DXY looks to be firming:

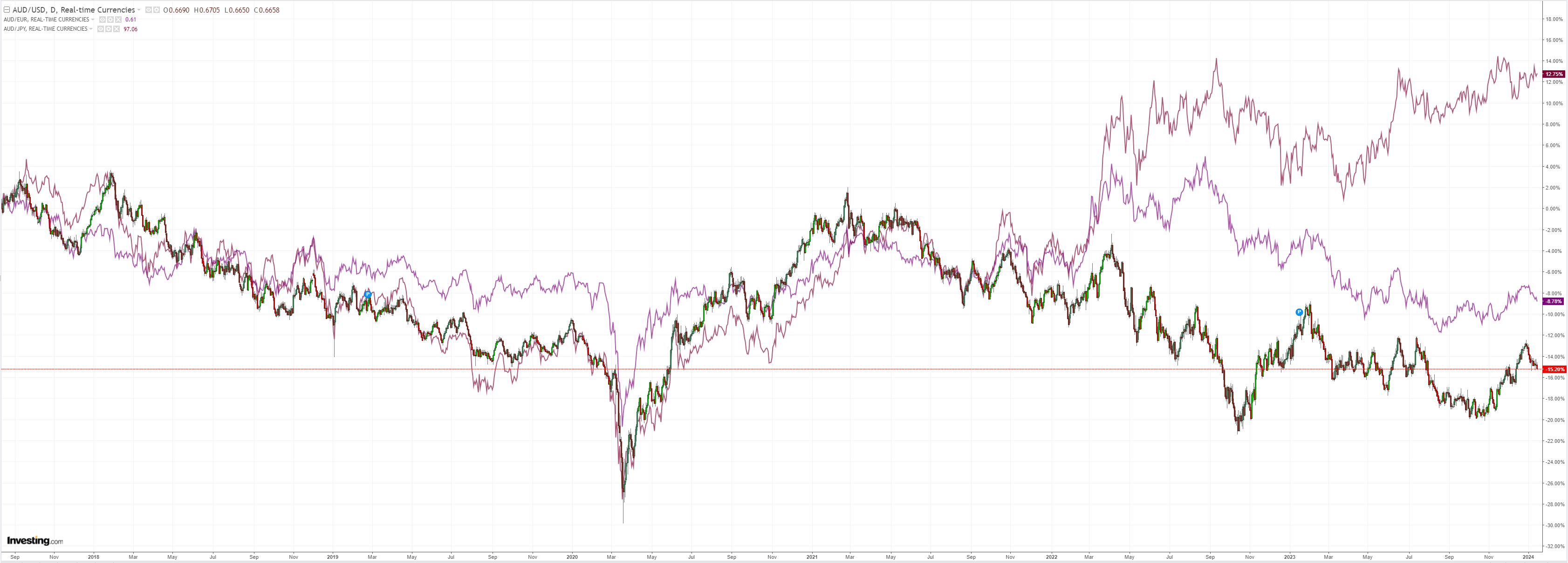

AUD does not look well:

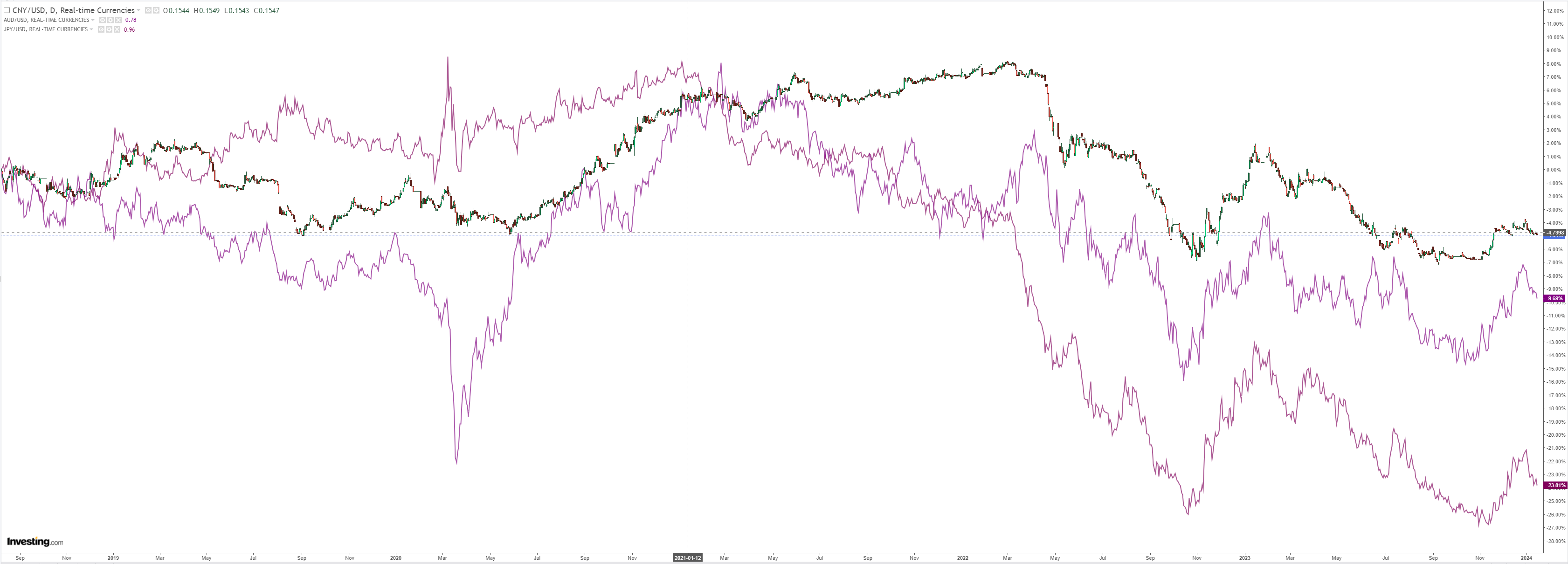

The north Asian headwind is blowing a gale:

Oil fell, gold firmed:

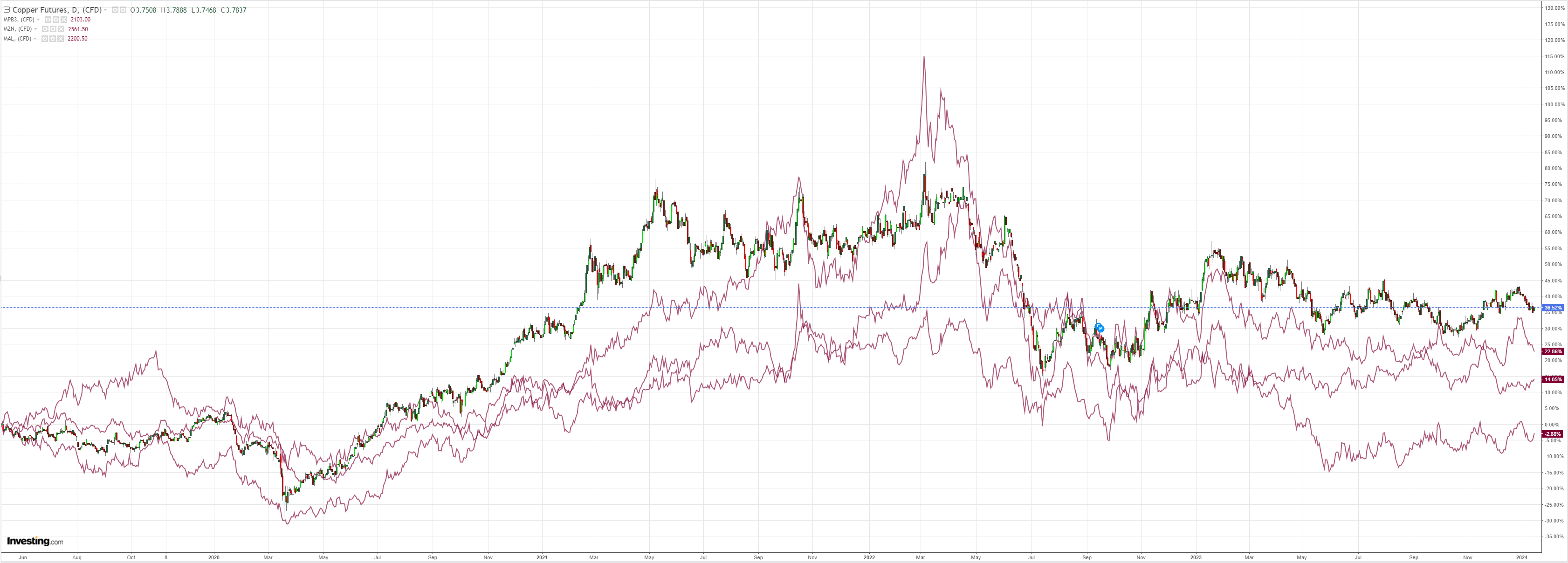

Dirt is going nowhere:

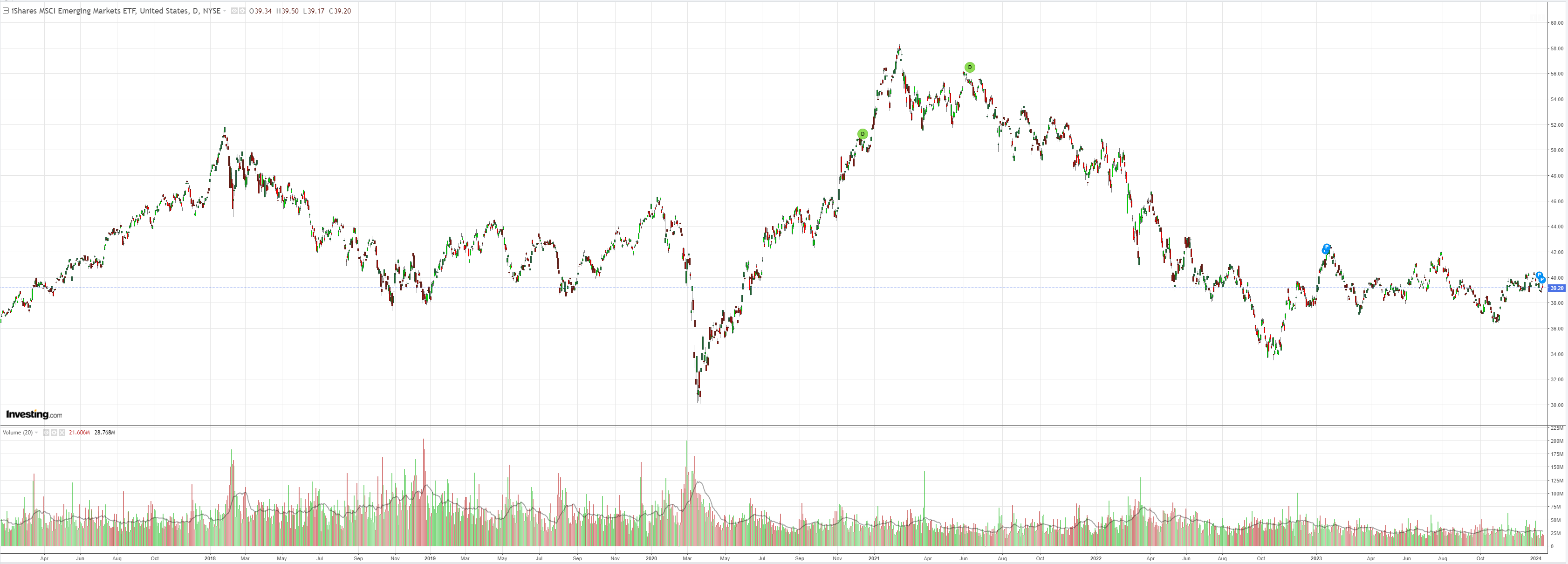

EM yawn:

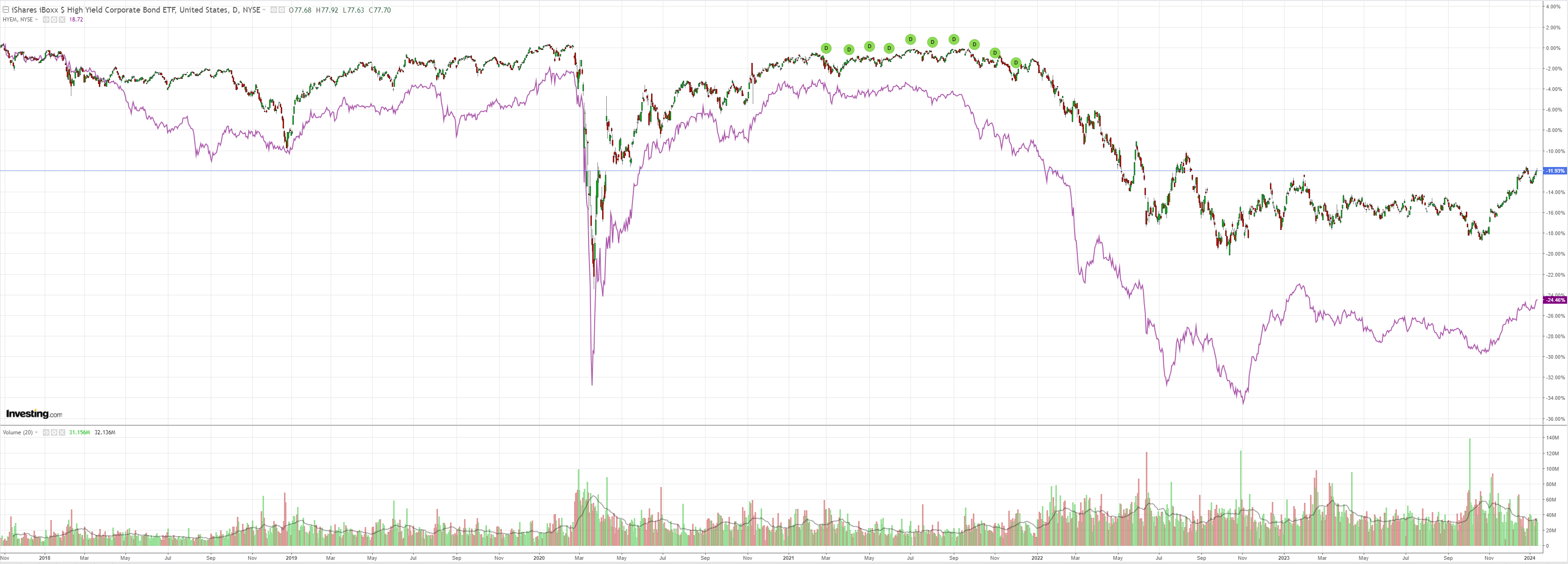

Junk hope:

US markets were shut:

But Europe fell:

The key to overnight moves was the Chinese refusal to admit that they are in trouble:

China’s central bank held a key interest rate as concerns about yuan volatility and the still-distant prospect of Federal Reserve easing limit the room policymakers have to support the economy.

…“In light of the weak data, a cut would probably have undermined the yuan and led to unwanted currency weakness,” said Robert Carnell, regional head of research for Asia Pacific at ING Groep (AS:INGA) NV. “I think the authorities are quite constrained with what they can do — and so I’m neither disappointed or surprised, but I am resigned to this being another difficult year.”

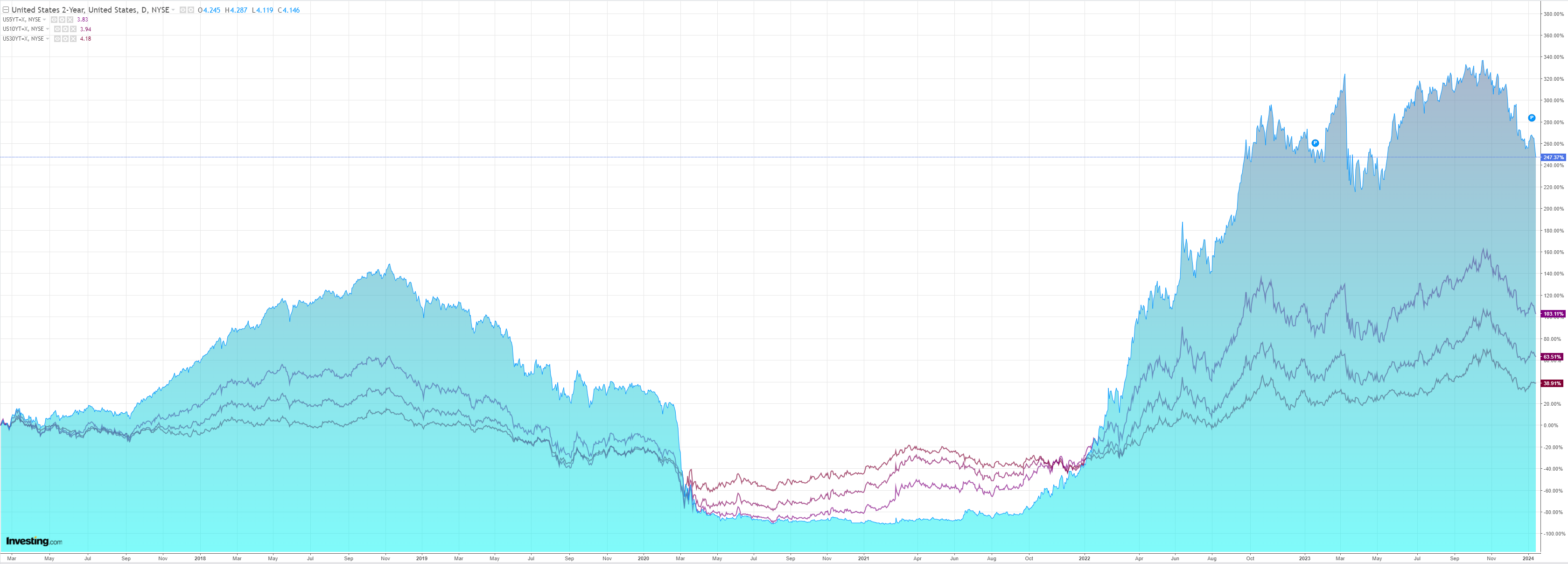

In my view, Fed cuts will begin in March, so that will lift some pressure from the PBoC.

However, I am not sure how much pressure. The ECB will shortly begin cuts thereafter and will be forced deeper than the Fed.

Meanwhile, JPY and CNY will be locked in a race to the bottom as the Chinese debt deflation advances.

Depression economics are sweeping China and it does not appear to realise it yet. This is deeply negative for the economy and, eventually, the currency.

I am increasingly of the view that the AUD rally that seemed assured this year is already in trouble as well.

The start of Fed cuts might give us one more leg up but might just as easily fire off a stock correction and DXY bid.

The AUD may have already peaked.