Street Calls of the Week

DXY is fast approaching the 106 breakout point:

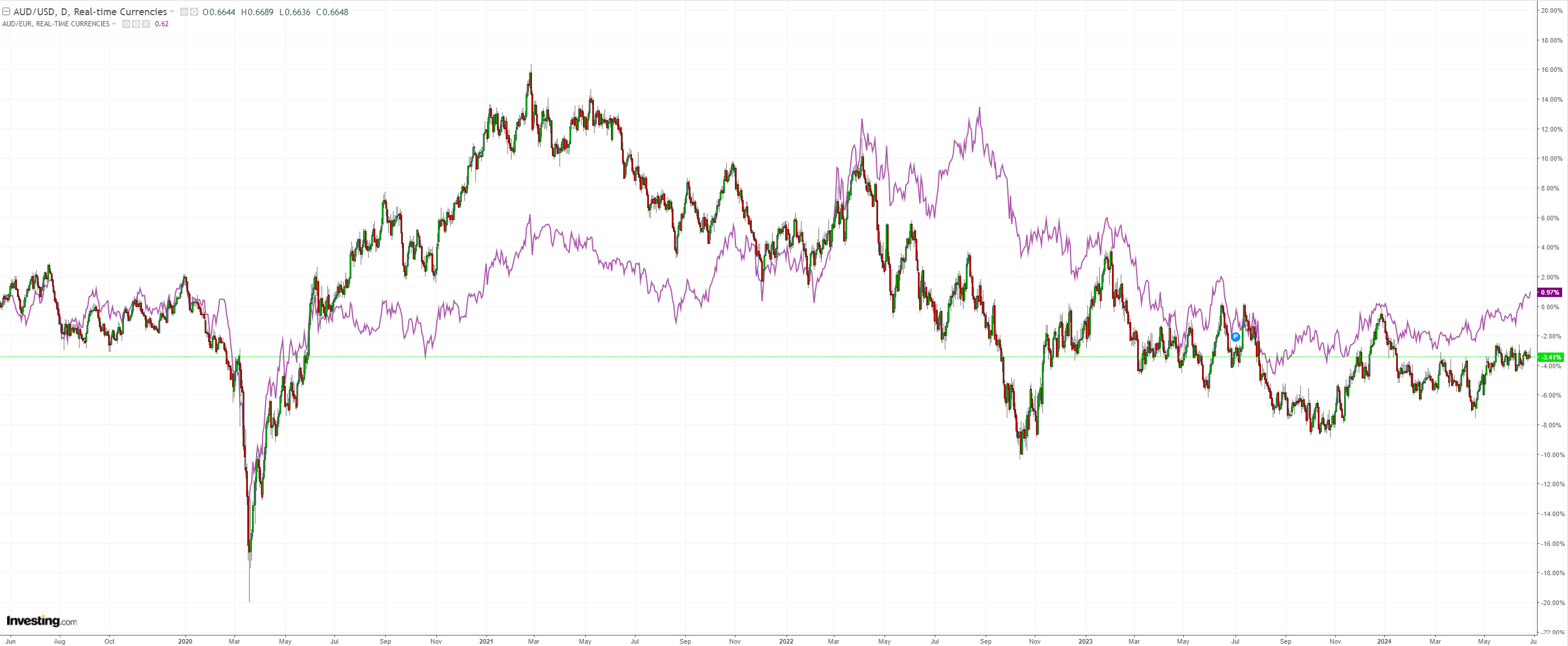

AUD popped and dropped:

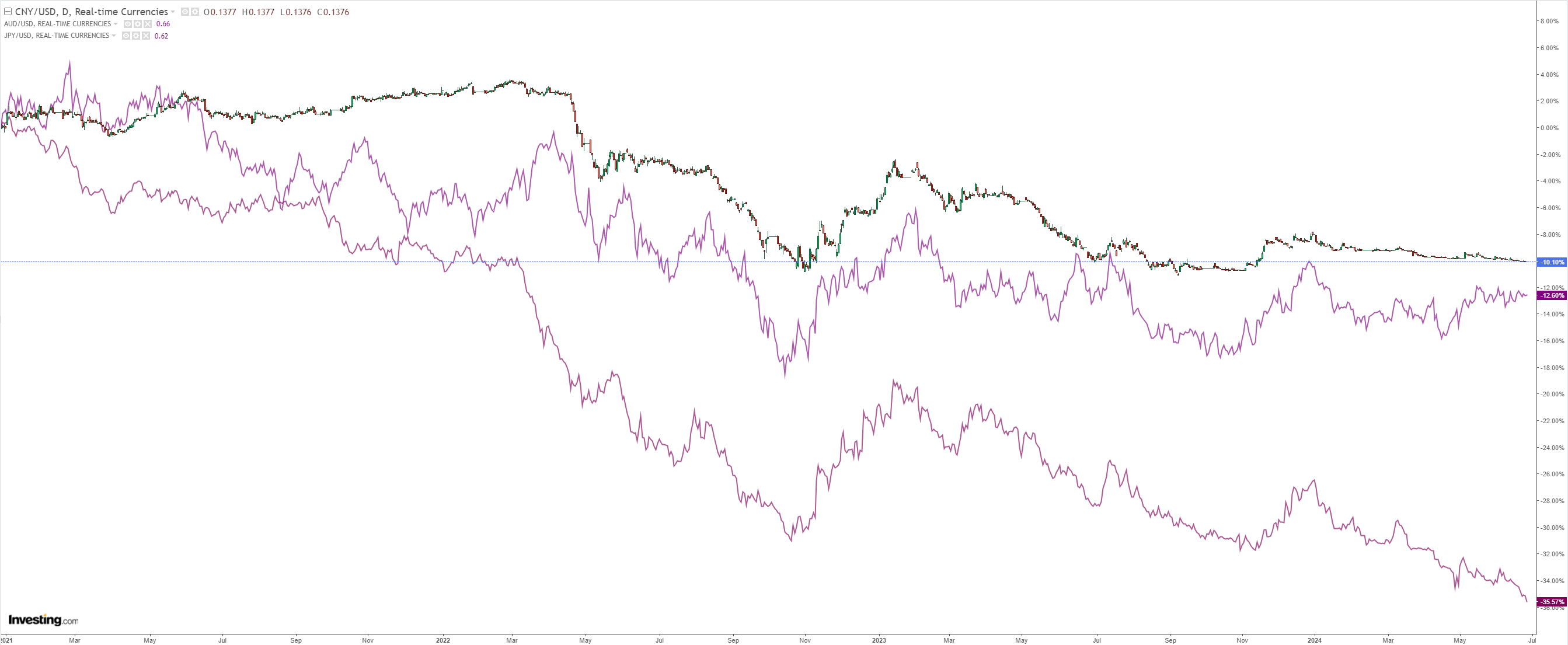

North Asia is not helping at all:

Oil and gold were whacked:

Copper is bleeding out:

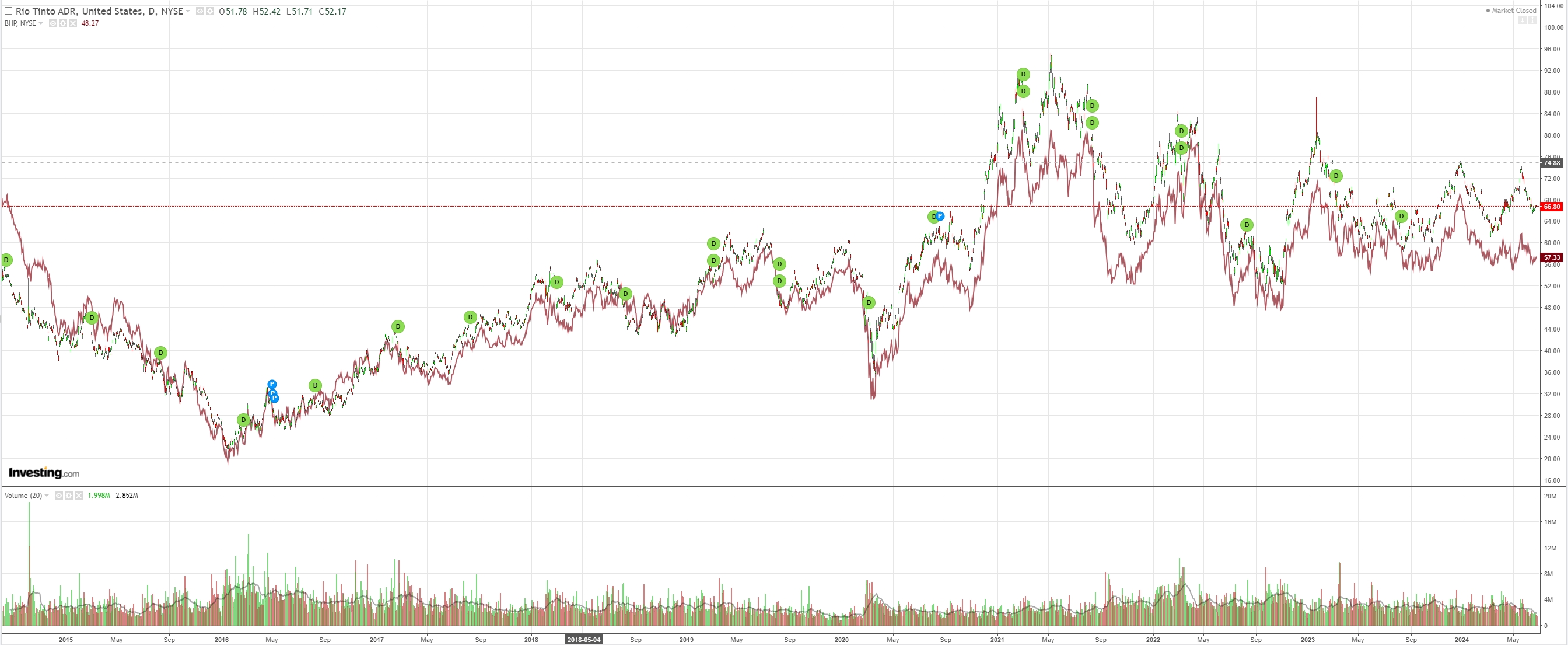

Miners meh:

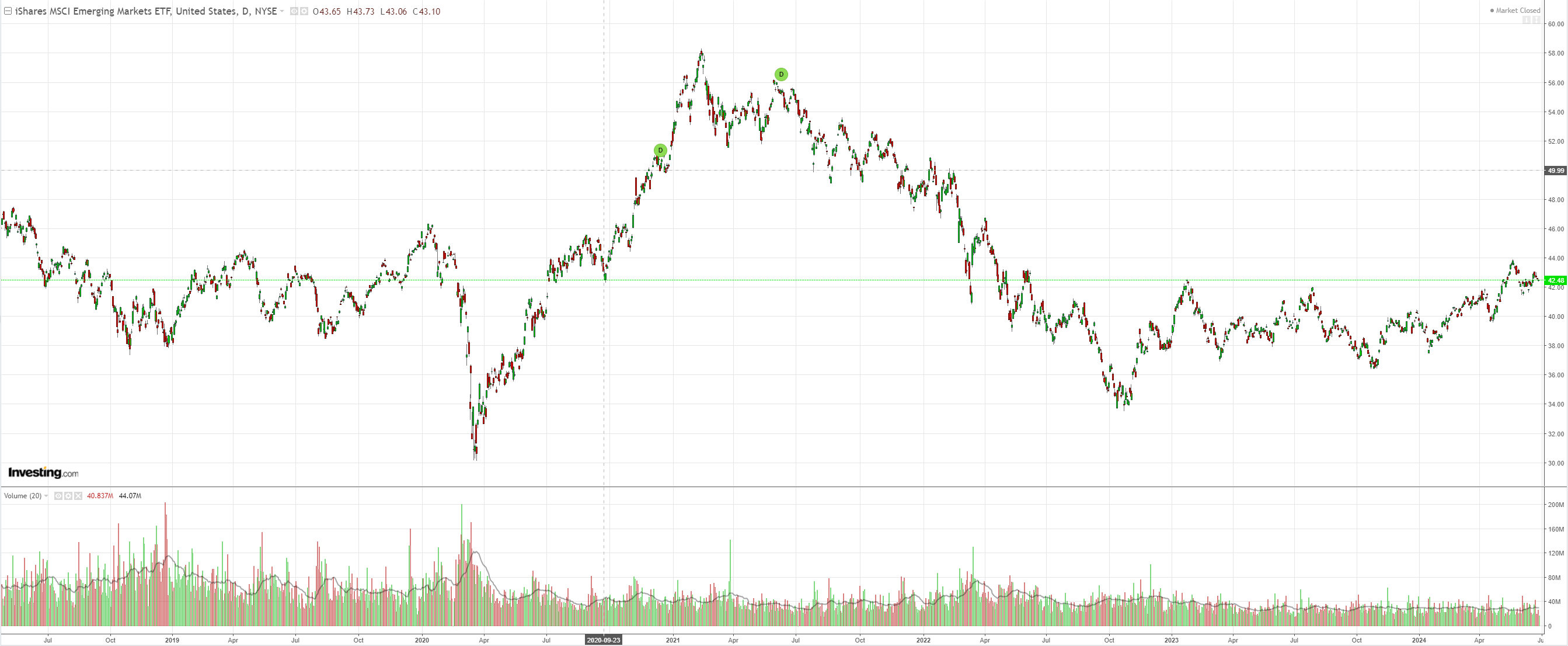

EM meh:

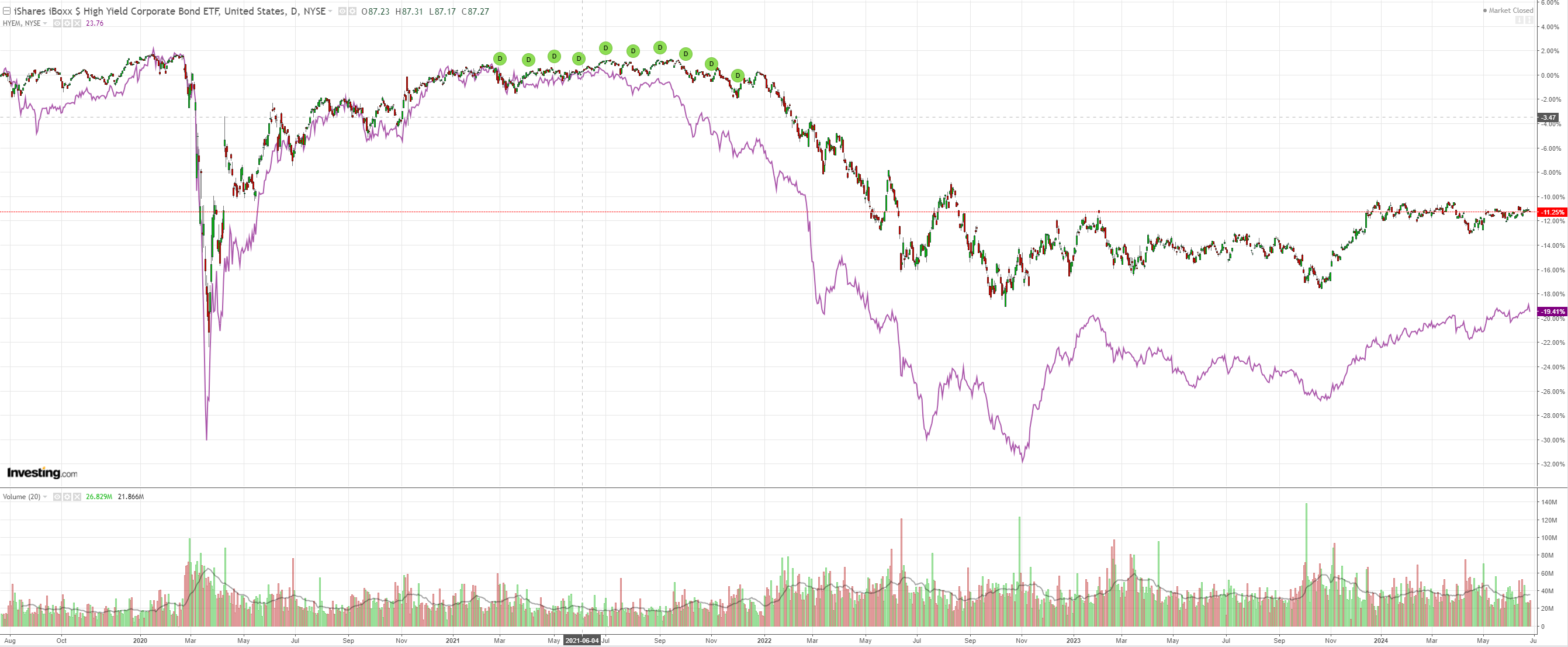

Junk reversed sharply:

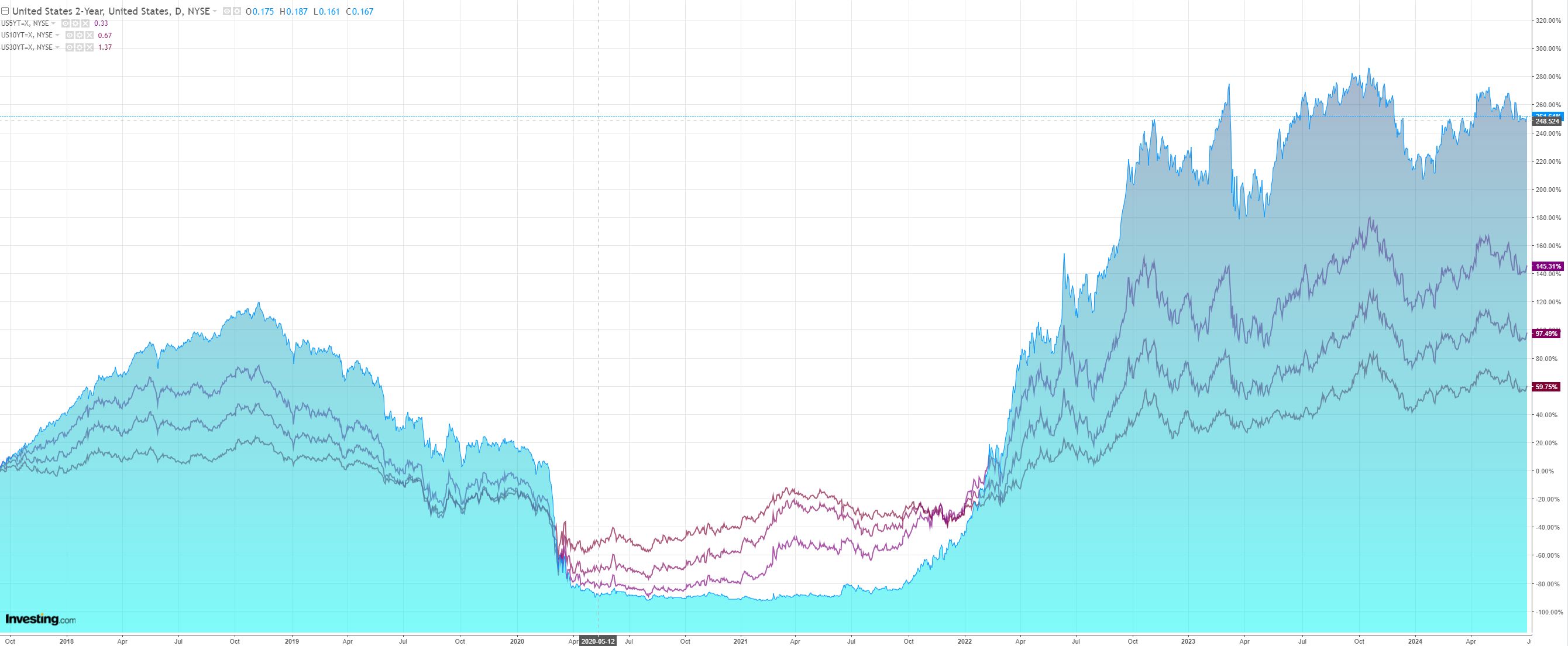

As US yields popped:

Still waiting for a decent sell-off in stocks:

The irresistible forces of the US facing a tariff-driven election and North Asia caught in a massive currency war quickly doused the inflation pop in the AUD.

There was more bad data in the US where new home sales tanked in May, though previous months were revised up strongly.

The first US presidential debate is tomorrow our time. The election is fast looming as the primary factor for FX.

Locally, the big issue is interest rates. Credit Agricole (EPA:CAGR) sums it well:

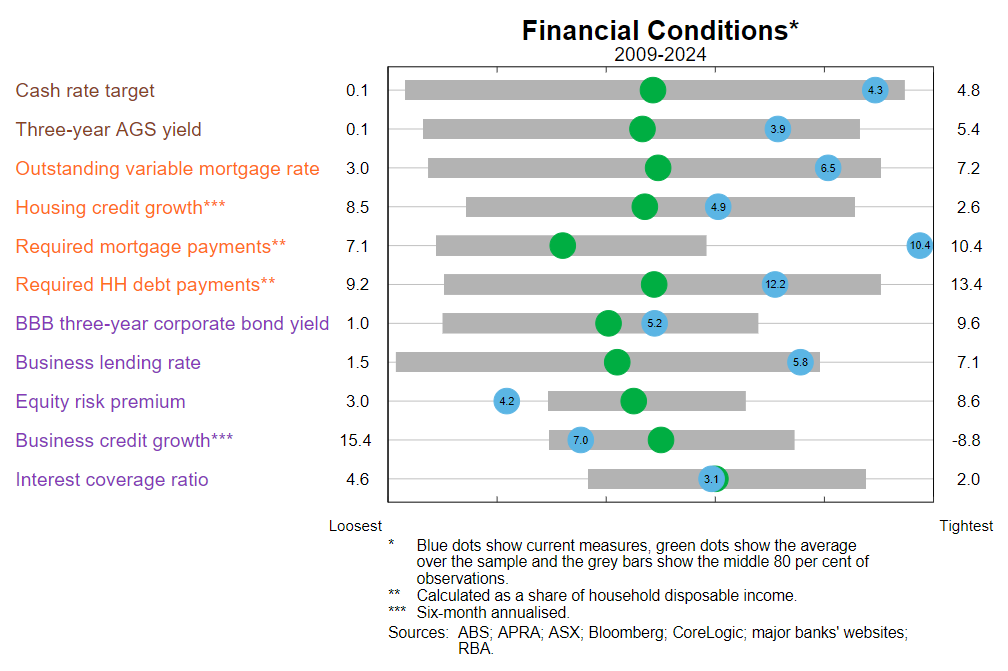

Ahead of the CPI release, RBA Assistant Governor of Financial Markets, Chris Kent, pointed to the RBA’s current policy setting being restrictive, but more so for households than businesses.

He also suggested the RBA’s estimate of the neutral rate has increased from 2.5% to 3.5% since the pandemic. This estimate is not that far below the current cash rate of 4.35%.

Using other measures of the tightness of financial conditions, including required mortgage payments, mortgage and business lending rates as well as household and business and credit growth, Kent pointed to financial conditions likely being more restrictive than suggested by the estimated neutral cash rate.

Whether this is restrictive enough to bring inflation back to target has been these ource of much debate in financial markets given that Australia’s policy rate setting is significantly below that of the US, Canada, NZ and the UK.

The further acceleration in inflation today suggests the RBA has more work to do. Indeed, this reacceleration is occurring before tax cuts and energy rebates put more money in households’ wallets and State as well as Federal government spending is ramped up.

The Q2 inflation number out on 31 July will ultimately determine if the RBA has to hike rates in August.

Current market pricing for a rate hike being a coin toss appears right to us.

For the AUD, the strong CPI data will benefit it against the NZD and CAD, but the currency will continue to struggle against the USD given weak iron ore prices, a declining CNY and investors being wary of selling USD ahead of the US core PCE data later this week.

AUD still stuck in the range.