DXY eased:

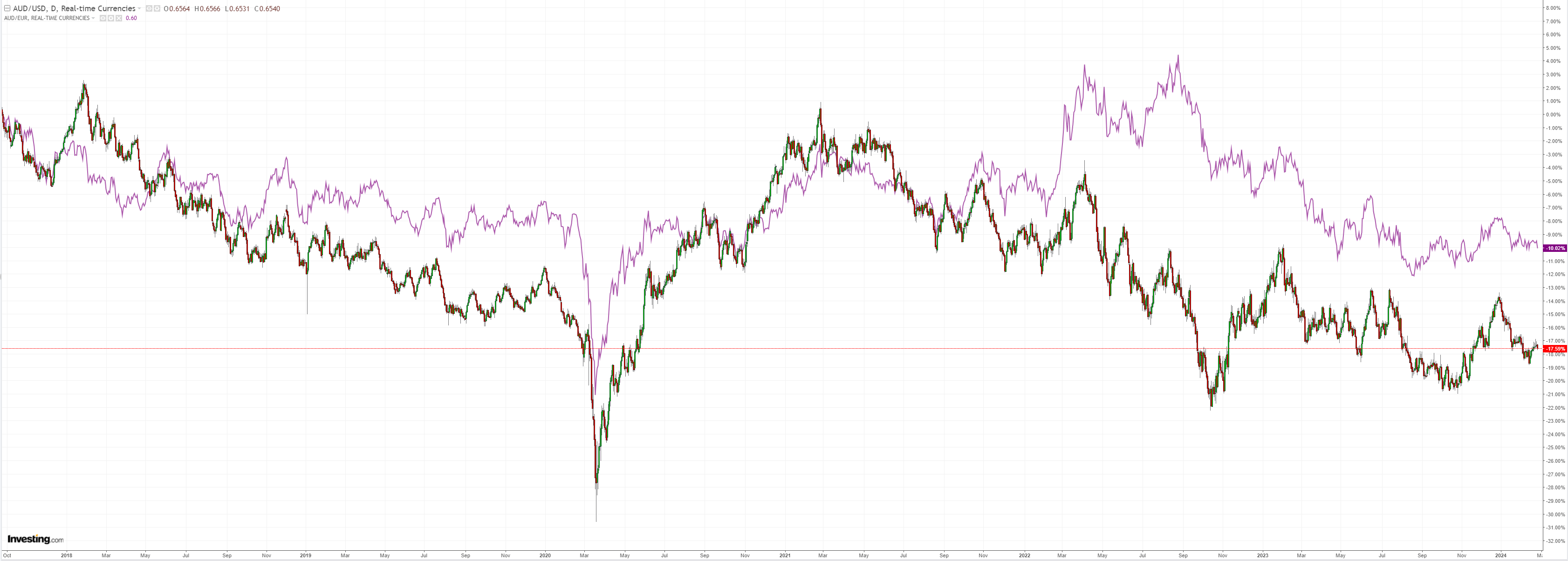

AUD fell anyway:

Dragged own by North Asia. Xi Jinping is sitting in his palace with a white-knuckled grip on CNY:

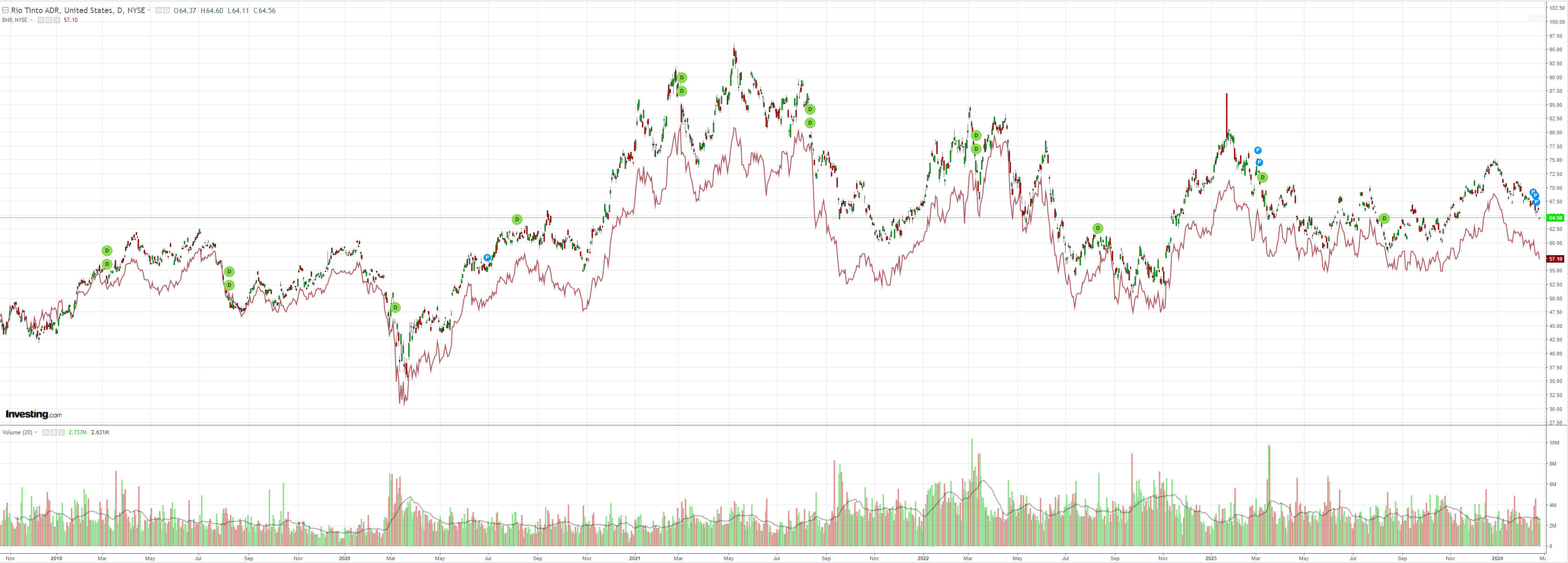

Dirt yawn:

Big miners are heading for a big test:

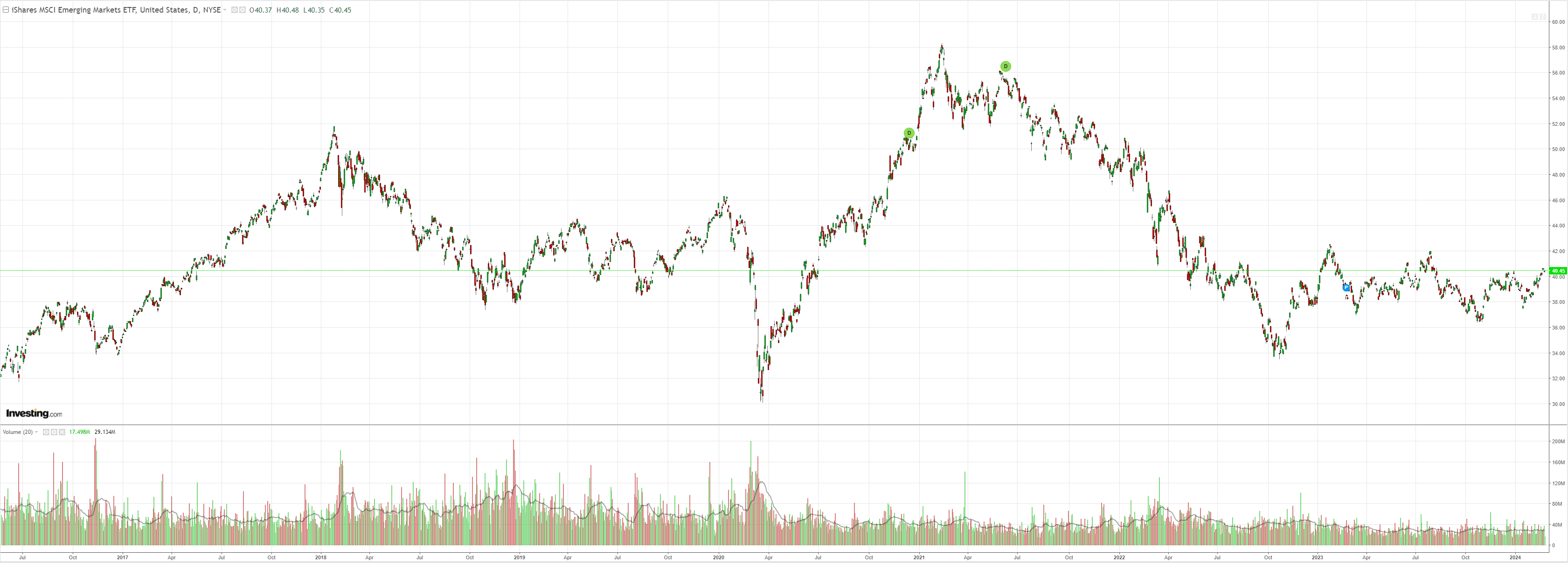

EM yawn:

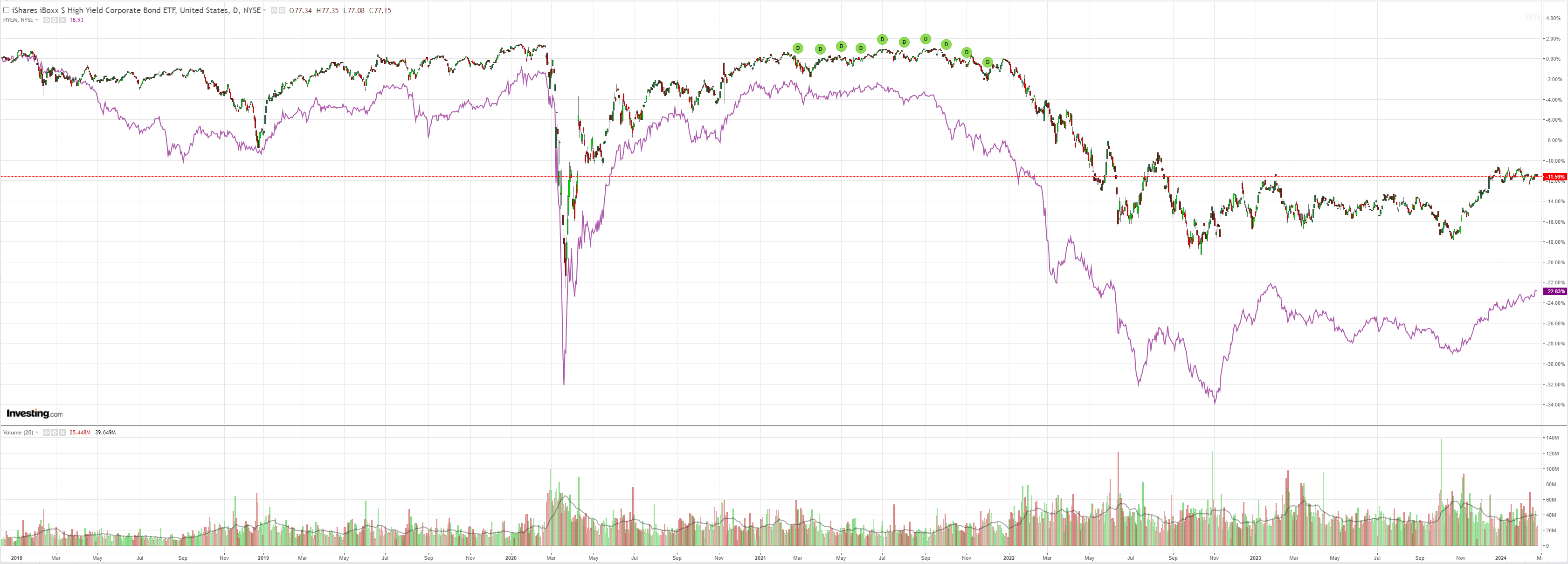

Junk yawn:

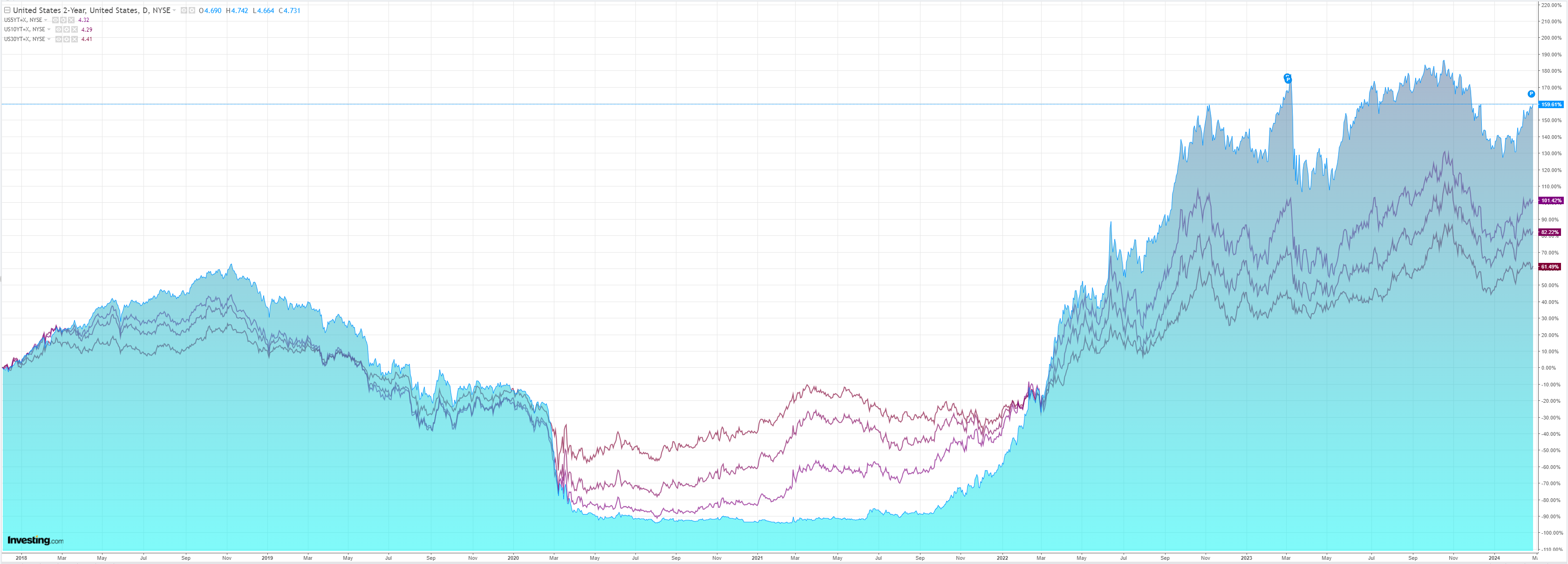

The curve is rolling over:

Stocks stalled:

Credit Agricole (EPA:CAGR) has an interesting observation:

One of the more interesting developments in FX markets since the start of 2024 has been the close correlation between the USD and the US equity markets in general–and the stocks of the ‘Magnificent 7’ technology companies in particular.

We conclude that the performance of US tech stocks seems to be driving at least some of the recent USD performance.

The conclusion is further corroborated by the results of our analysis of ETF flows, which suggest that the bulk of foreign inflows into the US stock market ETFs have been unhedged.

Indeed, we think that recent unhedged US stock market inflows gave the USD a boost while the bouts of currency weakness we saw could be due to foreign selling of US (technology)stocks.

US stocks have been going from strength to strength of late, but there is a limit to how much this could support the USD in our view.

Indeed, the approaching February month-end could see USD-selling from real money investors who rebalance their global equity portfolios.

Indeed, we note that months during which global stock markets have rallied typically saw the USD come under pressure at month-end on the back of rebalancing hedging flows.

We can take this as a nice metaphor for the forthcoming business cycle in which the converging productivity megaboom of AI, peak fat, peak oil and car, all lead to persistent US outperformance.

Certainly, versus the AUD, which will be beleaguered by the same trends without the profits boost as the Chinese tide goes out and an immigration-fed, labour-supply-led economy that runs into the brick wall of AI job losses.

Many desperate rate cuts ahead for stupid little Straya.

If the US has the Magnificent 7, Australia has the Terrible 1 in the AUD.