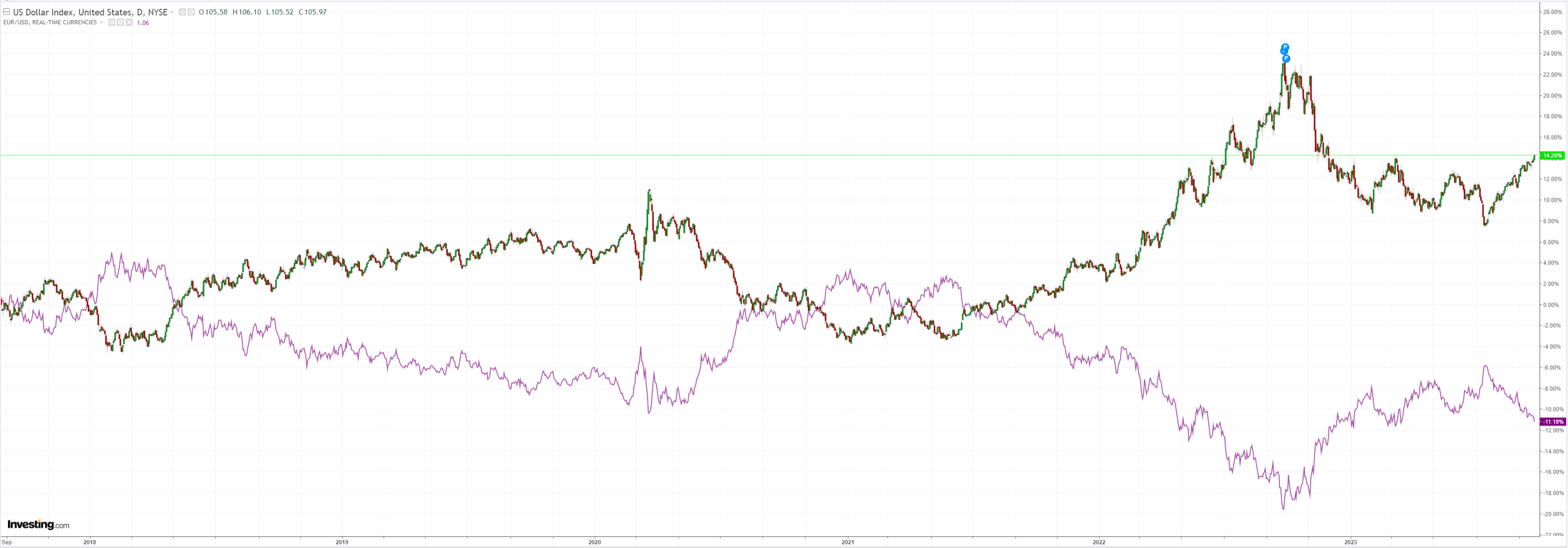

DXY has broken out into clear air:

AUD fell but is still being protected by the immense short:

CNY is nailed to the floor:

Overbought oil is consolidating:

Copper is breaking down:

And miners:

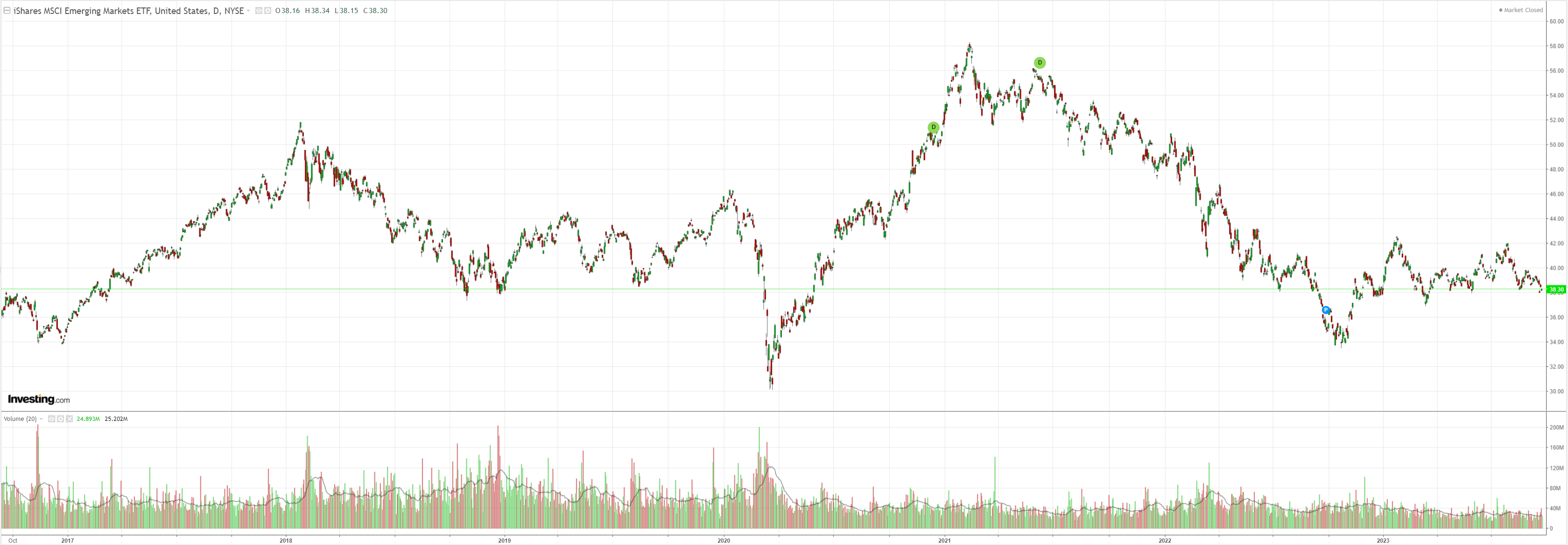

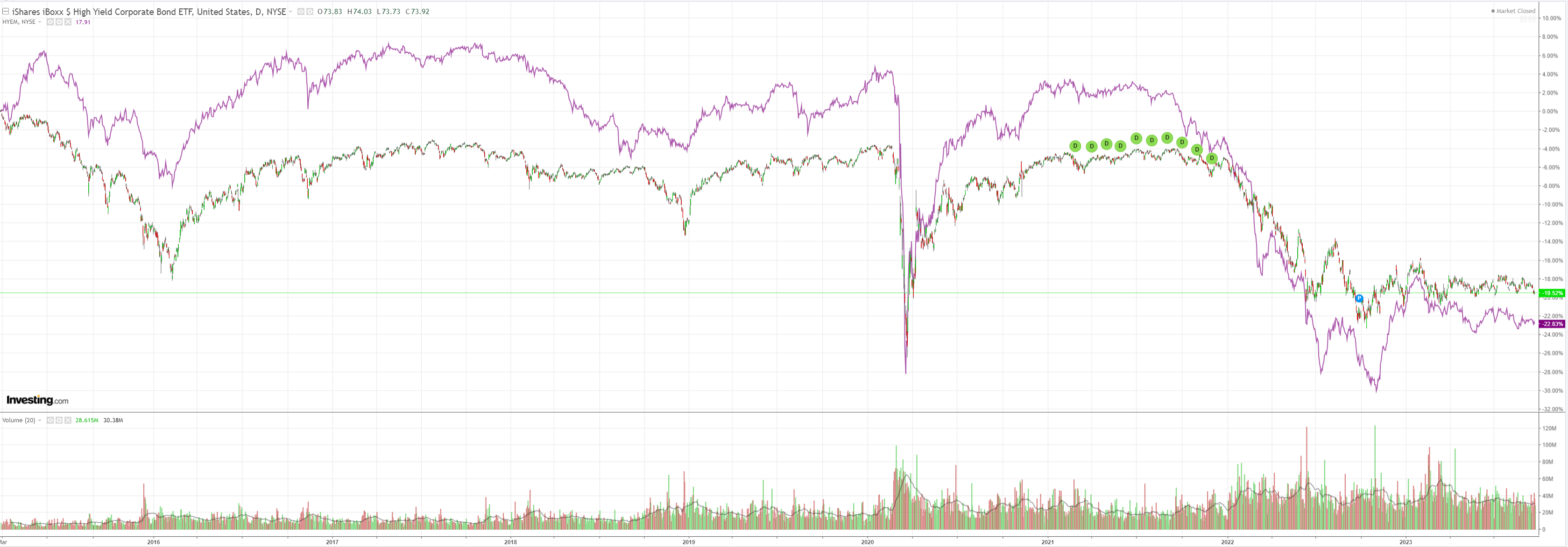

Plus EM and junk:

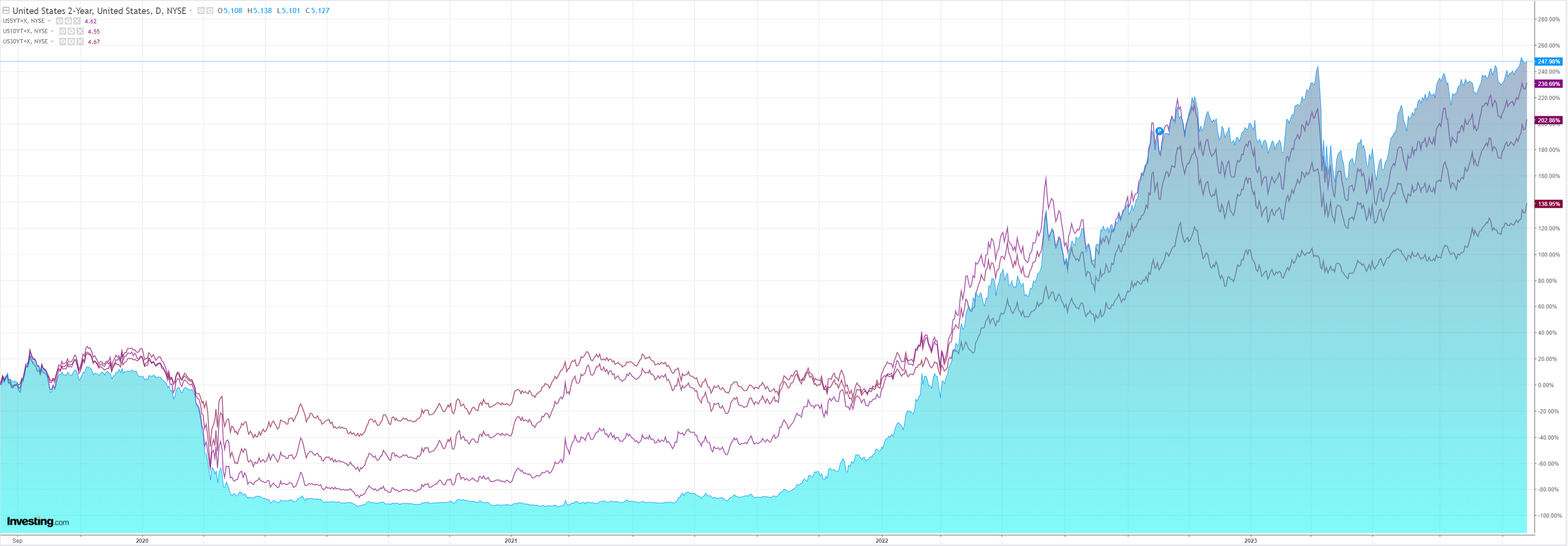

The Treasury bull steepening is the driver of it all:

Stocks are oversold too and managed a bid:

But, as yields back up, the risk of an unruly sell-off grows. Credit Agricole (EPA:CAGR) has more:

The Fed’s‘ higher rates for longer’ rhetoric continues to reverberate in markets and weigh on investor sentiment. Higher oil prices as well as weaker Chinese property developer equities added to moderately bearish sentiment in Asia at the start of the week. Evergrande (HK:3333) Group, an indebted Chinese developer, announced late on Friday it was cancelling talks with creditors that had been due to start today. At the time of writing, most Asian bourses were trading in the red and S&P500 futures modestly in the green. Higher UST yields and risk-off trading continued to support the USD. But only the Antipodean currencies, on the back of China concerns, registered significant declines against the USD during the Asian session. The JPY remains around YTD lows against the USD, but investors remain wary of verbal or actual FX intervention by Japanese policy officials.

USD soared to multi-month highs across the board last week, supported by a hawkish Fed and better-than-expected US data. The currency is further aided by growing cyclical divergence between the ‘no landing’ outlook for the US and the stagflationary outlook for Europe. Looking ahead, we think the focus this week will be both on the relative quality of the incoming data on both sides of the Atlantic as well as the evolving central bank narrative. In the case of the USD, we think that the attempts to avert a government shutdown in US Congress will be another key driver. Indeed, we note that, historically, market uncertainty about the government funding situation in the US has been a potent USD-negative.

Perhaps, but in today’s environment, would a shutdown just add to safe haven trades?

Lots of stretched markets now so a snapback is increasingly likely. AUD has a huge short underpinning it so any good news and it will spike.

That said, beyond your nose, the global economy and “risk” are still in trouble.