DXY has a very bearish chart but not yet broken. EUR is the mirror image:

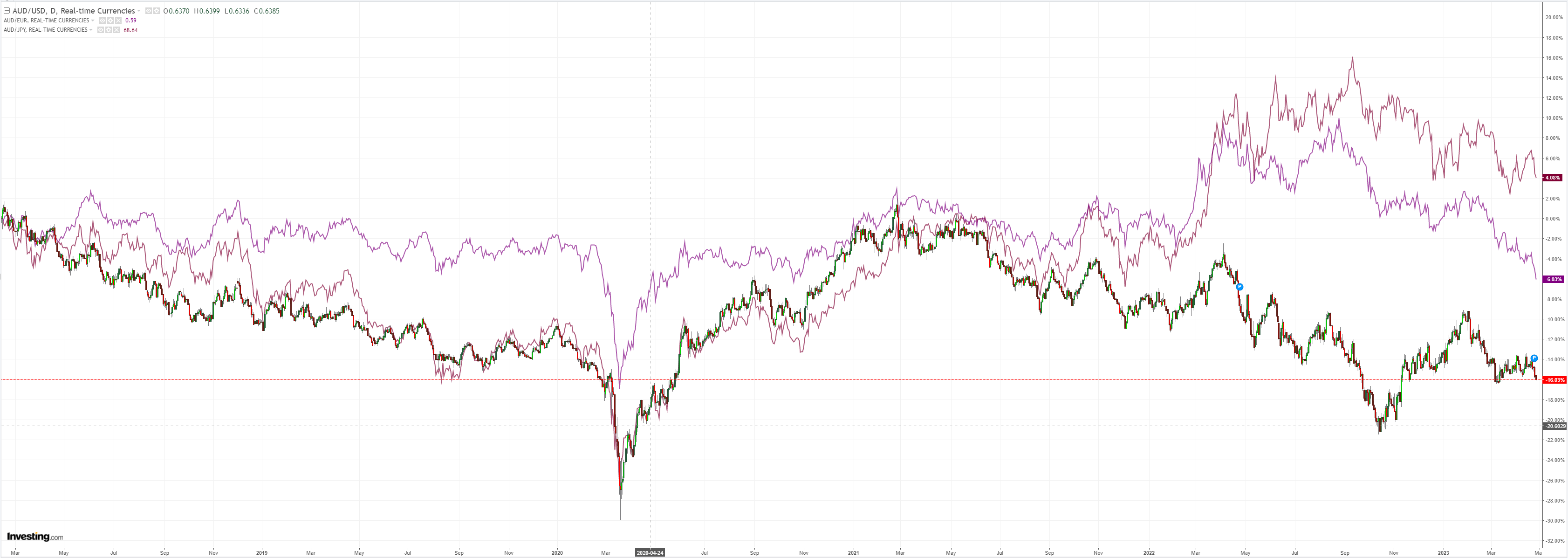

AUD is right at terminal support preventing a free fall to the October lows:

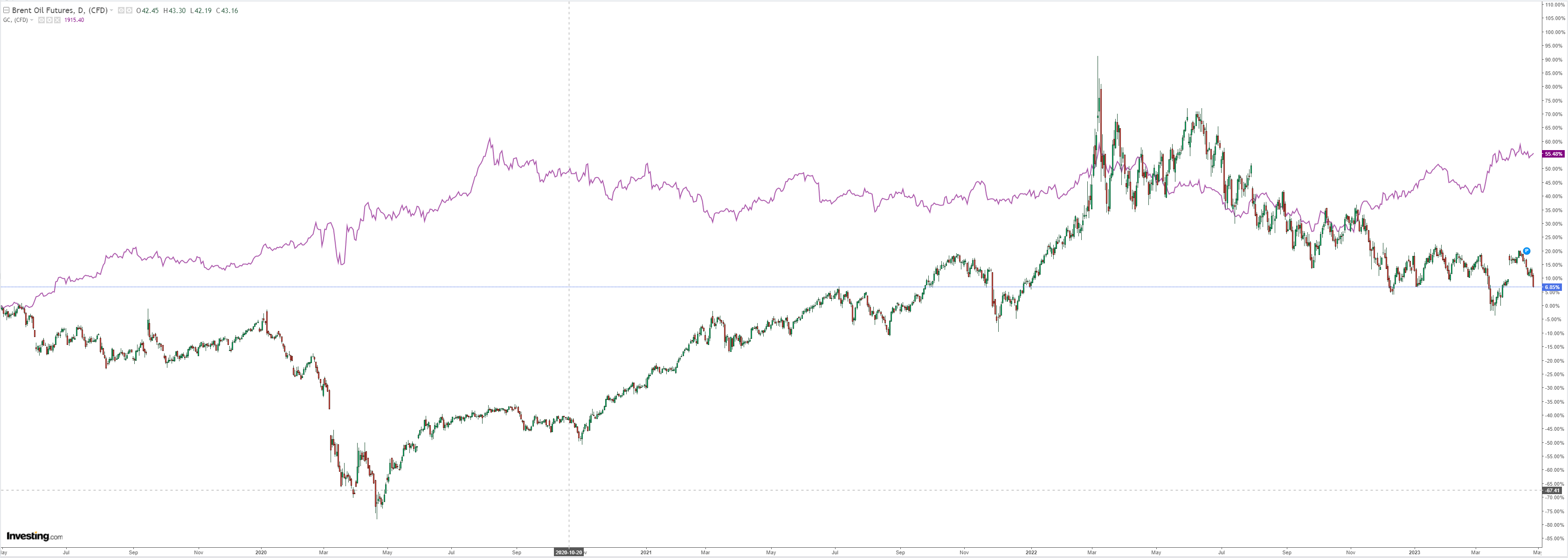

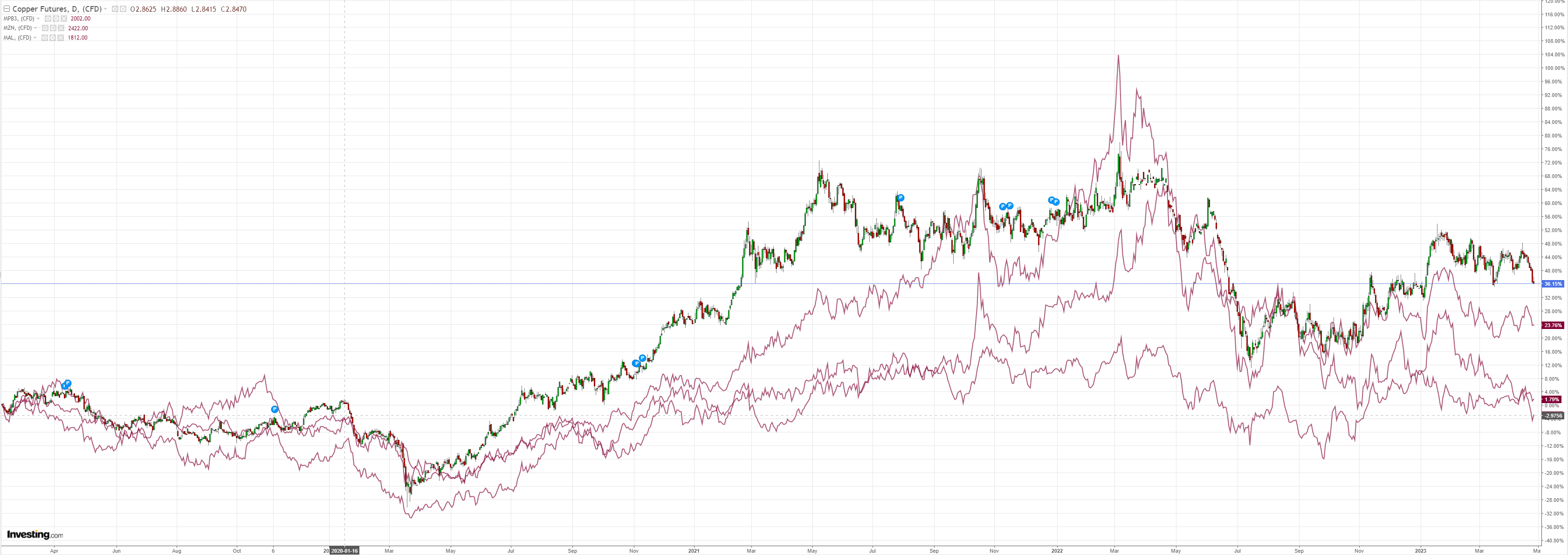

Other commods hung on:

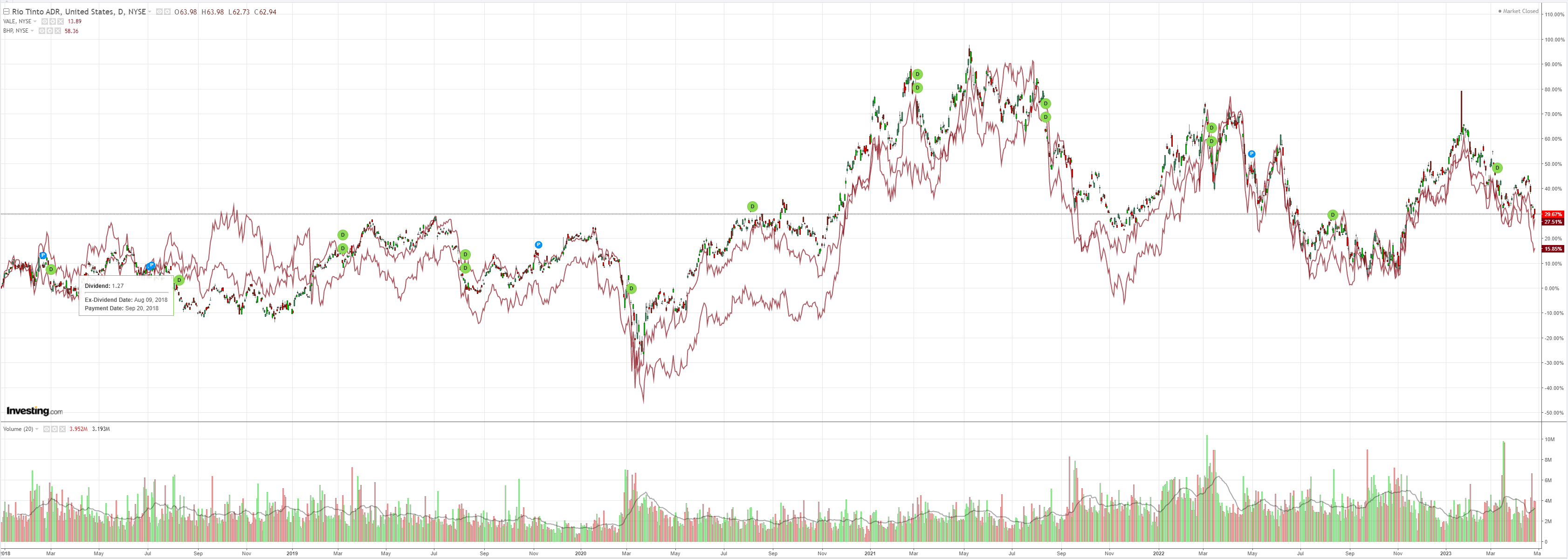

Miners (NYSE:RIO) dead cat bounced:

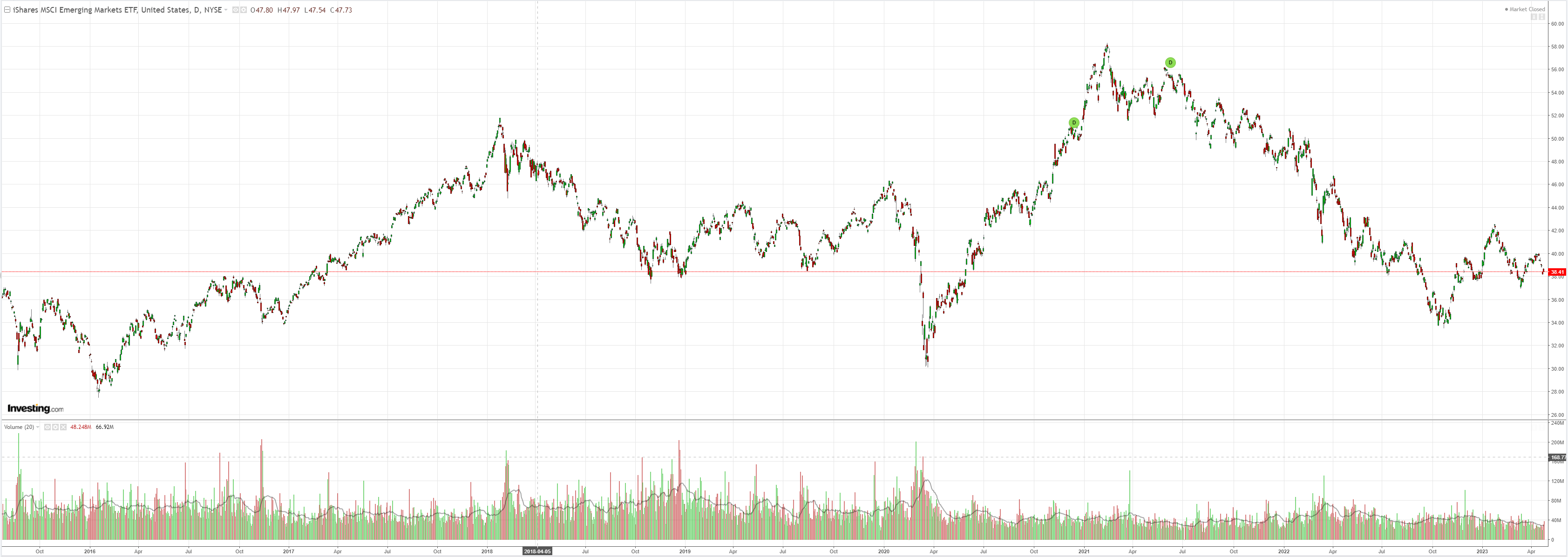

EM stocks (NYSE:EEM) also look very bearish:

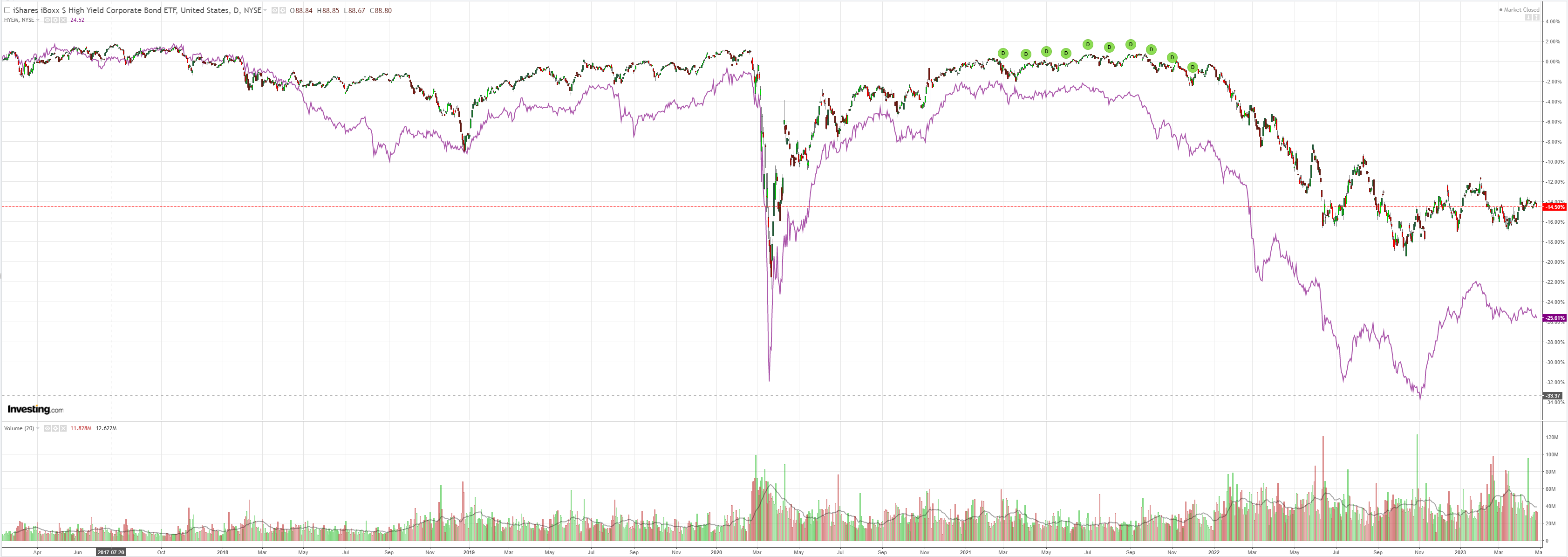

Junk (NYSE:HYG) hung on:

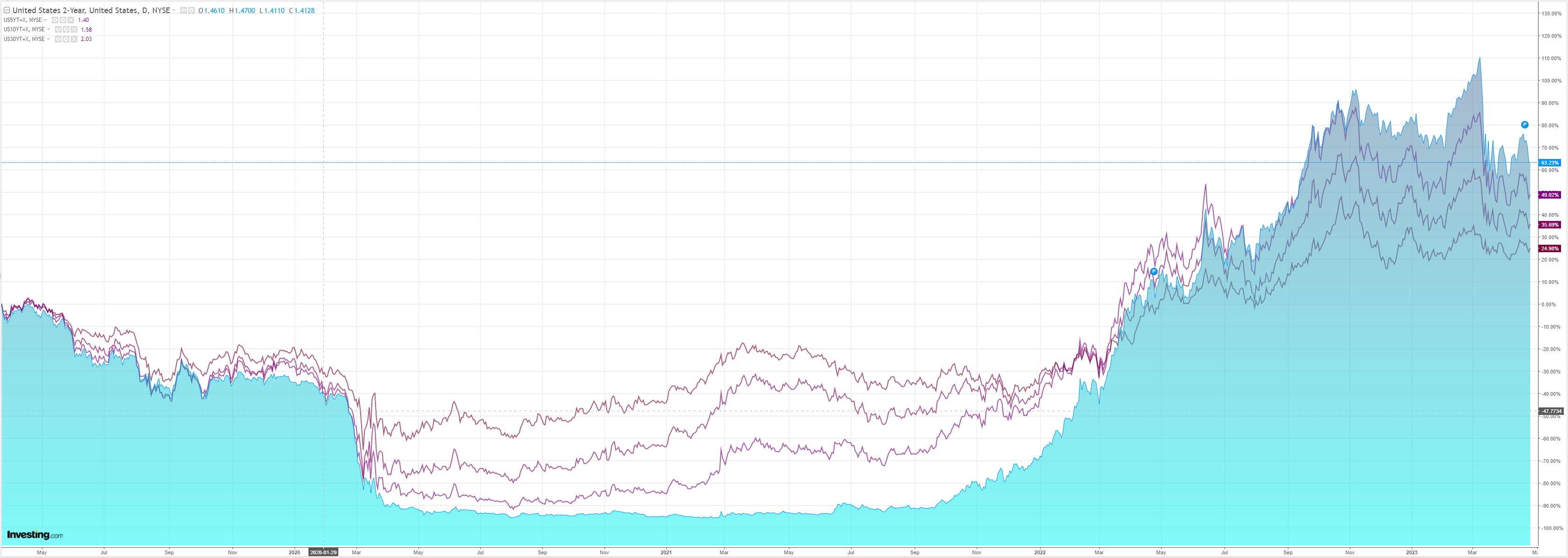

As yields popped a little:

Stocks want to go down suddenly:

We appear poised for a serious risk-off event:

- Oil is howling recession as it falls through OPEC cuts.

- Copper is sitting on terminal support.

- Stocks are weakening despite better-than-expected earnings.

- The EM bid is evaporating,

- Yields are hanging on as central banks keep hiking into growth shock signals.

DXY has a very bearish chart but it does not align with my macro views that the debt-ceiling debacle is bullish and Europe is the next growth shoe to drop with a hugely overbought EUR stock bid to go with it.

So, I am not confident about the major crosses but AUD appears poised for lower as the North Atlantic recession crowds in.