There is only one forex game in town now. DXY to the moon with twenty years highs looming:

{{|AUD}} murdered:

Oil does not look well. When $98 breaks the trapdoor opens:

Base metals were weak:

Big miners (LON:GLEN) up the escalator and down the lift in classic fashion:

EM stocks (NYSE:EEM) are tanking:

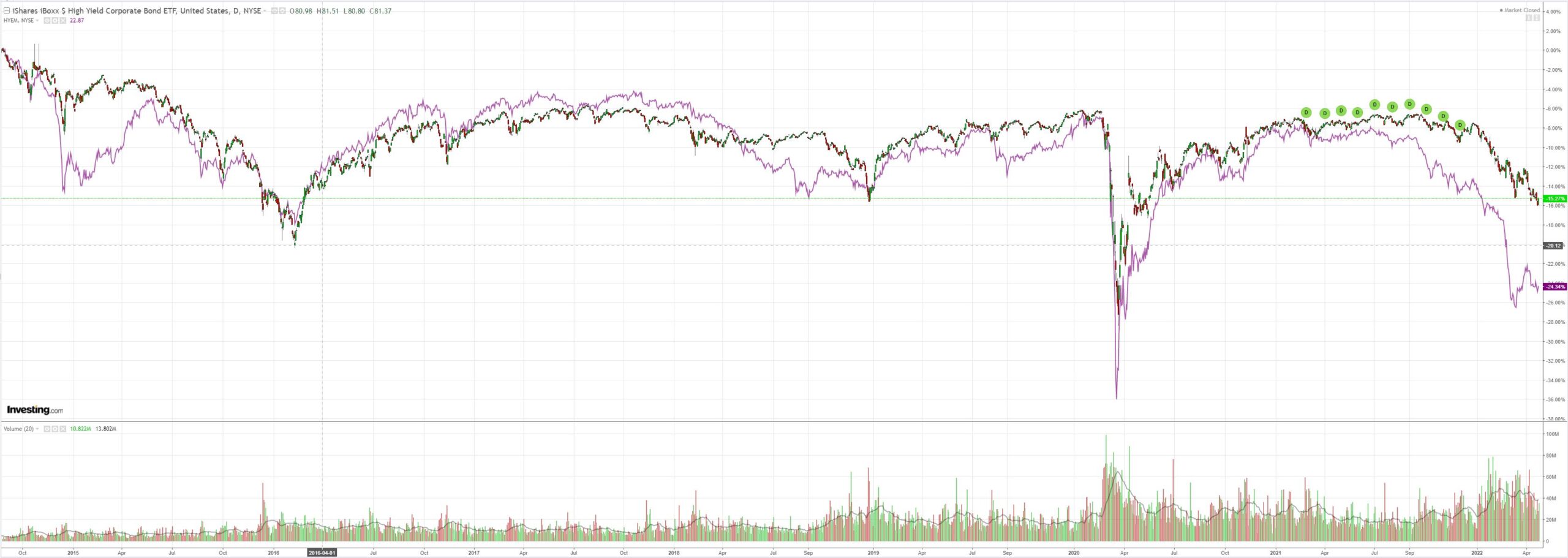

Junk (NYSE:HYG) held on:

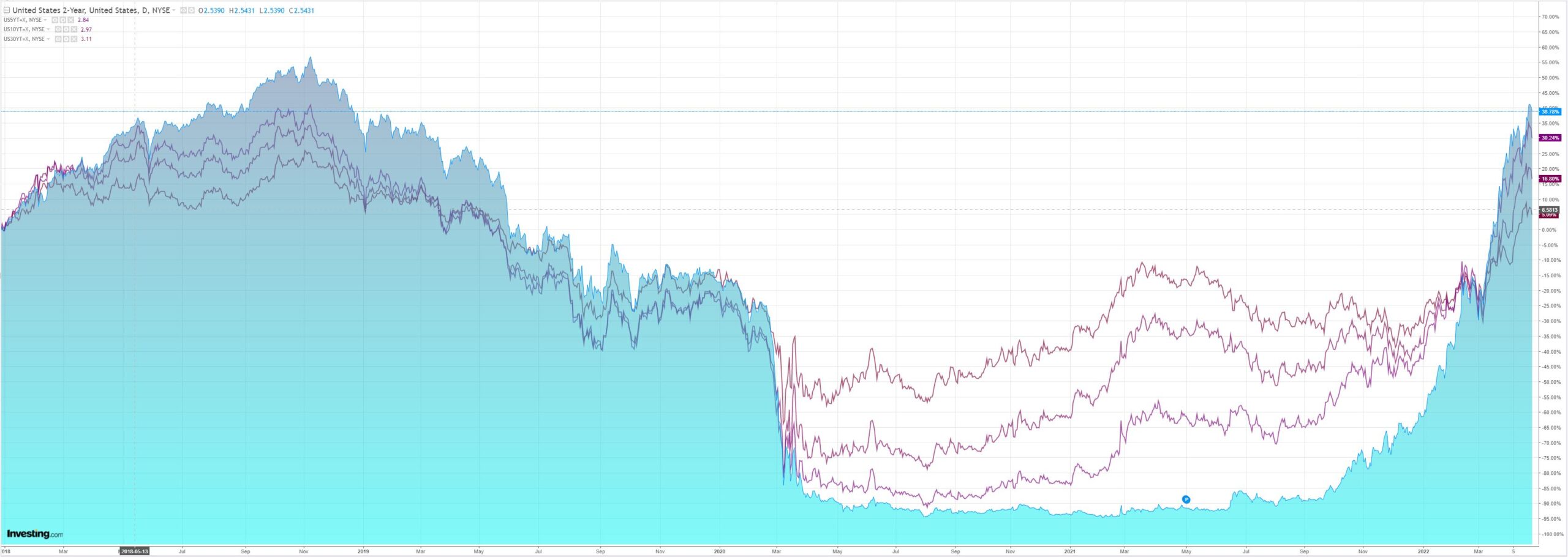

Yields down, curve flattened:

Stocks were rescued by Elon Musk for a day:

Westpac has the wrap:

Overnight Market Wrap

Global market sentiment: European equities fell to a one-month low, while US equities have recovered from an initial slump, the S&P500 up 0.6%. Bond yields fell, and the defensive US dollar rose to a two-year high.

Currencies: The US dollar Index is up 0.5% on the day and is at a high since March 2020. EUR fell from 1.0800 to 1.0697. USD/JPY fell from 128.60 to 127.520. AUD fell from 0.7200 to 0.7135 – a two-month low. NZD fell from 0.6630 to 0.6582 – a three-month low. AUD/NZD fell from 1.0880 to 1.0825.

Interest rates: US 2-Yr treasury yields roundtripped from 2.64% to 2.53% and back, while the 10-yr yield fell from 2.87% to 2.76%. Markets currently price the Fed funds rate to be 50bp higher at the next meeting in May.

Australian 3Yr government bond yields (futures) fell from 2.80% to 2.71%, recovering to 2.78%, while the 10-Yr yield roundtripped from 3.12% to 3.05% and back. Markets currently price the cash rate to be 48bp higher by the June meeting.

Commodities: Brent crude oil futures fell 3.7% to $103, Copper fell 2.5%, gold fell 1.6%, and iron ore fell 5.0% to $136.

Event Wrap

US Dallas Fed manufacturing survey fell to 1.1 (est. 4.8, prior 8.7), the outlook falling from -0.7 to -5.5, and uncertainty at 29.8 (from 20.5). Chicago Fed national activity survey for March was as expected at 0.44 (est. 0.45, prior 0.54), still indicating above trend growth.

Germany’s IFO economic survey surprised with a a slight rise. The climate component rose to 91.8 (est. 89.0, prior 90.8), as did both current assessment 97.2 (est. 95.9, prior 97.1) and expectations 86.7 (est. 83.5, prior 84.9).

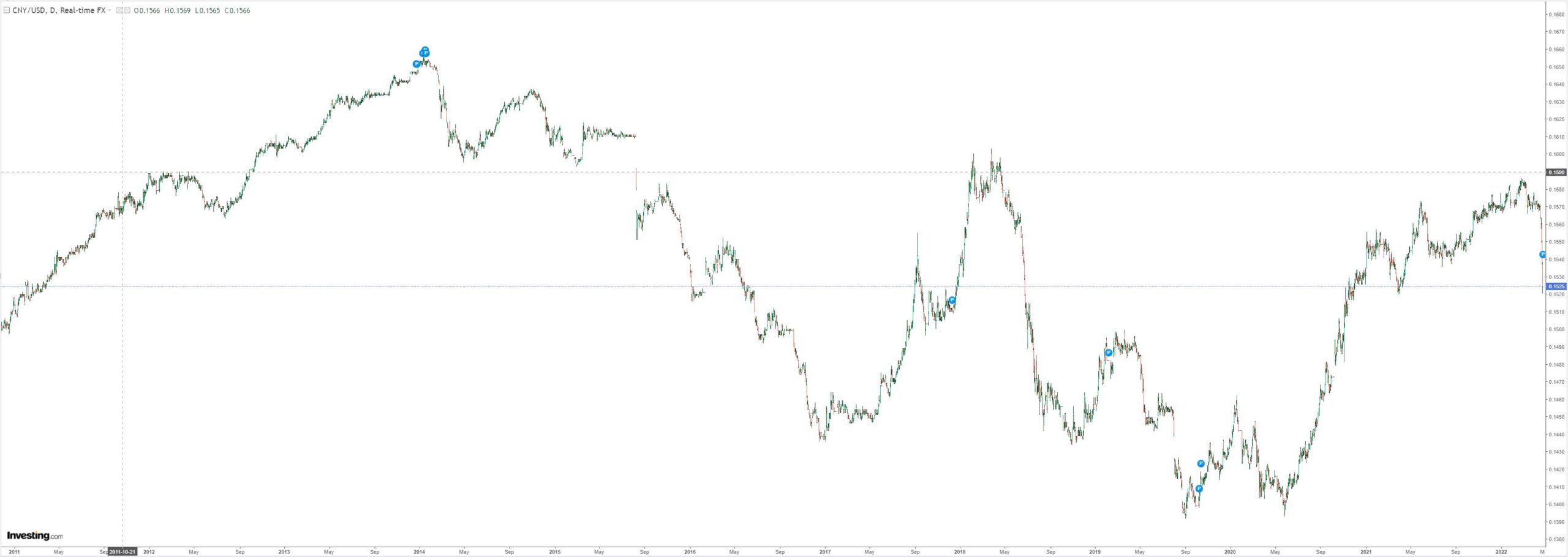

China’s PBoC cut financial institutions’ forex reserve ratio by 100bp to 8.0%.Officials continued to suggest that there will be further support measures – earlier in the day there were relaxations on credit restrictions on the property sector. China also announced that there would be mass testing of the whole of Beijing into month end, further increasing concerns that Beijing might enter similar lockdown restrictions as seen in Shanghai.

Bank of Canada governor Macklem reiterated its intent to hike by another 50bps, acknowledging earlier mistakes as well as getting things right in response to why they did not hike earlier. He also said that a hike of more than 50bps would be highly unusual and that Canada was near peak inflation.

Event Outlook

NZ: March’s credit card spending will provide a timely update on consumer spending.

US: Supply chain issues should remain as a source of volatility for durable goods orders in March (market f/c: 1.0%) and the challenge of sourcing materials and labour will continue to be reflected in April’s Richmond Fed index (market f/c: 8). Limited housing supply and robust demand are set to drive house price growth in the FHFA index and the S&P/CS index in February (market f/c: 1.5% for both). However, new home sales will better capture the slowing of sales activity in March given the onset of rising mortgage rates (market f/c: -0.3%). Meanwhile, consumer confidence is expected to improve slightly in April as inflation concerns are balanced with labour market positives (market f/c: 108.5).

We are beginning to price the forthcoming global recession. With the emphasis on “beginning”. Everything will need to deflate a lot further, especially commodities before the Fed relents.

Get ready for more commodities and AUD price cascades as CNY crashes:

It looks more and more to me like 2023 is going to be a year of spectacular deflation, rerunning the post-Spanish Flu episode of 1920/21.