DXY was soft last night:

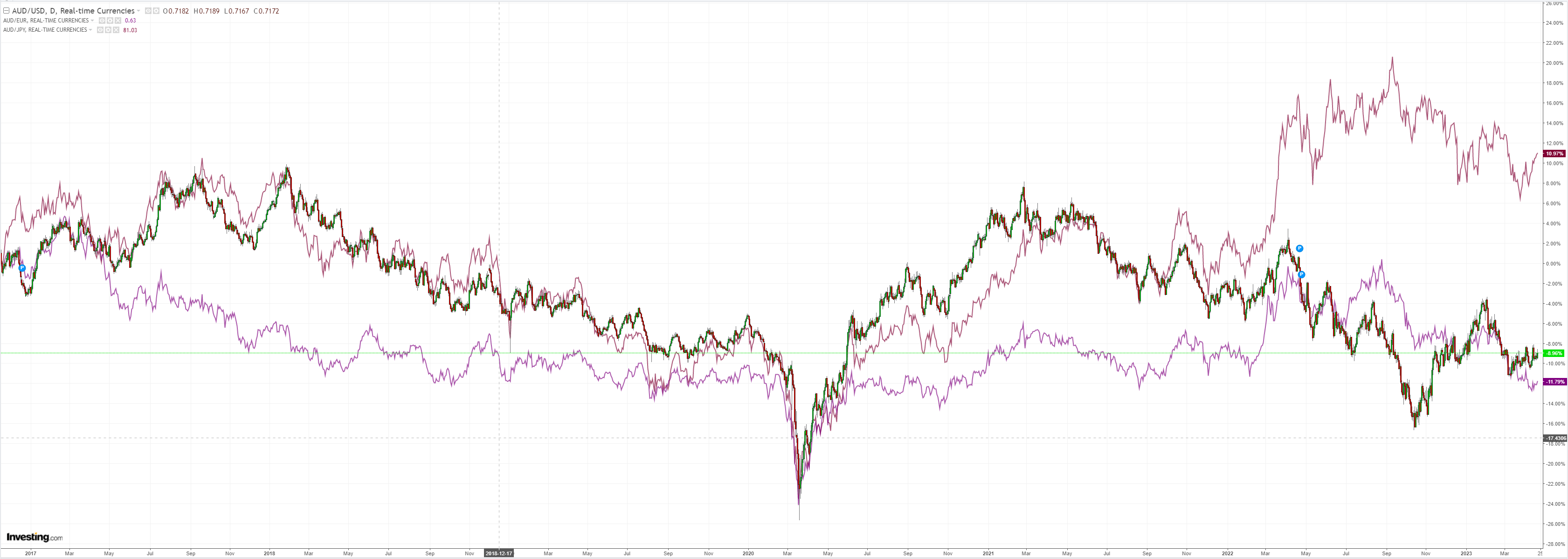

AUD lifted:

Oil is breaking down again. Not gold:

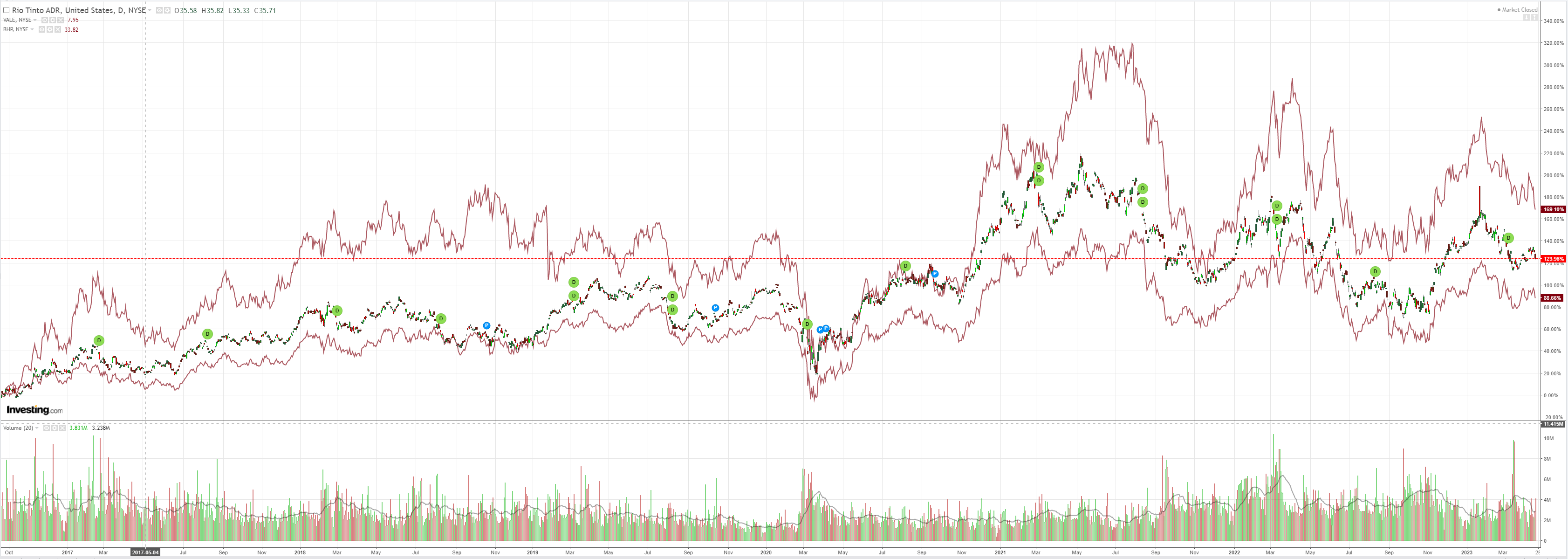

Dirt is the great sideways:

Miners (NYSE:RIO) are in trouble:

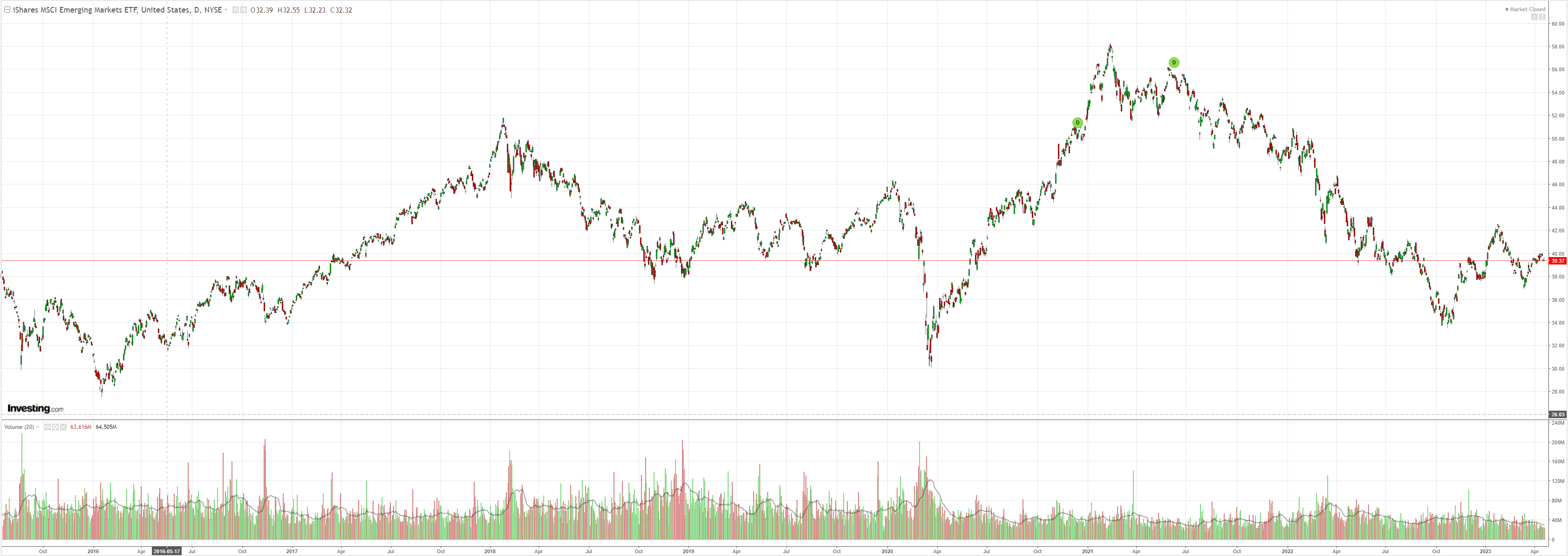

EM stocks (NYSE:EEM) don’t look well, either:

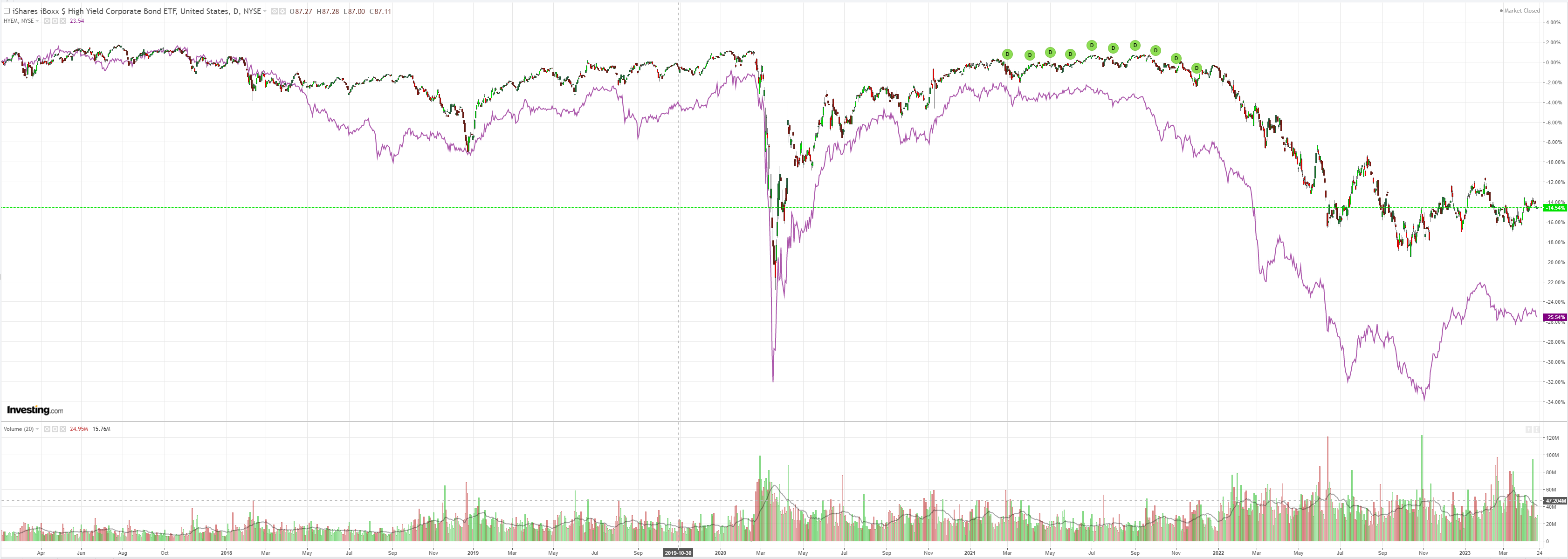

Junk spreads (NYSE:HYG) widened:

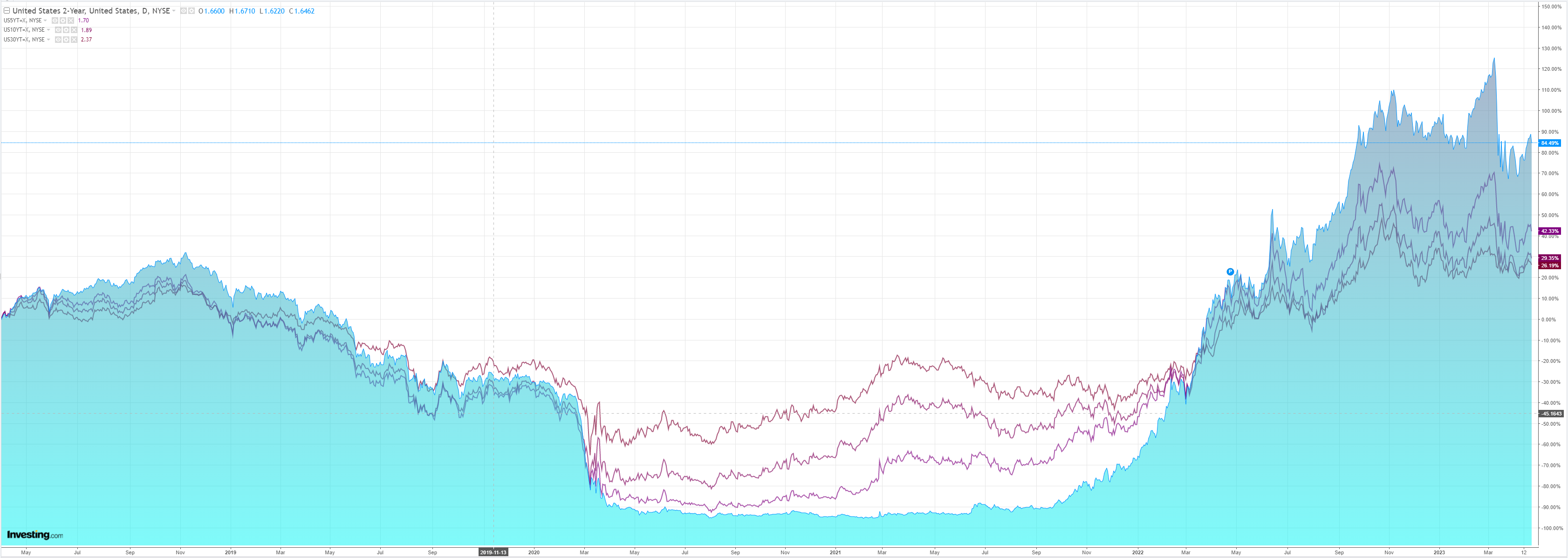

The curve steepened:

Stocks fell modestly:

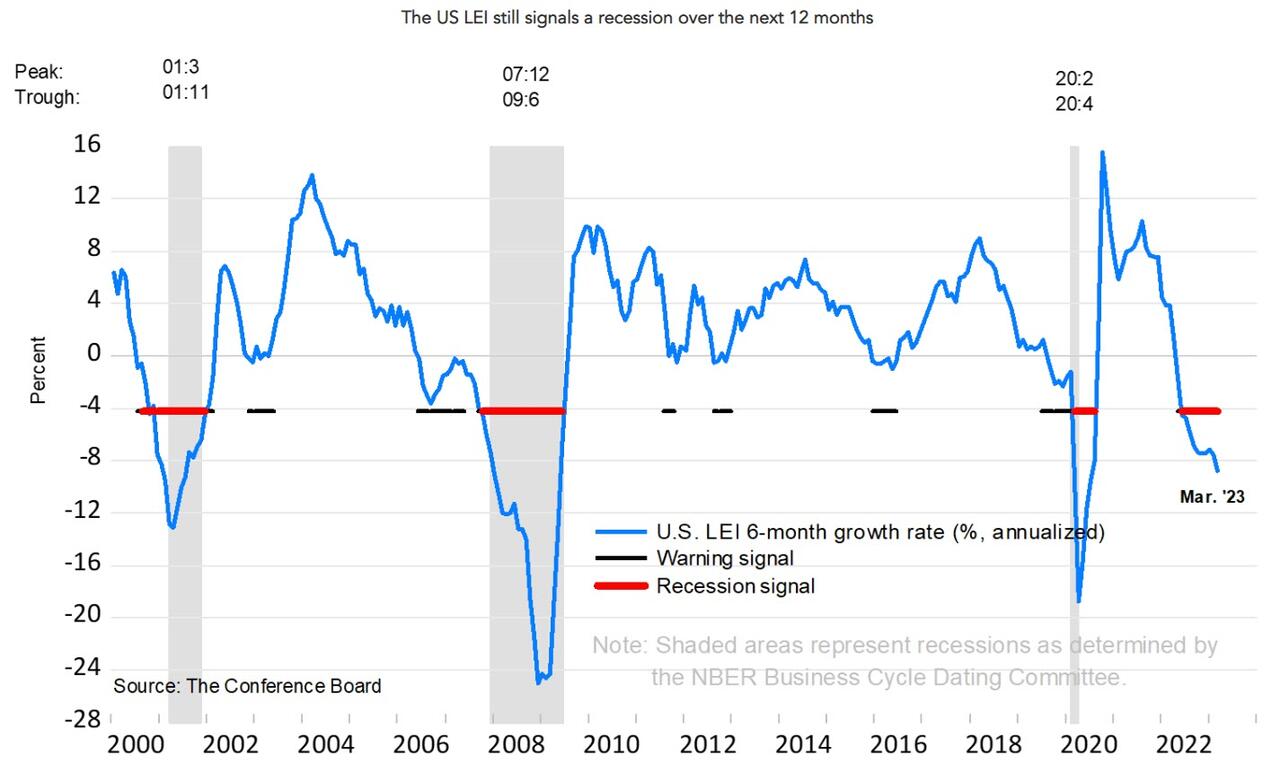

Both North Atlantic central banks remain hawkish despite data such as this:

“The weaknesses among the index’s components were widespread in March and have been so over the past six months, which pushed the growth rate of the LEI deeper into negative territory.

Only stock prices and manufacturers’ new orders for consumer goods and materials contributed positively over the last six months.

The Conference Board forecasts that economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023.”

LEI has a very good track record.

So, at this juncture, we have:

- a US C&I credit crunch;

- a global CRE credit crunch;

- rapidly fading US data and severely inverted yield curve;

- fast approaching debt-ceiling debacle and sudden stop in federal spending;

- a still hiking Fed into too high inflation;

- oil output cuts that do nothing for prices;

- a Chinese recovery that looks a lot more statistical than it does real for net global demand;

- Asian tigers with crashing exports, and

- slumping European bank credit, and a rabidly hiking ECB.

On the bull side, we have…stocks that always go up…

I recommend caution for AUD.