It would probably be more accurate to say that the DXY rocket is taking a breather:

CNY bounced:

The rest writes itself. AUD, commodities and (NYSE:EEM) up:

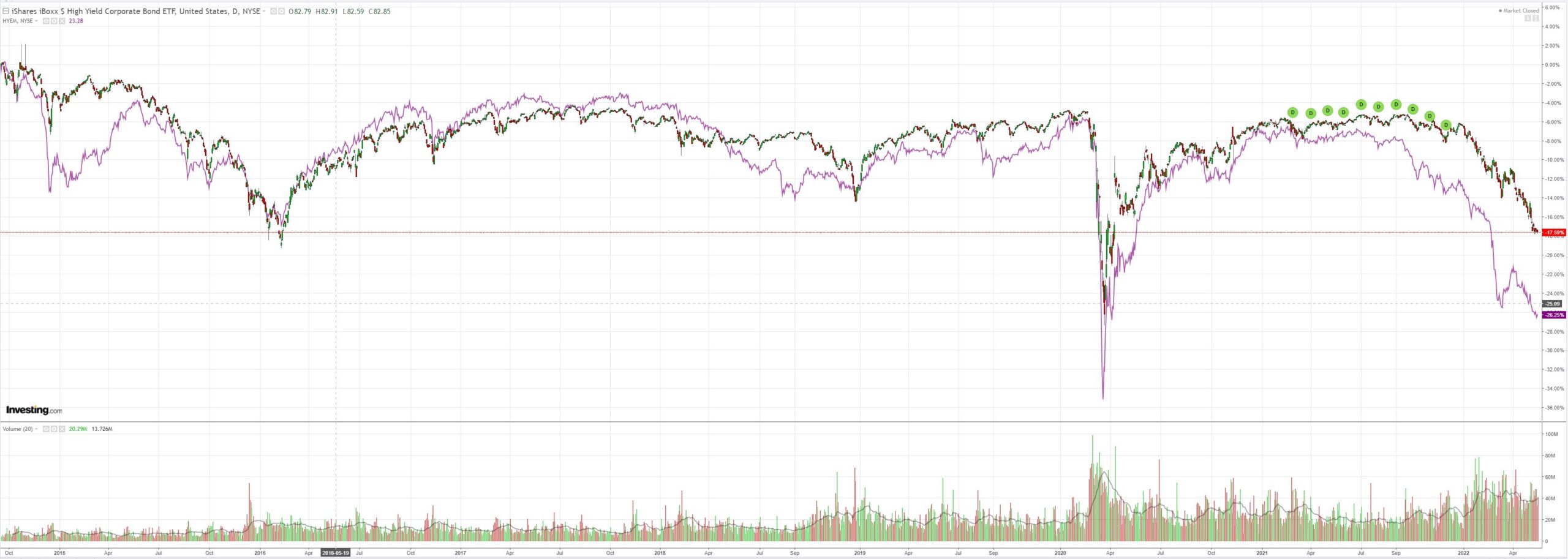

But credit (NYSE:HYG) is lagging, a bad sign:

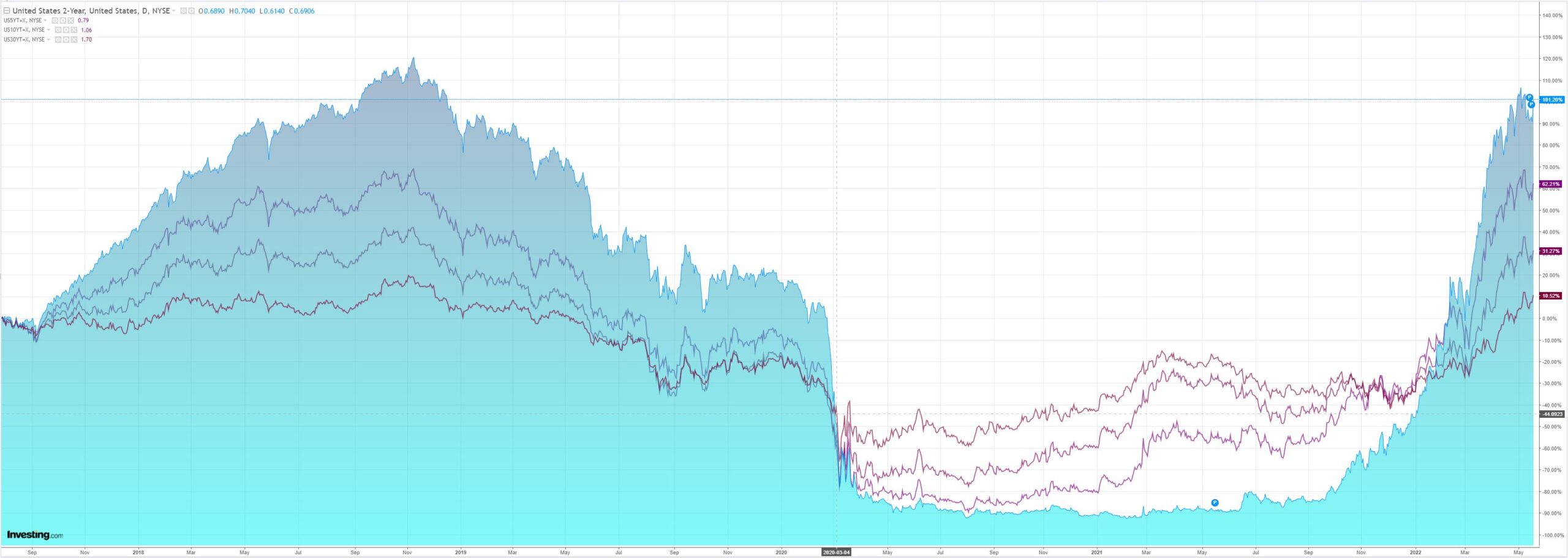

As yields leap:

Stocks took off anyway:

Westpac has the wrap:

Event Wrap

US retail sales in April rose 0.9%m/m (estimate +1.0%m/m), the data showing underlying strength, with core (control group) sales rising 1.0%m/m (est. +0.7%m/m) and upward revisions to March (headline sales revised to +1.4%m/m from initial +0.5%m/m, control group revised to +1.1%m/m from initial -0.1%m/m). Industrial production was also firm, headline production up 1.1%m/m (est. +0.5%m/m) and manufacturing up 0.8%m/m (est. +0.4%m/m) Capacity utilisation rose to 79.0% from prior 78.2% (est. 78.6%). NAHB homebuilder sentiment survey fell more than expected to 69.0 (est. 75.0, prior 77.0) – the lowest level since mid-2020, citing mortgage rate increases and high material costs and labour constraints. However, the levels remain historically high.

Fed Chair Powell emphasised that the FOMC is focused on bringing inflation back to the 2% goal, and no one should doubt the Committee’s resolve. To bring down price pressures, the Fed will have to slow down growth from the robust pace in 2021, and there could be some “pain involved,” he acknowledged. He also cautioned that the landing could be “a little bit bumpy.” But the markets are functioning well and has been processing the FOMC’s message quite well. If the economy performs as expected, 50bp hikes remain on the table. He does see upside wage inflation risks, and he reiterated that the FOMC needs “to see inflation coming down in a clear and convincing way and we’re going to keep pushing until we see that. If that involves moving past broadly understood levels of neutral we won’t hesitate at all to do that.”

FOMC member Bullard said that the Fed still needs to act given the underlying strength in the US economy and labour market. However, he said that the Fed was in a good place to act and that its policy was already being priced into markets. Kashkari underscored his less hawkish bias by saying that supply side changes could reduce the need for Fed to act, while acknowledging that it does need to move to neutral in order to stem inflation.

Eurozone Q1 GDP was revised slightly higher to +0.3%q/q from an initial reading of +0.2%q/q.

UK unemployment in March fell to 3.7% (est. unch. at 3.8%) and employment rose +83k (est. +4k).

ECB’s Knot was more hawkish than usual in his comments about inflationary pressures and the potential that the ECB might need to use larger than 25bps hikes if the data continued to show rising inflation.

Event Outlook

Aust: Despite softer reads across several components, the Westpac-MI Leading Index’s six-month annualised measure should still benefit from the post-delta rebound in April. The tightening labour market should facilitate a solid lift in the wage price index for Q1 (Westpac f/c: 0.8%).

NZ: Dairy prices are expected to fall at the upcoming GlobalDairyTrade auction given the weakness in Chinese demand (Westpac f/c: 2.0%).

Japan: The omicron outbreak and associated hit to consumption is anticipated to weigh heavily on GDP growth in Q1 (market f/c: -0.4%). Meanwhile, supply issues will continue to be a headwind to industrial production in March.

Eur/UK: Elevated energy prices are expected to continue driving consumer inflation in both Europe and the UK in April (market f/c: 0.6% and 2.6% respectively).

US: Strength in the labour market and limited supply should continue to support housing starts and building permits into the medium term (market f/c: -1.9% and -2.7% respectively). The FOMC’s Evans and Harker are due to speak at different events.

Nothing changed for me. Risk markets were oversold and now we get the rebound.

China may be beginning its reopening but so what? Until it rolls out mRNA it will still be in permanent lockdown. Property is in a debt-deflation doom loop. CNY has not finished its falls or I’m Chinese. Energy prices are still going up in Europe, made worse by the bear market rally. And the Fed is being given every reason to keep tightening with each tick higher in the bourses.

Given how oversold we are this might normally be a sizeable bear market rally. But the “Fed call” is a concrete ceiling so I’m not overly confident of even that.

AUD to follow the broader risk trends as usual.