And…here we go again. DXY was hammered last night on the Fed:

AUD was a screeching rocket:

Oil now looks bullish:

Metals rallied:

Though miners (LON:GLEN) missed out:

As EM stocks (NYSE:EEM) popped:

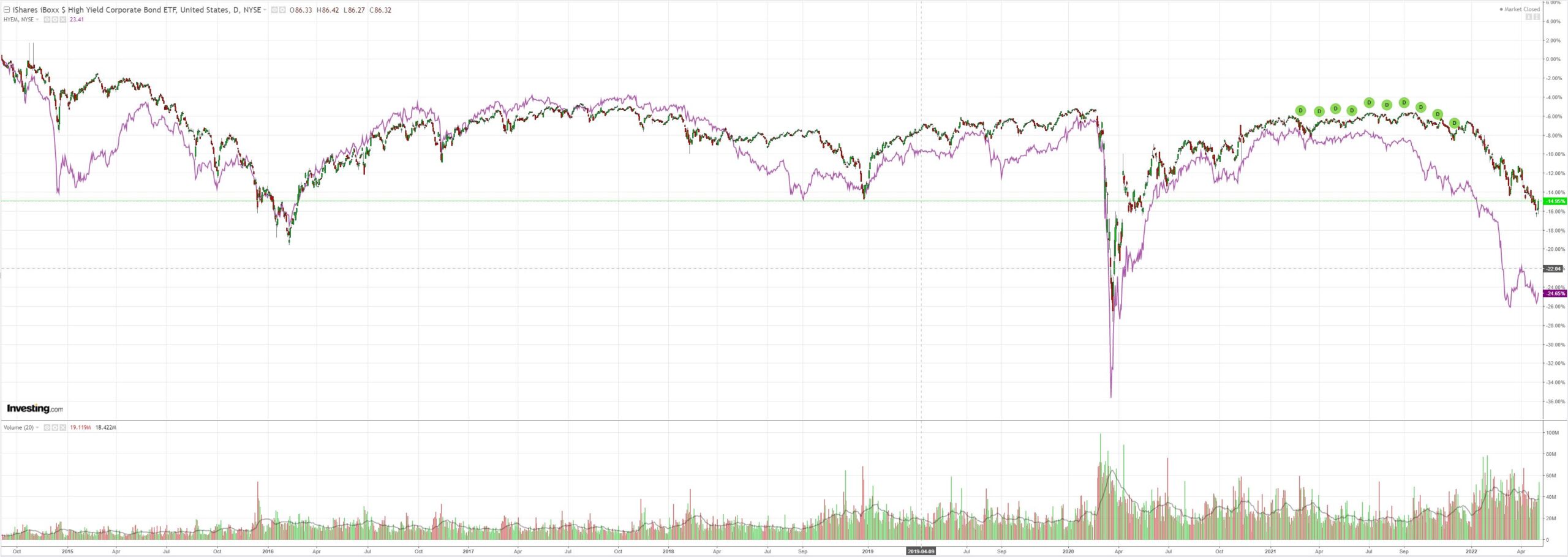

Junk (NYSE:HYG) too:

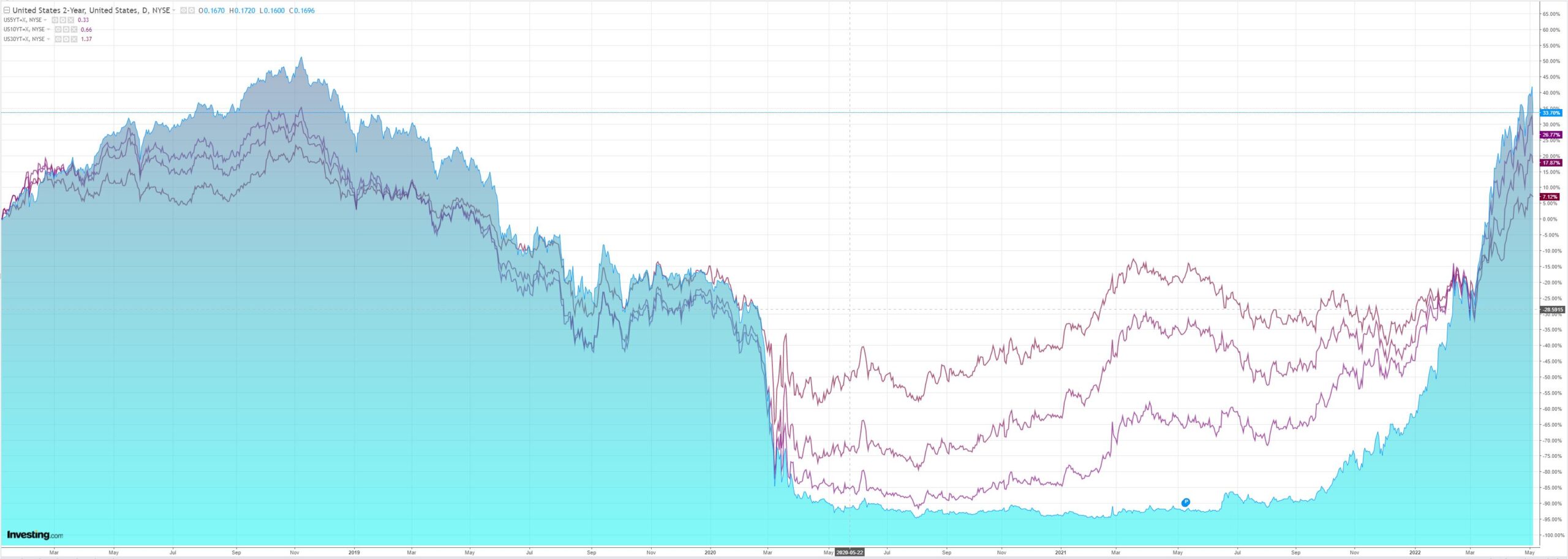

The curve steepened dramatically:

And stocks surged:

Westpac has the wrap:

Event Wrap

The Federal Reserve’s FOMC raised the funds rate by 50bp to a range of 0.75%-1.0% in a unanimous vote. It also emphasised its focus on inflation and expectations, and signalled more tightening to come, with 50bp hikes likely at the next two meetings. Chair Powell said it would not hesitate to push rates above neutral (estimated to be somewhere between 2% and 3%). Markets were disappointed by Powell’s assertion that 75bp hikes were not actively considered. The Fed also outlined its balance sheet reduction, with a 1 June start and reduction pace capped at $47.5bn/month initially, stepping up to $95bn/month from September.

Event Outlook

Aust: Dwelling approvals are expected to soften in March after the spectacular swings through January and February (Westpac f/c: -4.0%). Meanwhile, a partial unwind of February’s import surge and a lift in export prices should see the trade surplus widen further in March (Westpac f/c: $10.7bn)

China: Ongoing COVID-19 lockdowns will likely weigh on the Caixin services PMI in April (market f/c: 40.0).

UK: The Bank of England is expected to raise the Bank Rate by 25bps to 1.00% at their May meeting; a pause in rate rises to assess risks is nearing. The final estimate of the April S&P Global services PMI is also due (market f/c: 58.3).

US: Productivity is expected to decline in Q1 and remain volatile through 2022 (market f/c: -5.3%). Initial jobless claims are set to remain near record lows (market f/c: 180k).

Here’s the Fed:

Although overall economic activity edged down in the first quarter, household spending and business fixed investment remained strong. Job gains have been robust in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain. The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in conjunction with this statement.

Well done, Fed! You’re trying to kill inflation and your meeting just boosted it.

At issue was the fear of a 75bps hike which Chairman Powell put to bed. For me, this was all pantomime. The prospect of 75bps was never serious.

Anyways, markets got to the cliff’s edge and the Fed pushed us back from it. It is a reprieve, not a trend change, in my judgement.

Indeed, the rally itself only increases the prospect of more tightening, and AUD falls.