DXY is a one-way rocketship to the stars. This is TINA, there is no alternative. My best guess is we’ll hit the millennial highs. Here’s the monthly chart for along term perspective.

AUD is the inverse and there is every chance we hit the COVID monthly lows as the global recession advances:

CNY is a falling meteorite. If I am right about China’s structural downshift in growth triggered by the end of the great property ponzi then post-2009 lows won’t hold, either:

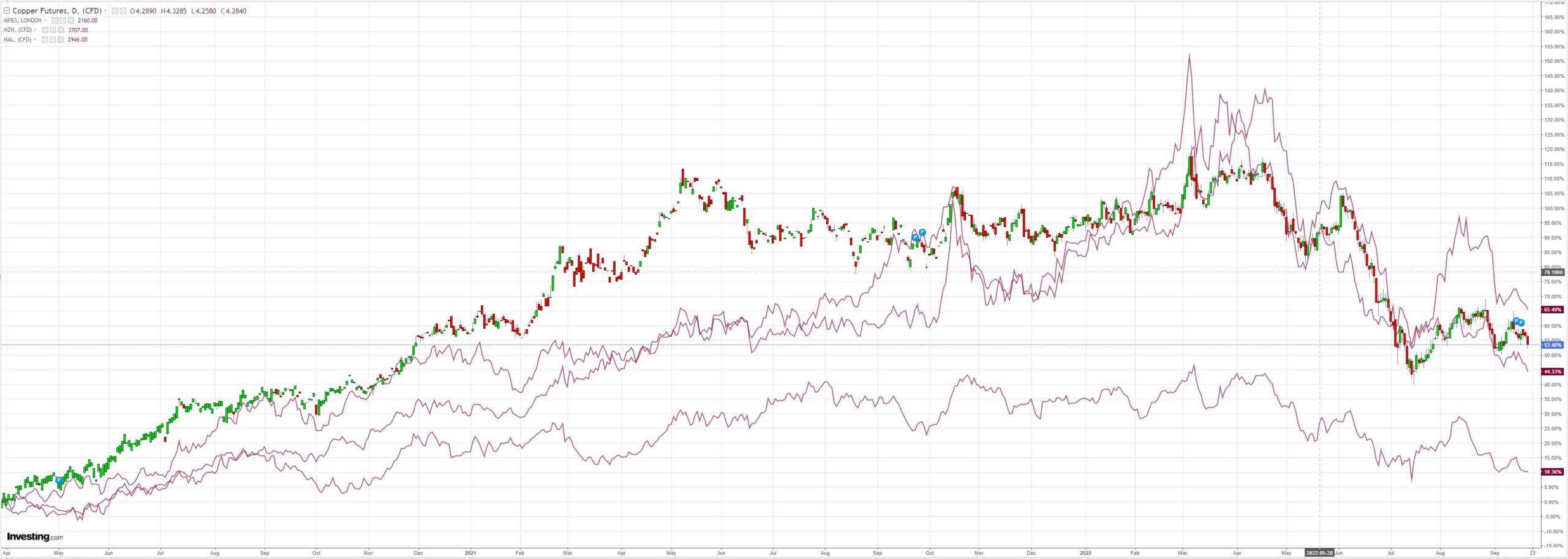

All commodities are on a hiding to nothing:

Big iron ore (NYSE:RIO) is right at the cliff’s edge:

EM equity (NYSE:EEM) is over it:

Junk (NYSE:HYG), too, is at the precipice:

As the US curve is beaten into a red, pulpy mess:

Taking stocks to the woodshed:

It was not a night for the faint of heart. Vladimir Putin went for partial mobilisation and here’s Peter Zeihan on the implications of that:

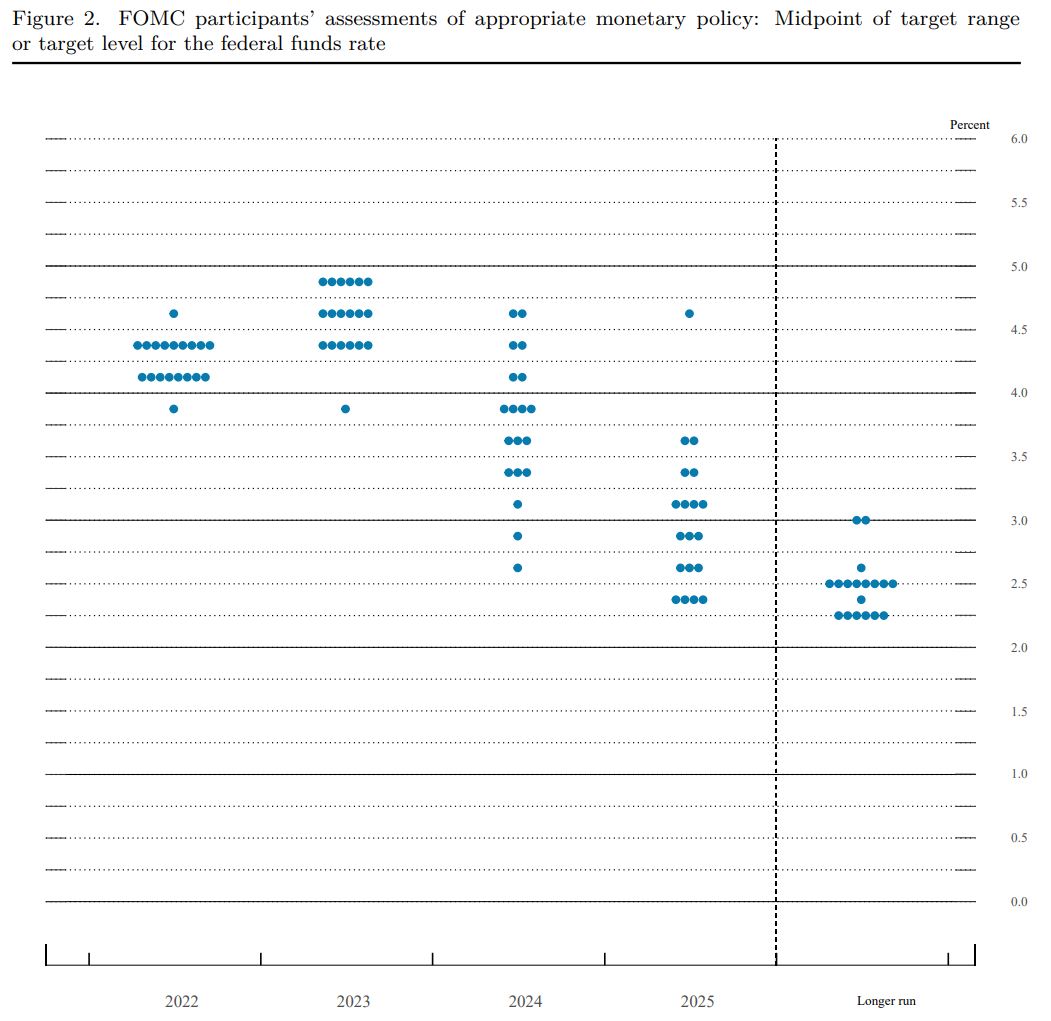

Then the Fed piled in with a 75bps hike plus a major lift in its dot plot for the terminal rate with rate cuts years away, a point Jay Powell reinforced in the presser:

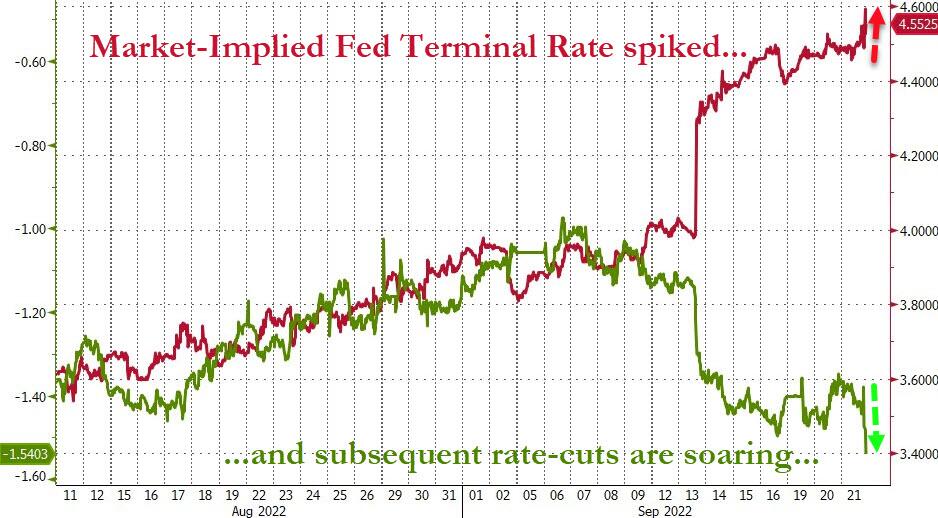

This is necessary to crush the equity village idiots. But the bond market is telling a different story that I agree with. The US curve is now the most inverted it’s been in a very long time (charts via ZH):

And rate cuts are on the way after the economy is crushed:

When the market narrative shifts sufficiently towards those cuts, DXY will top and take a lot of pressure off CNY. AUD will fly with reflation at that point.

But first comes the global recession, and whatever shocks that throws up, to trigger the blowoff in King Dollar and capitulation of AUD.