DXY to the moon:

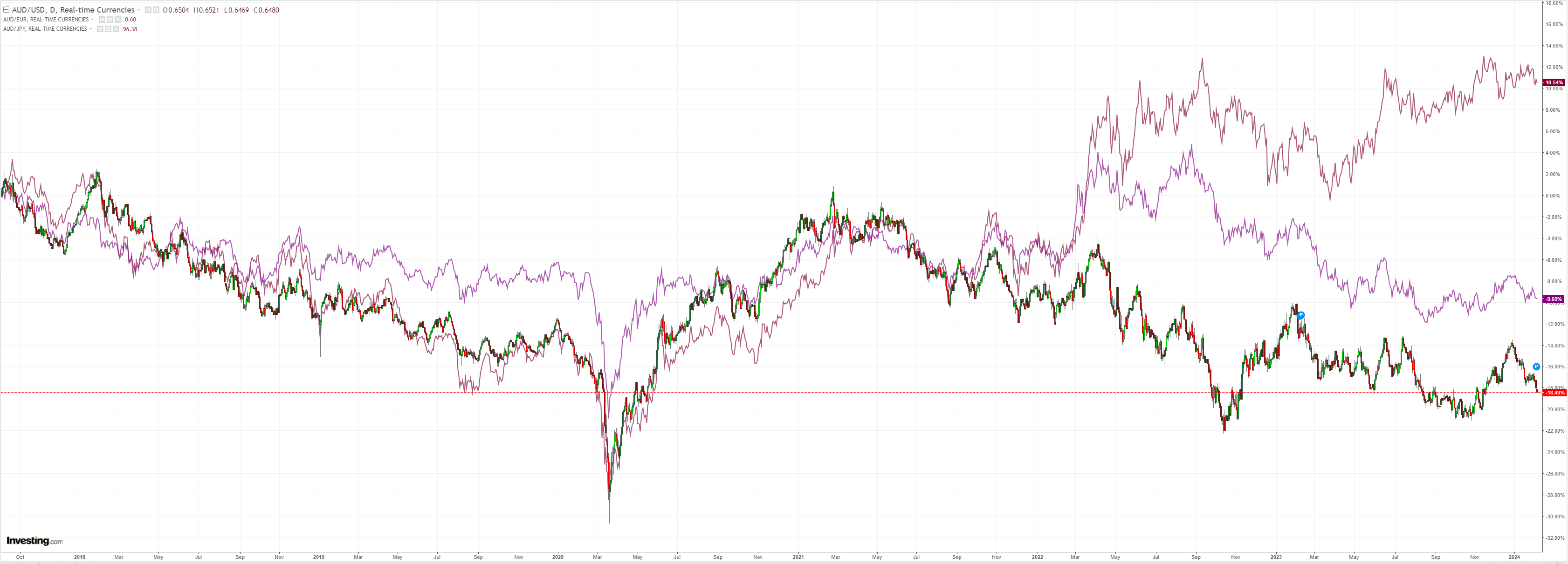

AUD through the trap door:

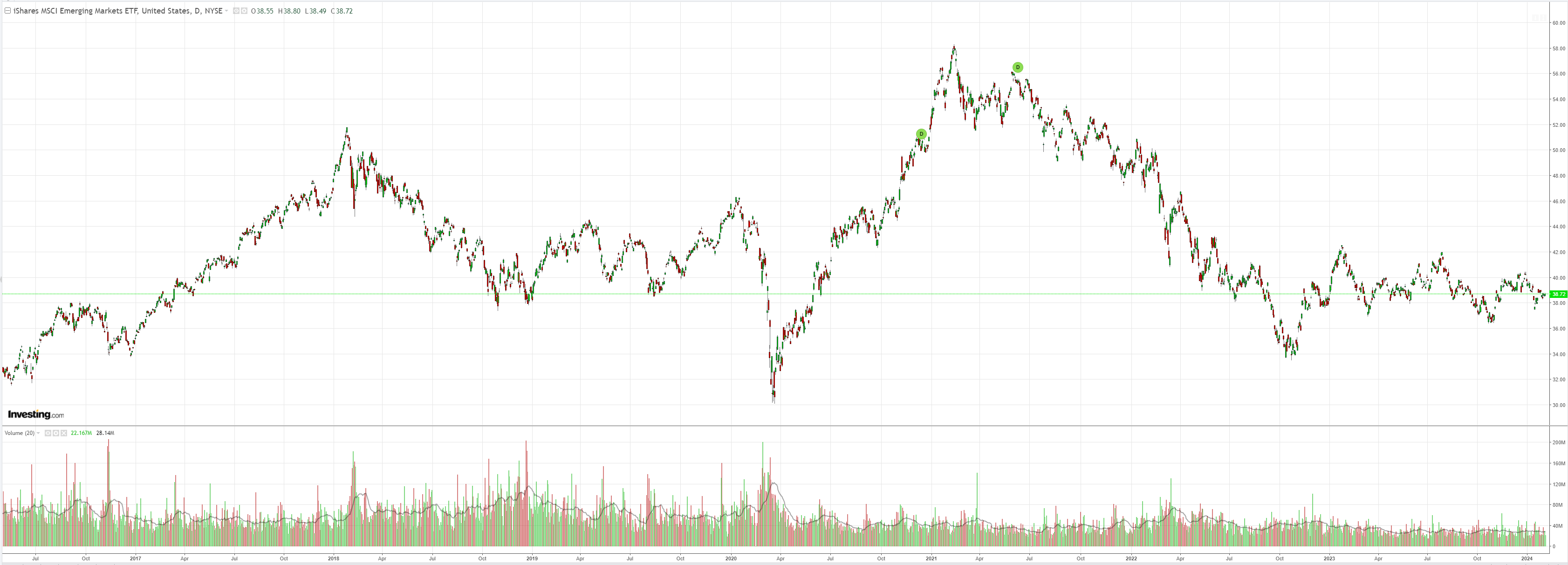

North Asia with it:

Oil and gold eased:

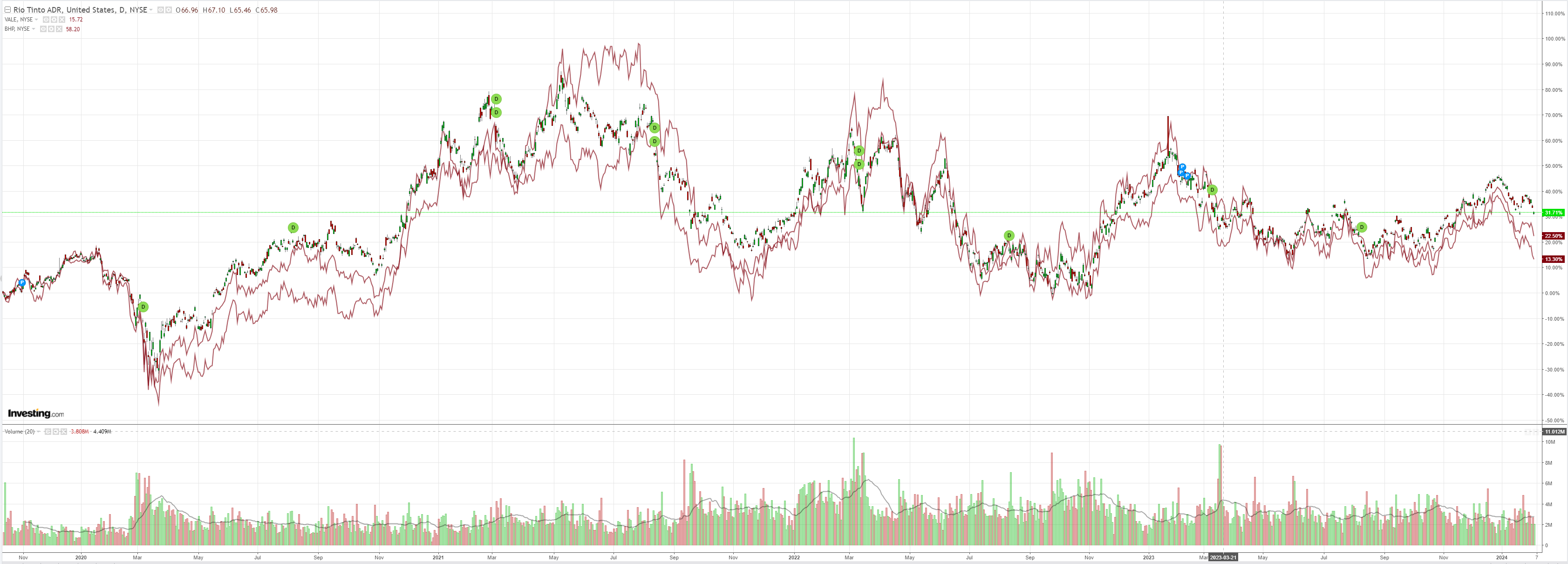

Dirt puked:

Miners too:

EM yawn:

Junk has abandoned the rally:

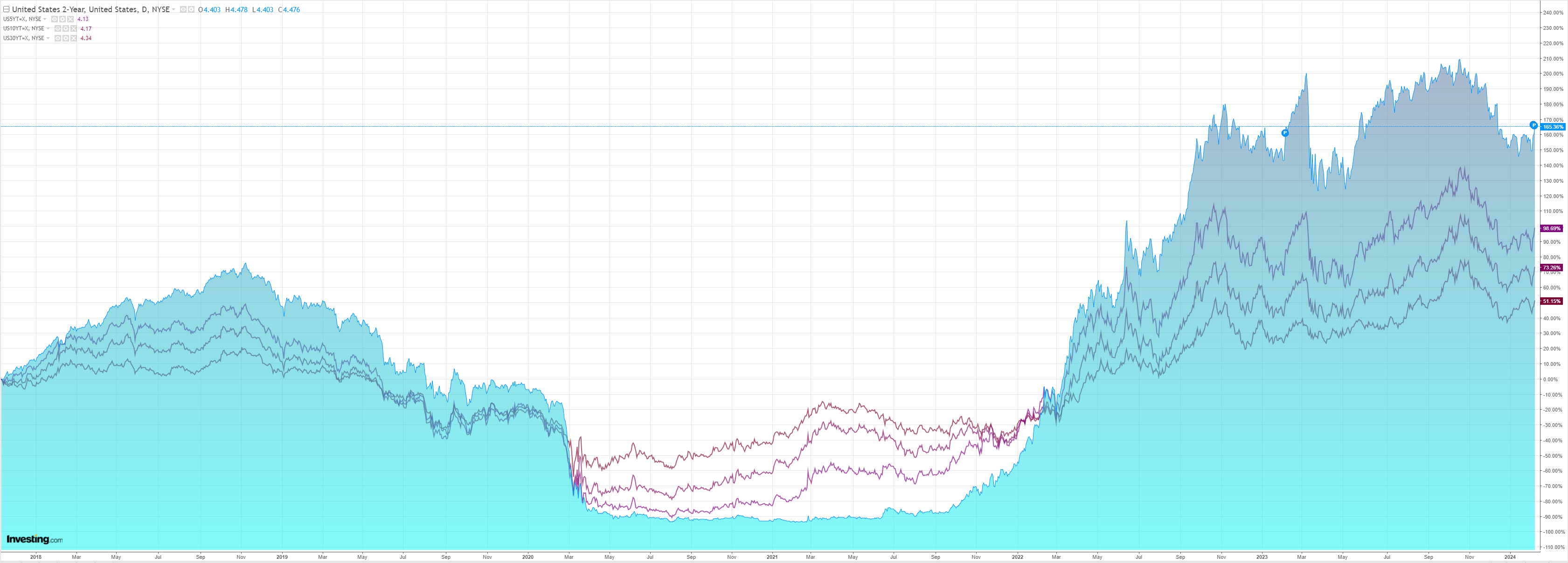

As yields jackknife:

Stocks only go up:

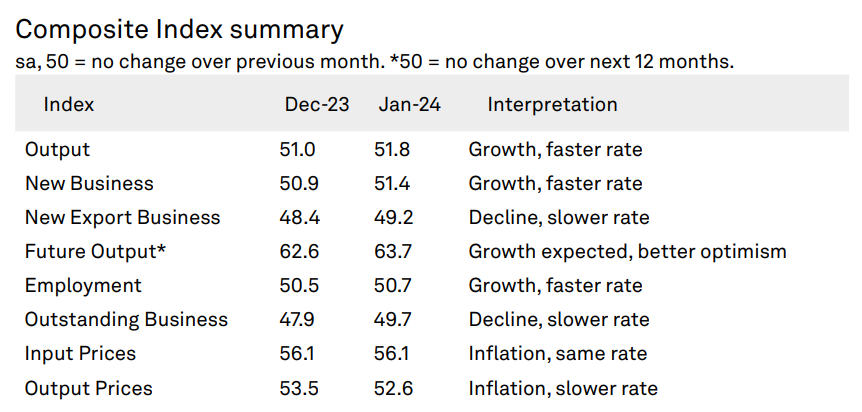

Data and Fed speakers were all over the place, but it was generally a positive message. The JPM global PMI is rebounding:

The upturn in global economic activity gathered pace at the start of 2024, with rates of growth in output and new orders accelerating to seven-month highs. Emerging markets continued to outperform their developed nation counterparts (on average), although the latter did see output rise for the first time since July 2023.

The J.P.Morgan Global Composite PMI® Output Index – produced by J.P.Morgan and S&P Global (NYSE:SPGI) in association with ISM and IFPSM – posted 51.8 in January, up from 51.0 in December and its highest reading since June 2023. The headline index has signalled expansion for three successive months (following the no change registered in October) and last indicated a downturn in January 2023.

This should be an environment favourable to the AUD. That it is not is a reflection of the persistence of US growth leadership and the Chinese growth laggard.

Goldman has more:

AUD: Working hard, hardly working.

Previously ,we have shown that AUD tends to be the highest-beta of the G10 currencies, with the strongest correlation to higher equity prices.

However, with recent AUD weakness in the face of record S&P highs, AUD’s equity beta hardly seems to be “working.”

Since the start of the year, we have seen AUD underperformance relative to our BEER model implied returns.

We think this is partly a correction of the moves in late December; we found the currencies which out performed the most post the Dec FOMC have seen greater underperformance YTD.

While this appears to be the main factor, we also noted that China growth expectations have had a noticeable imprint on EM FX returns lately, and it looks like that is also true for AUD.

That about covers it. I see AUD range trading now from 0.64 to 0.68 unless or until the US/China pattern changes.