The DXY bull market charges on. Where will it peak? 125 looks like a good place to start:

Australian dollar was murdered to the post-COVID lows. The break on EUR and JPY is pretty bearish:

CNY is threatening new lows:

Oil eased. Gold will forecast the end of the DXY bull market. Not yet!

Metals are giving in slowly:

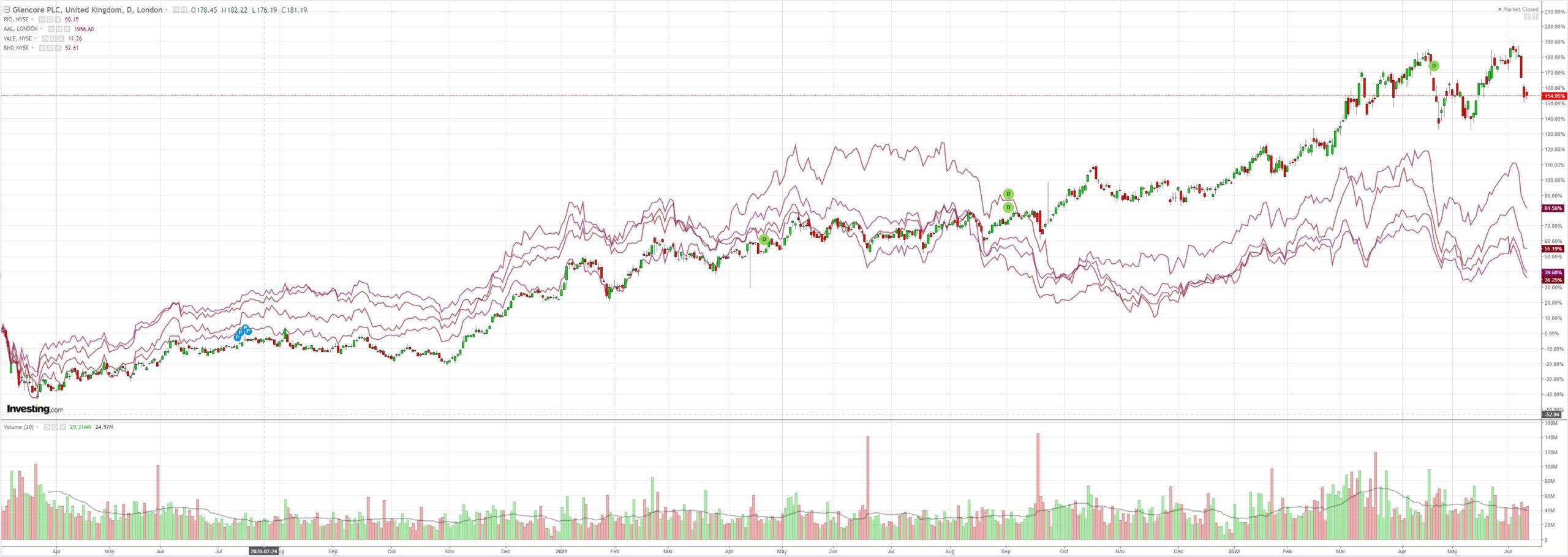

And miners (LON:GLEN):

EM equity (NYSE:EEM) held on as Wall St sells its latest balderdash of a China long:

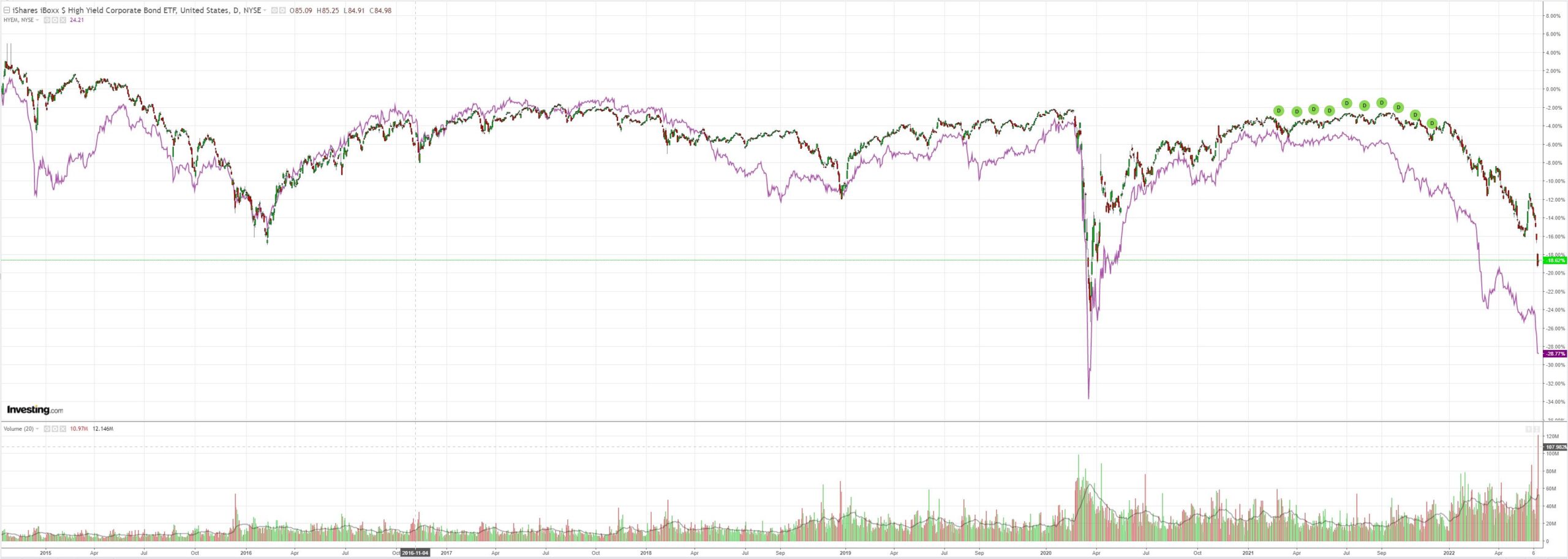

But not junk (NYSE:HYG):

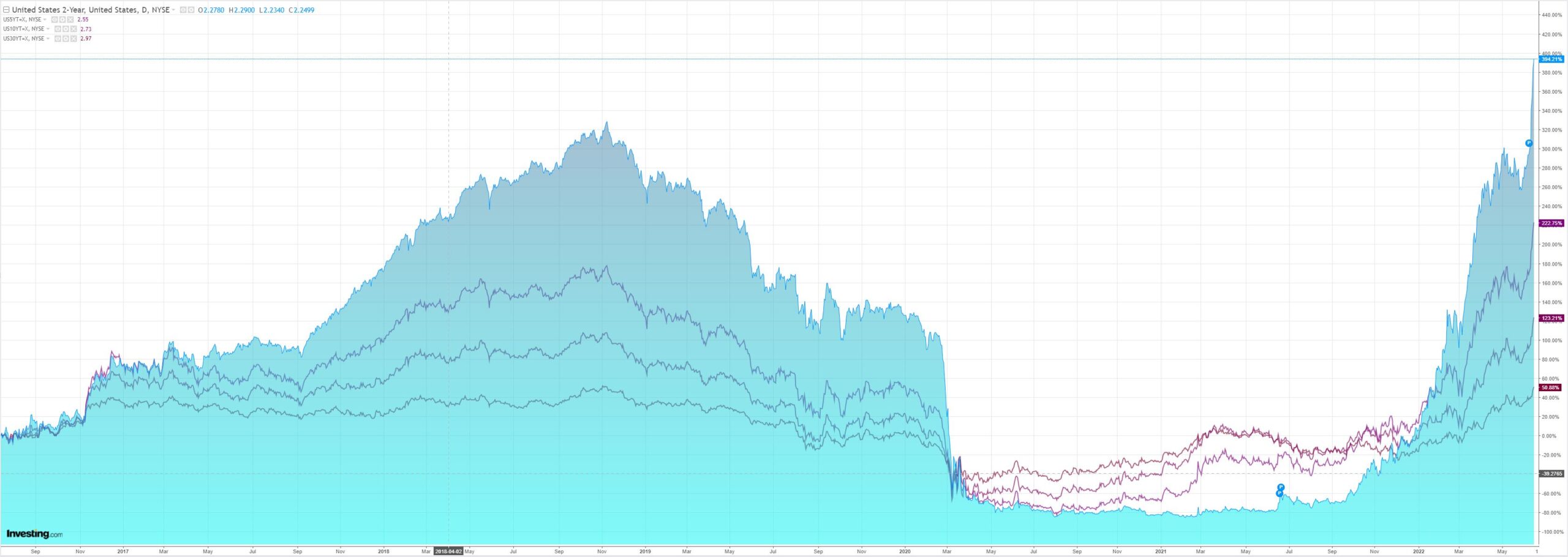

Yields to the moon:

Stocks down but not much:

Westpac has the wrap:

Event Wrap

US PPI was more benign than last week’s CPI release, rising 0.8%m/m (as estimated, prior revised to +0.4% from +0.5%), and 10.8%y/y (est. 10.9%, prior revised to 10.9% from 11.0%). Ex-food & energy rose +0.5%m/m (est. +0.6%, prior +0.2% from +0.6%) and 8.3%y/y (est. 8.6%, prior revised to 8.6% from 8.8%). NFIB small business optimism survey remained low but close to estimates at 93.1 (est. 93.0, prior 93.2).

Former FOMC member Dudley said he believes the Fed will hike by 75bp to deal with surging inflation: “My sense is that the Fed has decided to do 75 basis points rather than 50 basis points because of the data we’ve gotten over the last week or so showing higher inflation and maybe some more disturbing news on inflation expectations.” He said he doesn’t see a downturn as an immediate consequence of aggressive rate rises, but that trouble looms: “I don’t expect a recession in the very near term…the economy has considerable forward momentum, which is precisely why the Federal Reserve needs to tighten monetary policy quite a bit to slow down the economy, so I think this is mostly a 2023-2024 story in terms of hard landing.” On the balance sheet, he said it is still providing stimulus to the economy. Even allowing for maturity runoffs, “the balance sheet is not moving to a tight setting. It’s not going to get even to neutral for about three years.”

German and Eurozone ZEW surveys rose as anticipated as concerns over the Ukraine conflict were pared. German expectations rose to -28 (est. -26.8, prior -34.3) and current situation rose to -27.6 (est. -31.0, prior -36.5). Eurozone expectations rose to -28.0 from -29.5, while current situation rose to -26.4 from -35.0.

UK labour data for May was mixed, unemployment rising to 3.8% from prior 3.7% (est. 3.6%), but other components were more nuanced. Ex-bonus wages rose 4.2%y/y (est. 4.0%), Feb-Apr employment rose 177k (est. +106k), and May payrolls rose 90k (est. +70k).

Event Outlook

Aust: Westpac-MI Consumer Sentiment is set to see interest rate concerns dominate again with the RBA’s 50bp rate hike in June.

NZ: REINZ house prices and sales will continue to reflect a slowing market in May given the ongoing lifts in mortgage rates. The current account deficit is expected to widen further (relative to GDP) in Q1 given the strength of domestic demand (Westpac f/c: -6.0%).

Japan: Volatility in machinery orders will likely persist in April as supply issues cloud the investment outlook (market f/c: -1.3%).

China: Near-term weakness in consumption will continue to weigh on retail sales in May (market f/c: -1.7%yr ytd), although the building momentum in fixed asset investment and lingering strength in industrial production are providing resilience (market f/c: 6.0%yr ytd and 3.1%yr ytd respectively).

Eur: The European trade deficit should remain wide in April given elevated energy prices (market f/c: -€14.5bn). This, and supply issues, are ongoing headwinds to industrial production (market f/c: 0.5%).

US: The FOMC is expected to raise the fed funds rate by 50bp in June, marking the second of three consecutive 50bp rate hikes. As a consequence of higher rates and inflation, retail sales should be weak in May (market f/c: 0.1%). The Fed Empire state index has been volatile as of late, but the firm order pipeline will continue to support NY manufacturing (market f/c: 2.5). Meanwhile, import prices are expected to remain elevated (market f/c: 1.1%) and business inventories should continue building at a robust pace (market f/c: 1.2%). The NAHB housing market index will reflect the concerns of affordability, rising input costs and interest rates in June (market f/c: 67).

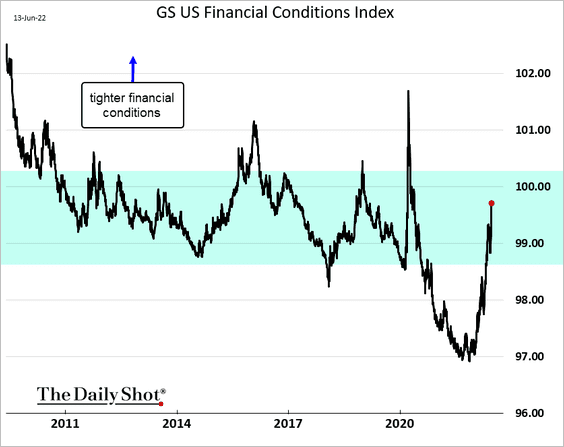

There is no end in sight to the bearish impulses in the market. US financial conditions are not tight enough yet:

Looks to me like we’re about halfway to where we’ll end up as the Fed accelerates hiking, something breaks, and a market panic overshoots the tightening.

AUD down, down.