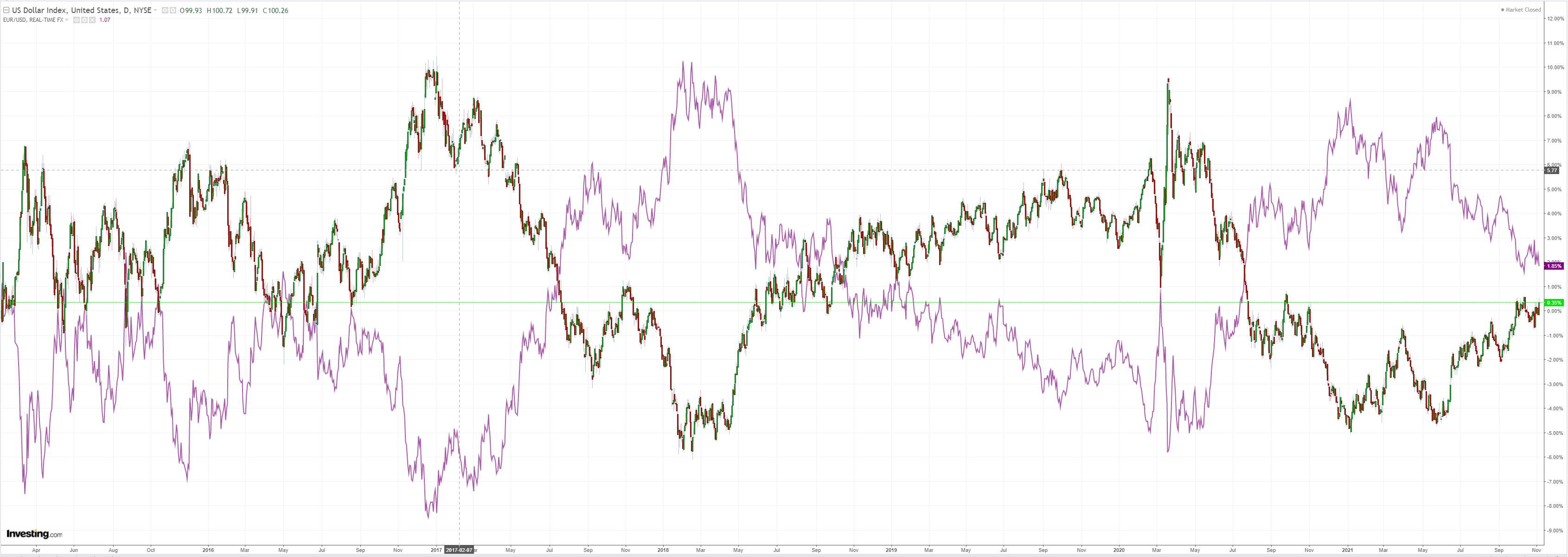

DXY was up strongly last night and its chart is bullish as EUR fades:

Australian dollar was hammered:

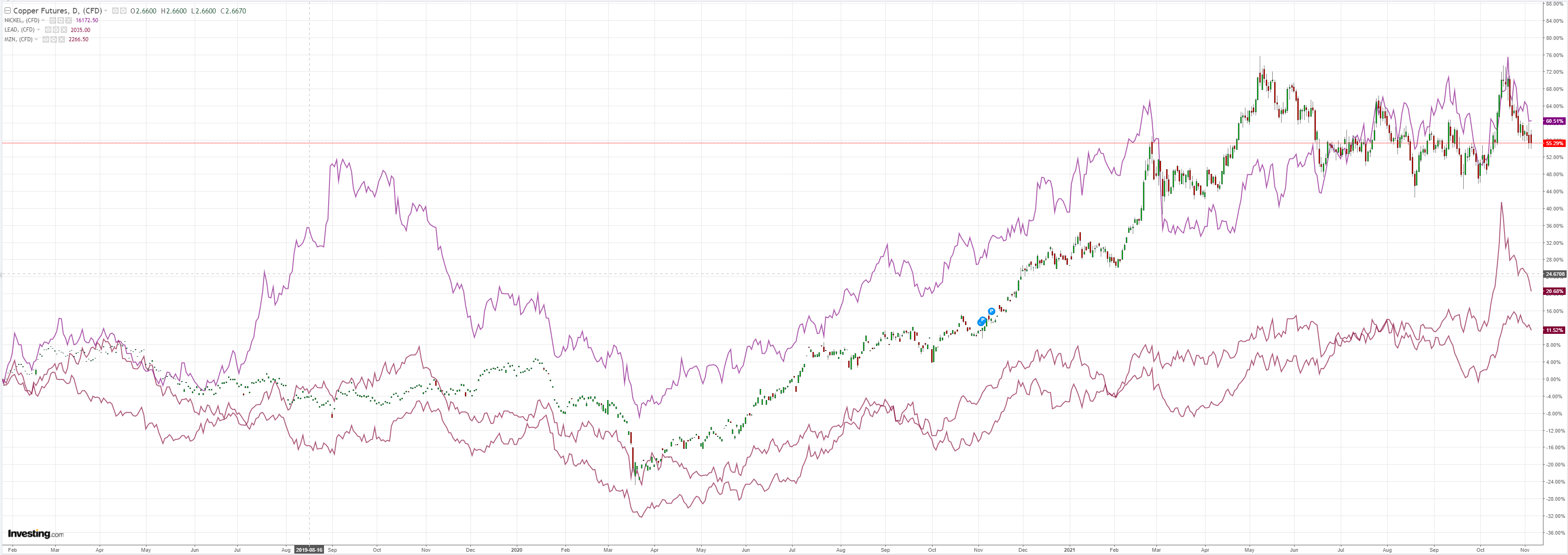

Base metals were soft:

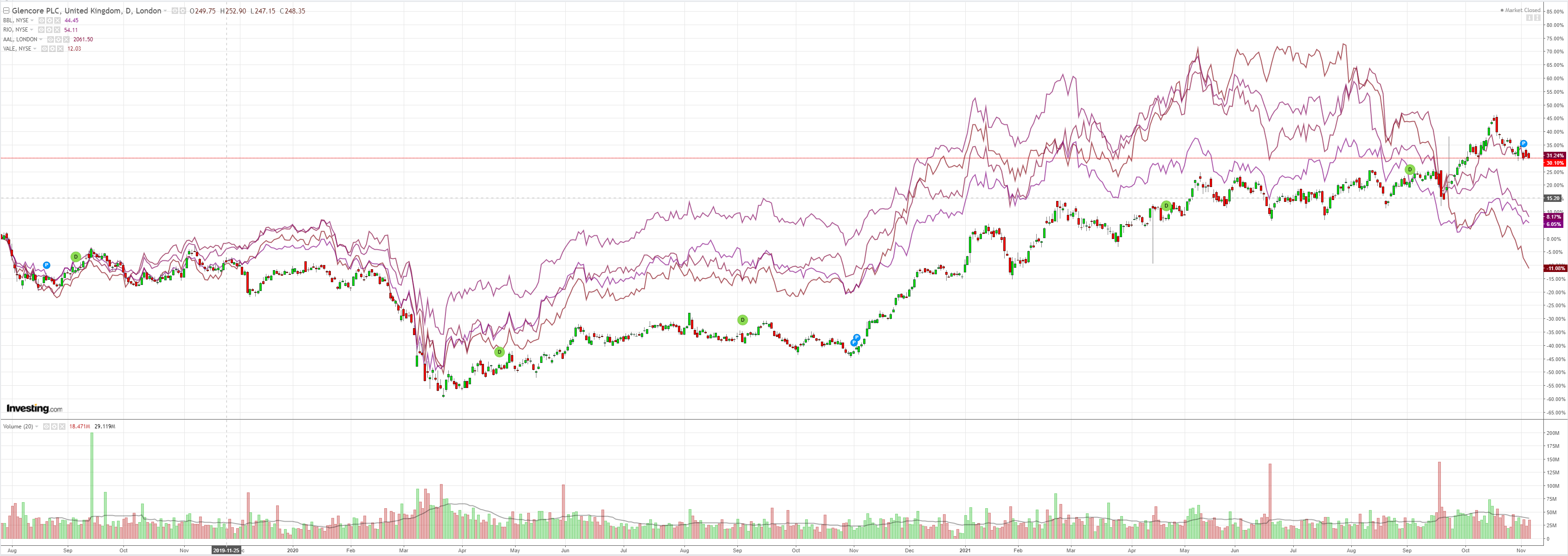

Big iron is falling like an anvil:

EM stocks hung on:

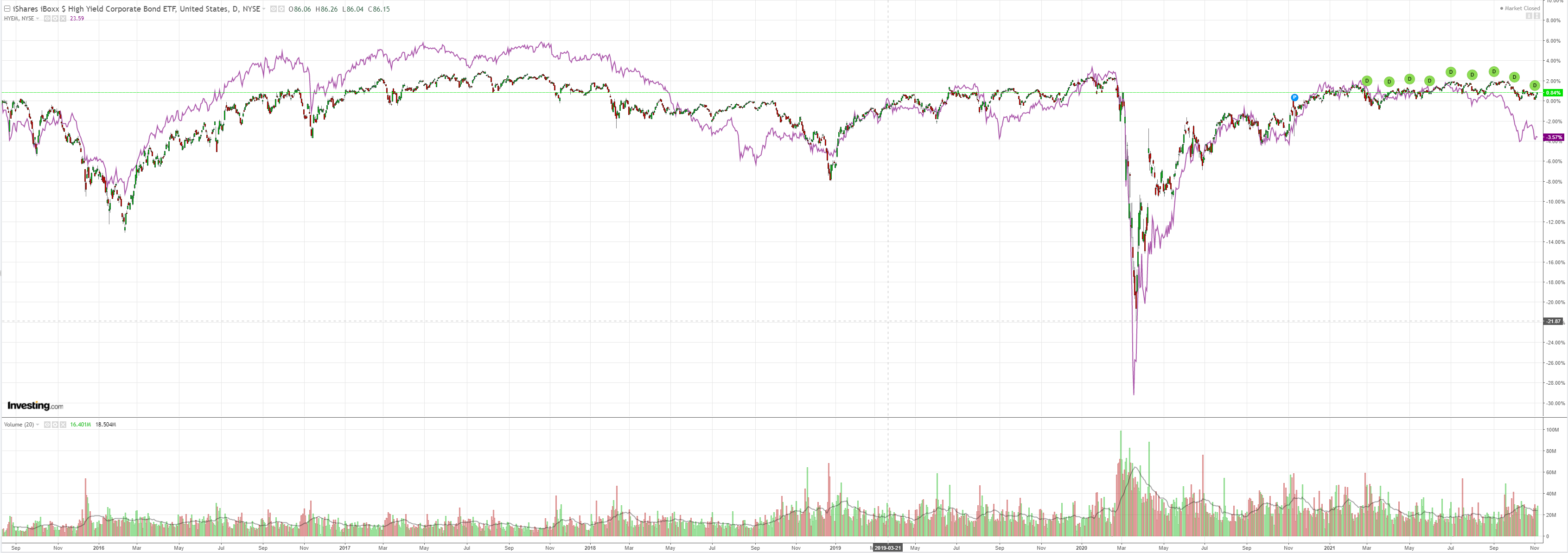

Junk is still warning:

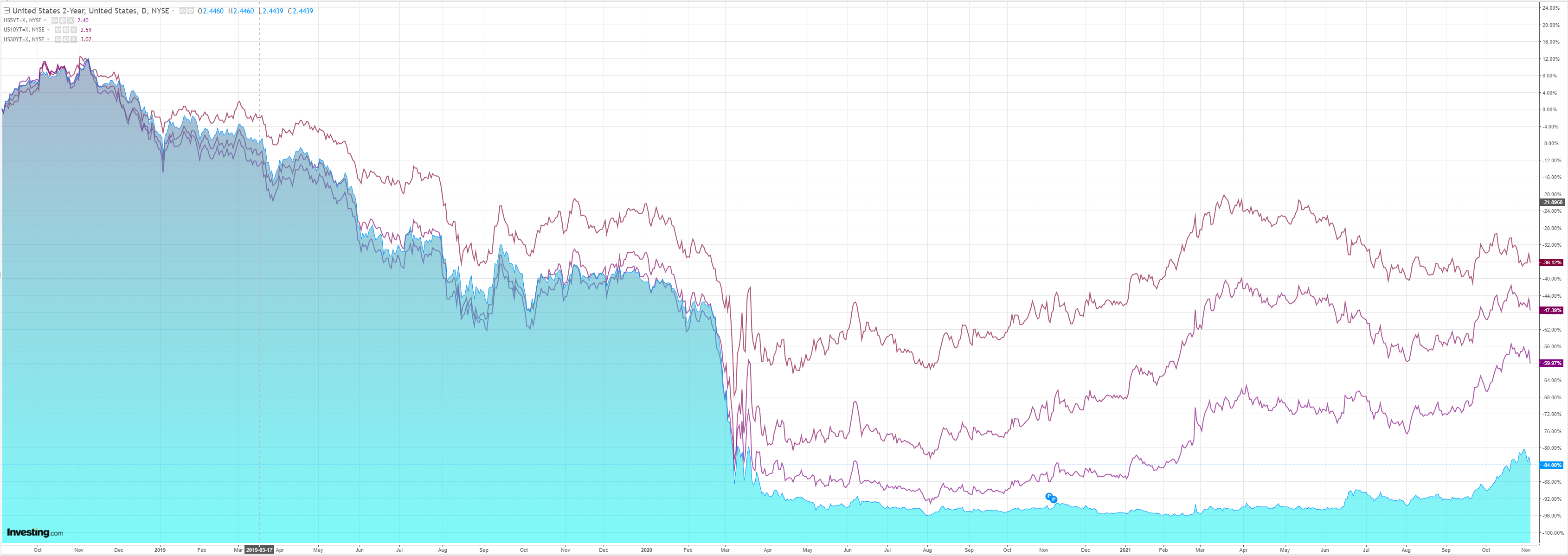

Treasury yields were slammed across the curve:

Needless to say, GAMMA surged:

Westpac has the wrap:

Event Wrap

The Bank of England left policy unchanged, in a 7-2 vote on the policy rate remaining at 0.10% and a 6-3 vote on maintaining QE into the end of 2021. The detailing of inflationary pressures, slack in the economy, concern over post furlough and employment all led to a softer path for the projected Bank Rate than markets had expected, surprising forecasters who were 50:50 on the prospects of a hike.

US trade deficit in September widened to USD80.9bn, close to expectations of USD80.2bn). Weekly initial jobless claims were close to estimates at 269k (est. 275k) and continuing claims were slightly below estimates at 2.205mn (est. 2.15mn). Q3 productivity fell 5.0%q/q (est. -3.1%q/q), on declining activity and a distorted rise in unit labour costs of +8.3%q/q (est. 7.7%q/q).

Eurozone PPI in September rose to 16.0%y/y (est. 15.4%y/y), reflecting the surging energy and supply constraints related costs cited in recent surveys. Eurozone final Markit services PMI fell to 54.6 from the Flash 54.6. German factory orders rose 1.3%m/m in September (est. +1.8%m/m), from a revised -8.8%m/m slump (prior -7/7%m/m), the annual WDA level pulled down to +9.7%y/y (est. +11.3%y/y).

Norges Bank met market expectations with the policy rate held at 0.25% this month, but with a strong guidance towards rates rising in December as domestic activity improvements offset Covid concerns.

Event Outlook

Aust: The RBA’s November Statement on Monetary Policy will be released, providing full detail on the Bank’s latest forecasts and their views on the risks to the outlook.

China: The Q3 current account balance will provide an in-depth look at China’s trade position, highlighting in particular the strength of exports.

Europe: Retail sales for September are expected to post a slight gain as the economy’s reopening sees more spending on services and less on the goods which make up the bulk of consumption surveyed for this release (market f/c: 0.2%).

US: Non-farm payrolls should see a strong gain in October (market median f/c +450k, Westpac +500k). The unemployment rate should edge down despite higher participation. Average hourly earnings are meanwhile expected to rise at a robust pace as labour shortages continue to support wage growth (Westpac f/c: 0.5%).

The BOE knocked some sense into bond markets and there is only one way to read that shift in the US yield curve which howled Fed “policy error”.

Who knows if this is the end of the stagflation nonsense. Probably not. We’ll need to see much deeper falls in the commodity complex to get us there.

They are coming.