DXY toyed with falls last night:

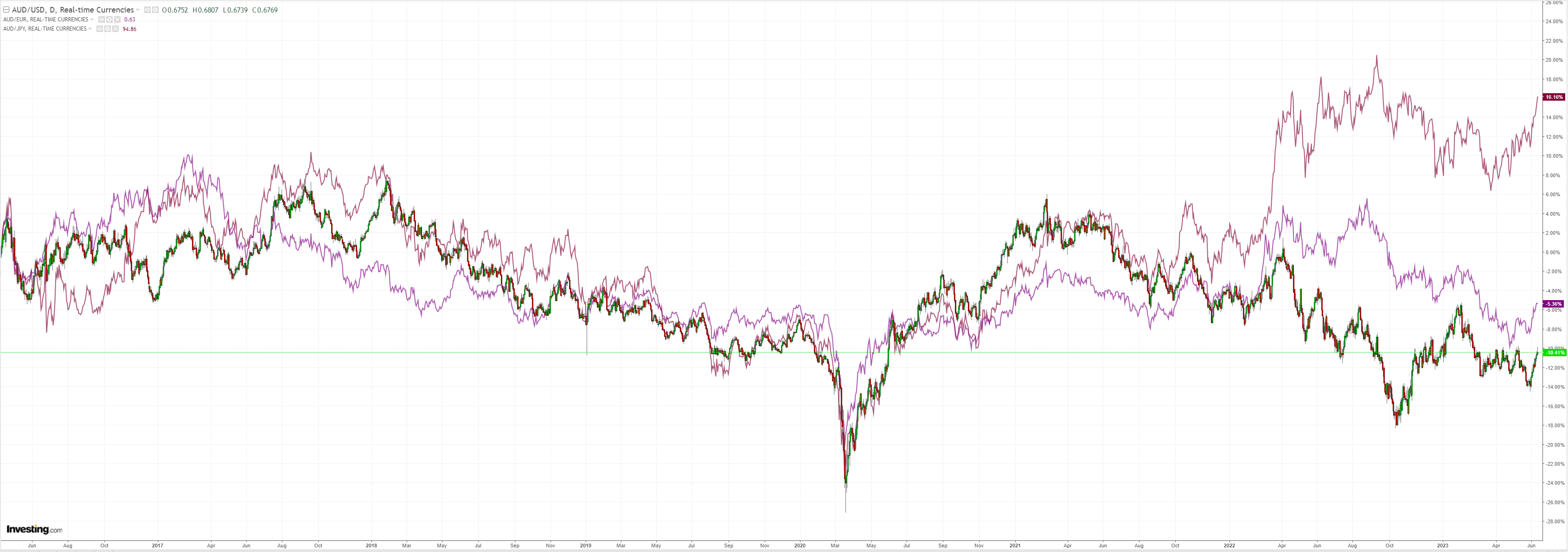

AUD whoa on the crosses:

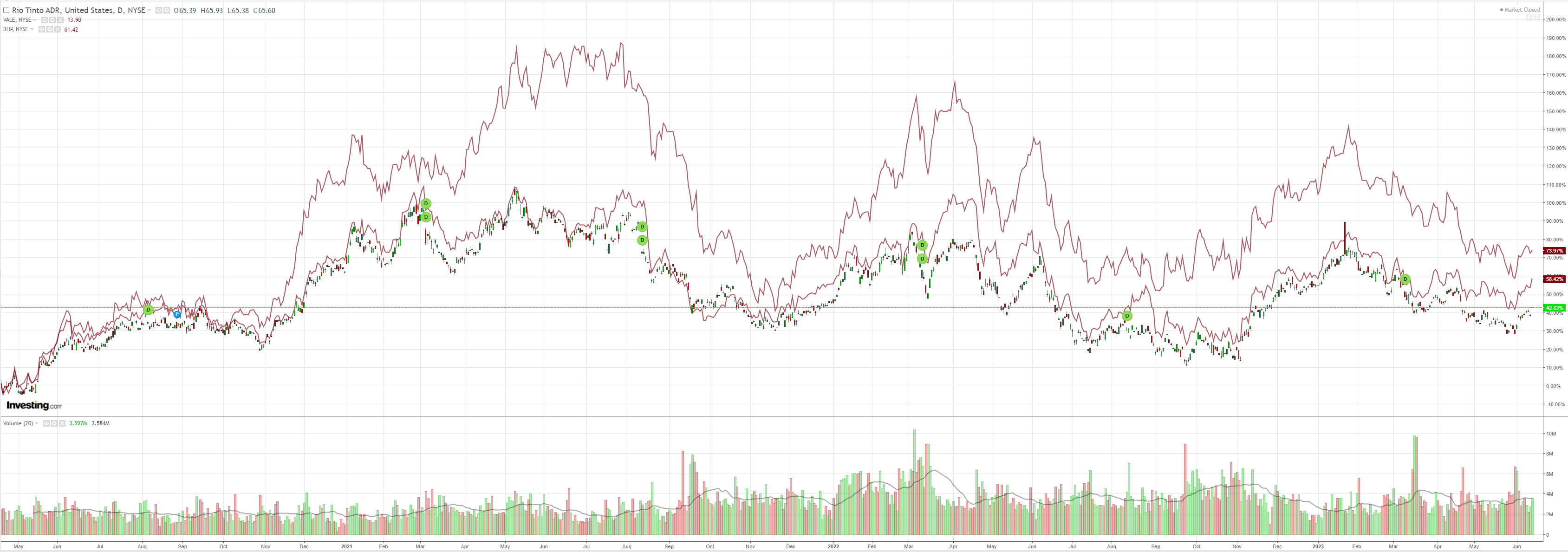

Dirt bounced:

Big miners (NYSE:RIO) flew:

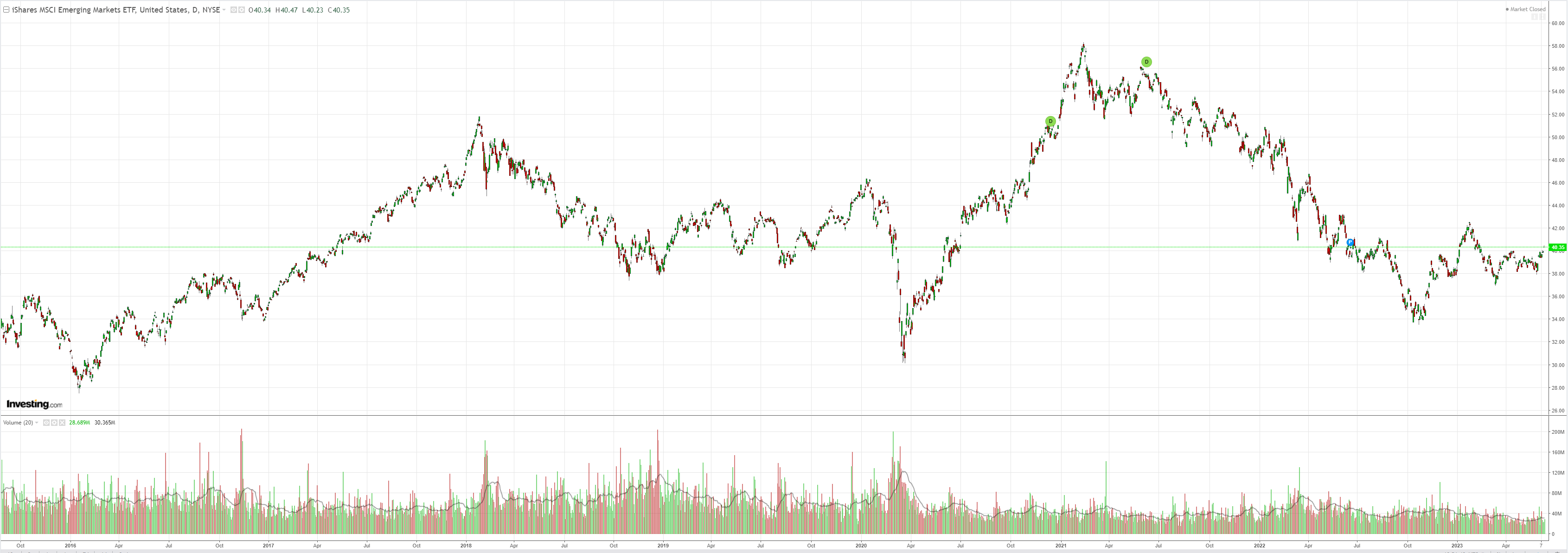

EM stockS (NYSE:EEM) up:

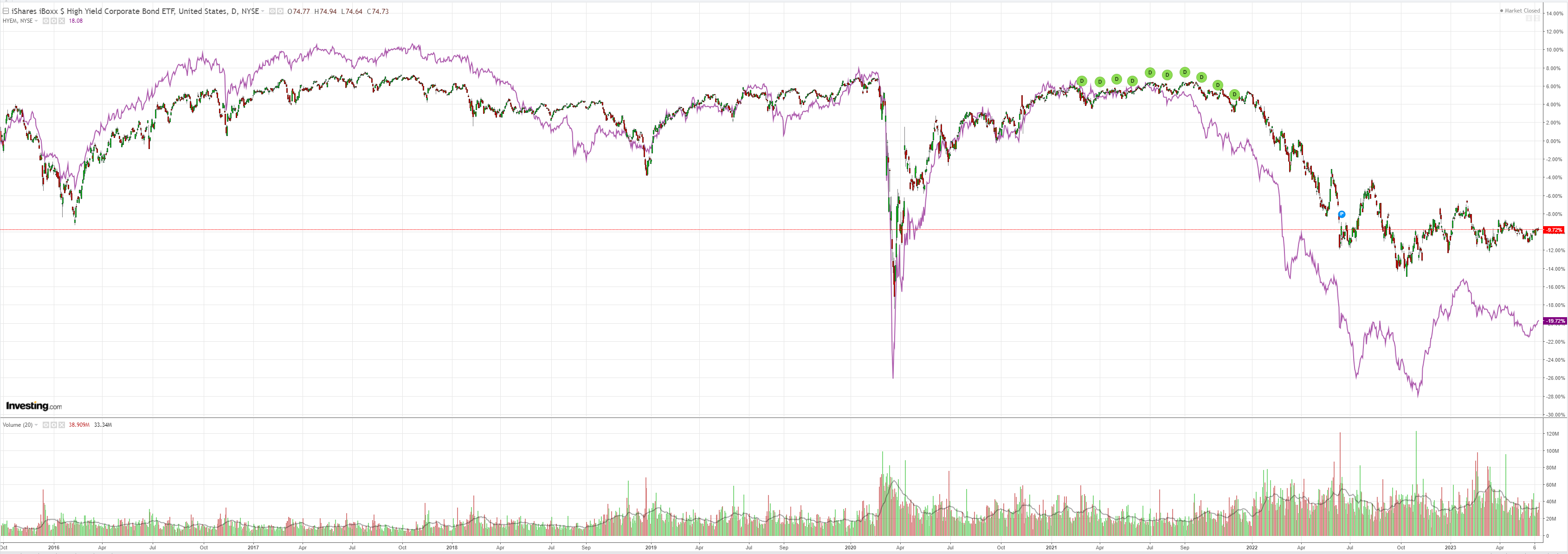

And junk (NYSE:HYG):

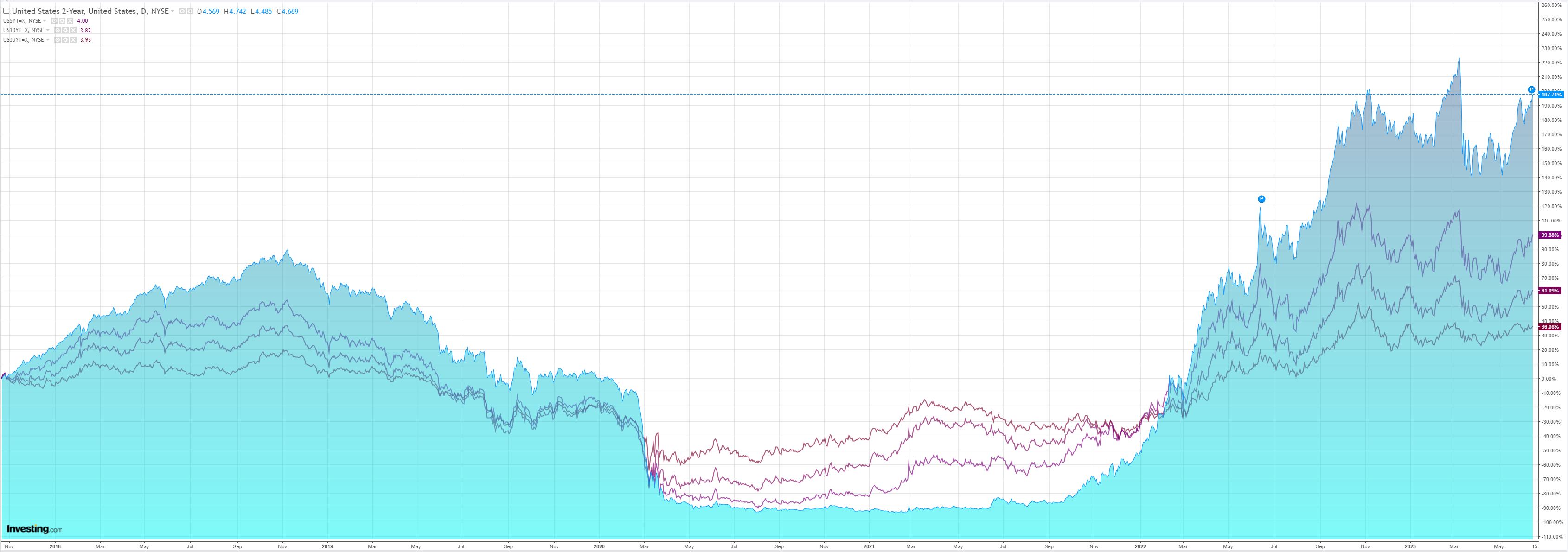

And yields:

This is just wow:

That is what can only be described as full-blown reflation. There were two triggers. US CPI, via Goldman:

May core CPI rose by 0.44% and the year-on-year rate fell two tenths to 5.3%, both somewhat above consensus. The composition was more encouraging, as used cars contributed +0.15pp and falling auction prices argue for declines in coming months. Additionally, the March/April slowdown in shelter categories was sustained in May. We view today’s report as supportive of our call for a pause at the June FOMC meeting followed by a hike in July.

Second, China mulling stimulus:

The People’s Bank of China unexpectedly cut a series of short-term interest rates on Tuesday, paving the way to lower a key longer-term policy rate on Thursday. In addition to these monetary policy actions, officials are considering a broad package of stimulus proposals, which include support for areas such as real estate and domestic demand, according to people familiar with the matter.

I don’t think either matter is resolved. The Fed will have to chase the stock bubble and unless China goes all in it can’t produce much to lift growth.

But markets don’t care about such subtleties and this is now the melt-up for the ages with AUD dragged along until it collapses upon itself.