DXY was a wild thing last night as bad data spoiled the party:

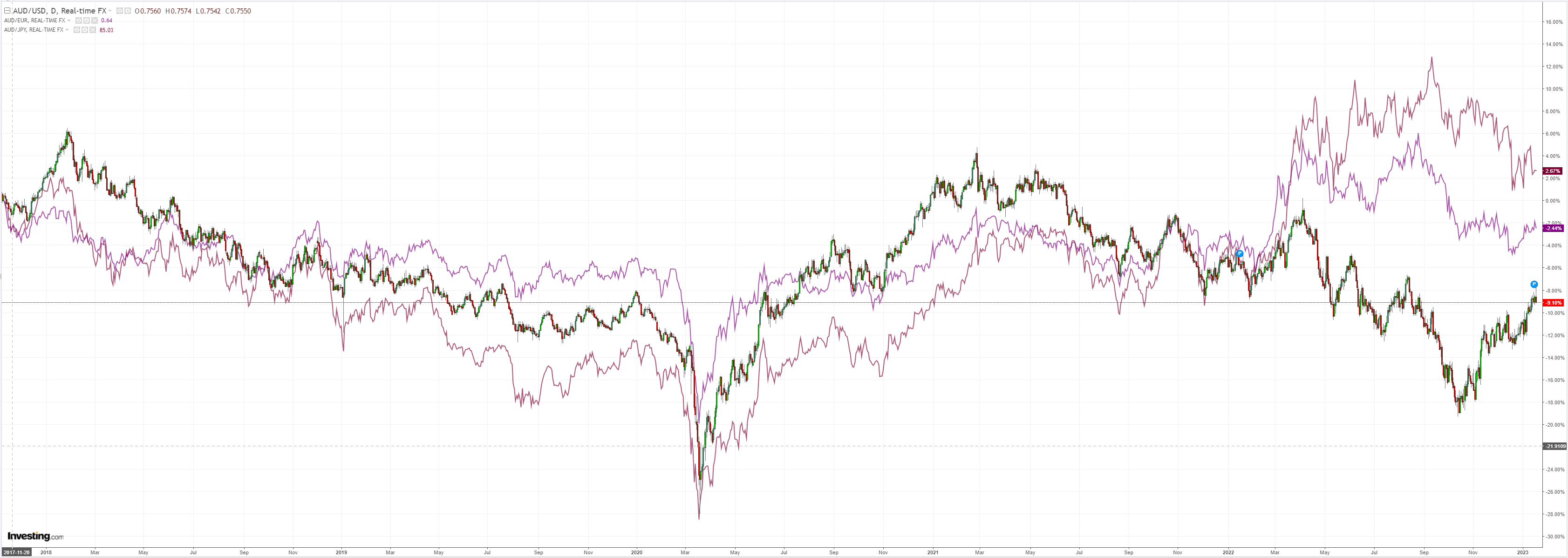

AUD printed a large and bearish shooting star:

So did oil:

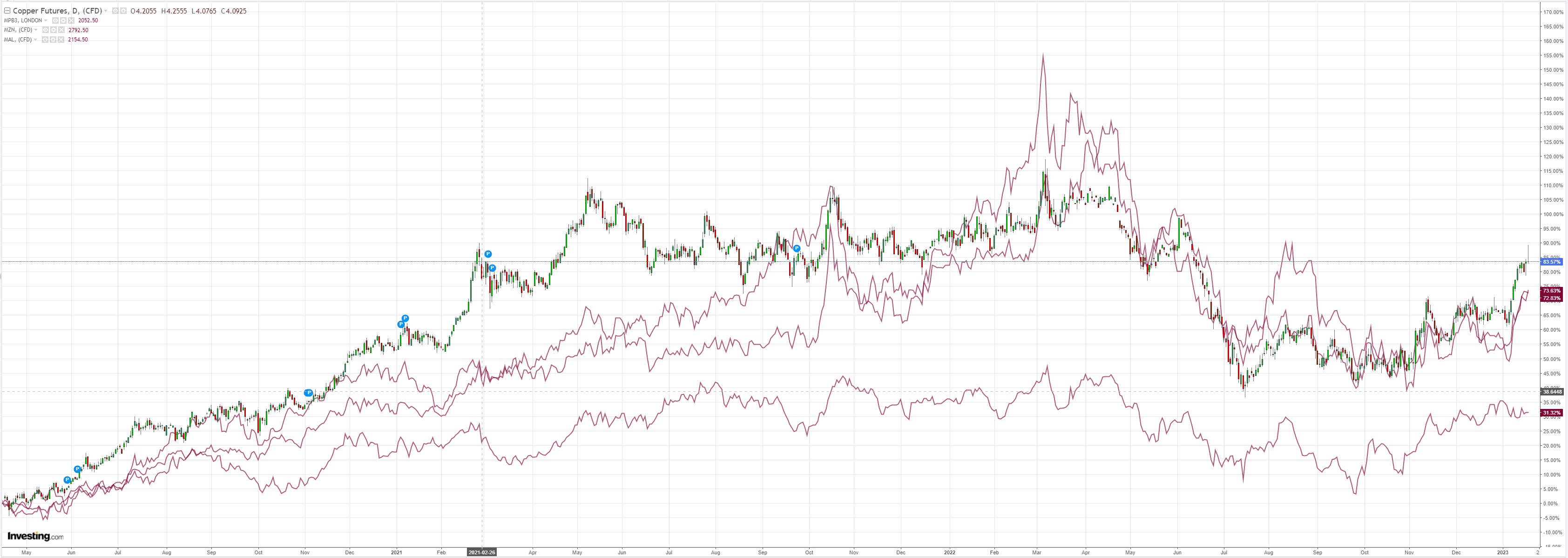

And copper:

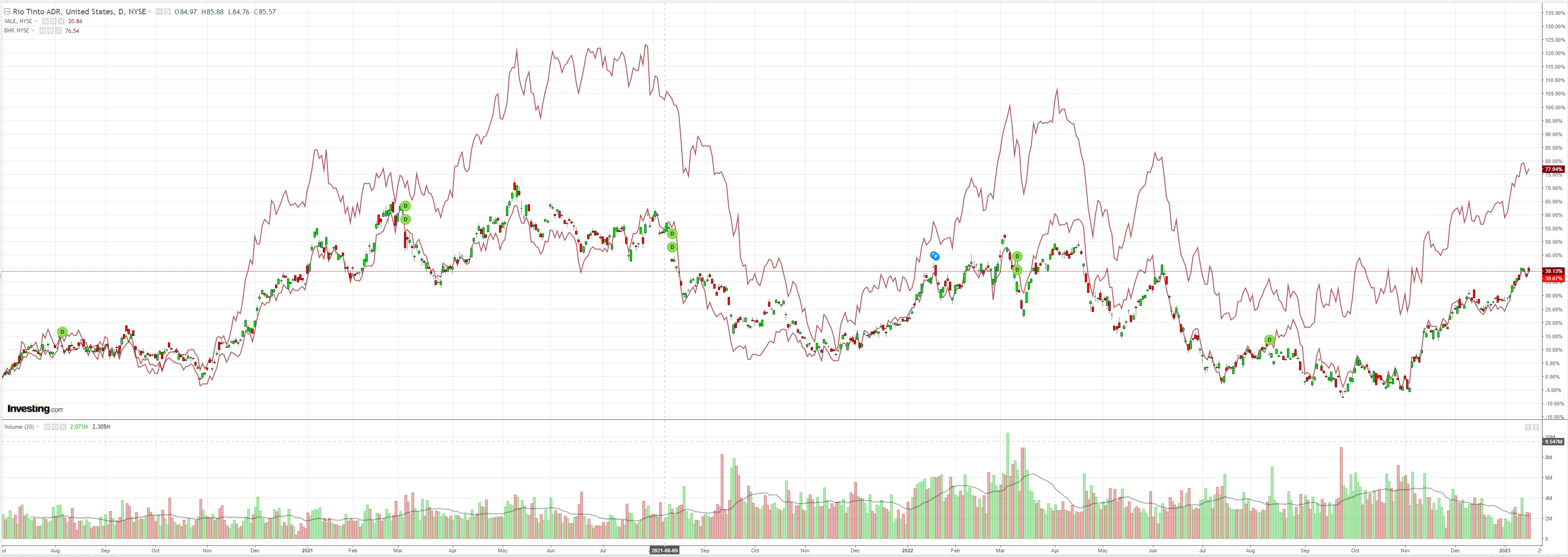

Miners (NYSE:RIO) were OK:

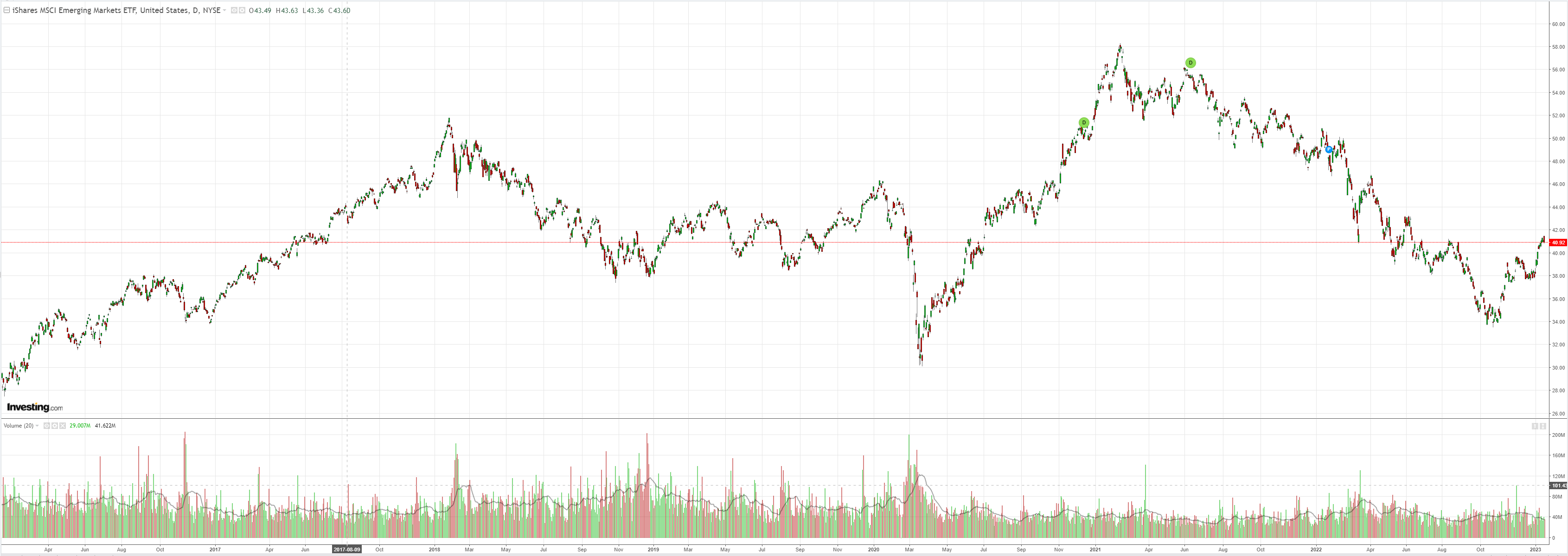

EM stocks (NYSE:EEM) flamed out:

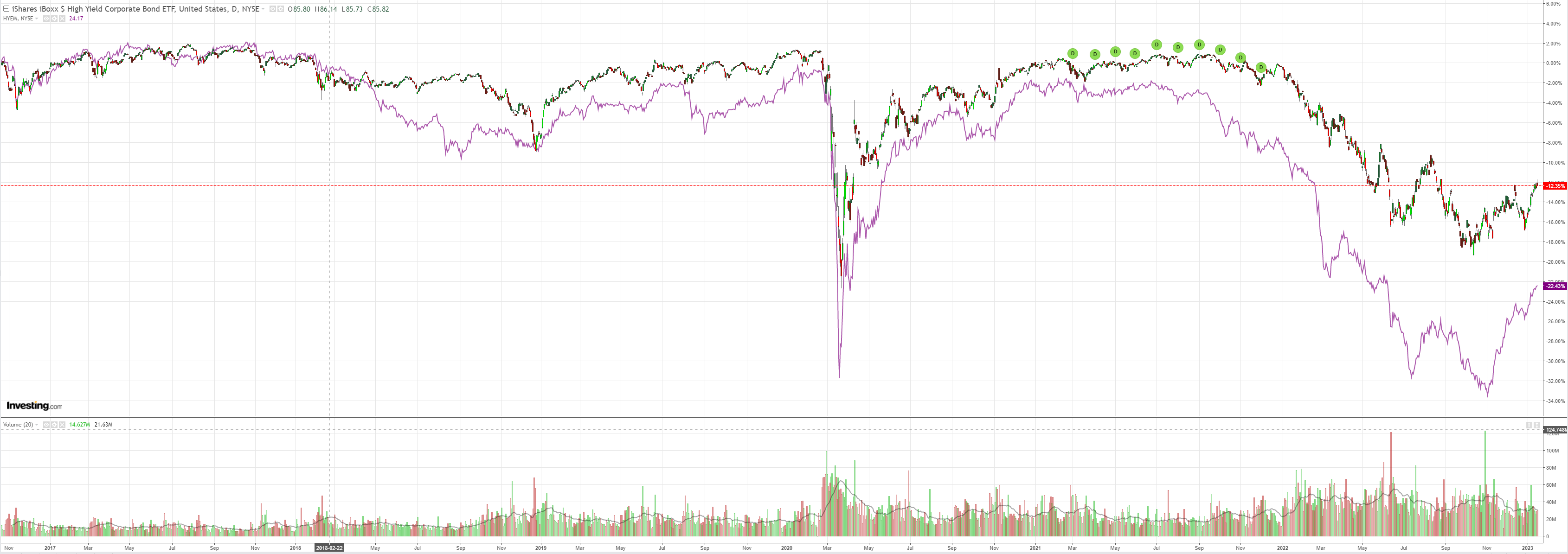

As did DM junk (NYSE:HYG):

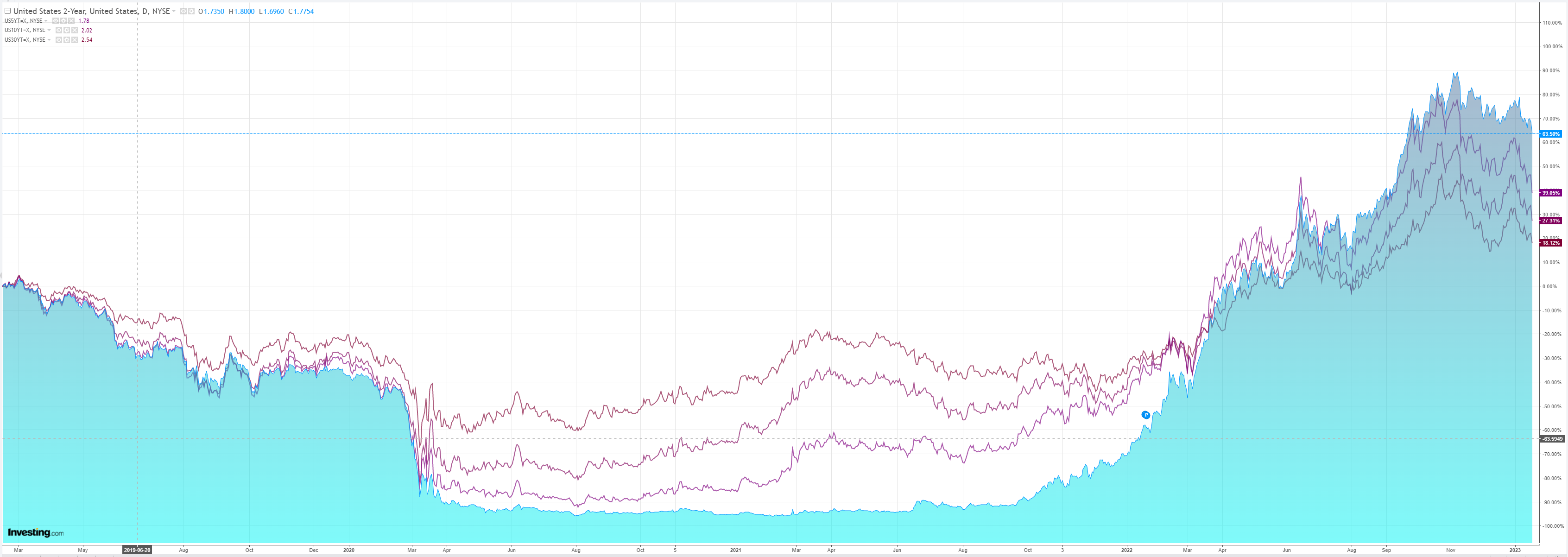

US yields ripped in and are forming a downtrend:

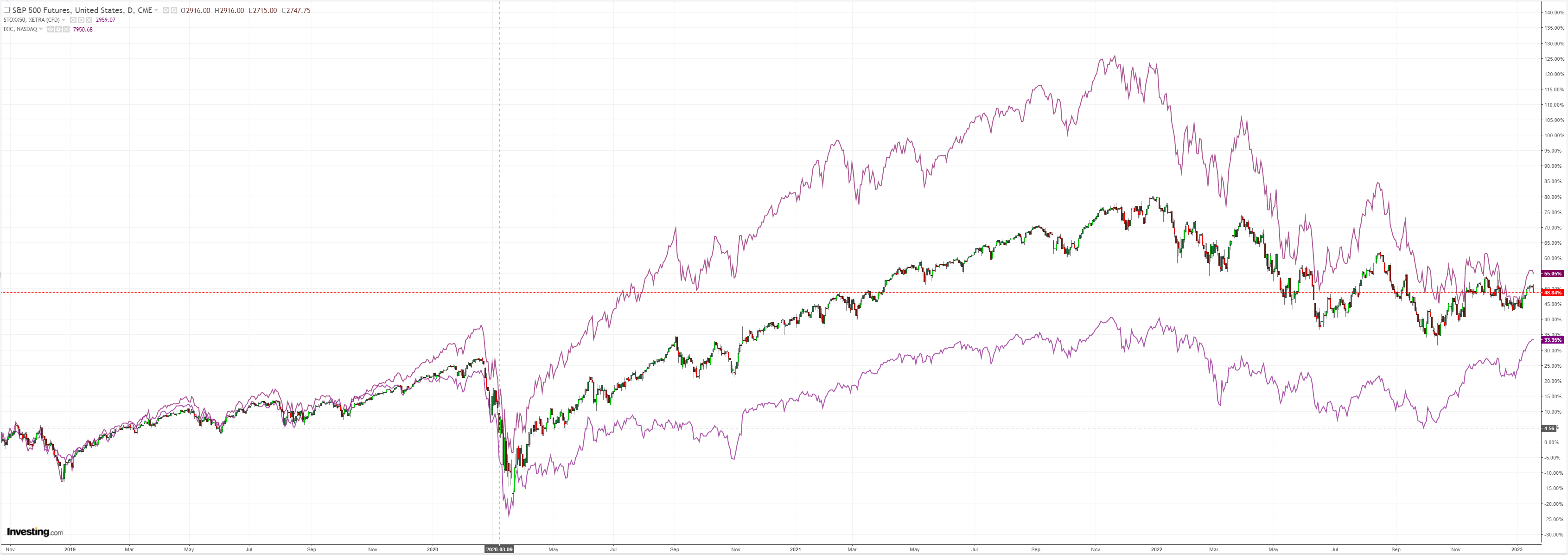

Stocks also went all shooting star:

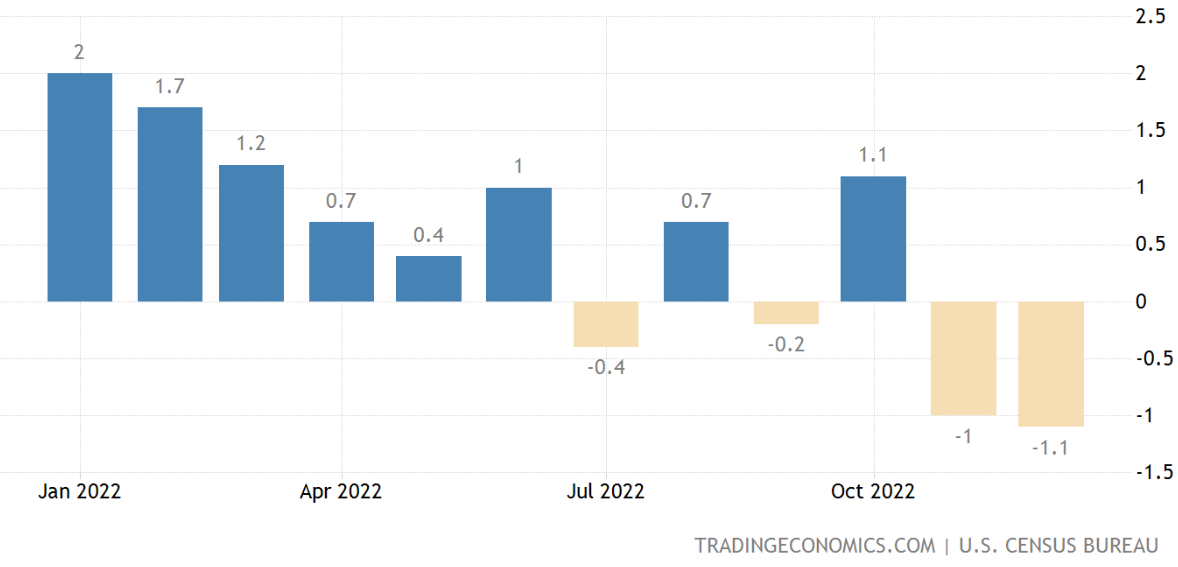

The automated chubby chasers were at work before US data puked over everything. December retail sales were poor, significantly, for a second month:

Adjust those falls for inflation and you get some serious volume hits.

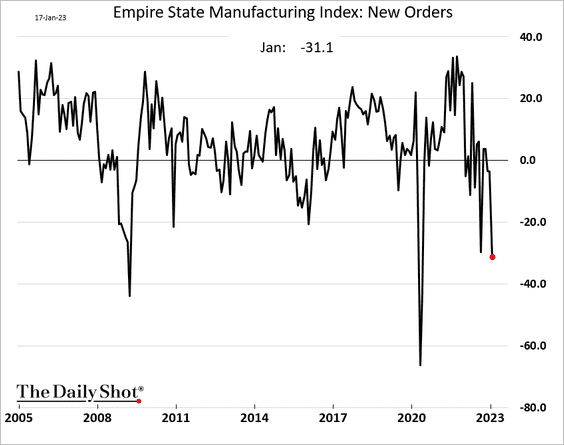

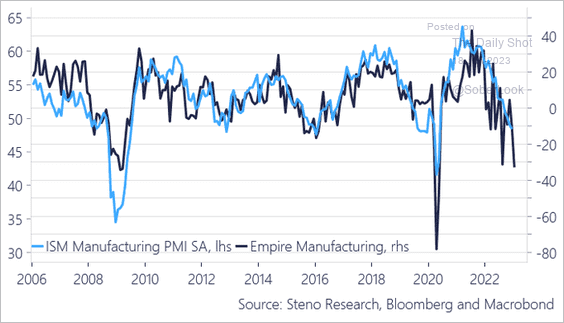

Which is why industry is now feeling it too. Yesterday the Empire State regional index was a disaster and the ISM is next:

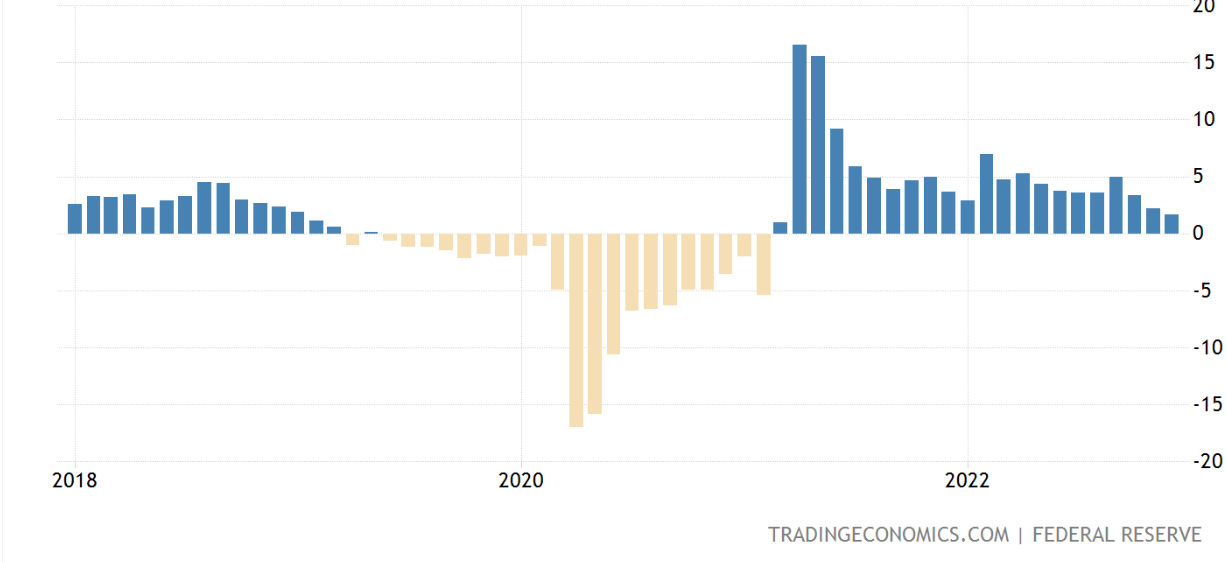

Today, industrial production growth slipped away with key measures such as business equipment shrinking:

Capex plans are sliding too.

Adding to the souring mood, Microsoft Corporation (NASDAQ:MSFT) warned:

Microsoft said it plans to cut 10,000 jobs, or about 5 per cent of its workforce, taking steps to cope with an increasingly bleak outlook that has now bruised many of the technology industry’s biggest names.

The company will take a $US1.2 billion ($1.7 billion) charge in the second fiscal quarter related to the move, which will shave 12 US cents off of earnings per share, the company said in a corporate filing.

The layoffs come as the software giant said it’s seeing customers exercise caution, with some parts of the world in recession and others heading toward one. Microsoft is scheduled to report results on January 24 and is forecast to post its slowest revenue increase in six years.

And, of course, yesterday, the BOJ hosed off the hawks which means no more easy DXY selling. With the market having already taken back half the pandemic JPY drop, why would the BOJ hurry? It’ll have deflation pouring in before long.

It seems to me that the US is on the verge of recession, if not already in it. Excess inventories are about to be destocked into China which is already shut. Europe is barely growing.

Everybody has chased the rally. Everybody hates DXY. The Fed is still hiking!

What could possibly go wrong?