DXY looks like it might be consolidating before pushing higher:

AUD was whacked:

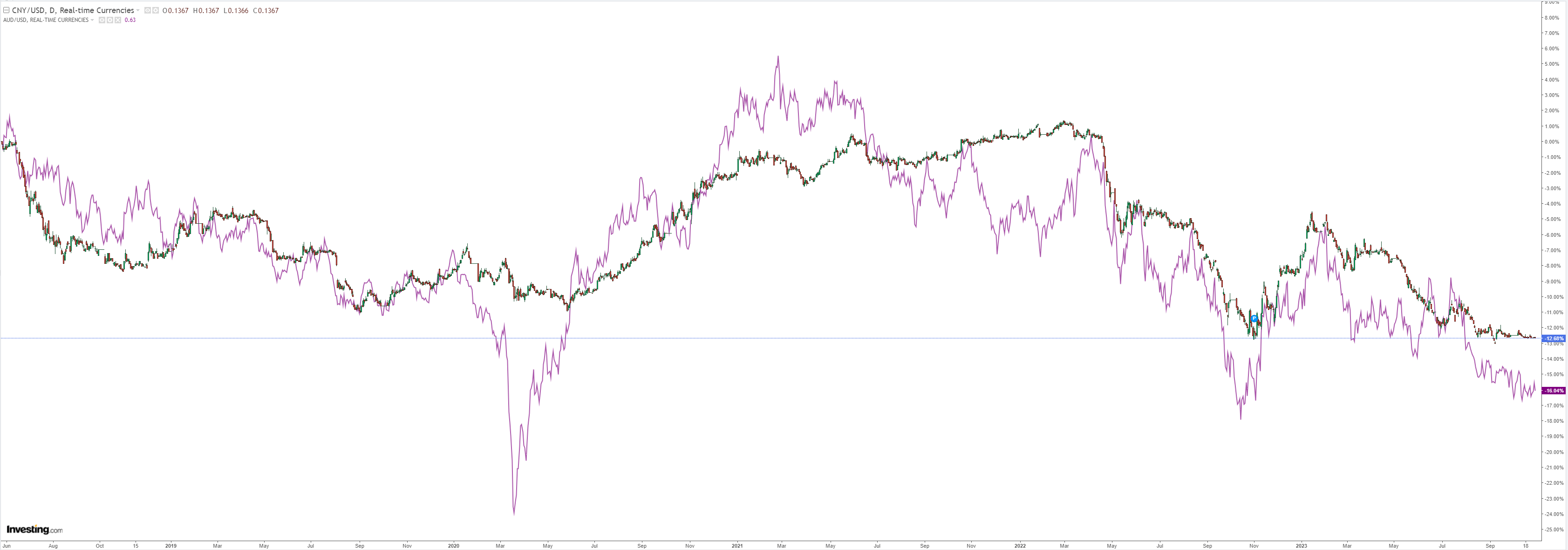

CNY going nowhere:

Oil slumped:

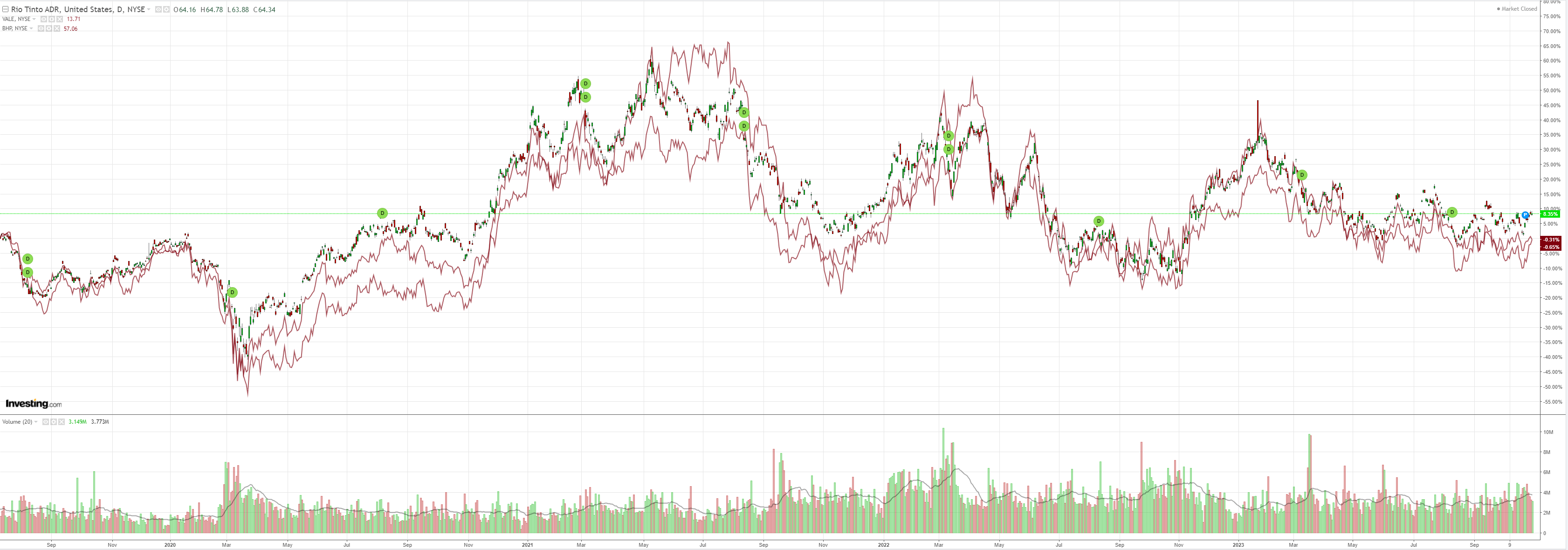

Dirt too:

And miners:

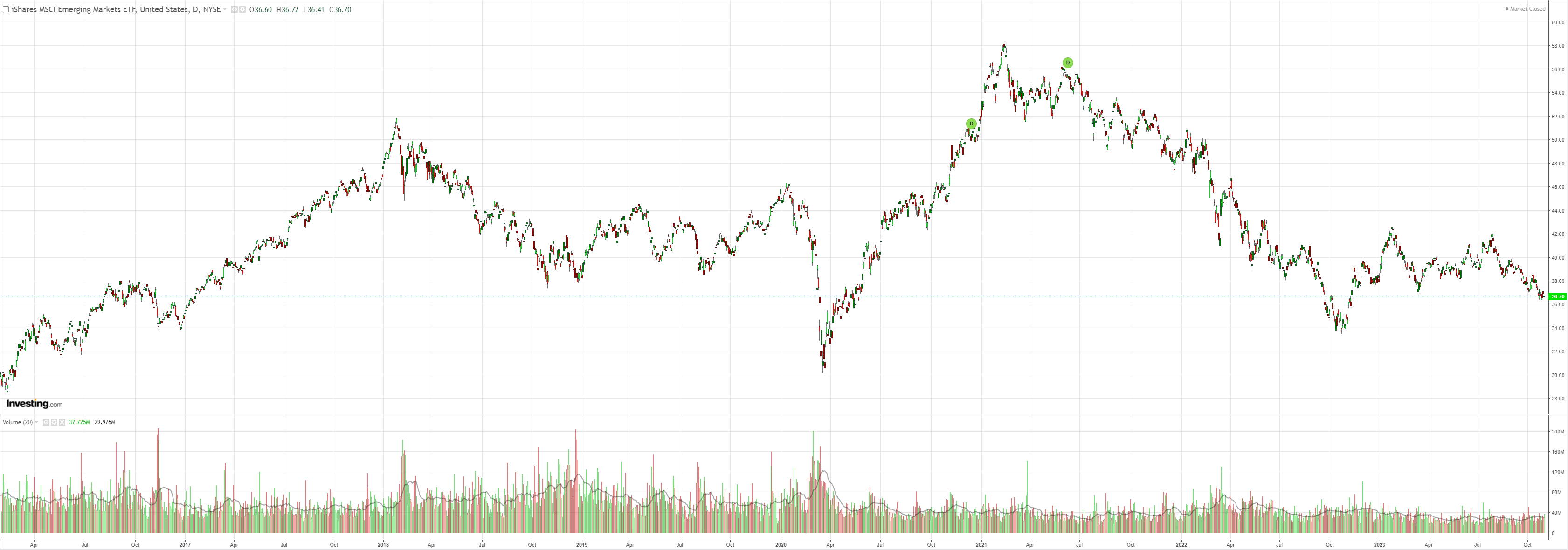

EM stuck:

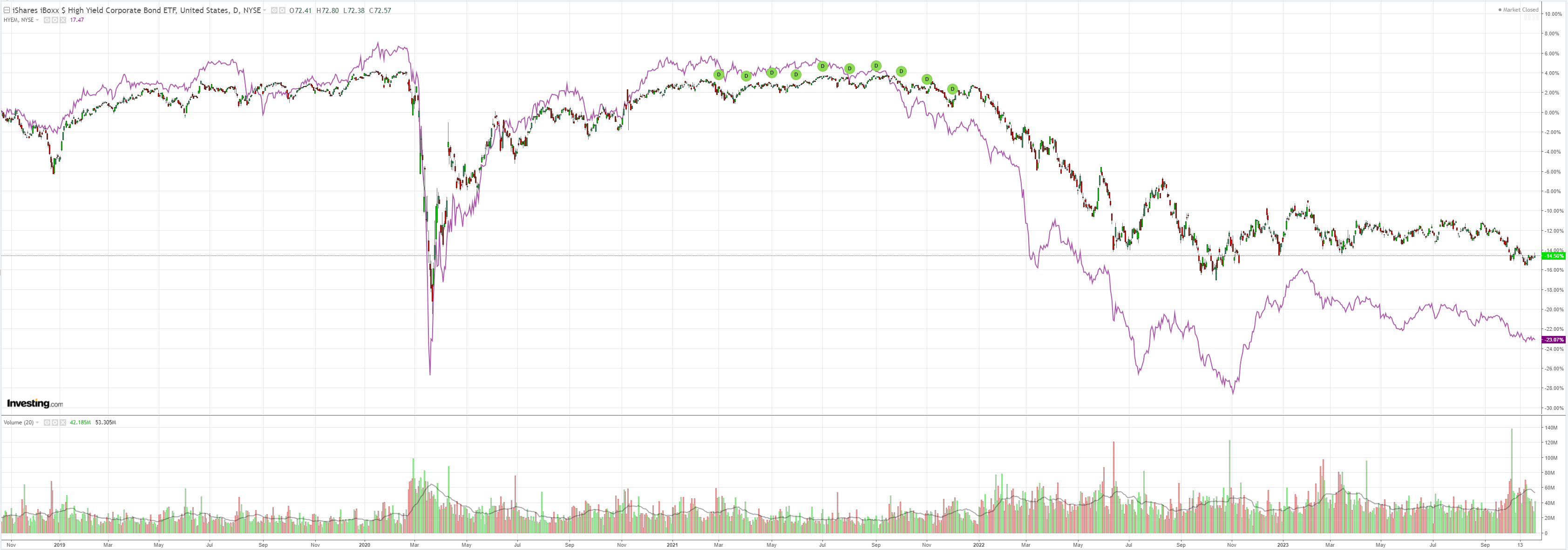

Junk on the ledge:

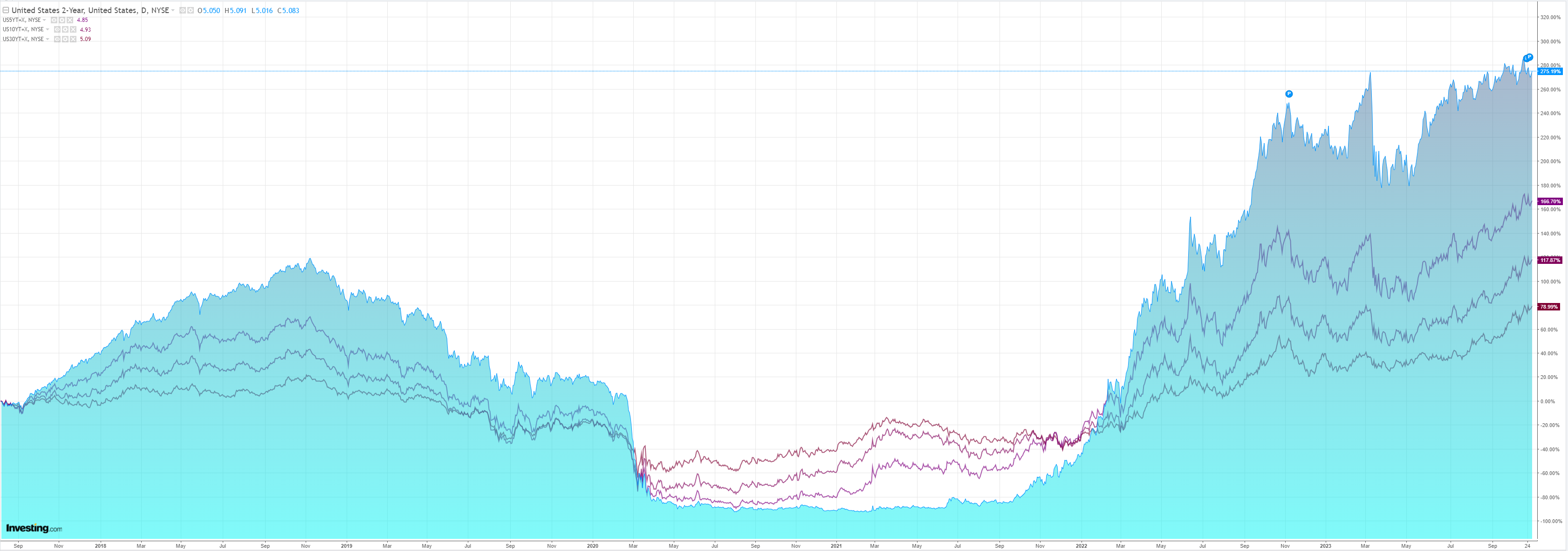

Yields firmed:

Stocks too:

Credit Agricole (EPA:CAGR) has the wrap on the big move:

The BoJ moved to adjust YCC last December and this July as upward pressure on the JGB yield curve strengthened in light of global bond yields remaining high.

The 10Y UST yield surpassing 4% last autumn likely triggered the move in December and Fed Chair Jerome Powell’s statement that the Fed staff no longer expects a recession before the July BoJ monetary policy meeting triggered the move in July.

The BoJ moving to adjust YCC at October meeting was likely triggered by the 10YUST yield reaching 5% and the government moving forward with an economic stimulus package.

With the adjustment, the central bank would be able to maintain the adjusted YCC framework without significantly increasing its JGB purchase even if net domestic fund demand expands to-5% and the 10Y UST yield rises to 6%.

The challenge the BoJ will likely face is whether it can maintain the 40bp downward pressure on the 10Y JGB yield that it currently has from just committing to the current easing framework.

In order to maintain the downward pressure on the 10Y JGB yield, the BoJ will likely need to strengthen its commitment to the negative interest rate policy and YCC framework.

Thus, the hurdle to start the normalisation process from the YCC and negative interest rate policy framework has likely increased.

If the BoJ succeeds in convincing the JGB market that its commitment to the current policy framework remains unchanged, the 10Y JGB yield will likely not rise significantly despite the BoJ adjusting YCC as it is already trading near the macro fair value.

The BoJ will likely justify the atest adjustment as a move to strengthen the longevity of the current easing framework.

Even with the series of adjustments to YCC since last December, the 10Y JGB macro fair value excluding the effect of the 10YUST yield, remains stable at around-0.5% and continue to exert an easing bias.

The central bank’s scenario for normalisation will likely remain unchanged and wait until the next cyclical upswing of the global economy, most likely in CY25.

With markets expecting the Fed to cut rates and the JPY likely to appreciate as the global economy shows stronger signs of slowing down, the BoJ will likely not pre-emptively tighten monetary policy and cause the JPY to appreciate.

The latest outlook report hints that the BoJ is becoming increasing cautious of the headwind the economy could face.

Meanwhile, the government is moving to pass an economic stimulus package centred on supporting households and stimulating domestic investment, as it continues to push the economy toward completely exiting from deflation.

The BoJ will likely not implement any measures that would act as a drag on the economy when the government is trying to stimulate it.

The BoJ will likely continue to try pulling the economy completely out of deflation and stagnant growth, in coordination with the government.

The more things change the more they stay the same. The cautious approach disappointed markets, sank JPY, lifted DXY and pushed down AUD.

No surprises there.