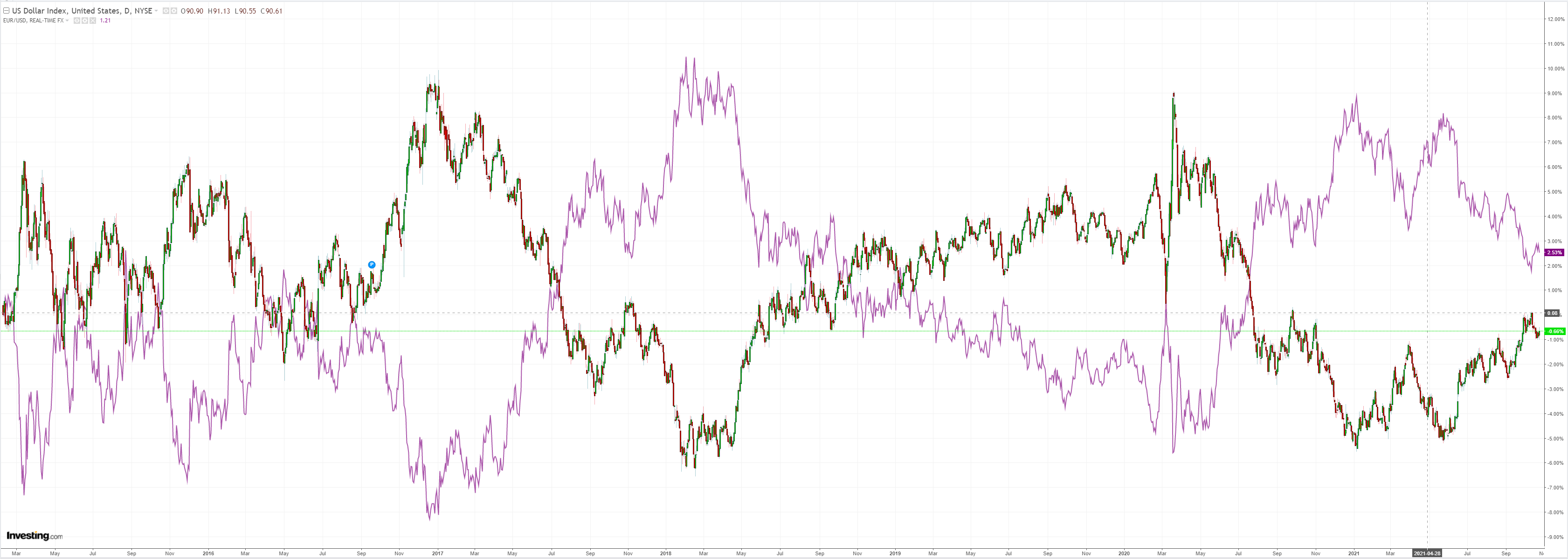

DXY firmed overnight as EUR sank:

But the Australian dollar rose anyway:

Base metals held on:

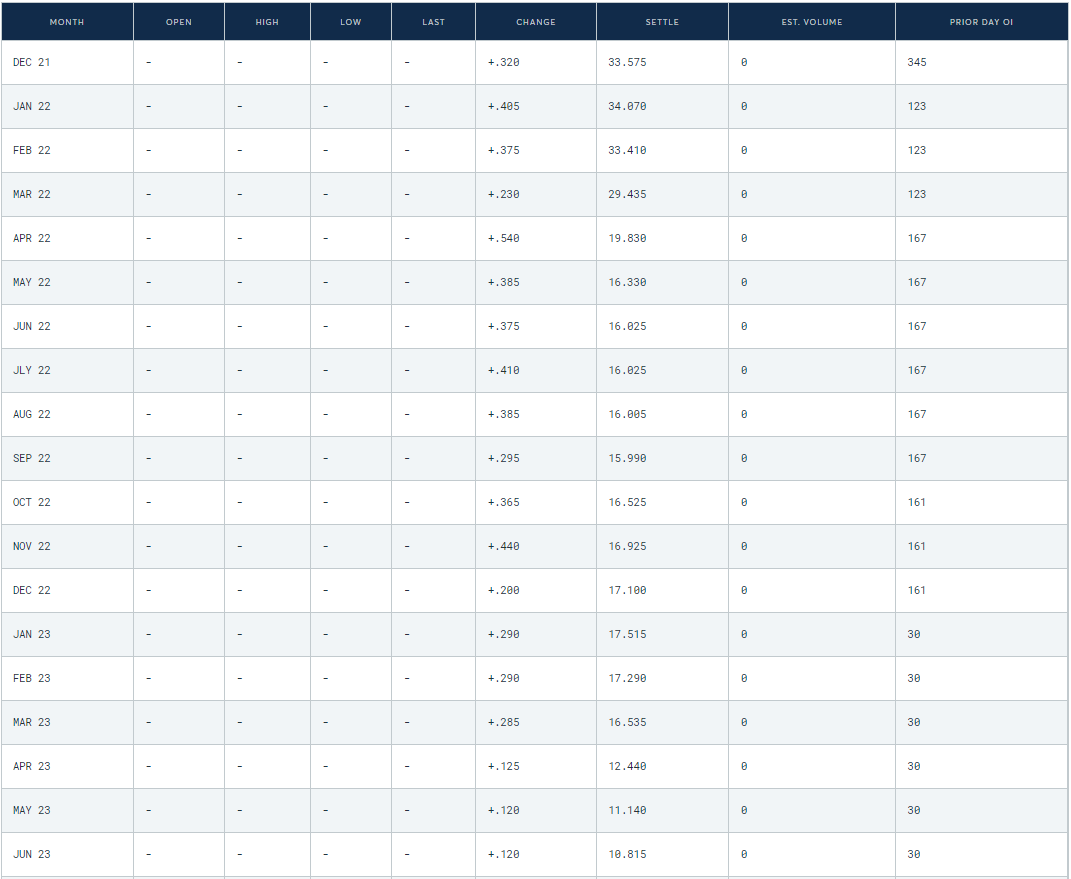

The key to the evening was energy. Both coal and LNG rebounded:

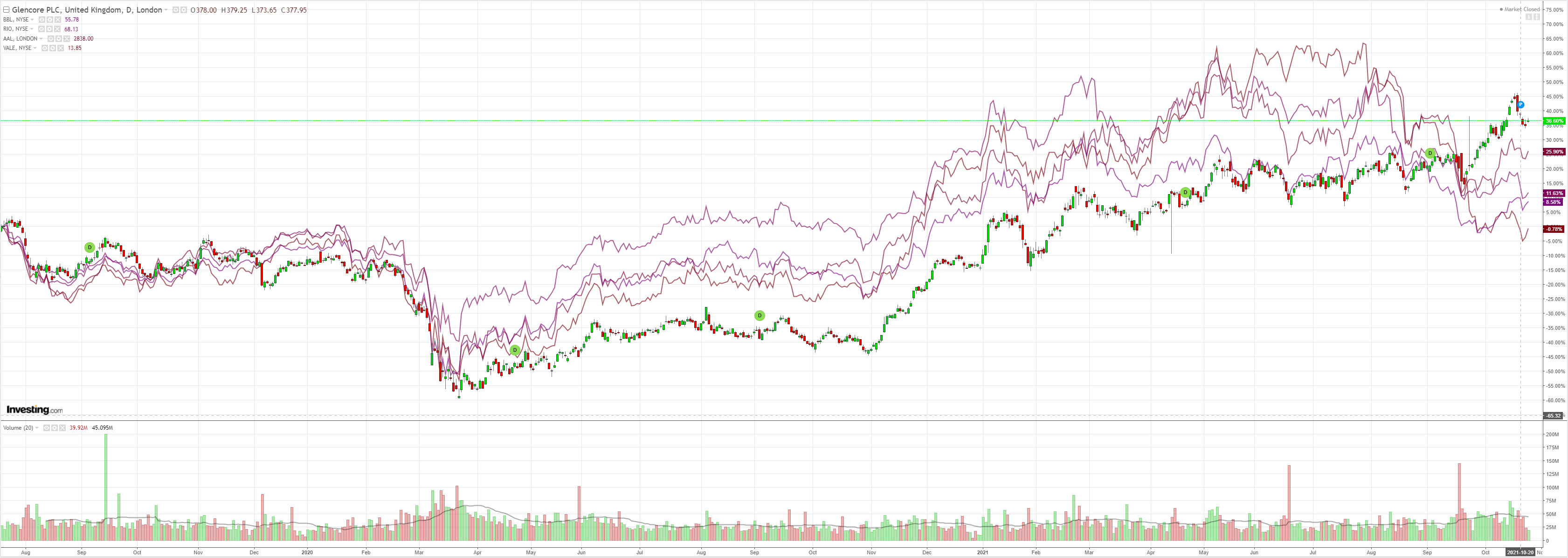

Miners too:

EM stocks held on:

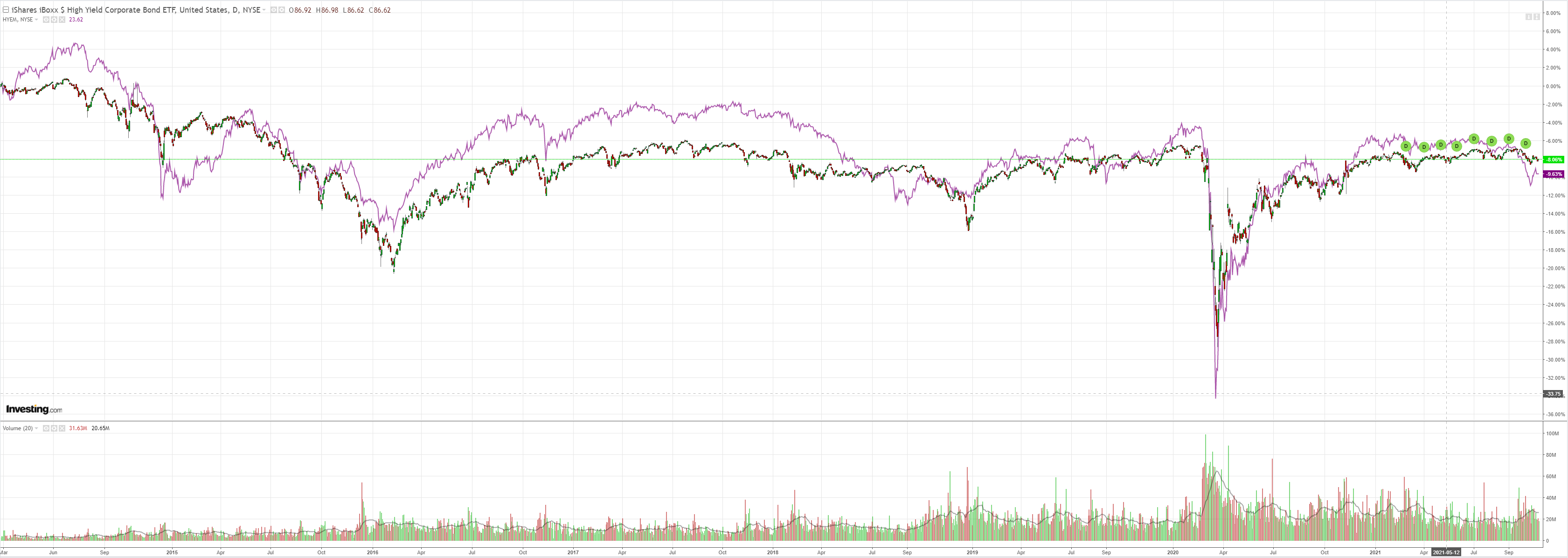

But the junk rally faded:

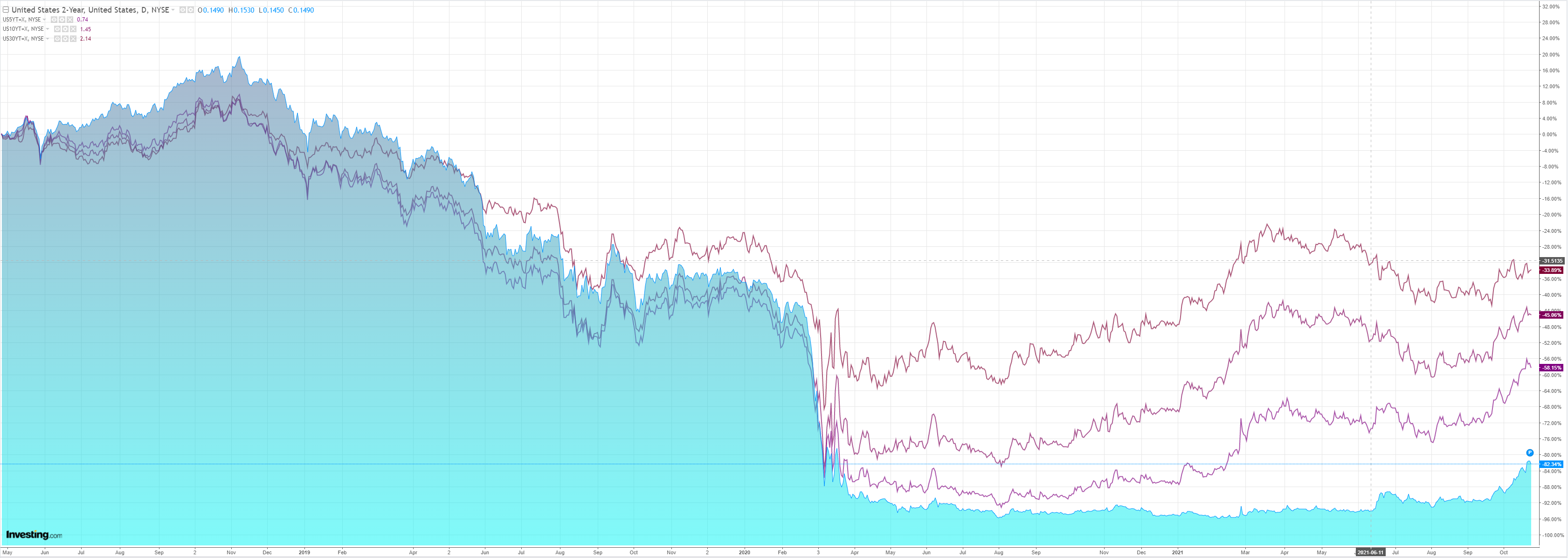

Treasuries were all over the place:

Stocks managed a modest bounce:

Westpac has the data:

Event Wrap

US Fed activity surveys were mixed. The less timely September Chicago Fed national activity survey fell to -0.13 (est. +0.20, prior revised down to +0.05 from +0.29), with the industrial production component falling 1.3%. The October Dallas Fed manufacturing activity survey surprised to the upside, rebounding to a healthy 14.6 (est. 6.2, prior 4.6), with a rise in new orders (to 14.9 from 9.5), and prices remaining at extremely high levels (prices received rising to 49.8 from 44.0).

Germany’s IFO survey fell to 95.4 (from 97.4, est 96.6) on the impact of higher costs and supply shortages. This weighed on the business climate component, at 97.7 (est. 98.0, prior 98.9), despite current assessments remaining firm at 100.1 (est. 99.4, prior 100.4).

The Biden Adminstration continues to be bound up in protracted discussions to gain Democrat support for their much reduced but still substantial spending plans. Despite Biden claiming that progress was being made and that a deal could be found this week, discussions with Manchin continue, though he did state that a framework could be worked on this week and that he is open to fair tax proposals.

BoE MPC member Tenreyro, who is seen as decidedly dovish, intimated that policy should be kept on hold as rising energy prices are seen as one-offs that will reduce discretionary spending and that supply shortages will ease. However, she also stated that wage costs need to be monitored in case secondary inflation impacts emerge.

Event Outlook

US: Growth in the FHFA house price index and S&P/CS home price index should remain robust in August, reflecting continued strength in home demand which should also see new home sales gain in September (market f/c: 758k). The Richmond Fed manufacturing index is expected to return a positive, near-average, print in October despite ongoing supply chain disruptions and delta risks (market f/c: 4). Consumers’ ongoing concerns with delta will however be highlighted by October consumer confidence.

Europe is steadily being dragged into the Chinese hard landing. There will be a reprieve on that front as supply-side bottlenecks ease with the bursting of the energy bubble but not until China panics about realty will Europe sustainably lift.

As Australia’s terms of trade are thumped ahead, I expect a second AUD tailwind to also dissipate. HSBC sums it up:

A “one-size fits all” hawkish narrative in G10 FX leaves a number of currencies (AUD, SEK, CAD & GBP) overbought

The latest fashion in the single-factor world of FX narratives is the inflation threat, one which, in the last month, has fostered a “one-size fits all” hawkish reappraisal of the future path of G10 monetary policy. FX performance has largely echoed the scale of the rate expectations shift, particularly in terms of where rates are expected to finish their tightening cycle. In some instances, this has led to justifiable gains which may extend in the coming weeks, for example in the NZD and NOK. But for others, such as the AUD, SEK and CAD, it leaves them vulnerable to a more concerted push-back from the central banks. The market’s impatience for a pivot away from ad ovish tone or a more strident endorsement of hikes makes recent rallies ripe for reversal, in our view. GBP could also be exposed should the November MPC fail to validate fully a hawkish shift that it has partly fostered. We prefer to play this GBP downside against the USD. This should be an interesting few weeks for the dollar, which has struggled somewhat lately as a “price-taking” mirror to the more hawkish shifts elsewhere in G10 FX. These pressures may go into reverse if we are correct about a dovish recalibration in some markets. In addition, the USD may also begin to dictate the tone again should the upcoming FOMC meeting linger a little longer on the upside risks to inflation as some Fed Governors have done recently .

I agree. The RBA is not going tighten. As the terms of trade crash hits, macroprudential slows property and immigration returns, Australian inflation will ebb like rain on the mountainside.

And the AUD with it.