DXY to the moon:

AUD flushed:

Oil held up as Putin asked OPEC to fund his war with output cuts:

Base metals still in big trouble:

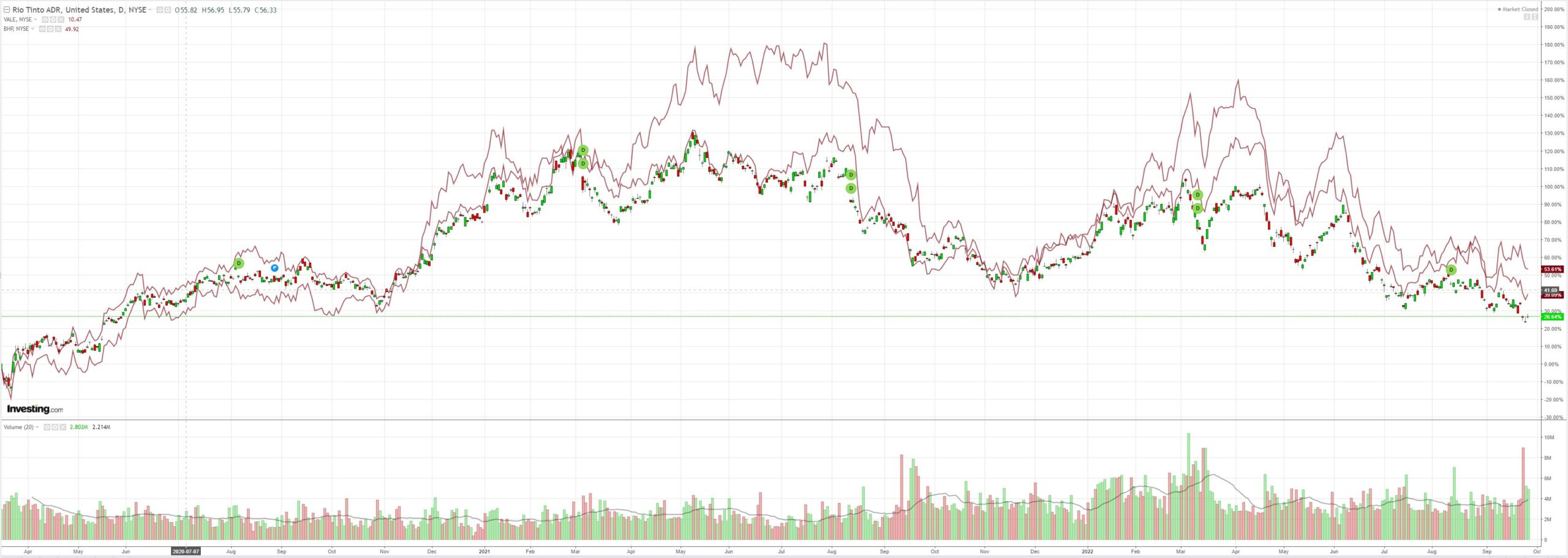

Big miners (NYSE:RIO) survived with iron ore:

EM (NYSE:EEM) flushed:

Junk (NYSE:HYG) flushed:

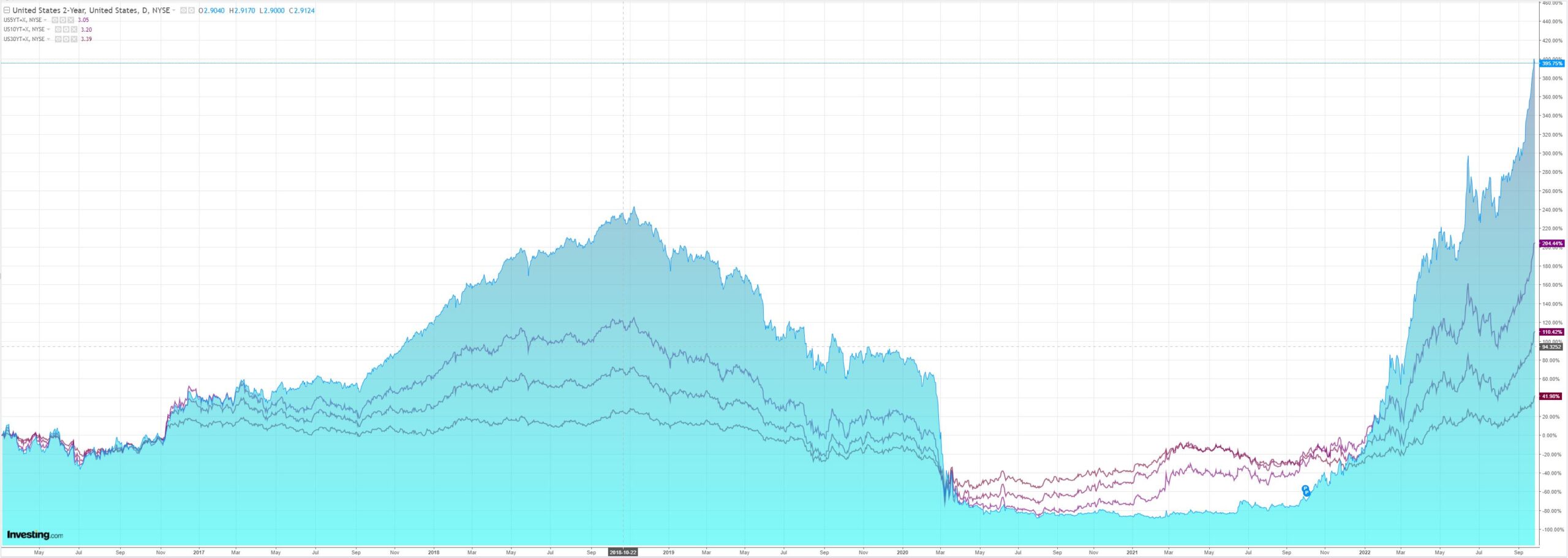

Treasuries flushed:

Stocks cling desperately to the cliff’s edge:

And the key chart, CNY/USD, was flushed to perhaps the most significant chart support level in modern Australian economic history:

For if CNY breaks through this level decisively then all hell is going to break loose in markets as it confirms that:

- China is going ex-growth as its property market adjusts structurally lower;

- China has no intention to rebalance its economy unleashing all kinds of trade war blowback;

- EM economies are now in direct competition with the largest trade gorilla ever landed on their shores;

- DXY has not topped out and EM economies will also see capital fleeing their shores;

- any and all EMs are at risk of imminent external crisis;

- stock prices are still too high;

- and, commodity prices are going much lower right along with the AUD.

The good news is, it will crush global inflation, which markets will understand in due course.