DXY was up Friday night:

AUD was down again:

With North Asia this time:

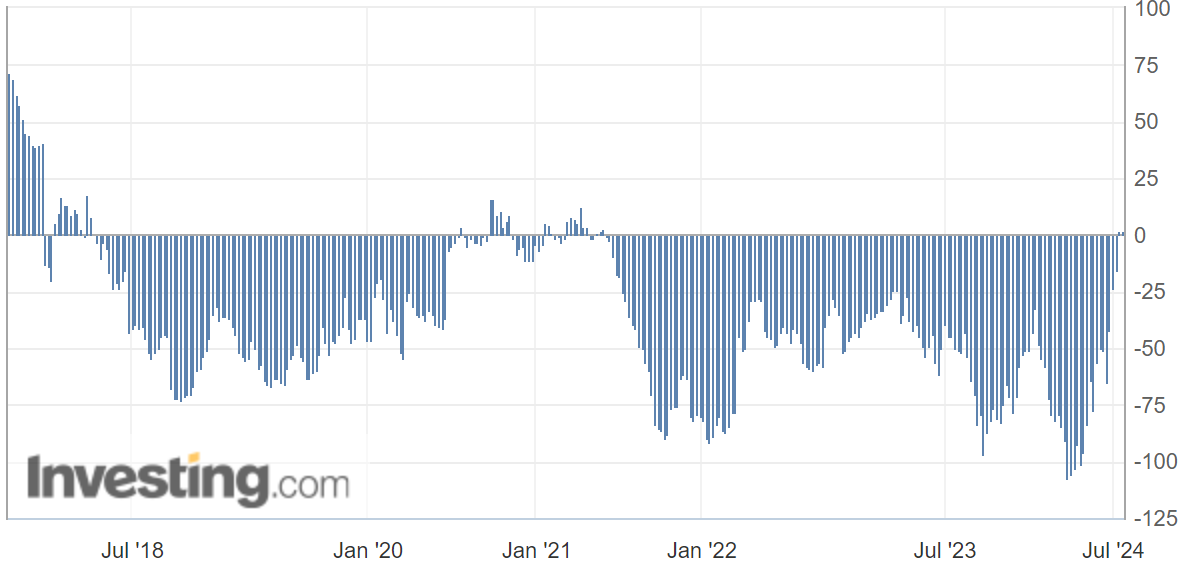

The specs are still marginally long:

All commodities were smashed:

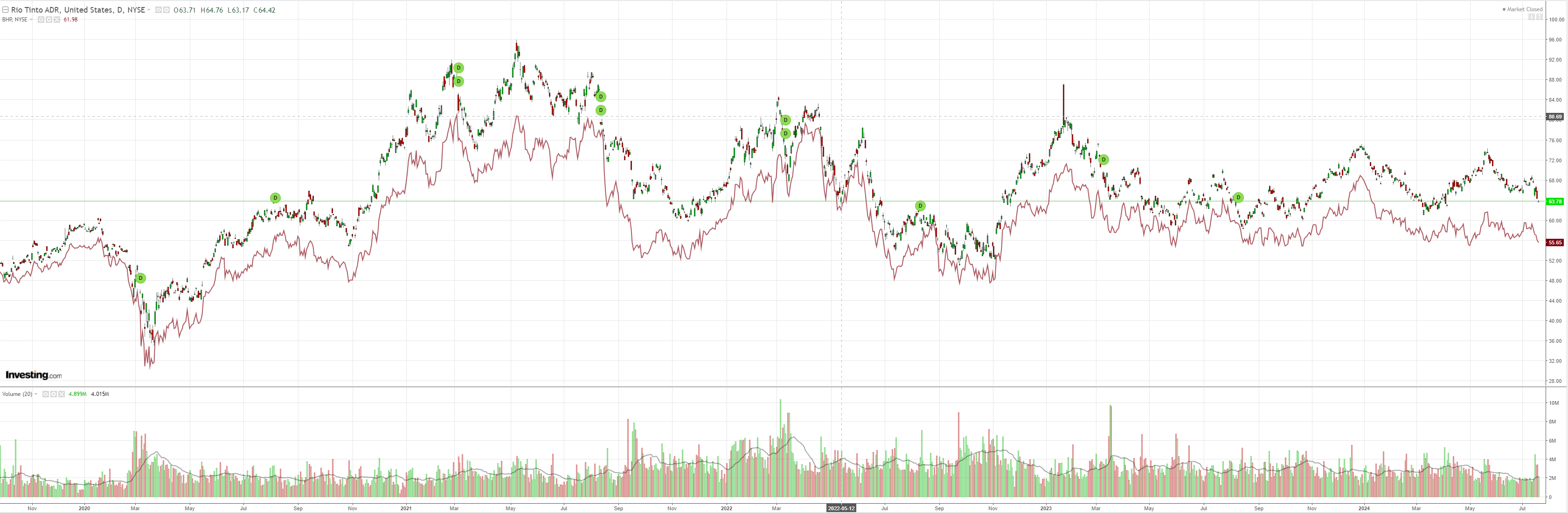

Miners are in trouble:

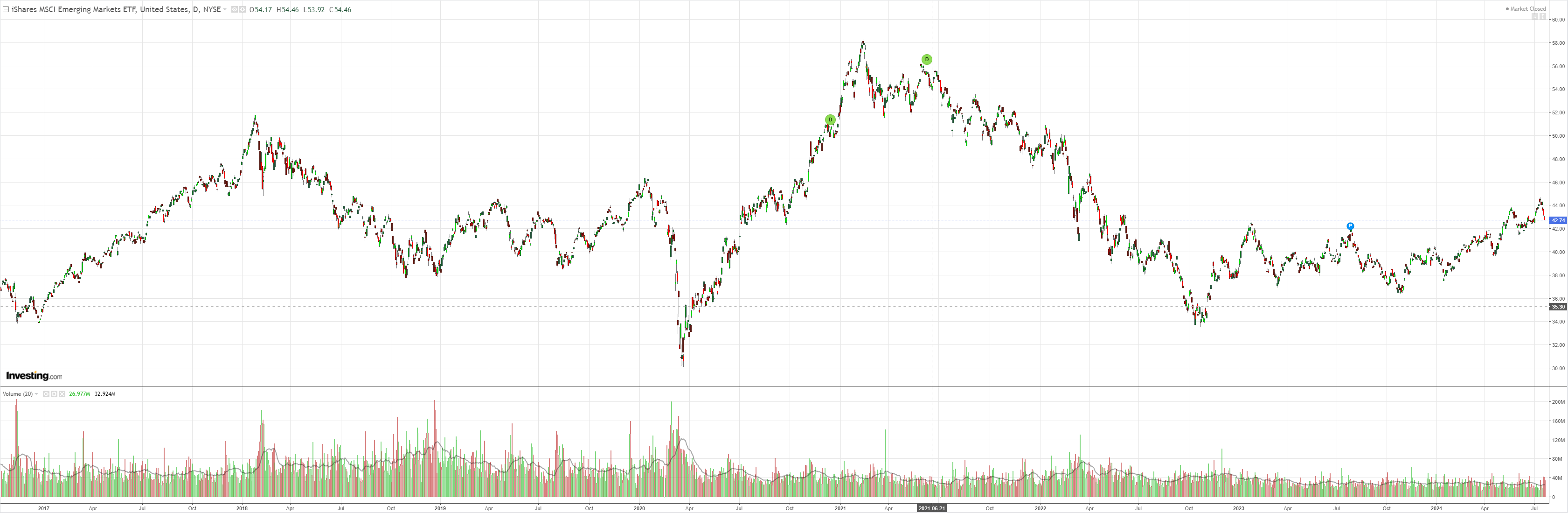

EM stocks are retesting the break out:

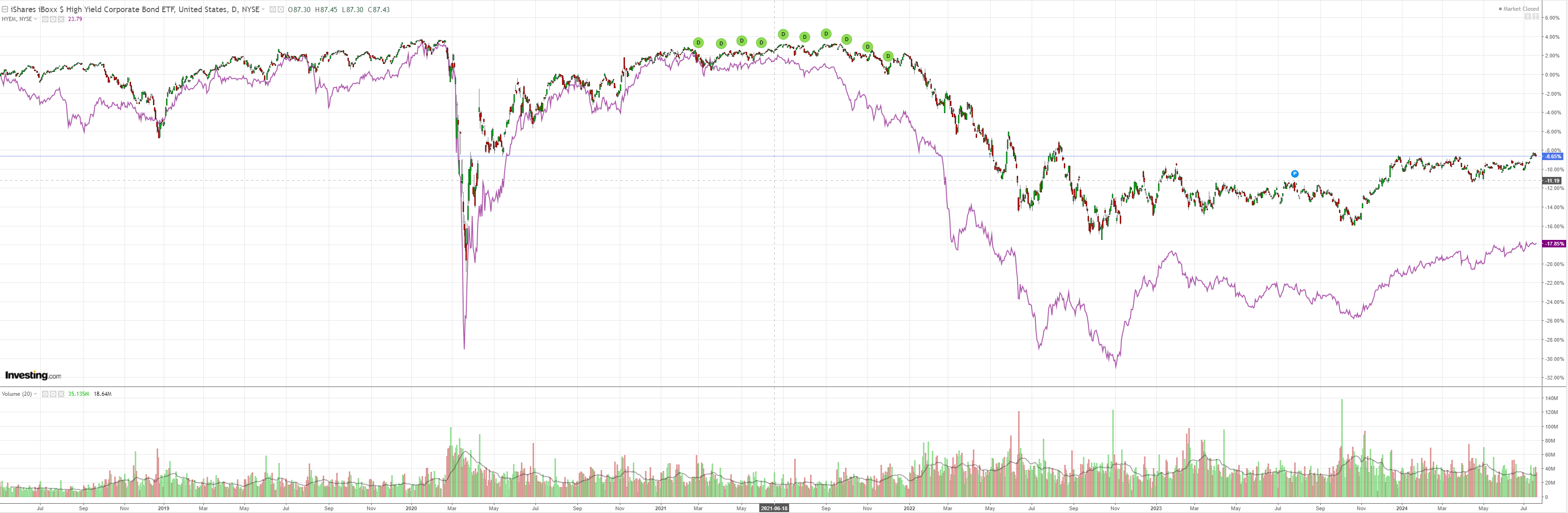

Junk is fine:

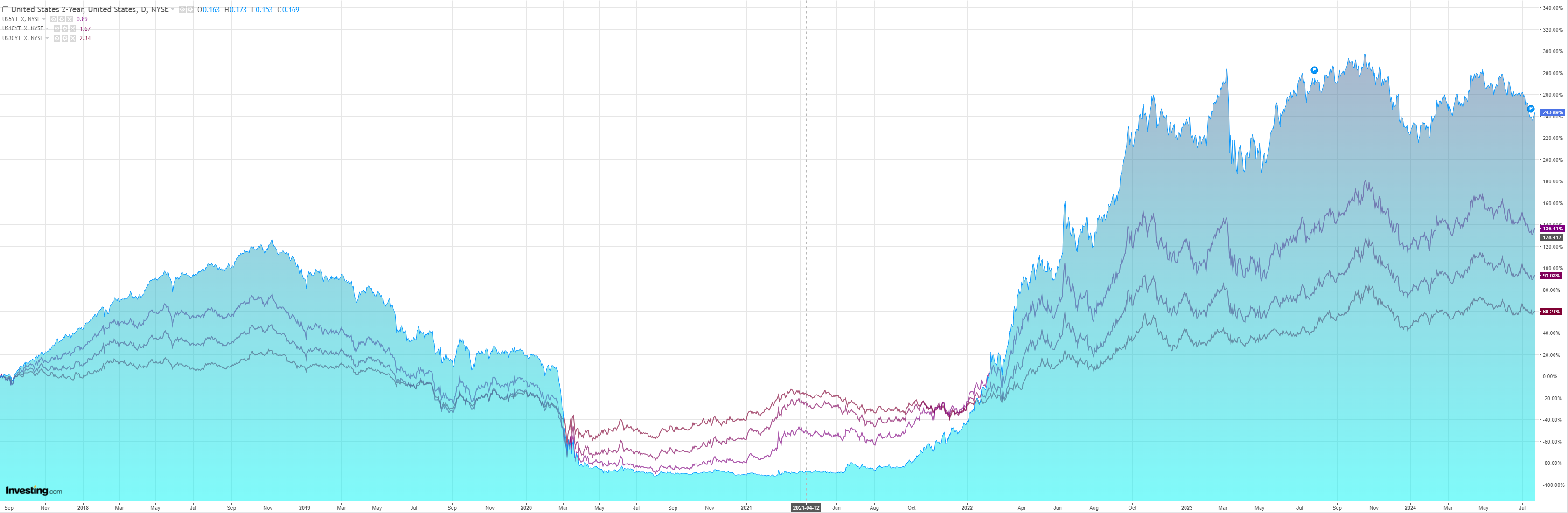

The curve flattened:

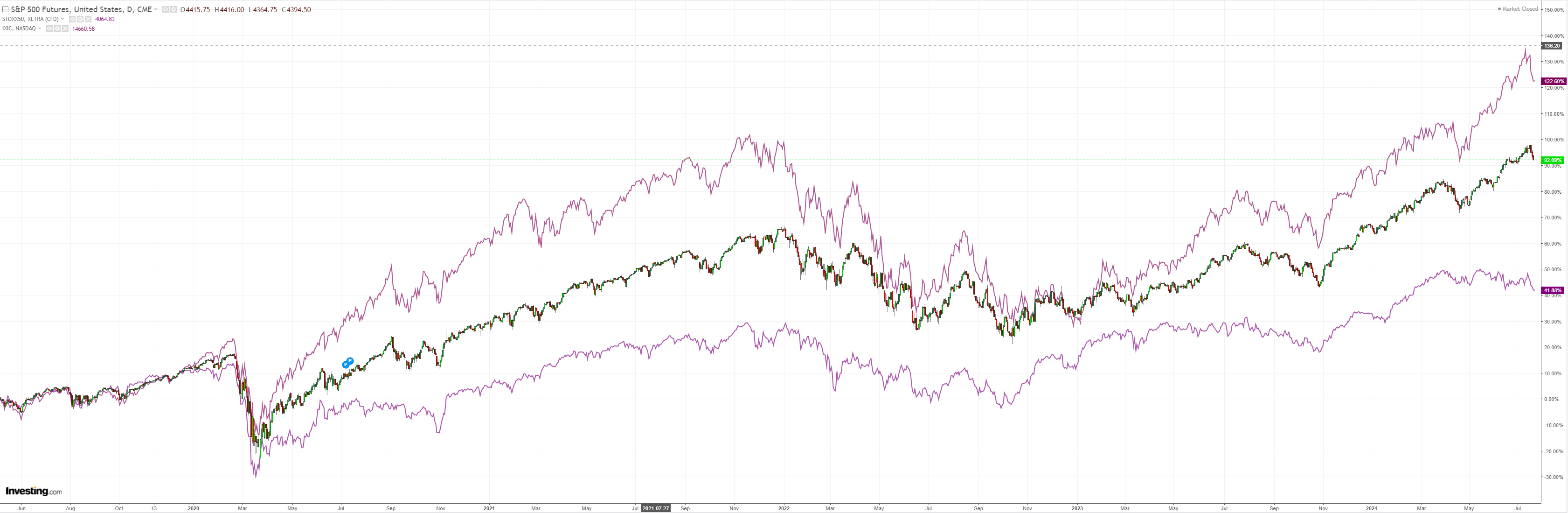

Stocks sold again:

These moves suggest the Trump trade is being priced with the prospect of tariffs and lower immigration:

- backing up yields;

- killing Chinese growth prospects so commodities fall;

- preventing DXY from falling on Fed cuts.

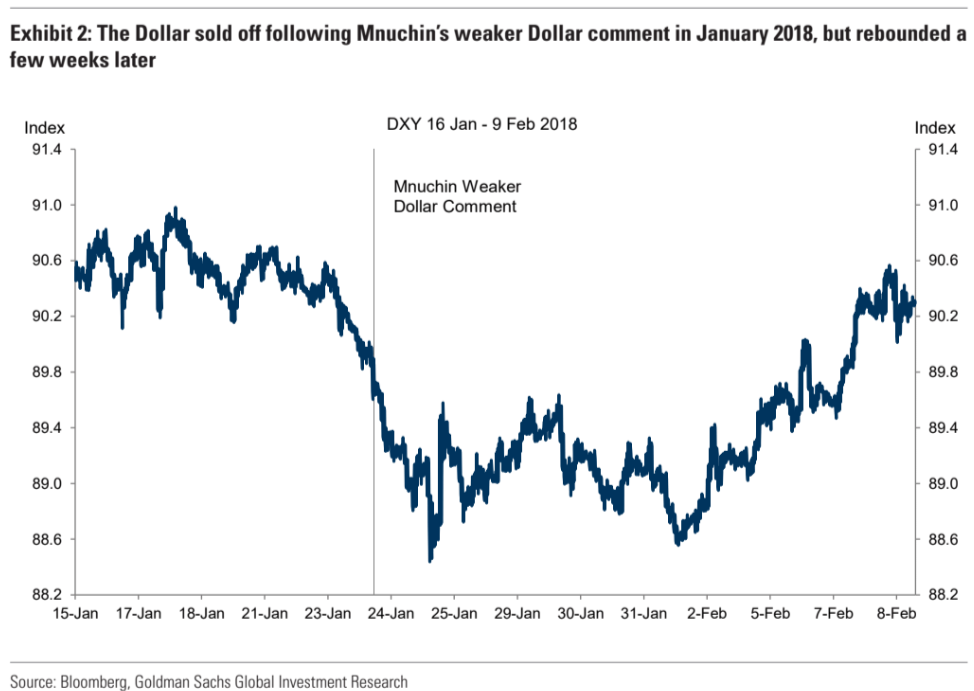

Can Trump turn this around with his weak dollar policy? Goldman has more.

The deal with currency deals.

If the Chief Executive wants a weaker currency, that is certainly an achievable outcome.

But, outside of regular business cycle fluctuations, it would require a concerted, cohesive policy effort that seems unlikely even if former President Trump is elected to a second term—mostly because it is at odds with the rest of his fiscal and trade policies.

We are skeptical of that a comprehensive “currency pact” like the Smithsonian Agreement or Plaza Accord can be achieved without a substantially different policy mix.

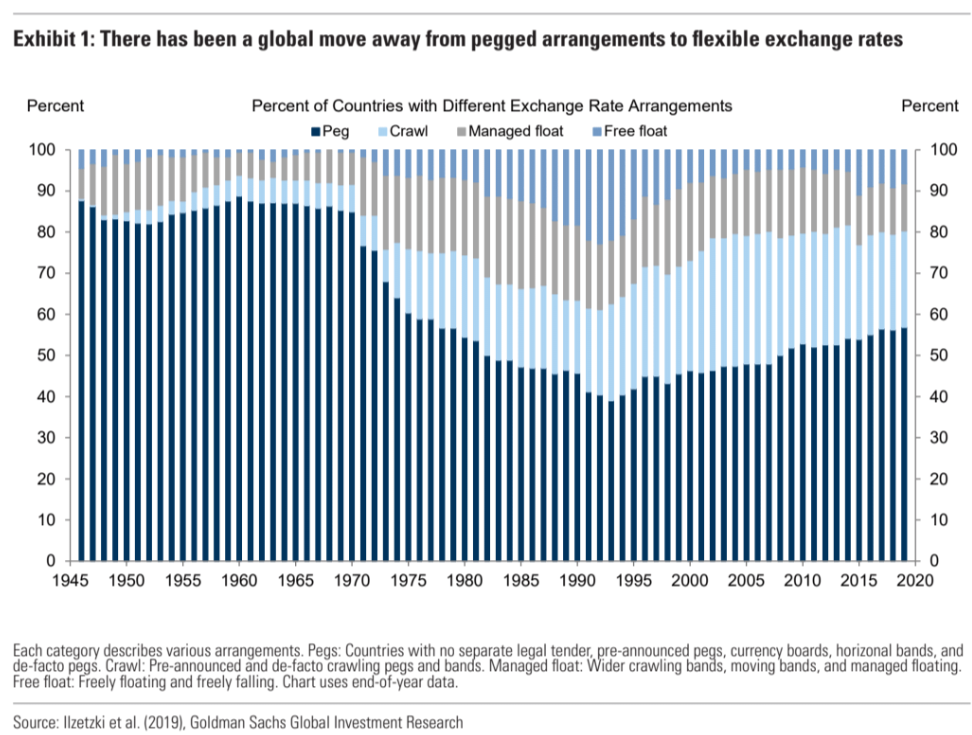

The structure of the FX market has changed meaningfully since then, making centrally-planned FX agreements difficult to implement (Exhibit 1).

And, one important thing has not changed—for FX intervention to be successful, it helps for market forces to be pushing in the same direction as the intervention.

That was the case before both of those seminal currency pacts; it is not the case now.

If the US does want to go the intervention route, there are substantial practical hurdles to overcome.

While both the Treasury and the Federal Reserve have authority to intervene in currency markets, Treasury funds are limited.

For intervention of any material size, Treasury would need to convince the Fed to use its balance sheet to carry out the administration’s exchange rate policy (and this is not a statutory responsibility for the Fed).

Beyond the operational complications this would entail, a coordinated currency deal of consequence would require the Fed to purchase less-liquid and lower-rated assets like CGBs, while the administration would essentially be encouraging foreign trading partners to sell US Treasuries—something that seemingly runs counter to other stated policy goals like maintaining the Dollar’s reserve currency status.

Outside of the intervention route, there are other options for managing the currency weaker, like reducing US fiscal support and convincing trading partners to spend more in ways that would support domestic consumption.

Again, while this would result in a weaker Dollar, it would also require a shift away from other policies.

I can’t see China agreeing to a Plaza Accord, even if it should.

So, Trump’s tariffs, tax cuts, and lower immigration will be DXY bullish, preventing deep falls as the Fed cuts.

Those cuts can still deliver near-term AUD upside but Trump’s tariffs are already smashing commodity prices via the two channels of a strong DXY and weak Chinese growth, inviting the RBA into the global rate-cutting cycle, so 2025 shapes as another tough year for AUD.