DXY firmed towards former support which should now be resistance if the breakdown is real:

AUD was flogged:

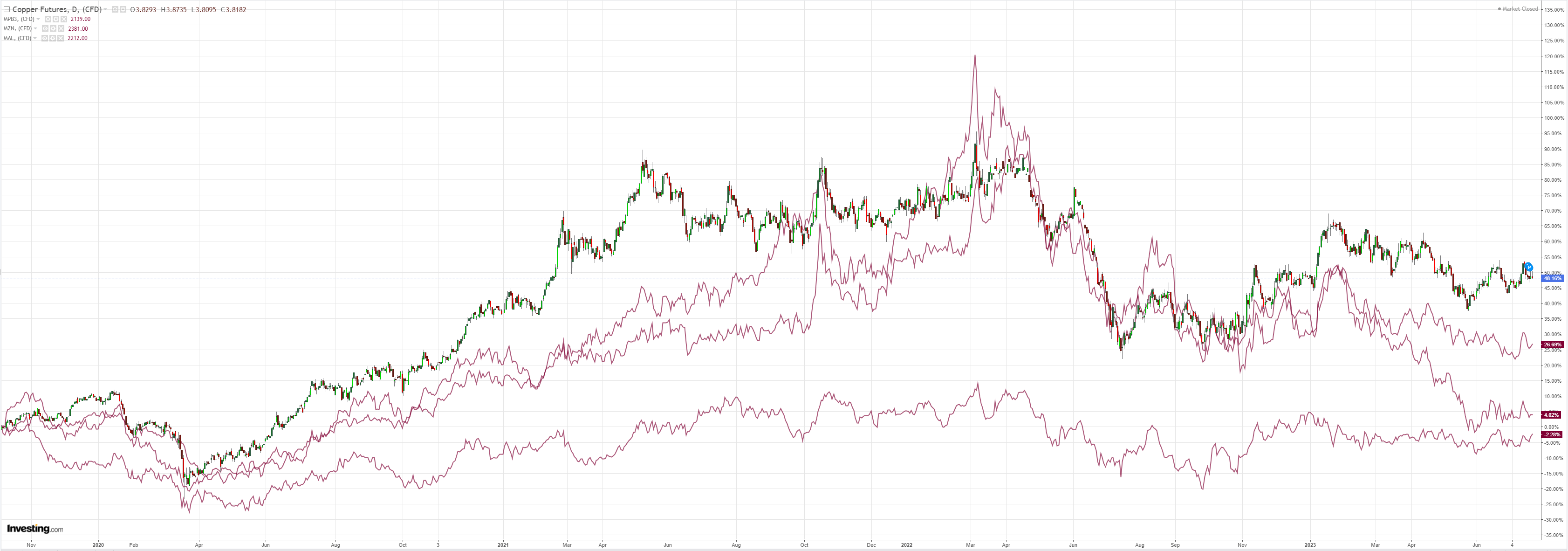

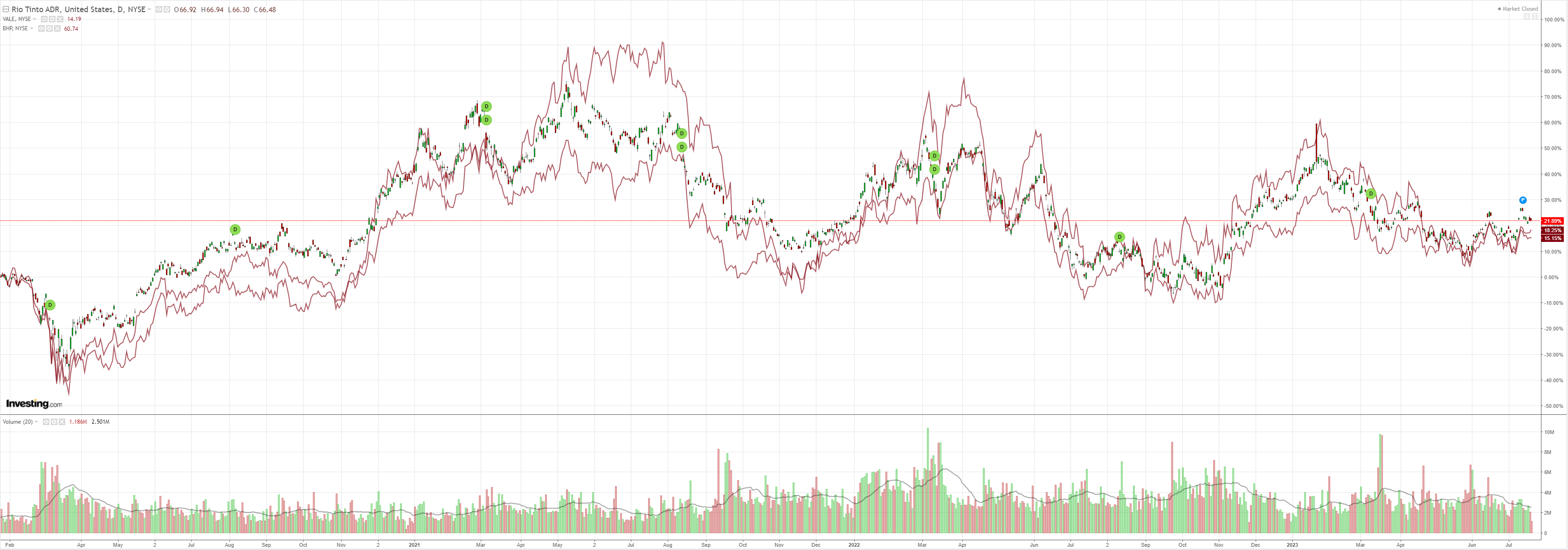

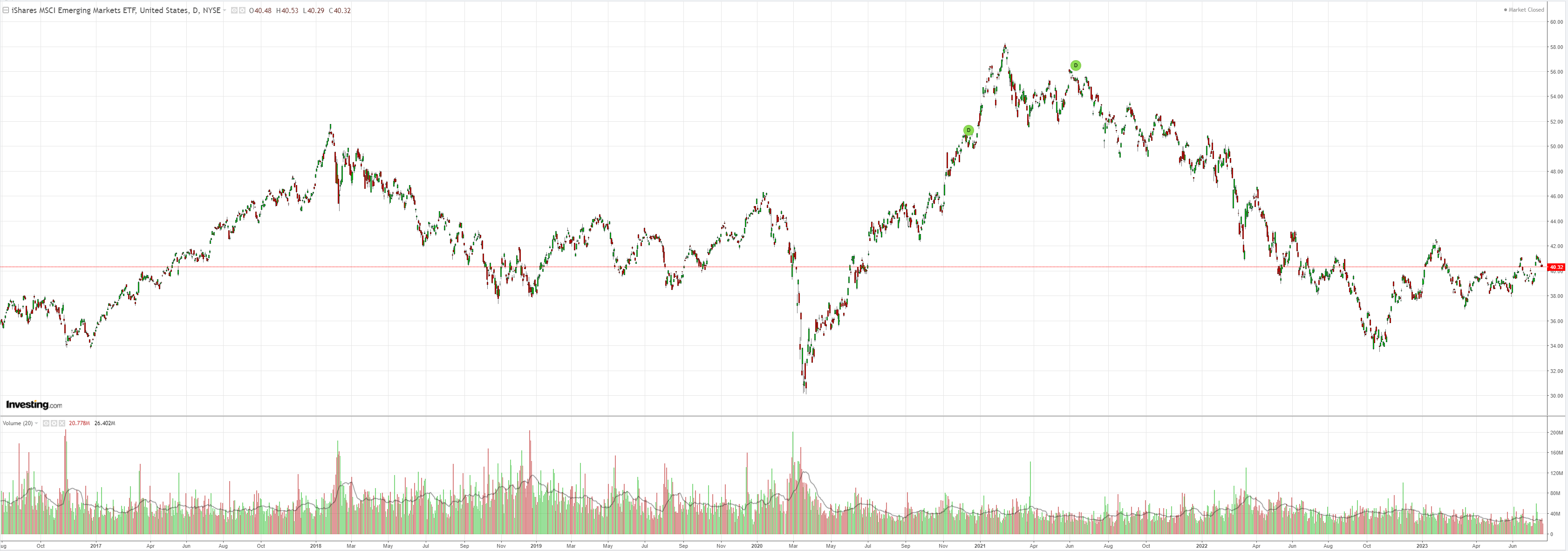

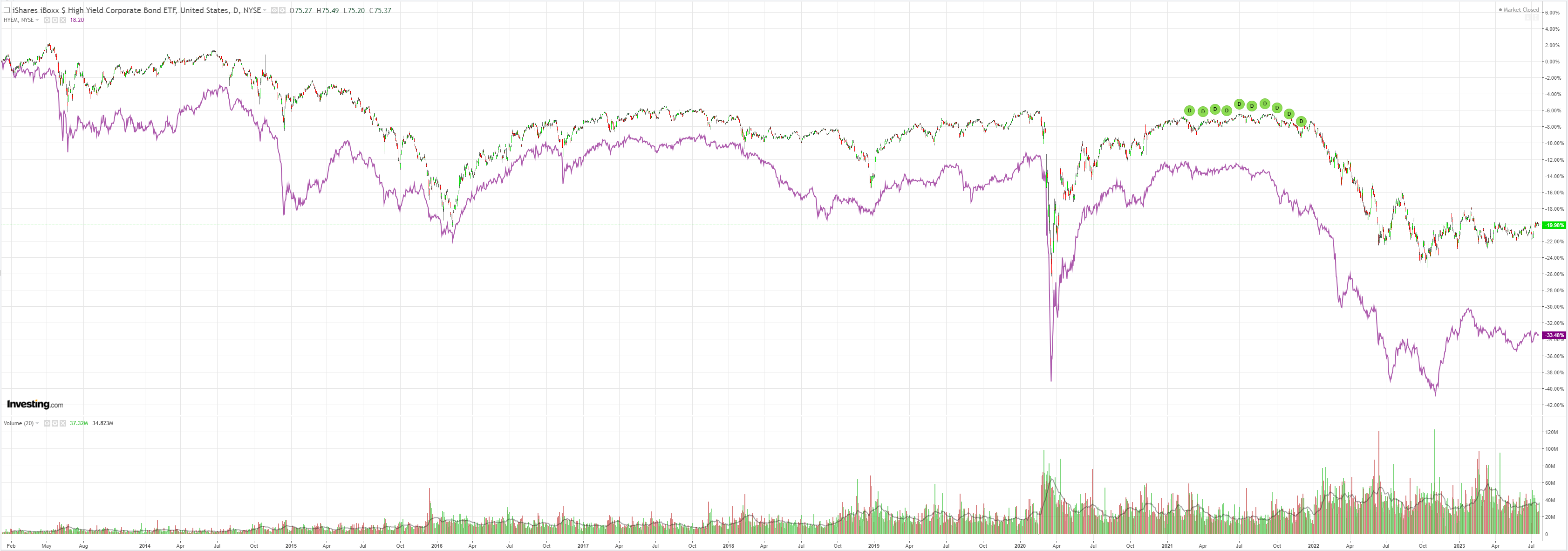

The Crap Complex – dirt, miners Rio (NYSE:RIO), EM (NYSE:EEM) and junk (NYSE:HYG)– are all going absolutely nowhere:

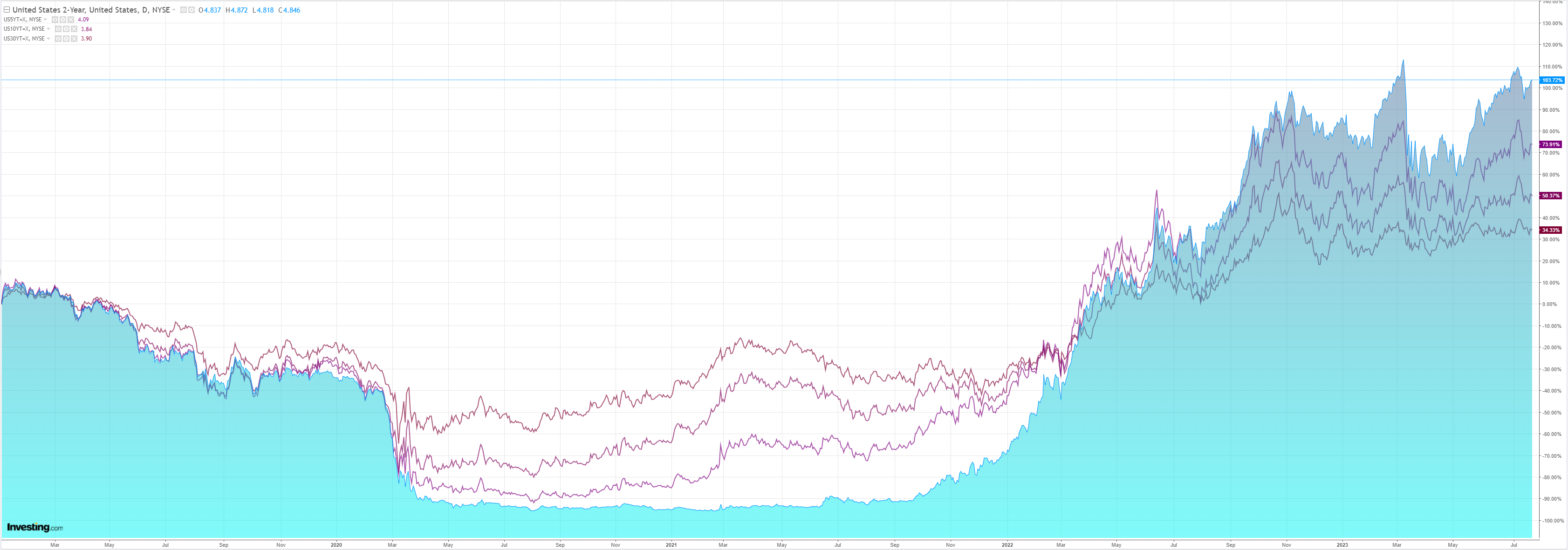

Treasury yields eased:

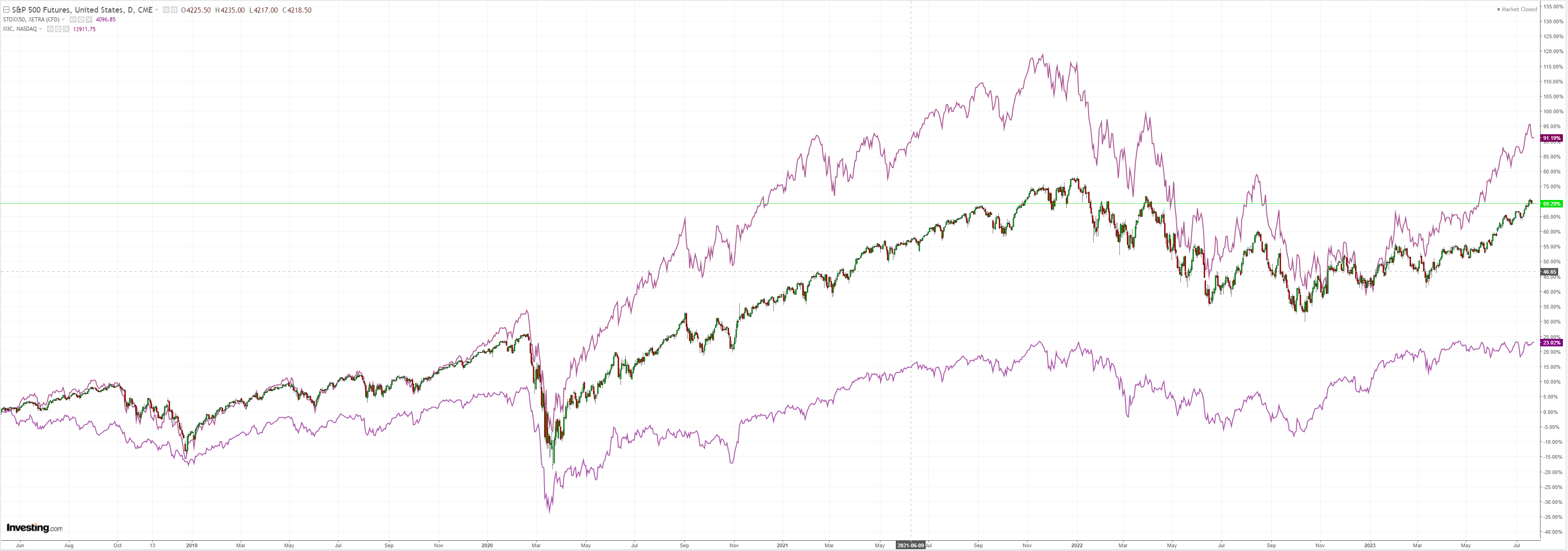

Stocks fell:

Goldman has a pretty ordinary record on forex but it is making sense at the moment:

USD: Sticking with shallow Dollar depreciation, even after the last hike.

All year, we have argued that the Dollar’s decline from last year’s peak will be shallow and bumpy. Despite the sharper decline after last week’s US CPI report, we are sticking with that view. The benign inflation outlook should keep the Dollar on a depreciation trend as the factors behind last year’s peak can recede further, and cyclical betas should take a leading role. But we think it is another turn on the bumpy path rather than a change in trajectory, for three reasons. First, our US inflation forecast and Fed outlook are somewhat ‘stickier’ than current market pricing for a faster inflation deceleration and a chance of rate cuts early next year. So, we do not think the Fed will be able to pivot as quickly as it often does, even if this is the final hike. We still think the risk of reacceleration will be at least as pertinent as the risk of recession. Second, we have long argued that the global picture is ‘not that divergent’, and this is no different—the US is far from alone on the disinflation journey, and the relative policy outlook could even be modestly Dollar supportive. Third, FX is a relative asset and sharper Dollar depreciation requires better capital return prospects in the ‘challengers’. But, weak Euro area growth and a China policy path heading in the other direction means that is probably still some time away. That said, the non-recessionary rate cuts the market has begun to ponder would undercut a lot of these arguments and are the clearest risk to our ‘shallow’ view. A lot of these considerations should be on display at the FOMC meeting this week. While recent inflation news should be encouraging, the resilience in the economy (and some nascent signs of price surveys bottoming, Exhibit 1) should keep policymakers vigilant and likely to stress that the job is not done. Even if the market takes some relief if Chair Powell signals that future hikes will be subject to upcoming inflation prints, similar to earlier this year, we think markets have already moved a long way in this direction and suspect that the ECB will probably say something similar the following day.

I will add that the forthcoming Chinese Politburo meeting is crucial. If it surprises either way it will have a material impact upon CNY and EUR.

And, therefore, AUD.