Street Calls of the Week

DXY is getting hosed as Fed hopes metastasise. EUR is on a moonshot:

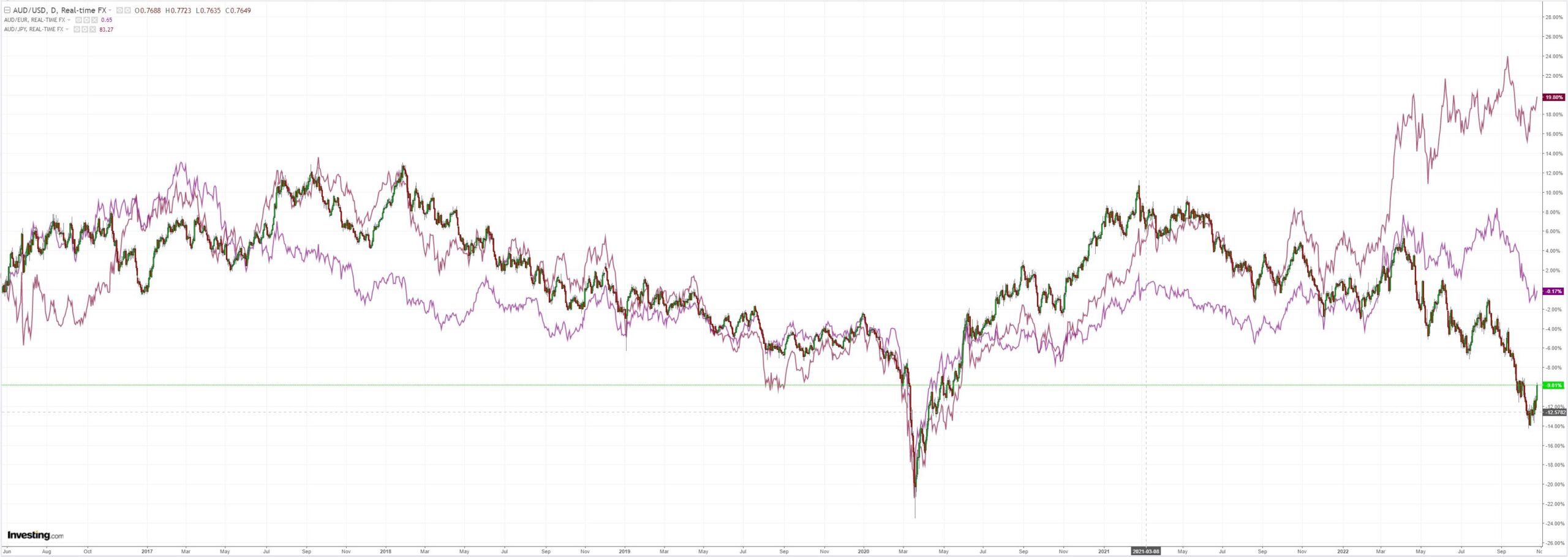

AUD has jacknifed:

Oil looks ominous:

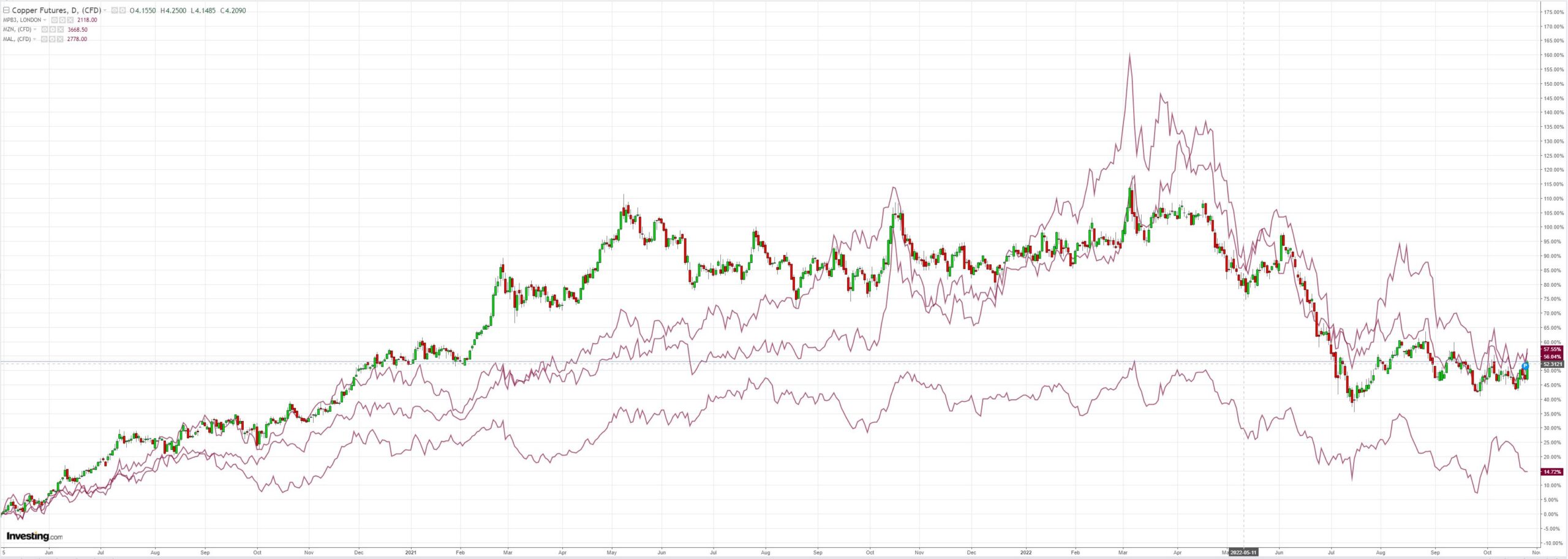

Base metals relief:

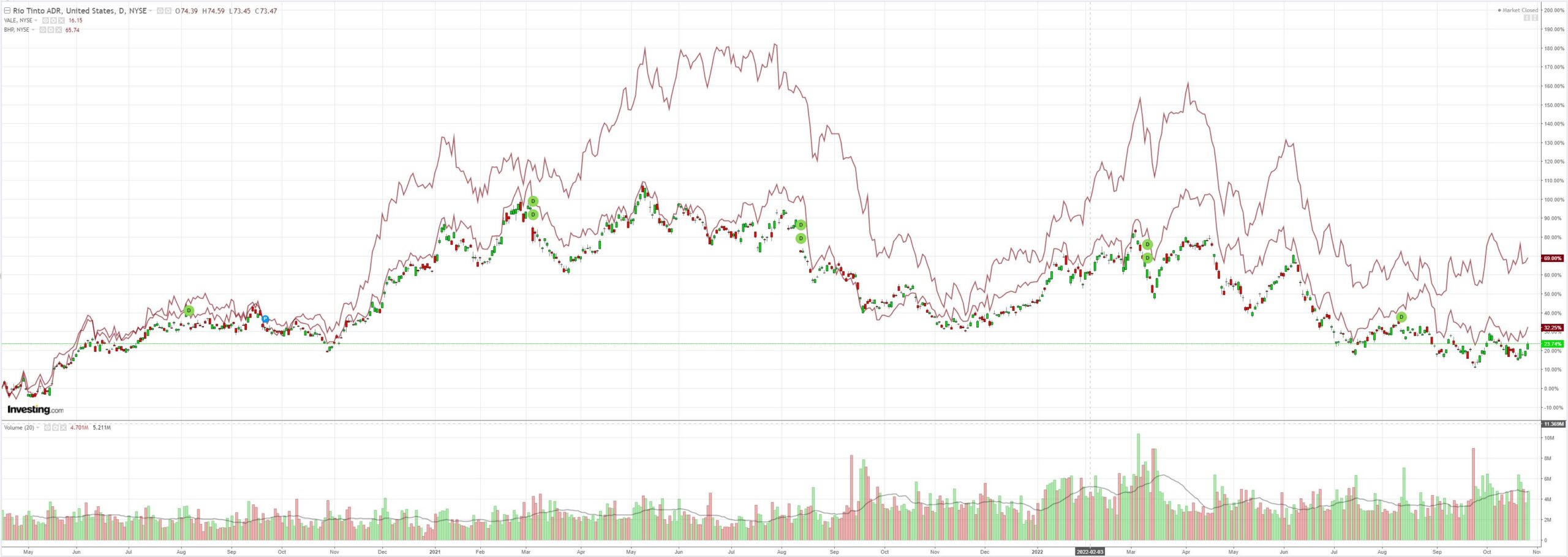

Big miners (NYSE:RIO) too, despite iron ore:

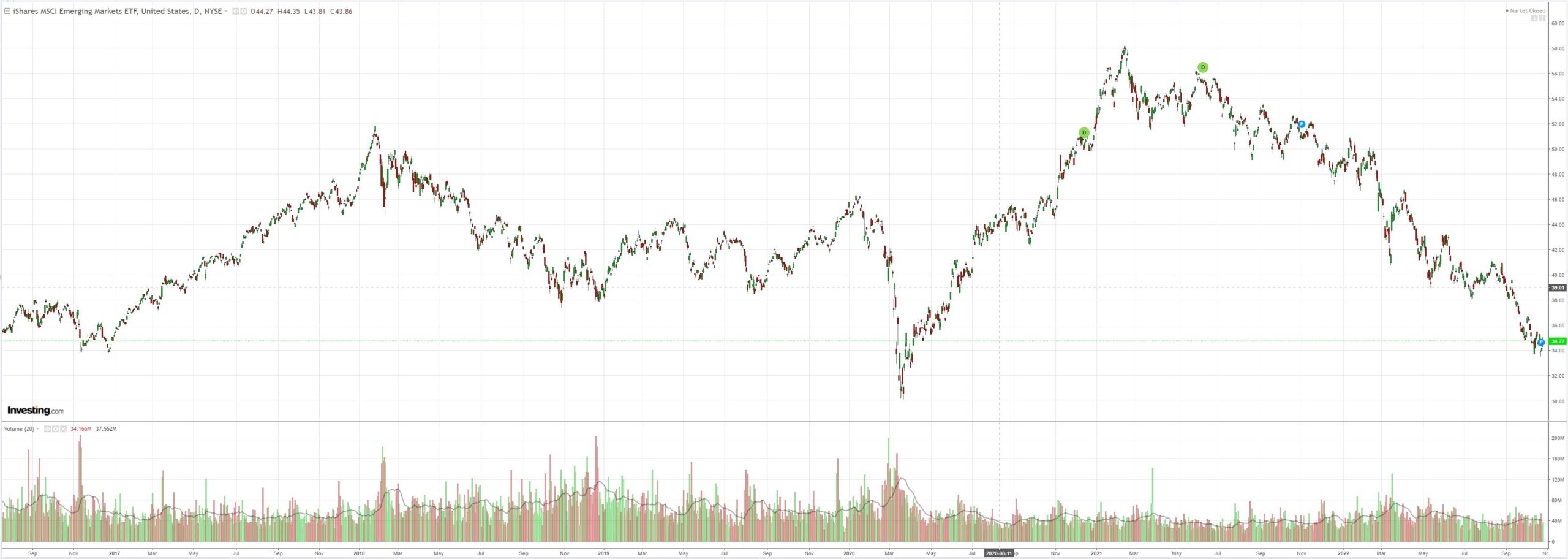

But EM (NYSE:EEM) is sitting this out entirely as the tyrant rises:

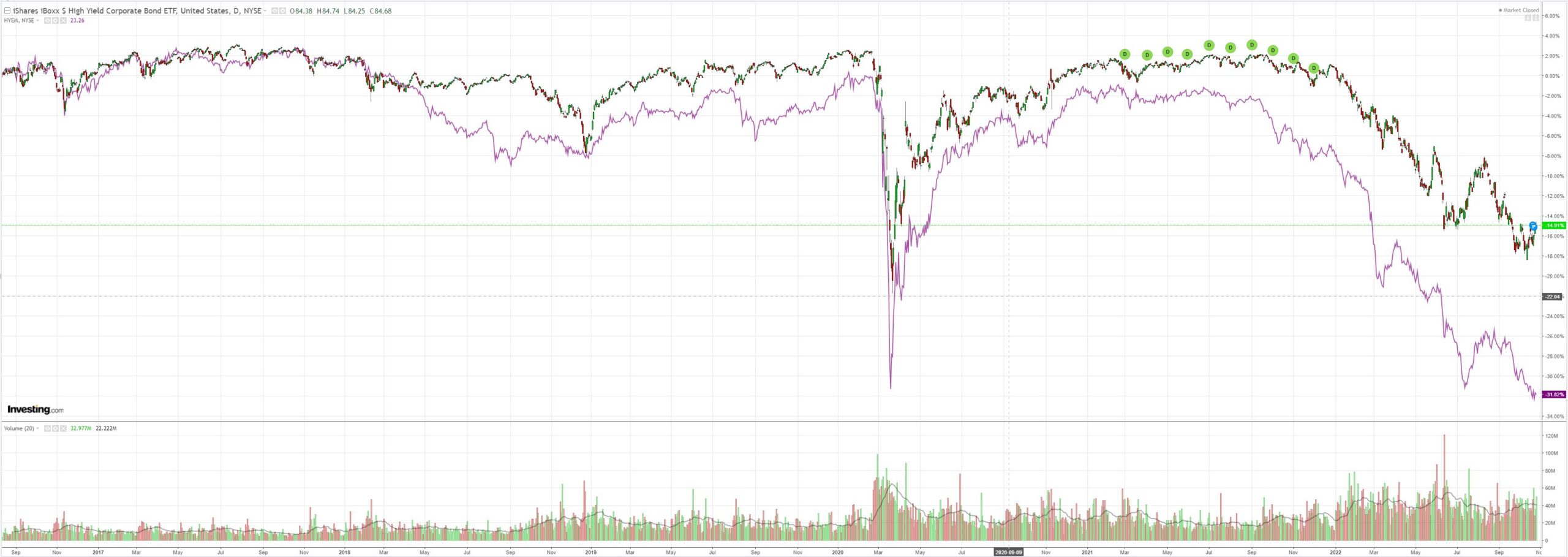

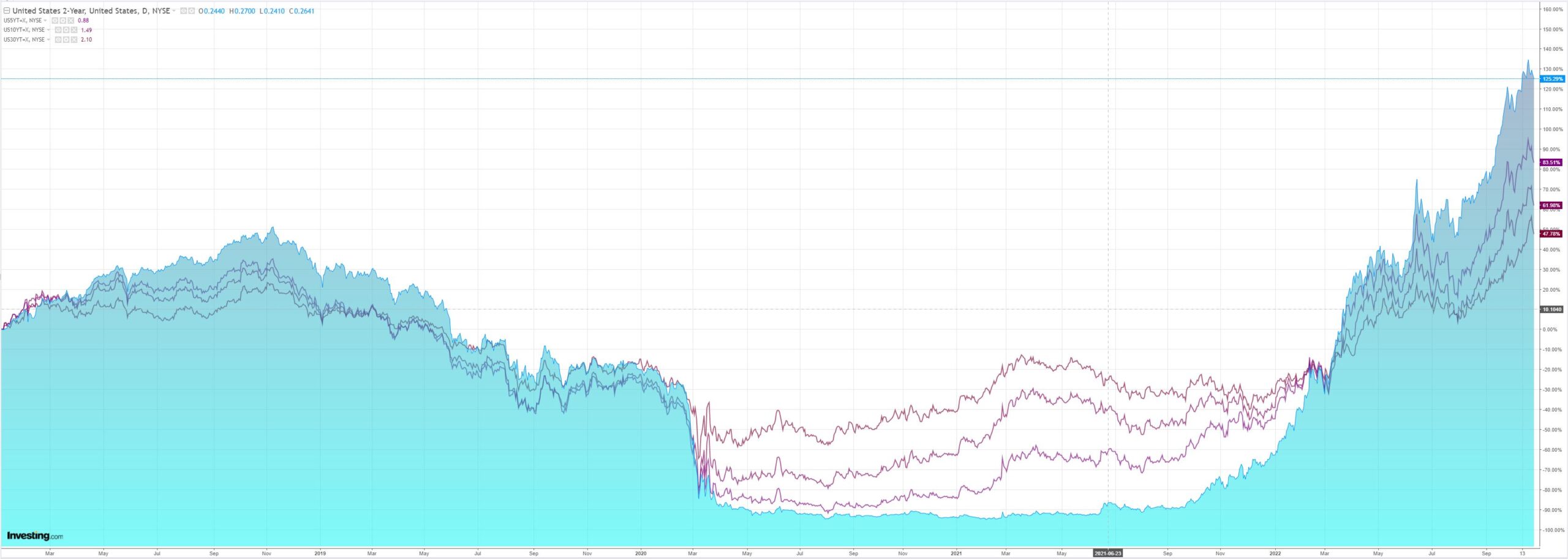

Treasuries were gobbled up:

But stock dumped anyway on tech earnings trouble:

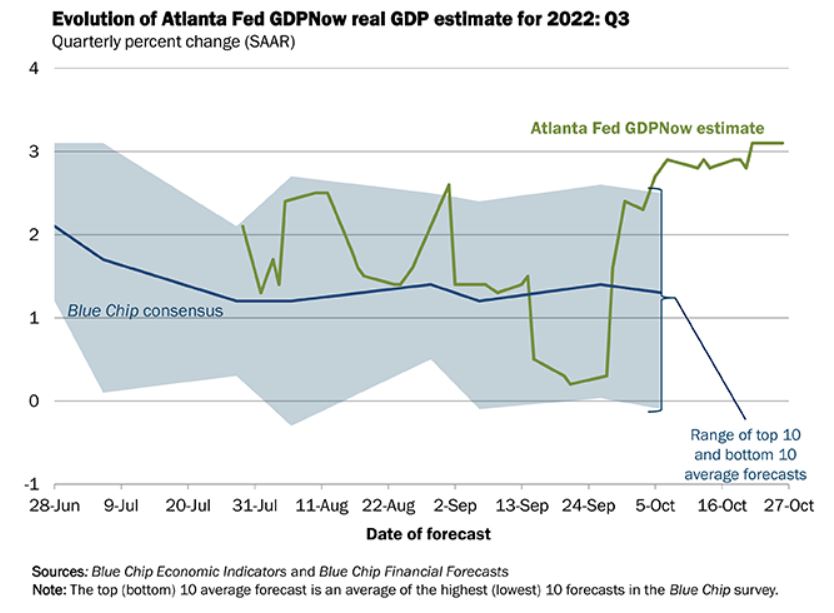

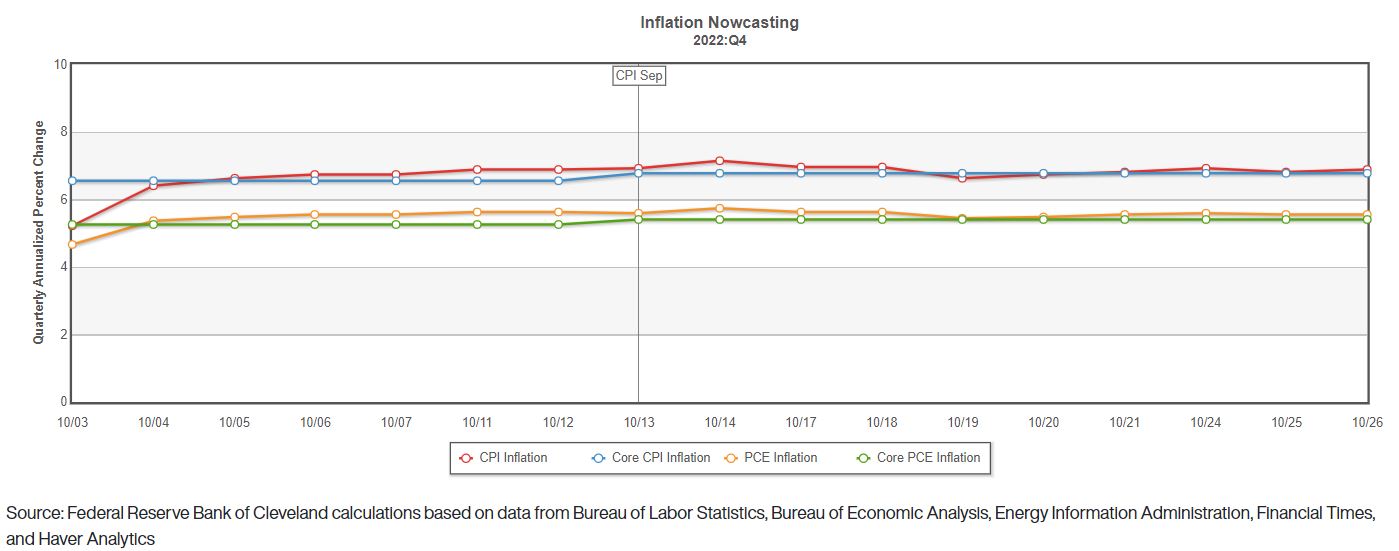

Another bear market rally of sorts is underway. But the market’s hopes for a benign Fed has three very large problems.

First, growth in the US is booming:

Second, inflation nowcasts are super sticky above 5%:

Third, the more market rallies, the easier the FCI gets, making points one and two both stronger not weaker.

I am encouraged that bonds are rallying and stocks not so much. That is a change that is indicative of us being closer to end-of-cycle dynamics.

However, the Fed still has more work to do. A few weeks of warm weather in Europe to ease energy fears does not a winter make. And Chinese growth is getting worse by the minute.

I can’t see DXY topping persuasively until the threat of a Fed-induced market accident is gone and global growth shows promise of a rebound. That makes the last few days of intervention in JPY and CNY Pyrrhic at best.

For me, AUD is enjoying a relief rally with lower yet to come.