DXY is up and away:

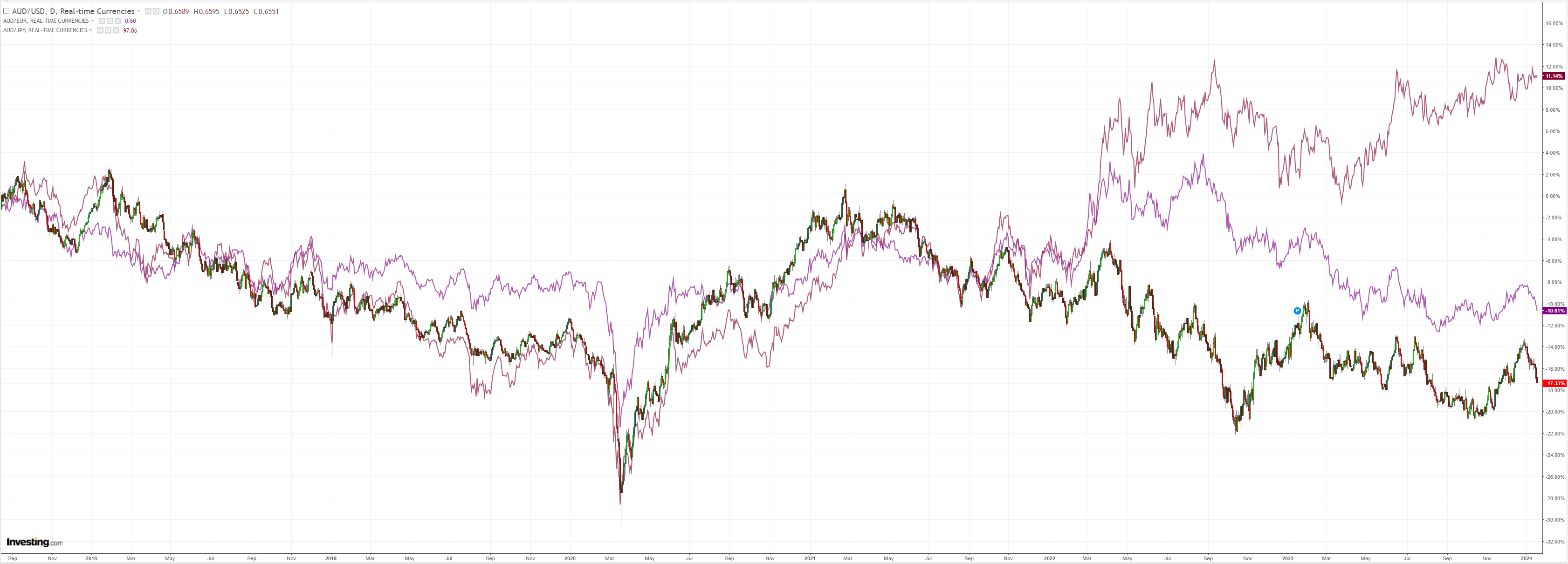

AUD is in free fall:

Yet it can’t keep up with JPY:

Oil and gold broke:

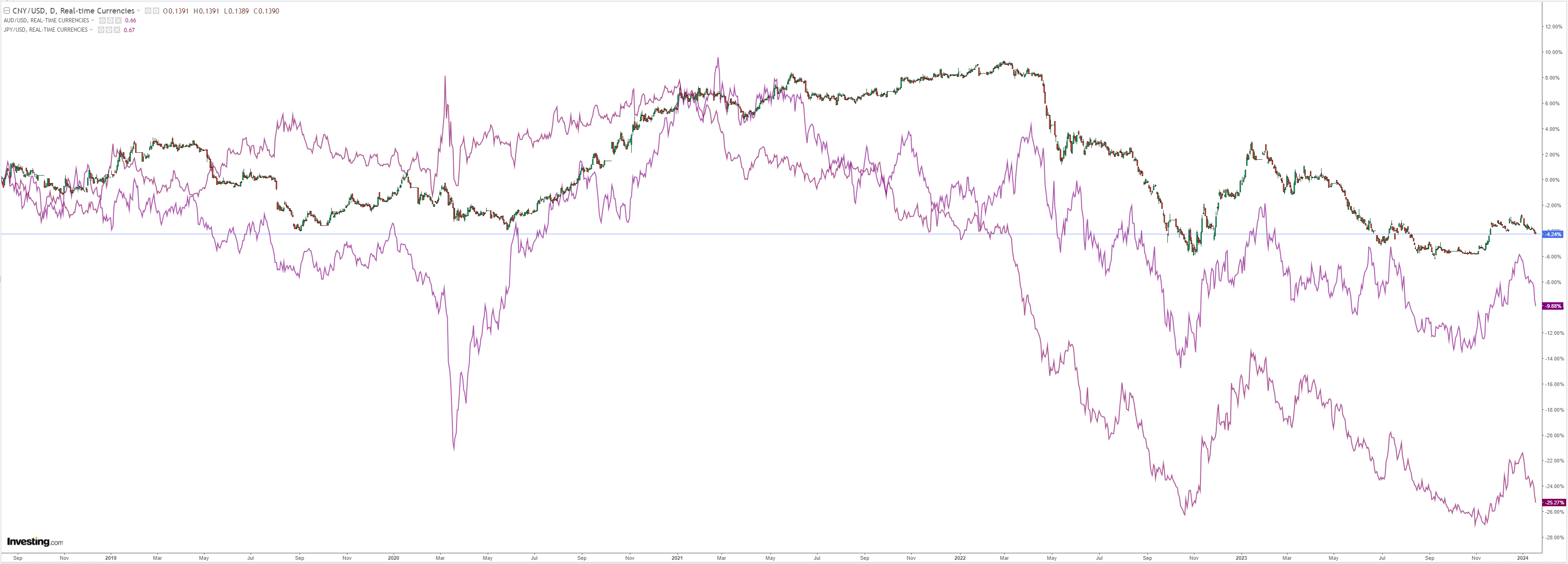

Dirt was hosed:

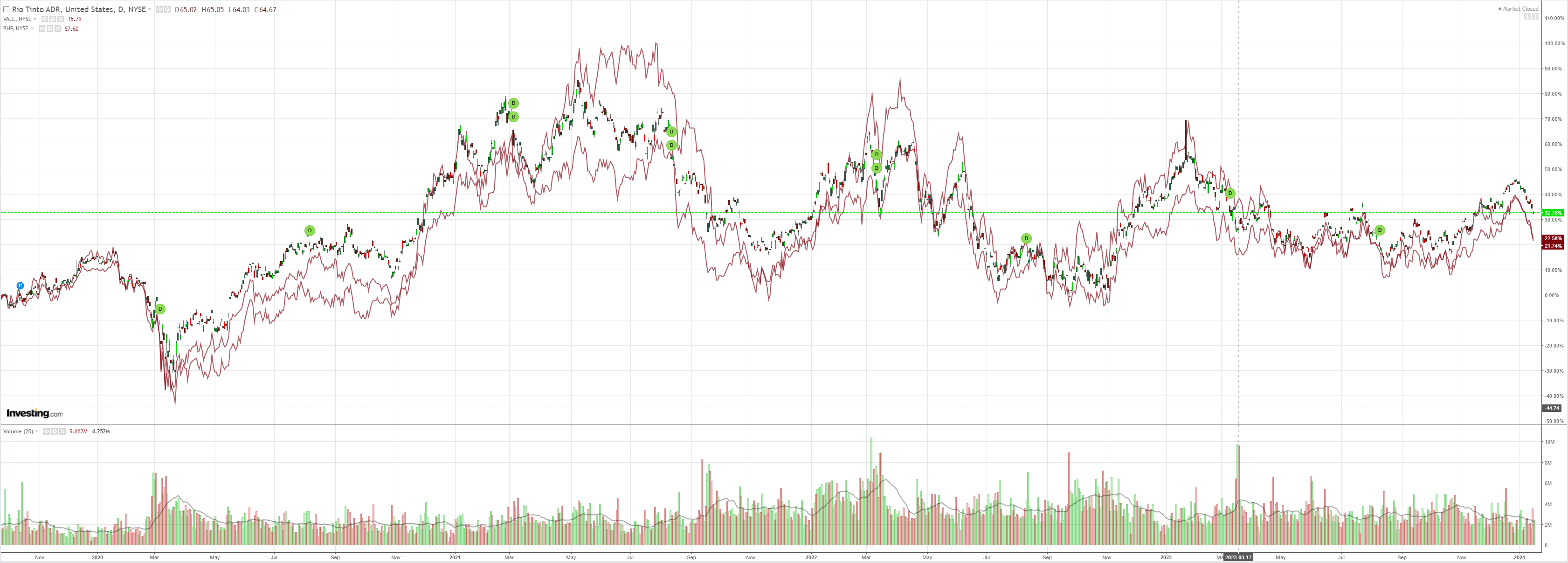

Classic miners up the escalator and down the lift:

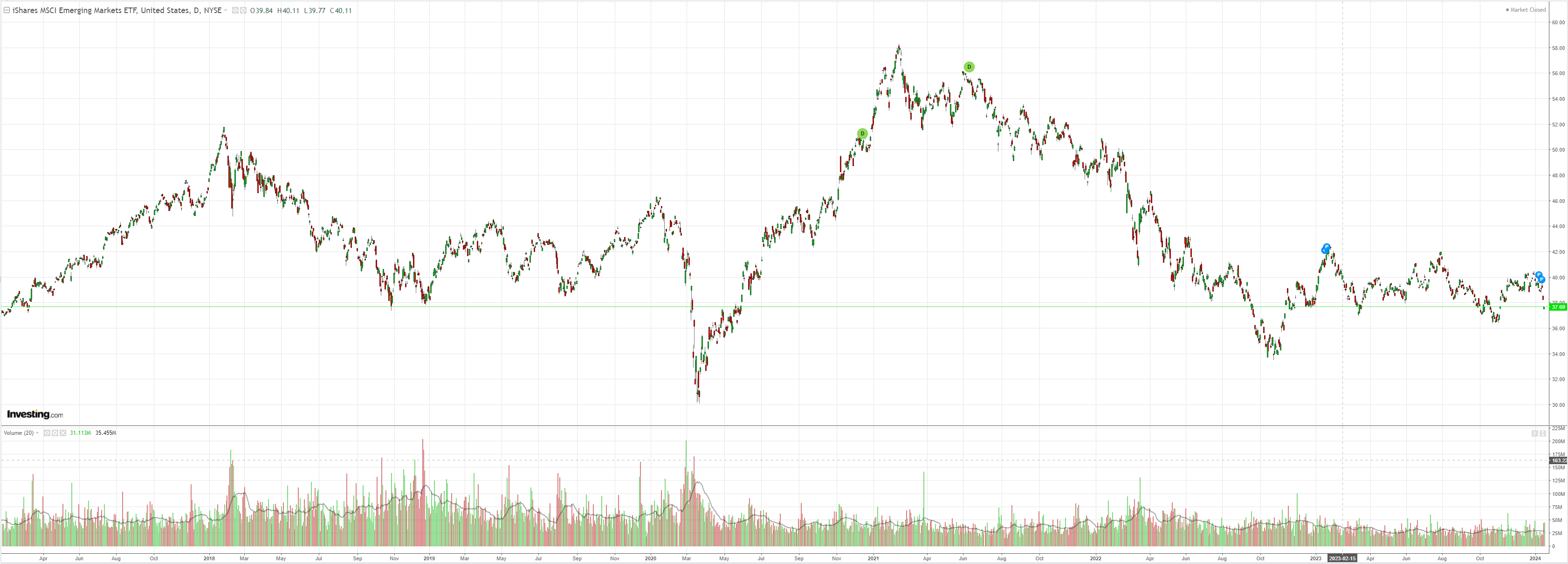

EM woe:

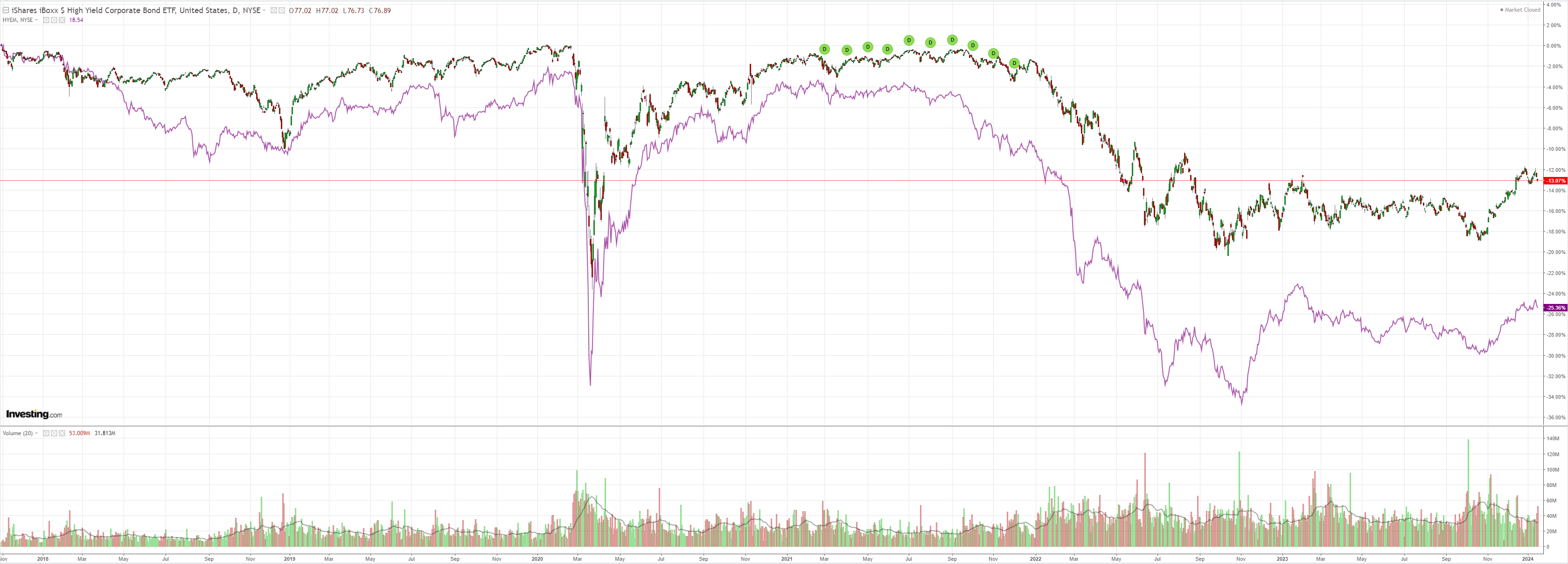

Junk fade out:

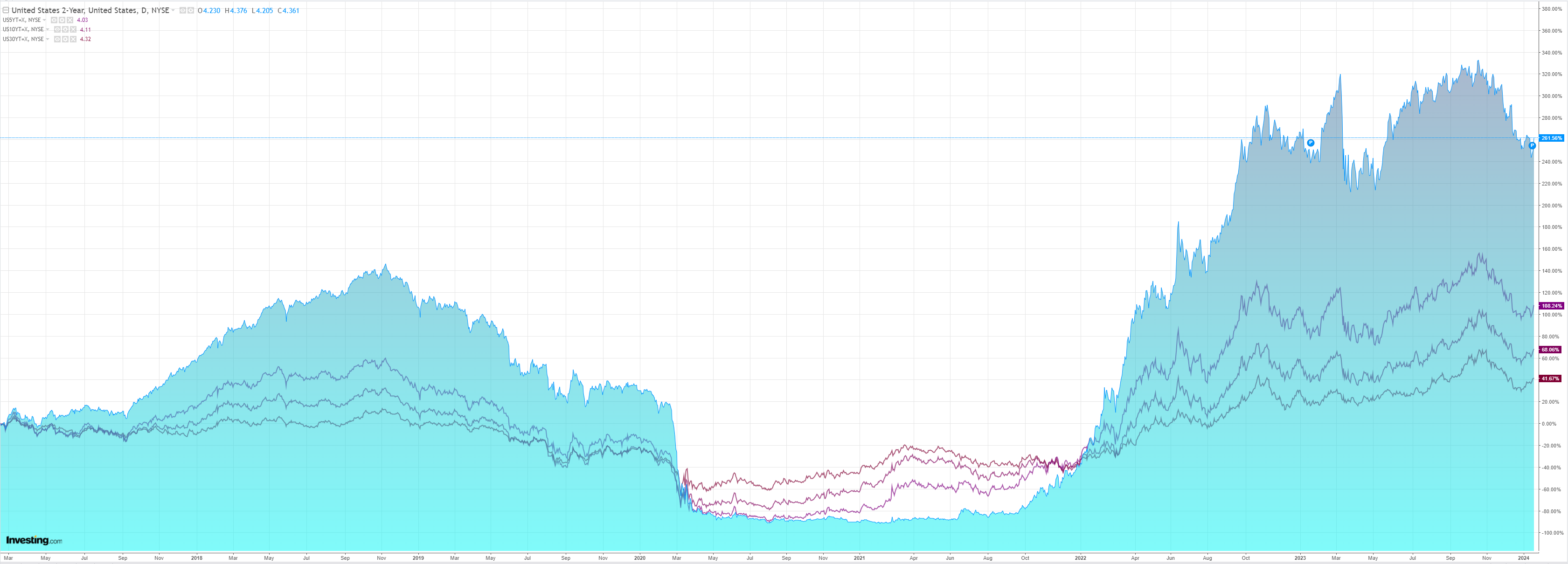

Yield spike:

Stocks hanging on:

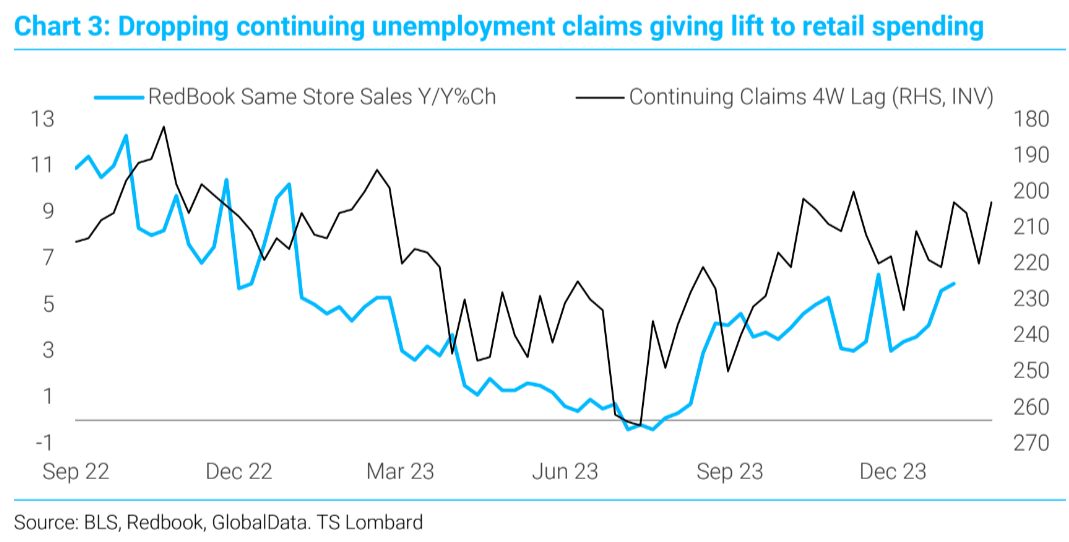

US retail sales popped 0.6% in December and, unlike Australians, are enjoying rising real wages, a strong labour market and record wealth to keep it running. TSLombard:

…the improvement in continuing unemployment claims since mid-year has led to an improvement in same-store sales based on Redbook data(Chat 3). Current level of claims imply better spending into the new year.

Waller noted that depleted savings and high credit burdens would slow spending. Yes and no.

Households of all wealth cohorts have asset/liability ratios not seen since the 1990s.

In addition, although credit payments are sky high relative to wages, credit outstanding to income levels remains very low.

So yes, some slowing in goods purchases from financial stresses, but the jobs and wages are the best indicators of future spending, and these continue to rise (wages are now rising in real terms).

I still see rate cuts coming sooner rather than later, but, as previously mooted, the pace and depth are now up for debate, and overbought markets do not like it.

AUD will keep falling until we have clarity.