Don't look now but DXY is back in the saddle:

AUD put in an impressive shooting star reversal:

Gold got whacked, oil looks like it wants to retest the lows:

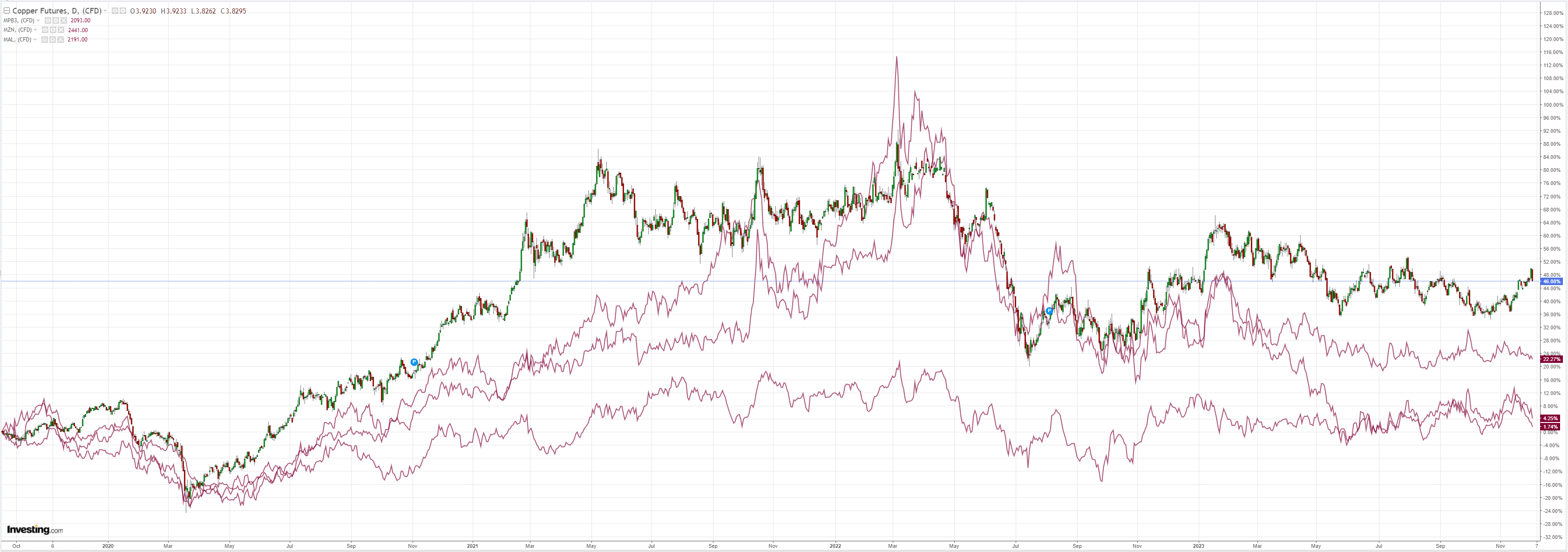

Dirt was hosed:

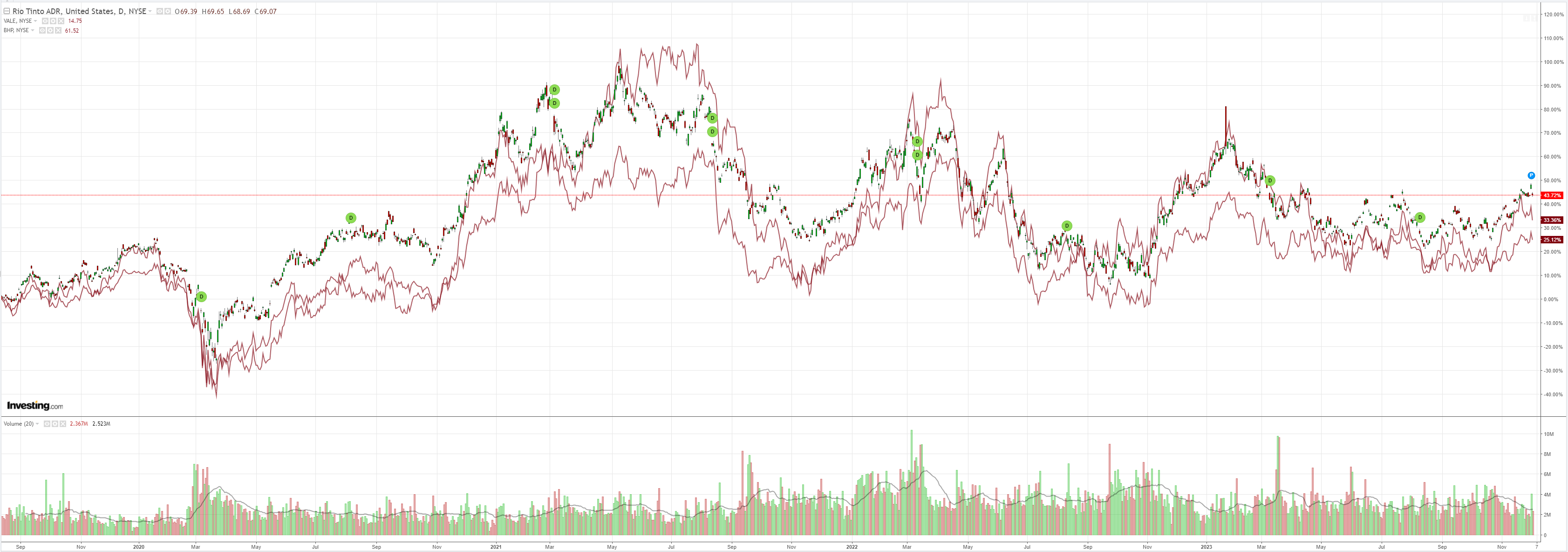

Big miners puked:

EM (China) is dead and buried:

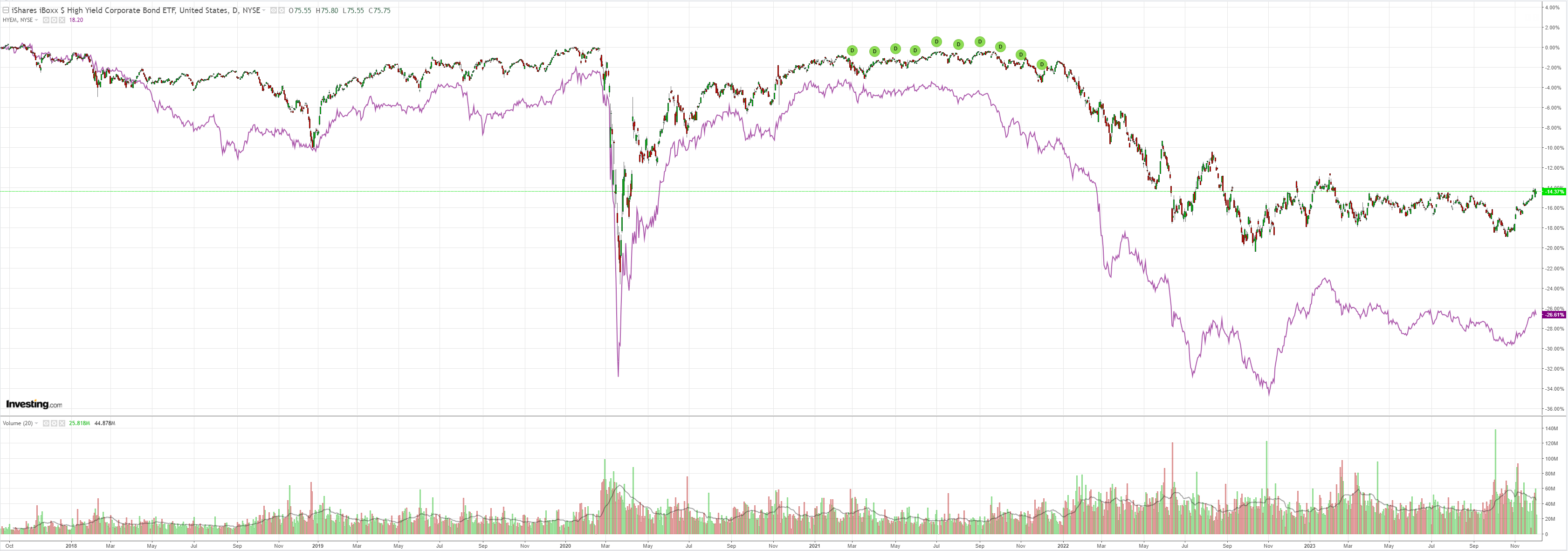

Junk stalled:

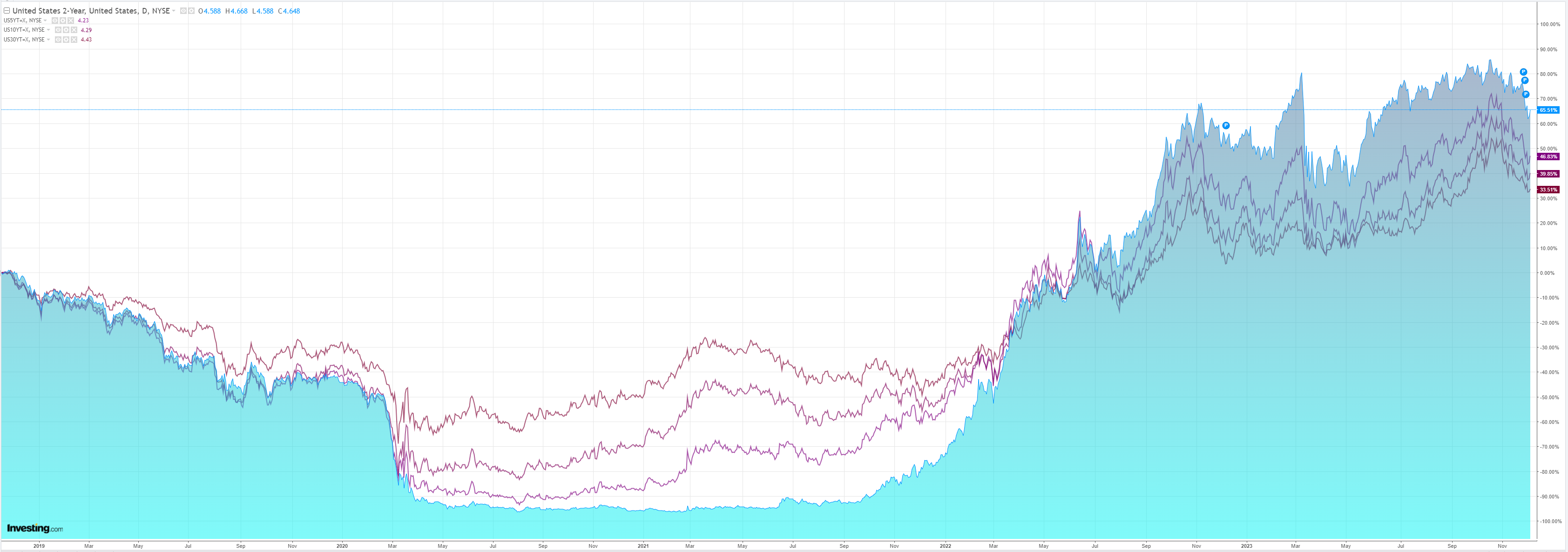

Yields popped:

Stocks dropped:

There was no particular data point, but a pop in SOFR reminded markets that QT and tightening are ongoing even if it wishes otherwise. Charlie McElligott at Nomura:

In my view, and being grotesquely over-simplistic, the impulse higher in the Friday SOFR fix was characteristic of “higher level of funding volatility” at the very least, and a likely function of QT slow-drip impacts and a shift within sponsored-repo funding, which may finally beginning to pass-along costs to end-users…which is certainly related to- and meaningful into the year-end turn.

At the very least, this SOFR fix is showing signs of deteriorating liquidity / tighter funding into YE, which is probably a fair-signal for today’s “De-Grossing” flows from recent Macro and Thematic “trend trades,” as higher funding / deteriorating liquidity is only further incentivizing monetization of “winners” and / or closing out of “losers” at this point in the PNL year, as performance is looking to be protected (and / or late-comers are getting “stopped-out”).

So Bonds / STIRS selling off meaningfully…Gold smashed lower….USD squeezed higher….and broad Equities Index lower too, although the reversal there is more about the multi-month Themes trading backwards instead of absolute Spot Index level per se:i.e. where“Momentum” longs in say Quality / AI / Secular Growth / MegaCap Tech are all getting hit substantially, while heavily shorted / underweighted Equities in economically-sensitive Small Caps and “Cyclical Value” factor, heavily shorted “Leveraged Balance Sheet” and “Low Quality” (e.g. Unprofitable Tech now +10% in 2d, LOL) are all squeezing sharply. De-gross.

In other words, today is much more about a risk-management exercise to protect performance (monetize “winners” for what you can, in a PNL-challenged year) as YE liquidity begins to dry-up while funding volatility shows signs of life….than what would be yet-another shift in the tactical market narrative…i.e. I still don’t see Equities Index moving much at the very-least into post Op-Ex unclenching, unless of course we were to see this Rates / Bond selloff pick-up steam in short-order….

Although YES (and somewhat turning the page on the above observations), the low Delta—but largest “shock / reversal risk” to 2024’s currently consensus “Dovish Fed cuts on immaculate disinflation (and not recession)” softer-landing market views—would theoretically look extremely similar to today’s “reversal flows”(Bonds down / Yields up, Bear-flattening, USD higher, Equities thematic reversal Cyclical Value & Low Quality over Secular Growth Mega Cap High Quality), in the case we were to see yet another “Animal Spirits” data & inflation reacceleration surprise in, say 2Q24, off the back of all this recent FCI easing allowing the economy—and more imporantly, inflation—to “re-heat / stabilize sticky higher,” to the hypothetical extreme chagrin of the Fed.

I see FCI indexes as the chop overlaying the tide of interest and QT. So long as the latter has not been going out too fast, or has been offset by fiscal, then chop can appear to be the driver of underlying economics.

But if the tide is genuinely going out then chop only serves to disguise the fact and will catch down in due course.

What does this mean for forex? It remains my that the US economy is going to slow more meaningfully than most think into 2024 as both public and private credit recede (soft or hard landing). Without rate cuts sooner rather than later the chop of markets that drive FCIs will follow.

That means volatility while markets figure it out!

Overall, AUD is still more likely to move higher in the months ahead but it will be bumpy.