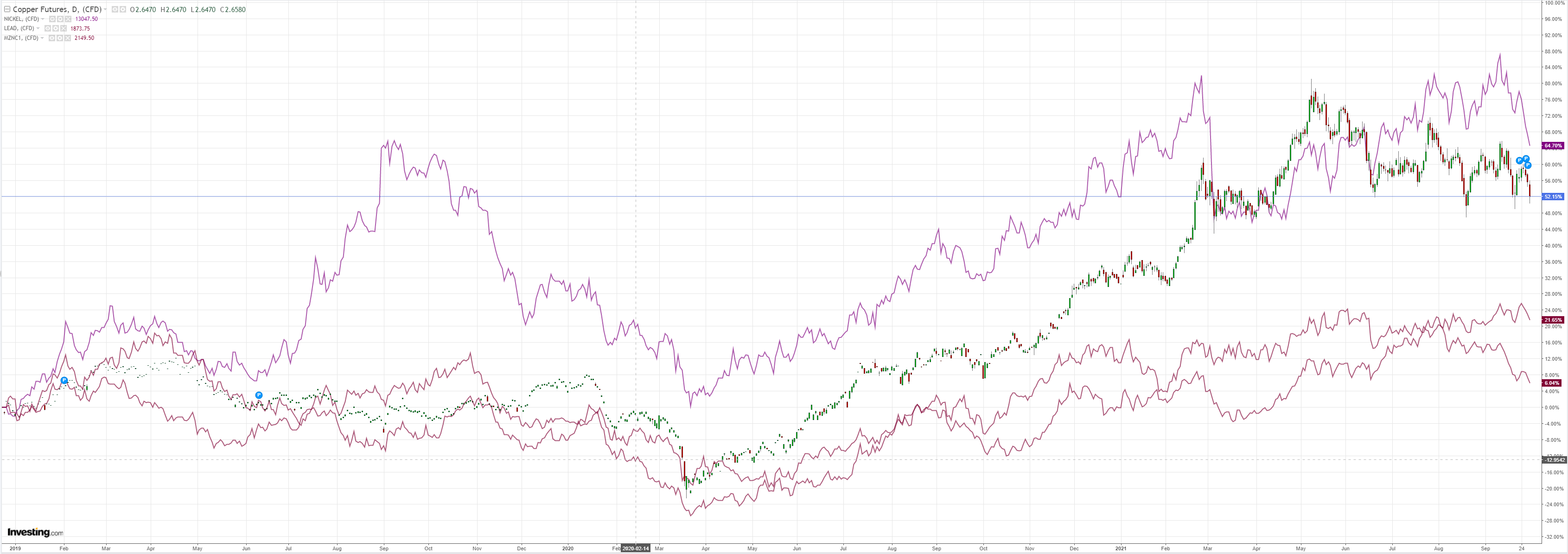

But base metals are in trouble as Chinese growth sinks:

Big miners lifted with iron ore:

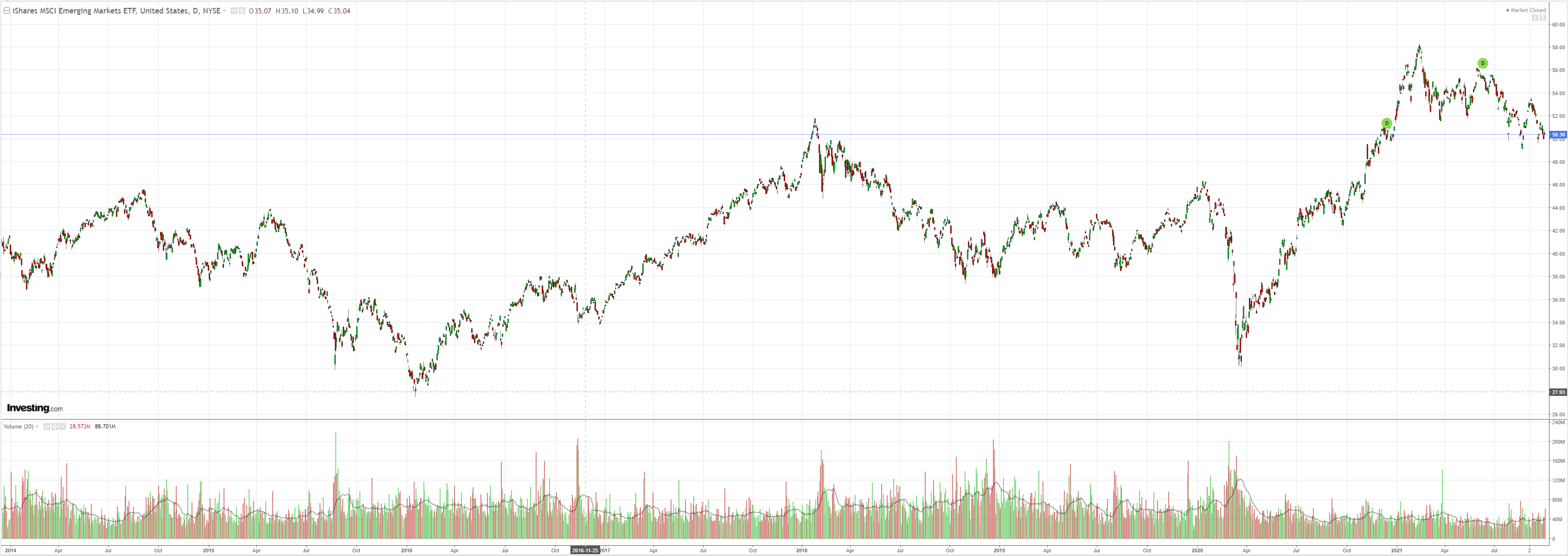

EM stocks held on:

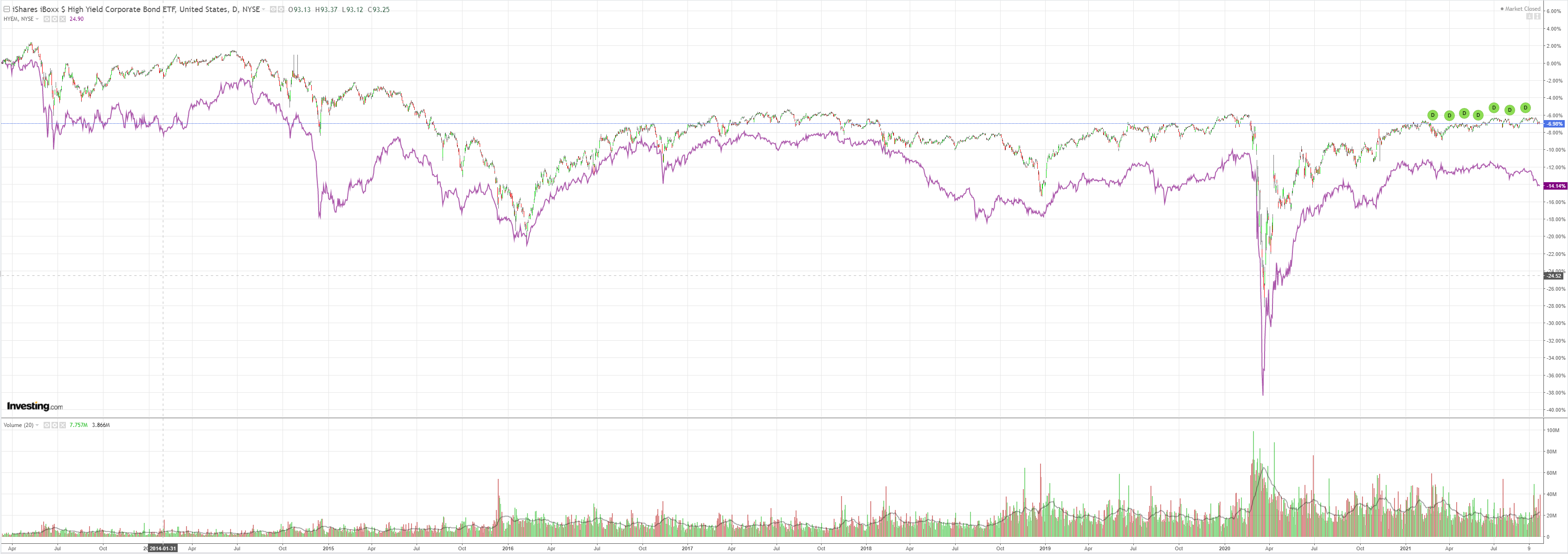

But the EM junk siren is still blaring:

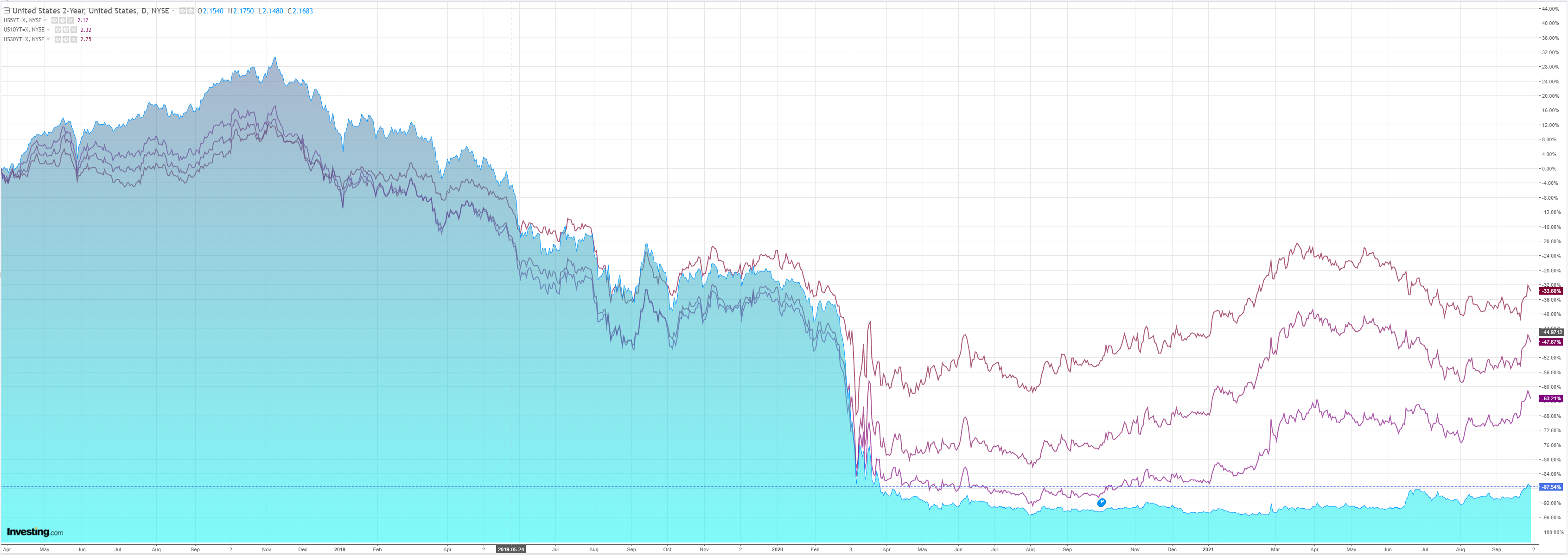

US yields rolled:

Following stocks lower:

Westpac has the wrap:

Event Wrap

The US Congress passed a stopgap spending bill in the House by 254 to 175 votes that will extend Government funding through to December 3.

US final/third take on 2Q GDP was little changed at +6.7% annualised q/q from a prior +6.6% with both headline and core and PCE unchanged at 6.1%q/q.

US jobless claims were slightly above estimates, with little impact: Initial claims 362k (est. 330k) and continuing claims 2.8mn (est. 2.79mn).

US Sept. Chicago MNI continued to pullback from its very high levels and slipped to a still strong 64.7 (est. 65.0) as order backlogs and new orders featured as pullback drivers. Employment improved despite continuing concerns over skilled labour shortages.

Eurozone August unemployment at 7.5% was in line with expectations (prior 7.6%)

German Sept. CPI rose above 4% since the early 1990’s. Both headline and HICP hit 4.1%y/y (est. 4.2%y/y and 4.0%y/y respectively) and were overall in line with estimates. Although the rise is partly due to base effects and shifts in Govt. policy, both aspects that will keep the y/y level high into 2022, the base effect issues are also likely to lift Eurozone CPI (released tomorrow) which is expected to push to 3.3%y/y on headline and core could threaten 2%y/y.

UK final 2Q GDP lifted to +5.5%q/q from initial +4.8%y/y, aided by Govt spending, a tighter deficit and firmer business investment.

Event Outlook

Australia: Westpac is forecasting a 1.4% rise in September in the CoreLogic home value index despite ongoing delta lockdowns. For August housing finance, Westpac is forecasting a decline of 3.0% as lockdowns impede housing turnover.

New Zealand: The September ANZ consumer confidence index should show Covid restrictions weighing on sentiment.

Euro Area: Rising energy and household goods costs are supporting a temporary surge in CPI inflation (market f/c 3.3%yr).

US: Pandemic relief programs have provided an income boost that is now fading, with personal income in August expected to rise a modest 0.2%. A rotation to services should meanwhile be apparent in August personal spending (market f/c: 0.6%). Energy will be a factor for the PCE deflator, but the core PCE deflator will be benign (market f/c: 0.2%). Further, robust housing demand should lift August construction spending (market f/c: 0.3%). Finally, FOMC’s Harker will discuss the economic outlook, whilst FOMC’s Mester will speak on inflation and employment.

The Australian dollar is a cork in the ocean of titanic swells emanating from the China recession, slowing US growth and global energy shock.

It is getting support from runaway energy prices while the rising risk-off environment centered on China is sucking it down.

I still think that the Fed will persist with taper, more or less alone of the major CBs, because US inflation is so much stronger than elsewhere, so DXY should remain strong.

The path of least resistance for AUD is therefore still lower.