DXY eased last night:

JPY roared on hopes of shock rate hikes. Forlorn, in my view. AUD popped:

Oil stopped falling for the day:

Dirt kept going:

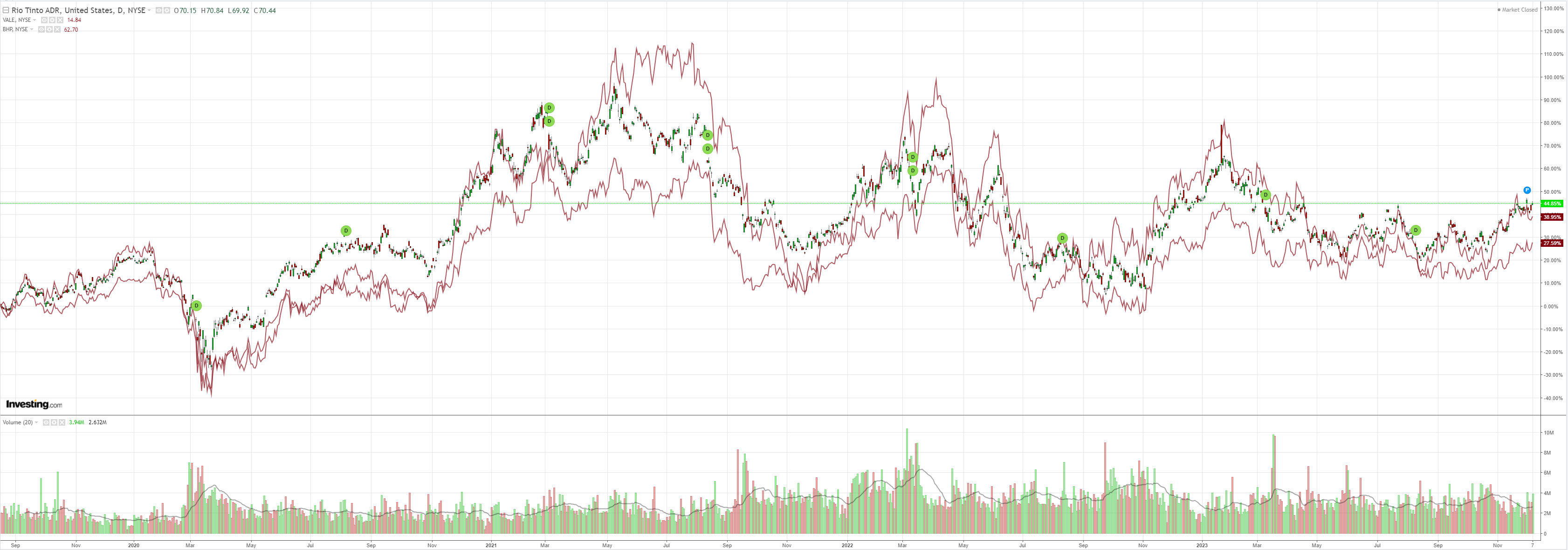

Miners popped:

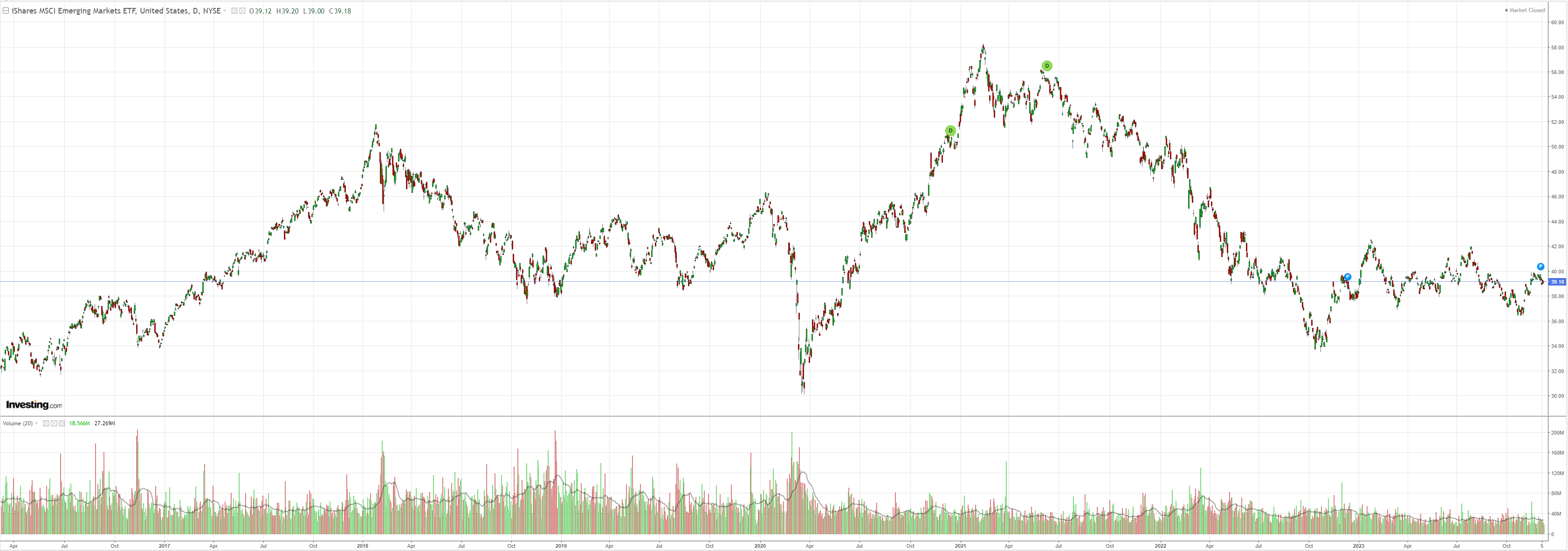

EM doom:

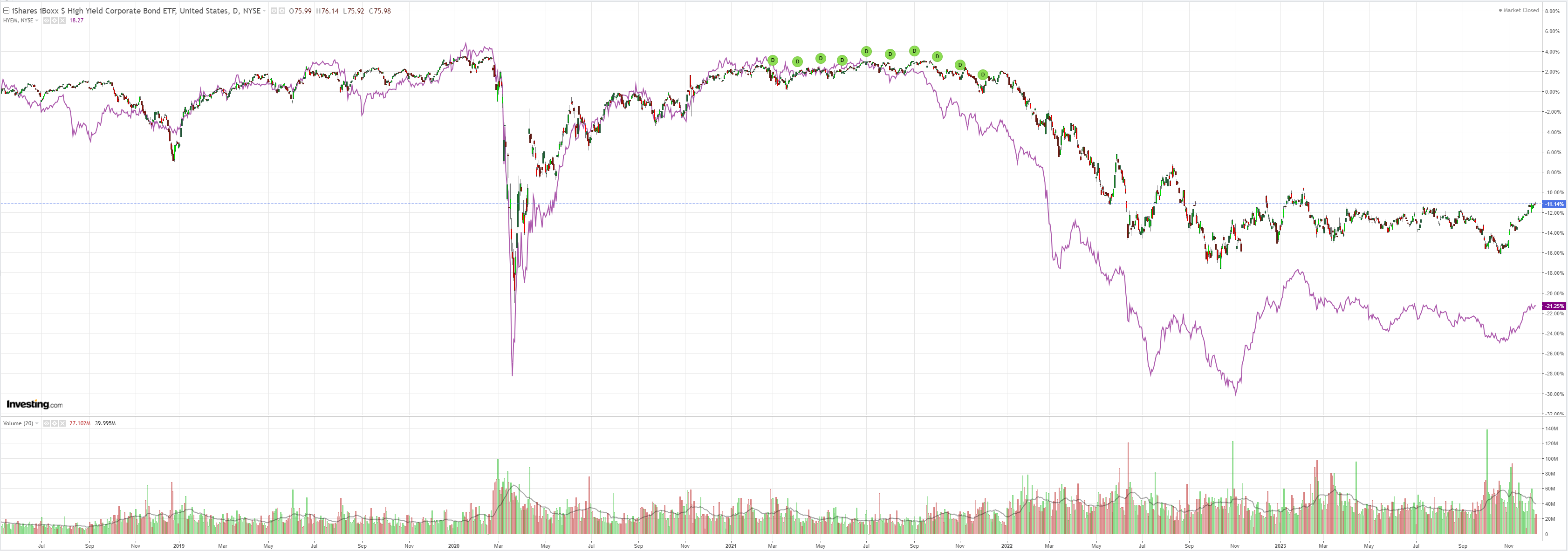

Junk better:

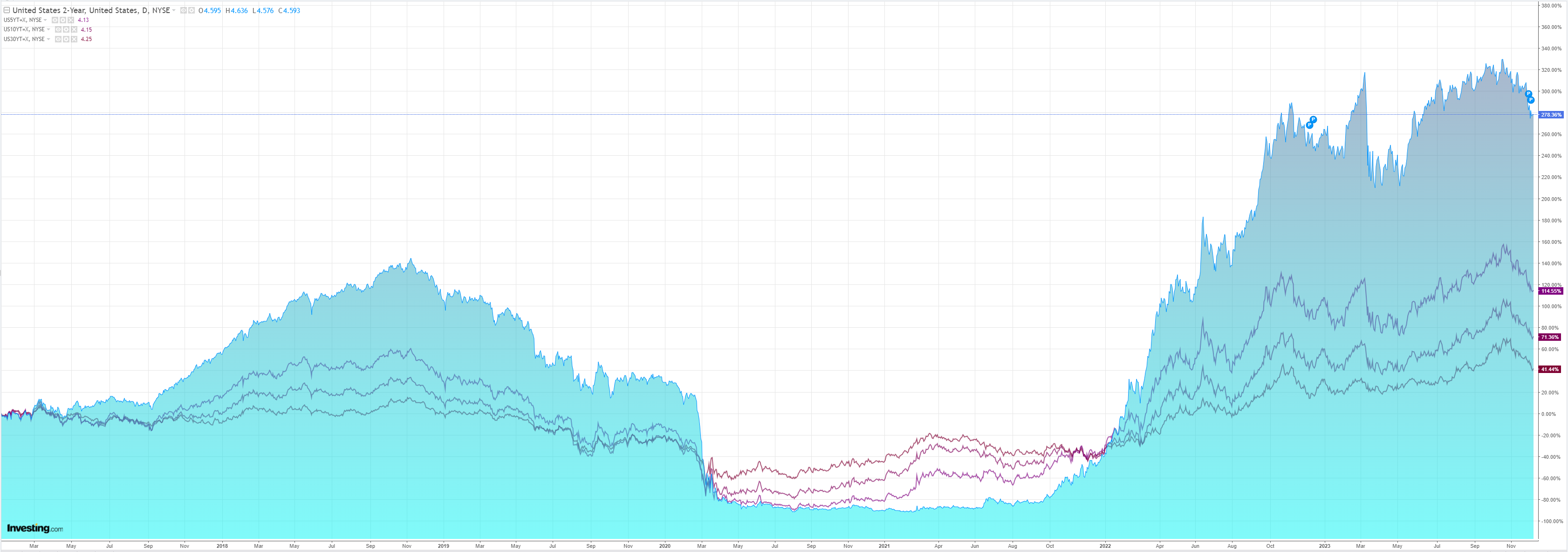

Treasuries sold as stocks harked back to the AI boom:

Tonight’s jobs report shapes as better post-car strikes.

From BofA economists:

“Nonfarm payroll employment likely rose by 200k in November following a 150k increase in October. The main factor behind the acceleration relative to September is that two major strikes ended ahead of the November survey period. … On the household survey, we expect the labor force participation rate to be unchanged at 62.7% as we believe cyclical gains to participation rate are diminishing. Given this and our expectation for fairly strong employment growth, we forecast the unemployment rate to be unchanged at 3.9%, though there is a risk that it rounds down to 3.8%.”

From Goldman Sachs (NYSE:GS):

“We estimate nonfarm payrolls rose by 238k in November, above consensus … Alternative measures of employment growth indicate another month of robust job growth on average, government hiring likely remained strong, and layoffs remain low. … We estimate that the unemployment rate declined to 3.8%.”

As a rule, I do not bet on employment reports. They are simply too volatile.

The AUD will fly if it is weak and fall if it is strong.